Monkey see, monkey do?

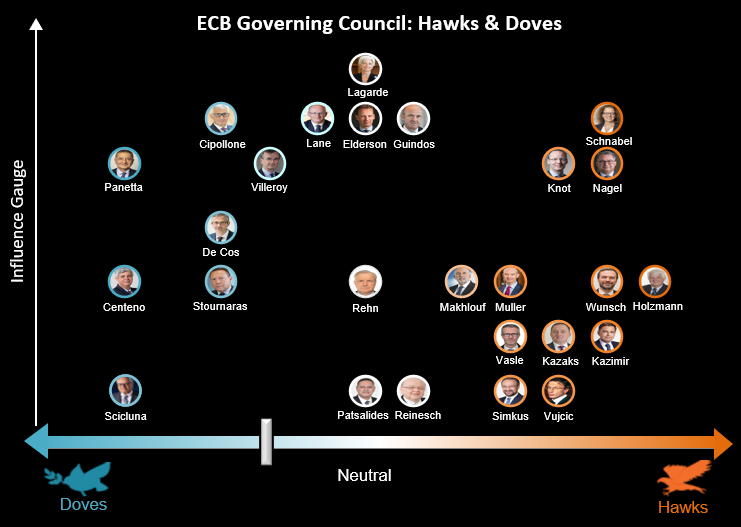

Today marks a pivotal moment for global monetary policy as the European Central Bank (ECB) is widely expected to announce its first interest rate cut in nearly five years. This move comes at a time when Central Banksters around the world are grappling with the delicate balance between taming inflation and supporting economic growth.

All eyes are on Frankfurt as the ECB prepares to lower its key deposit rate by 25 basis points to 3.75% from the current record high of 4%. This anticipated cut has been well-telegraphed by ECB officials in recent months, with President Christine Lagarde hinting at a summer rate reduction as early as January.

All eyes are on Frankfurt as the ECB prepares to lower its key deposit rate by 25 basis points to 3.75% from the current record high of 4%. This anticipated cut has been well-telegraphed by ECB officials in recent months, with President Christine Lagarde hinting at a summer rate reduction as early as January.

The ECB’s decision to ease monetary policy is driven by the significant progress made in curbing inflation across the Eurozone. After peaking at 10.6% in October 2022, inflation has fallen closer to the ECB’s 2% target in recent months. However, some concerns remain about the stickiness of core inflation, particularly in the services sector.

The ECB’s rate cut puts it on a different trajectory than the U.S. Federal Reserve, which has maintained a hawkish stance amid persistent inflationary pressures and a robust labor market – though that has seen signs of cooling this week (and tomorrow we get the Non-Farm Payroll Report to confirm this). This divergence could put downward pressure on the Euro against the Dollar, potentially fueling imported inflation in the Eurozone.

ECB officials have emphasized their readiness to chart an independent course, prioritizing the needs of the Eurozone economy over external factors. However, the risks associated with a weaker currency and its impact on inflation will likely be a topic of debate during the ECB’s meeting this morning.

Money markets are pricing in two quarter-point rate cuts by the ECB this year, with a small probability of a third cut. Traders will be closely monitoring the ECB’s forward guidance and President Lagarde’s press conference for clues about the pace and magnitude of future rate reductions.

The immediate market reaction to the ECB’s decision may be muted, as a rate cut is widely anticipated. However, any surprises in the ECB’s economic projections or Lagarde’s comments could trigger volatility in the Euro and European bond markets. Deutsche Bank economists now see a risk of just two reductions. Not so long ago they expected five back-to-back cuts at each and every meeting this year, totaling 125 basis points.

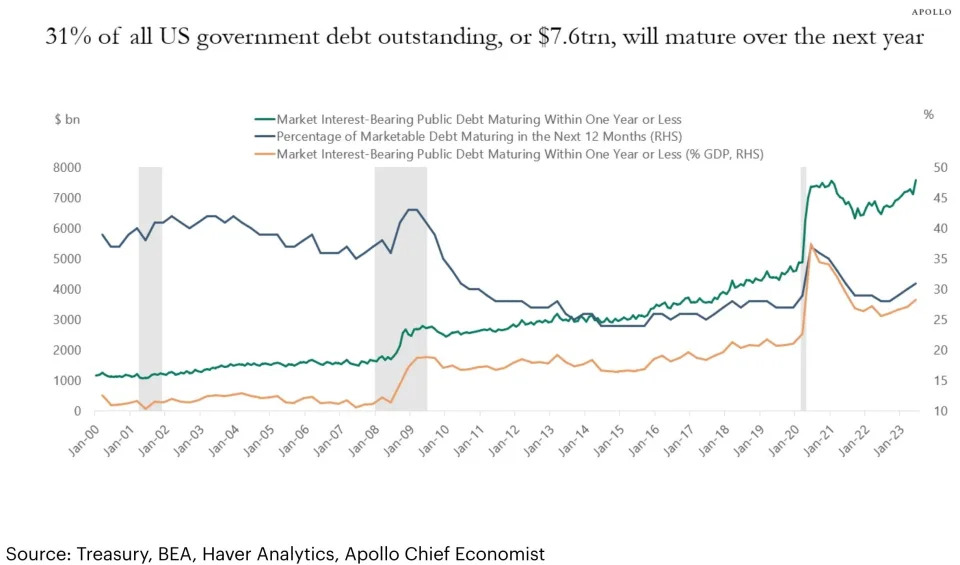

While the ECB is poised to cut rates, the U.S. Federal Reserve may not have as much freedom to lower rates as many people believe. The U.S. Government is borrowing a tremendous amount of money, with over $500 Billion in debt rolling over each month, of which approximately $150 Billion is new debt.

To attract bond and note investors, the U.S. must maintain its interest rates above a certain threshold. The Treasury Department has announced that it expects to borrow $7.6 Trillion ($7,600,000,000,000) of U.S. government debt maturing within the next year, representing 31% of all outstanding debt, the Fed faces challenges in lowering rates without risking a lack of demand for U.S. Treasuries. If rates fall too low, investors may seek higher yields elsewhere, making it more difficult and expensive for the U.S. Government to finance its debt.

This dynamic constrains the Fed’s ability to cut rates aggressively, even if economic conditions warrant it. The Central Bank MUST balance the need to support the economy with the imperative of maintaining the attractiveness of U.S. Government debt to investors or risk a far greater disaster than a slowing economy.

This dynamic constrains the Fed’s ability to cut rates aggressively, even if economic conditions warrant it. The Central Bank MUST balance the need to support the economy with the imperative of maintaining the attractiveness of U.S. Government debt to investors or risk a far greater disaster than a slowing economy.

As the ECB embarks on a new easing cycle, the path forward remains uncertain. The central bank will need to carefully navigate the risks of a weaker euro and potential inflationary pressures while supporting the Eurozone’s fragile economic recovery.

Traders will be keenly focused on any hints from the ECB about the timing and magnitude of future rate cuts, as well as the Fed’s response to the evolving global monetary policy landscape. The interplay between these two major central banks will be a key driver of financial markets in the coming months.

8:15 Update: It’s done – the ECB has cut its three key interest rates by 25 basis points. As to projections – they’ve raised their 2025 outlook, so it’s a mixed message:

- ECB Sees 2025 Inflation at 2.2%; Prior Forecast 2%

- ECB Sees 2026 Inflation at 1.9%; Prior Forecast 1.9%

“The Governing Council is determined to ensure that inflation returns to its 2% medium-term target in a timely manner. It will keep policy rates sufficiently restrictive for as long as necessary to achieve this aim. The Governing Council will continue to follow a data-dependent and meeting-by-meeting approach to determining the appropriate level and duration of restriction. In particular, its interest rate decisions will be based on its assessment of the inflation outlook in light of the incoming economic and financial data, the dynamics of underlying inflation and the strength of monetary policy transmission. The Governing Council is not pre-committing to a particular rate path.”

See, the same BS we get from our Fed!

Our Fed will get their turn at bat next Wednesday but it’s almost a certainty that they will see their shadow and we will have 6 more weeks of 5.25% interest at least until the July 31st meeting – when it’s also unlikely we’ll get that rate cut.

Our Fed will get their turn at bat next Wednesday but it’s almost a certainty that they will see their shadow and we will have 6 more weeks of 5.25% interest at least until the July 31st meeting – when it’s also unlikely we’ll get that rate cut.

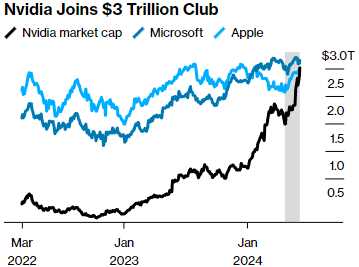

As the ECB cut was basically built in – the market doesn’t seem to care as all eyes are on – not tomorrow’s NFP Report but NVDA’s 10:1 stock split that will either take the Nasdaq up to new record highs or signal the top of a frenzy that’s been driving the market for the past 18 months.

Quixote wrote about this last night so I don’t want to re-hash but note that, since Jan, 2023, Microsoft (MSFT) and Apple (AAPL) gained $2Tn in market cap while Nvidia (NVDA) gained $3Tn making up 60% of the entire Nasdaq’s gains in just 3 stocks and their current $9.2 TRILLION combined market cap is higher than the ENTIRE value of the mainland Chinese market – the word’s 2nd largest economy!

Quixote wrote about this last night so I don’t want to re-hash but note that, since Jan, 2023, Microsoft (MSFT) and Apple (AAPL) gained $2Tn in market cap while Nvidia (NVDA) gained $3Tn making up 60% of the entire Nasdaq’s gains in just 3 stocks and their current $9.2 TRILLION combined market cap is higher than the ENTIRE value of the mainland Chinese market – the word’s 2nd largest economy!

If that seems ridiculous, it’s because it is.

Absurd, actually…