Lots of dangerous data this week.

Lots of dangerous data this week.

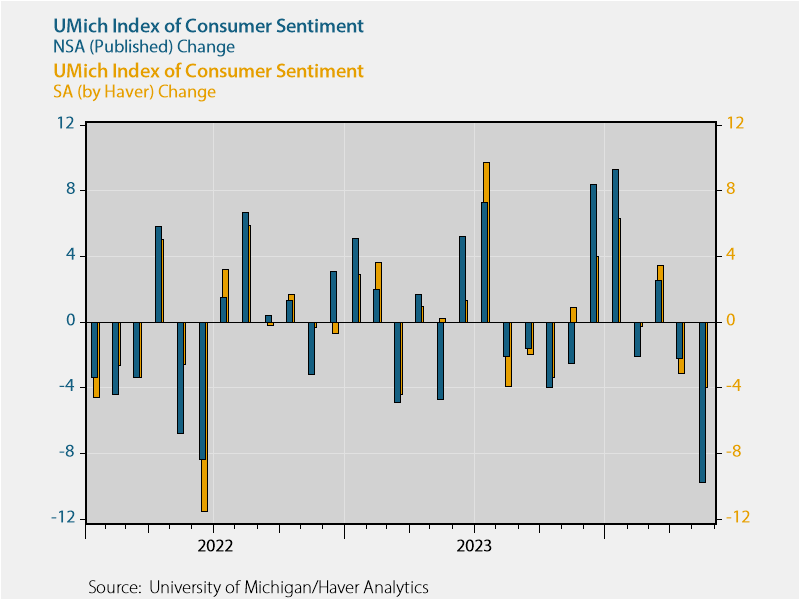

First of all, let’s talk about Friday, when the University of Michigan Consumer Sentiment survey plunged to 67.4 in May, down from 77.2 in April. Leading Economorons were expecting a reading of 76, so that’s a 12.7% monthly drop! What’s got consumers feeling so low? Inflation! That pesky little monster that just won’t go away. The survey’s one-year inflation outlook jumped to 3.5%, the highest since November. Even the five-year outlook has ticked back to 3.1% and, let’s not forget how many times the Fed has said they won’t be lowering rates until they are getting to their 2% target – now 5 years away!

As Joanne Hsu, the survey’s director, put it: “While consumers had been reserving judgment for the past few months, they now perceive negative developments on a number of dimensions. They expressed worries that Inflation, Unemployment and Interest Rates may all be moving in an unfavorable direction in the year ahead.”

Yikes. When consumers start worrying about the trifecta of economic boogeymen – Inflation, Unemployment, and Interest Rates (Oh my!) – it’s time to sit up and take notice. Other indexes in the survey also took a nosedive. The current conditions index fell more than 10 points to 68.8, while the expectations measure slid 9.5 points to 66.5. Both posted monthly drops of over 12%, making April’s awful readings look downright rosy in comparison.

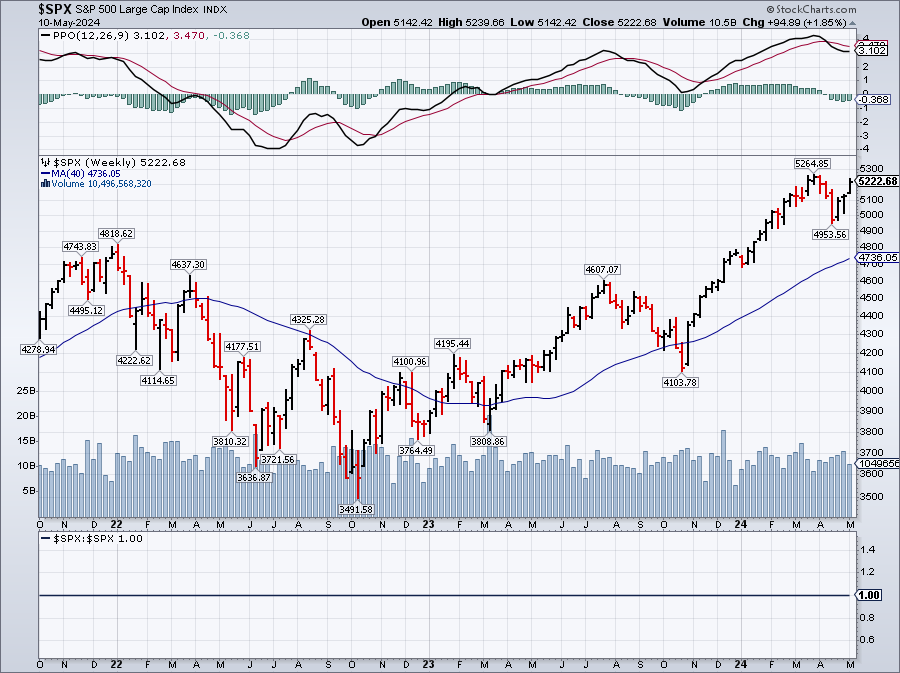

The big head-scratcher is that this confidence crash comes amid a stock market rally, lower (but still elevated) gas prices, and a seemingly strong job market (although jobless claims did just hit an 8-month high). The economy is sending more mixed signals than a bad Tinder date!

As Paul Ashworth of Capital Economics mused: “All things considered, however, the magnitude of the slump in confidence is pretty big and it isn’t satisfactorily explained by” geopolitical factors or the mid-April stock market sell-off. “That leaves us wondering if we’re missing something more worrying going on with the consumer.” Yes Paul, you are missing the people you step over on the way to work – all the struggling bottom 90% of them!

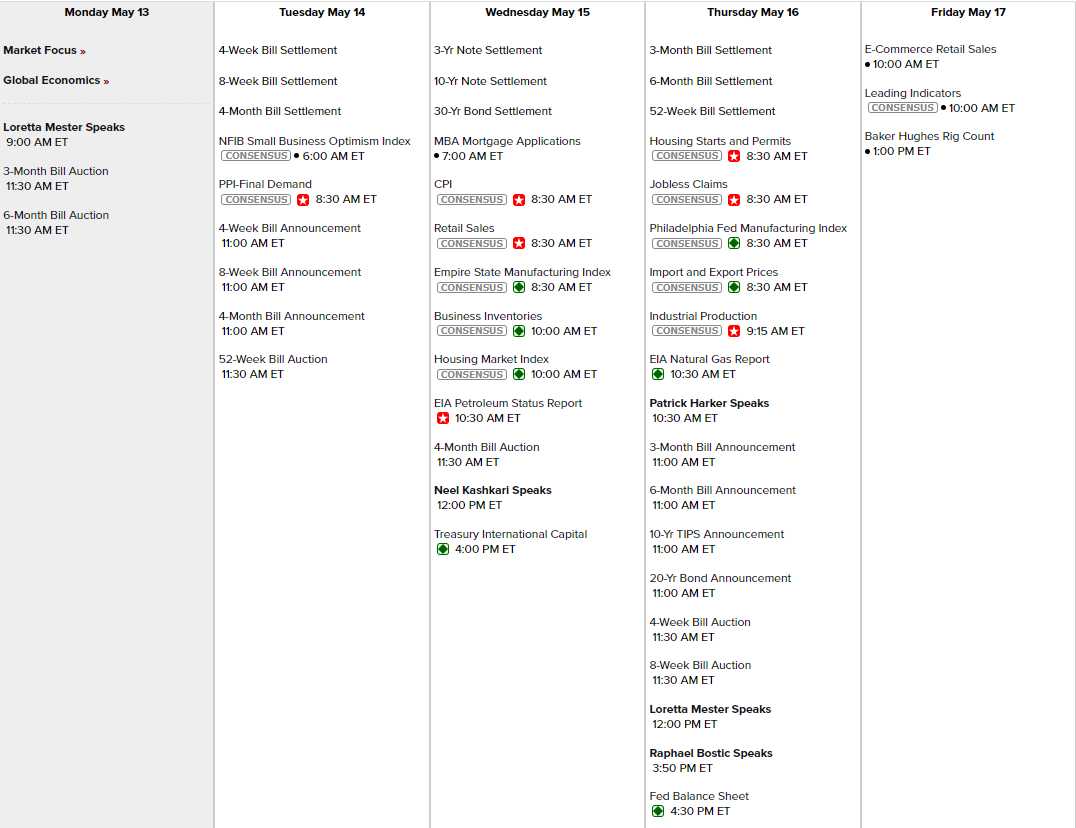

This week we’ve got to run the gauntlet dangerous economic data:

- PPI (Producer Price Index): Will rising input costs keep squeezing corporate margins like a vice grip?

- CPI (Consumer Price Index): The Fed’s favorite inflation gauge. Will it play nice or throw a non-taper tantrum?

- Retail Sales: Are consumers still spending like drunken sailors in the storm or finally starting to batten down the hatches?

- Industrial Production: The manufacturing engine is already sputtering on fumes.

- Leading Indicators: The economy’s crystal ball. Will it show storm clouds brewing?

Oil plunged back to $78 this morning as trouble is brewing in the House of Saud. Iraq, OPEC’s second-biggest producer, is refusing to play ball with the Cartel’s plan to keep propping up oil prices with continued production cuts.

Iraq’s oil minister, Hayyan Abdul Ghani, just dropped a bombshell, declaring that Iraq “has cut enough and will not agree to any other cut” at the upcoming OPEC+ meeting. Apparently, Baghdad has had enough of the production cut game and wants to let the spigots flow freely.

Now, on the surface, this might seem like a bold move. After all, Iraq is struggling to rebuild its war-torn economy and could use every PetroDollar it can get. BUT, by undermining OPEC’s efforts to boost prices, Iraq is essentially shooting itself in the foot. It’s like refusing a pay raise because you don’t want to work an extra hour you might have more free time, but good luck paying the bills…

This is just the latest crack in OPEC’s increasingly shaky foundation. The Saudi-led cartel has been desperately trying to keep oil prices afloat by slashing output, but it’s starting to feel like a Sisyphean task. A Bloomberg survey found that 87% of traders and analysts expect OPEC+ to extend the current cuts into the second half of the year, possibly through the end of 2024. But even that might not be enough.

Why? Chinese EVs!

Why? Chinese EVs!

China, the world’s second-largest oil consumer, is going electric at a breakneck pace. In 2023, EVs made up a whopping 22% of China’s auto sales and 31% of its car market. The country exported 1.2 million EVs last year, an 80% surge from 2022. Even in the commercial vehicle space, China sold over 330,000 electric trucks and buses in 2023.

This EV boom is kryptonite for oil demand. As more and more Chinese drivers plug in instead of filling up, gasoline consumption is taking a hit. Some analysts predict Chinese oil demand could peak as early as 2025, years ahead of predictions.

For OPEC, this is a nightmare scenario. The cartel’s go-to move of cutting supply to inflate prices is losing its mojo in the face of China’s EV revolution. It’s like trying to stop a tidal wave by building a bigger sand castle – the demand destruction is simply too powerful to overcome…

This puts OPEC in a real pickle ahead of its June 1st meeting. Does it double down on cuts, sacrificing market share to U.S. shale and other non-OPEC producers? Does it stay the course and pray for a global economic rebound? Or does it wave the white flag and open the taps, risking a price-crushing tsunami of crude supply?

Meanwhile, Iraq’s defiance only adds to the uncertainty. If Baghdad follows through on its threat to ignore further cuts, it could inspire other cash-strapped members to follow suit, unraveling the fragile production cut pact.

Make no mistake, the oil market is entering uncharted waters. OPEC’s tried-and-true playbook is being rendered obsolete by China’s EV surge, and the cartel’s unity is fraying at the seams. It’s a perfect storm that could either end in a price crash or a desperate battle for market share.

One thing’s for sure: it’s going to be a bumpy ride. Better buckle up and grab the popcorn, folks. The OPEC soap opera is about to get interesting!

And those earnings reports just keep on coming. Still plenty of big names to ponder, including the biggest consumer name of them all: Wal-Mart (WMT) – who report on Thursday morning with their $700Bn in annual revenues (12% of all US Consumer Spending). They report with BIDU and JD but tomorrow we hear from HD, SONY and BABA, so we’ll have a nice preview of what to expect: