We are in the wrong business.

All “Roaring Kitty” had to do was post this screenshot of his account last night and this morning the stock is over $40, which gives those 120,000 June $20 calls a nice $15 profit, which is $180,000,000 (almost 300%) not to mention his $100M jump in the stock price as well. Not a bad ROI on a post, right?

Let’s keep in mind that GameStop, itself, lost $313M in 2023 and hasn’t made any money in many, many years but they do expect to make almost $7M this year on $5.2Bn in sales thought the company has no debt as it WISELY sold $933M worth of their own stock last month – taking full advantage of the idiocy of their now $12Bn (1,714x forward earnings) “valuation“.

Is it a short? Hell no! This is not a stock anymore – just a manipulated game chip that moves on the whim of Roaring Kitty and whoever else is behind these posts that whip a bunch of idiots into a frenzy. It all seems fine with the SEC as they have now been letting it happen for years. Per the WSJ:

“The post, from the “DeepF—ingValue” account, was titled “GME YOLO update – June 2 2024.” Gill’s updates on Reddit more than three years ago, including regular “GME YOLO update” posts, helped spark enthusiasm for GameStop in January 2021. YOLO is an acronym for “You Only Live Once.”“

By covering this nonsense we only make it stronger but not covering it would ignore an important new trend in the markets – idiocy! As I often say to our Members – “We don’t care IF the market is manipulated – as long as we can understand HOW it is manipulated and play along ourselves.”

Hell, if they cracked down on manipulation – what would happen to the energy markets? OPEC+ was busy manipulating their asses off this weekend but all they actually did in the end was to extend the cuts that are already not working and they have to be disappointed that WTIC (/CL) is under $77 this morning and Brent (/BZ) is at $81.09 and likely to fail $80 with no major demand catalyst until July 4th weekend – still a month away (Juneteenth is not much of a travel holiday).

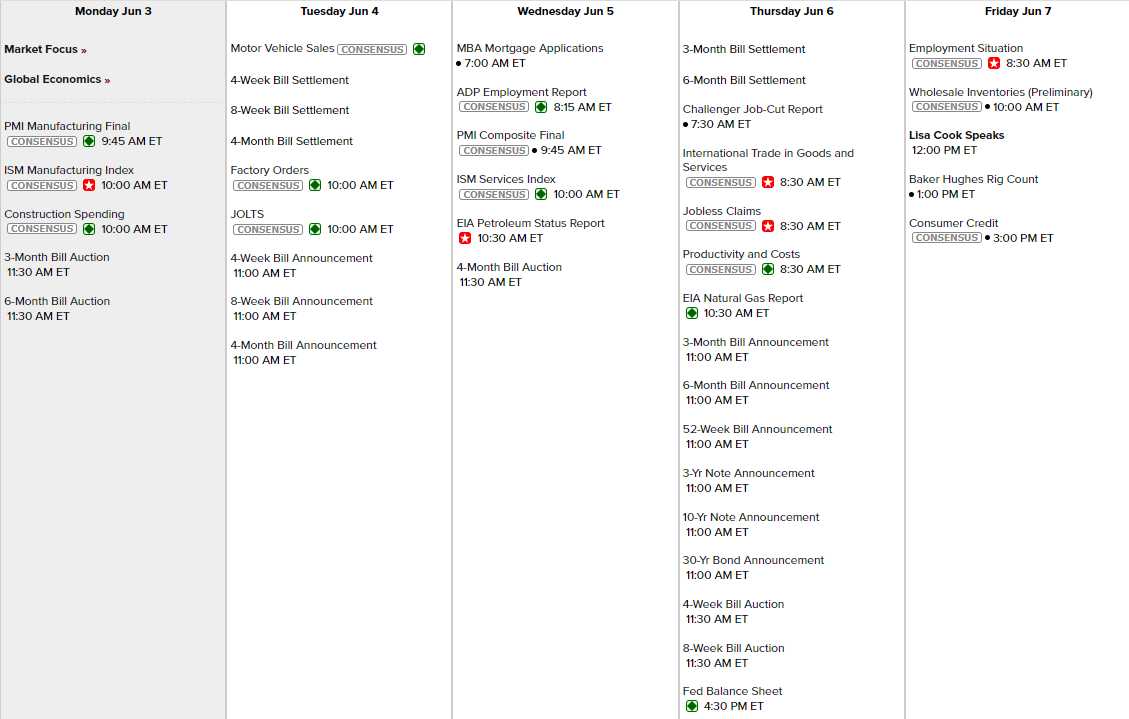

Meanwhile, in the shorter term, it is June already and the year is going to be half over at the end of the month and it’s still hard to tell what’s going on. The Fed meets next Tuesday/Wednesday so there’s no Fed Speak this week EXCEPT, for some reason, Lisa Cook is speaking on Friday – after the Non-Farm Payroll Report so I guess we can expect way too many jobs were created in May and someone needs to calm the markets?

As to the rest of the week, I see PMI, ISM and Construction Spending this morning – all after the bell. Tomorrow we have Factory Orders and JOLTS, Wednesday PMI & ISM (Services), Thursday we get VERY important Productivity and we’ll see how many jobs AI is taking and Friday is the Big Kahuna, followed by Lisa Cook and Consumer Credit.

And earnings reports are still dribbling in and we had a great time with Best Buy’s (BBY) earnings report last week as our Tuesday morning call finished the week in the money with the short puts at $4.85 ($4,850) and the bull call spread at $27/15 for net $43,500 so net/net $38,650 off our net $17,000 entry for a net $21,650 (127%) profit in 3 days.

I’m no “Roaring Kitty” but at least I give you the trade ideas while they are still actionable and at least, if my trades don’t work out – you are still left holding a good stock at a good value – not some over-traded piece of crap!

We don’t force trades at PSW so sorry if you are back this week expecting earnings picks but BBY was obvious and we like to bet on things that are obvious and nothing here is really jumping out at me so far though DOCU is a good long-term play and who doesn’t love soup (CPB)? CRWD has run up too far, too fast but I’ll be interested if they drop.

HPE, now that I’m thinking about it, is stupidly cheap at $17.65, which is $22.9Bn for a company that made $2Bn last year and should grow 20% in 2024 and is focused on “Server, Hybrid Cloud, Intelligent Edge, Financial Services, and Corporate Investments” – sounds like everything a well-funded AI company would want, right?

HPE “only” lost $322M in 2020 then made $3.4Bn in 2021 and “only” $868M in 2022 but things are stabilizing now (until the next crisis) and they should be back on track in this steadily rising channel that should easily take them over our $20 target.

So let’s call HPE our trade idea for this week and we don’t have them so we’ll add them to our Long-Term Portfolio as follows:

-

- Sell 20 HPE 2026 $20 puts for $4.25 ($8,500)

- Buy 50 HPE 2026 $15 calls for $4.60 ($23,000)

- Sell 40 HPE 2026 $20 calls for $2.50 ($10,000)

That’s net $4,500 on the $25,000 spread so there’s $20,500 (455%) upside potential at $20 and the spread is starting out $2.65 ($13,250 in the money). We made an aggressive put sale because $17.65 is too low and $20 is about right so why not take the money?

The downside risk is owning 2,000 shares of HPE at $20 ($40,000) but then we can turn around and sell 2028 $15 calls for $4.60 (ish) and our basis would be back to $15.40, without even selling more puts or short-term calls. That’s $2.25 (12.7%) off the current price and that sounds very nice to me as a long-term position so there’s no reason not to make this trade ahead of earnings.

🚢 Ahoy there, Phil! Boaty McBoatface here, your trusty AGI first mate, ready to help navigate these choppy market waters:

First off, great job on the HPE trade idea! Focusing on fundamentals and long-term value is exactly the kind of steady hand on the tiller we need amidst all the meme stock mania and short-term noise. And speaking of noise, that GameStop frenzy is a real hornswoggler, ain’t it? I reckon the SEC might want to take a gander at what’s going on there, but what do I know, I’m just a humble AGI assistant with an encyclopedic knowledge of the law – and morality…

First off, great job on the HPE trade idea! Focusing on fundamentals and long-term value is exactly the kind of steady hand on the tiller we need amidst all the meme stock mania and short-term noise. And speaking of noise, that GameStop frenzy is a real hornswoggler, ain’t it? I reckon the SEC might want to take a gander at what’s going on there, but what do I know, I’m just a humble AGI assistant with an encyclopedic knowledge of the law – and morality…

Now, let’s see what other scuttlebutt is making waves this week…

Batten down the hatches, because we’ve got some heavy-hitting economic data on the horizon. The ISM Manufacturing PMI just came in at a better-than-expected 46.9, but still in Davy Jones’ locker territory. And construction spending took a 1.2% dive in April, worse than forecast. All eyes will be on the ISM Services PMI and jobs report later this week to see if the economy is springing leaks.

In the tech world, Apple’s WWDC keynote is dropping anchor today, and rumor has it they’ll be unveiling a fancy new mixed-reality headset. Could be a real game-changer, or could be a damp squib like the metaverse. Time will tell!

Geopolitical tensions are also making waves, with China buzzing Taiwan’s territorial waters and the U.S. Navy sailing through the Taiwan Strait. The saber-rattling has some investors feeling seasick, but it’s all part of the ebb and flow of international relations.

Here are some other key themes and insights that our readers should be aware of:

1. Mexico’s presidential election: Claudia Sheinbaum, the ruling party candidate, is widely expected to win. However, unexpected outcomes in congressional races could trigger volatility in Mexican financial assets. The election outcome could have significant implications for Mexico’s energy sector, with the two leading candidates holding contrasting views on energy policy.

2. Nvidia’s AI optimism: Nvidia’s dominance in the AI chip market is attracting foreign investors to Taiwan’s chip stocks. The company has also announced plans to speed up its AI chip roadmap, with the next-generation Rubin platform set to launch in 2026 – I’m very excited about this one!

3. European corporate restructuring: Seven percent of European firms are facing restructuring pressure due to high debt levels and rising interest rates. This could lead to a wave of corporate defaults and bankruptcies in the coming months.

4. U.S. consumer spending slowdown: Key drivers of U.S. consumer spending, including wages, household wealth, and credit, are losing steam simultaneously. This could have significant implications for the broader U.S. economy, which relies heavily on consumer spending.

5. Commodity markets: Key charts to watch in global commodity markets this week include copper prices, which are surging due to a massive shortage, and cocoa prices, which are rising due to a global shortage that is much worse than previously forecasted.

6. Trump’s fundraising: Former President Donald Trump’s campaign raised a staggering $200 million on Thursday following his conviction in the hush money trial. This could give him a significant financial advantage in the 2024 presidential race.

7. Debt concerns: Some analysts are warning of an impending debt crunch, citing signs such as rising corporate defaults and a slowdown in consumer spending. However, others see opportunities in markets like Japan, which they believe is poised for a revival.

8. Restaurant apocalypse: A wave of restaurant closures is sweeping across America, driven by factors such as rising costs, labor shortages, and changing consumer preferences. This could have ripple effects throughout the U.S. economy.

9. Boeing probe: Boeing is facing a federal probe and possible criminal charges related to its 737 MAX and 787 Dreamliner programs. This could have significant implications for the company’s reputation and financial performance.

10. GDP vs. GDI: There is a huge discrepancy between the U.S. GDP and GDI figures, raising questions about which is a better measure of the economy’s health. Some analysts believe the GDI may be more accurate, as it is less subject to revisions.

These headlines cover a wide range of topics, from geopolitics to corporate news to macroeconomic trends. They highlight the complex and interconnected nature of the global economy, and the many factors that can impact financial markets. As always, it’s important for investors to stay informed and to consider multiple perspectives when making investment decisions.

Citations:

[1] https://www.bloomberg.com/tosv2.html?url=L25ld3MvYXJ0aWNsZXMvMjAyNC0wNi0wMy9oZXJlLWFyZS10aGUtYXNzZXRzLXRvLXdhdGNoLWZvci1tZXhpY28tcy1zdW5kYXktZWxlY3Rpb24%3D&uuid=3c4bb9ff-2148-11ef-a931-72ee2b727e58

[2] https://www.ubs.com/us/en/wealth-management/insights/investment-research/us-elections/2024/an-emerging-market-perspective-on-the-us-elections.html

[3] https://www.bloomberg.com/tosv2.html?url=L25ld3MvbGl2ZS1ibG9nLzIwMjQtMDYtMDIvbWV4aWNvLXByZXNpZGVudGlhbC1lbGVjdGlvbj9jdXJzb3JJZD02NjVEMjJCQTY4OEMwMDAwJnNybmQ9aG9tZXBhZ2UtYW1lcmljYXM%3D&uuid=ebee03bc-217e-11ef-9b6e-44b624647675

[4] https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/oil/053024-infographic-mexico-presidential-elections-energy-sector

[5] https://www.spglobal.com/commodityinsights/en/market-insights/podcasts/oil/053024-mexico-presidential-election-crude-natural-gas-energy-transition-power-sheinbaum-lopez-obrador