Everything is just a little bit off this morning:

When you see a heat map like that you know there’s a macro issue to be contended with. It’s also a good time to look at stocks like LLY, AMD, TSLA, GM, PEP, PFE and think about what makes people buy them on such a bad day. There are still plenty of bargains to be had out there – we just have to look a bit harder to find them.

AAPL’s WWDC was a bit of a bust yesterday. Their AI rollout seems to be well thought-out but not much will actually happen this year and the other AI companies will have advanced quite a lot in 6 months. The Dollar is continuing on it’s rampage as Conservative gains in EU elections of all places have caused Macron to call a snap election and that’s pushing the Euro back to 107 but at least it saved the Yen from failing the 0.63 line (for another week, anyway).

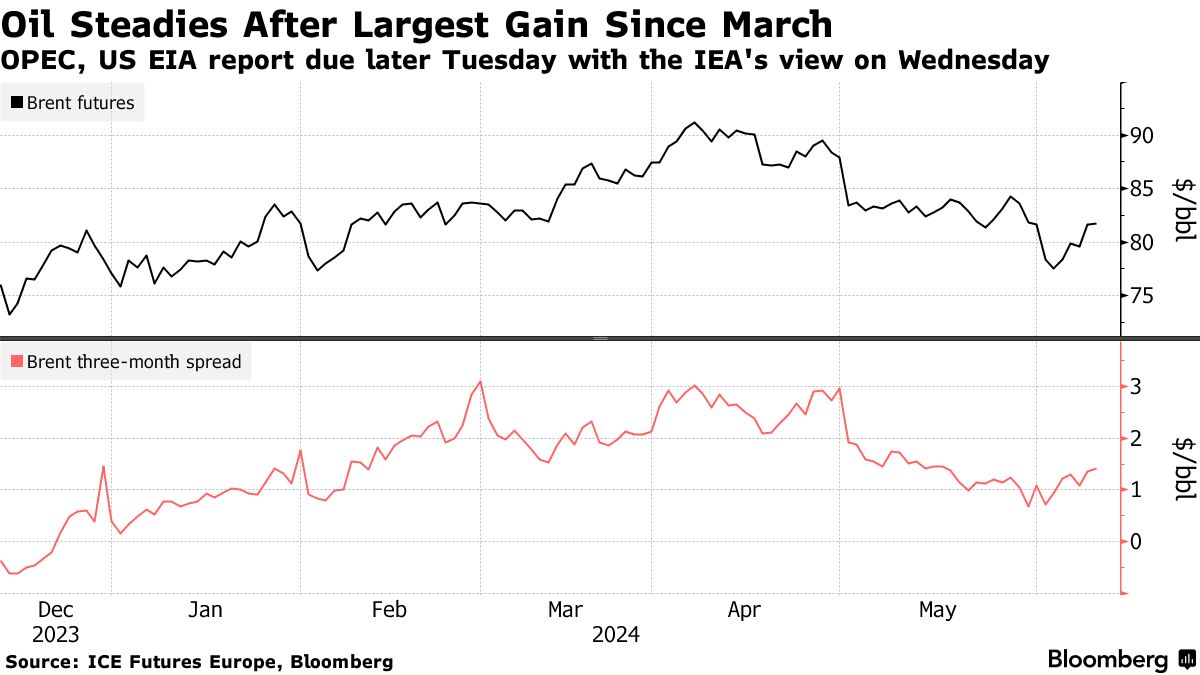

You only get 0.72 for a Canadian Dollar as well – almost a 30% discount for Americans going to Canada this summer! Oil (/CL) tested $78 yesterday, which was $82 on Brent (/BZ) and $2.43 for Gasoline (/RB) and Gasoline gave it all back already as consumers rejected it at the pump so I like playing /CL short below the $77.50 line with tight stops above.

The recent rebound in oil prices reflects some “buy the dip” mentality after the steep selloff last week. However, the broader trend since April has been lower on concerns about weakening demand and rising non-OPEC supply.

A trio of oil market reports from OPEC, the EIA, and IEA this week will provide important signals on the supply/demand balance. If they point to rising inventories and a looser market in the second half of the year, as Morgan Stanley analysts suggest, it could cap the upside for prices. On the other hand, the backwardation in the Brent futures curve, with the 3-month spread widening out to $1.40, indicates some near-term tightness that could support prices into the July 4th weekend – though it is a bit early for that, contracts that close next week are delivered in July but post-holiday – so these guys are playing with fire if demand isn’t there to siphon off those deliveries!

Beyond the oil-specific factors, the broader macro environment will be key to watch. The Federal Reserve decision tomorrow is the main event, with the market expecting no change to interest rates but watching closely for signals on the timing of potential rate cuts later this year.

The recent string of stronger-than-expected economic data, including the blowout May jobs report, has led investors to pare back bets on imminent Fed easing. This has boosted the U.S. dollar, which is bearish for oil and other commodities priced in greenbacks. If the Fed maintains a hawkish tone and pushes back against rate cut expectations, it could be another headwind for oil.

The other key data point this week is the May CPI report tomorrow. Unlike Leading Economorons, we expect headline inflation to tick up slightly to 3.5% year-over-year, with core inflation easing a bit to 3.5% from 3.6%. A hotter-than-expected reading could further dent rate cut hopes and weigh on risk assets like oil.

Geopolitical risks also can’t be ignored, even if they’ve faded into the background recently. Any flare-up in tensions between the U.S. and Iran, or further escalation in the Ukraine war, could quickly put a geopolitical risk premium back into the oil price.

Overall, oil looks delicately balanced here with competing bullish and bearish forces. The path of least resistance may be higher in the very near-term if this week’s reports show the market tighter than feared. But the upside looks limited unless the Fed takes a dovish turn or macro fears dissipate. Playing oil from the short side on rallies to the $77-$78 area for WTI, with tight stops, makes sense as a tactical trade. But be nimble and don’t overstay your welcome if the bullish catalysts start to build.

- Emerging Currencies Drop as EU Elections Add to Political Risks

- Asian Stocks Cautious Ahead of Key US Indicators

- Here Are The Key Takeaways From The EU Elections

- What to expect from the housing market in the second half of 2024, according to real estate experts

- NYC Landlord to Sell Office Building at Roughly 67% Discount

- The Tension Between The ‘Centralized Manager Class’ & Reality Is “Explosive”

- Russia’s Oil & Gas Revenues Surged By 73.5% In January-May

- The Fall of Germany’s Greens

- Climate Change Is Coming for the Finer Things in Life

- Apple Intelligence: A Guide to Apple’s AI-In-Everything Strategy

- Here’s everything Apple announced at WWDC24: Apple Intelligence, Siri with ChatGPT, iOS 18 and more

- Elon Slams Apple’s Farcical “AI” Launch, Says Will Ban Tim Cook’s “Creepy Spyware” Devices If They Integrate OpenAI

- Taiwan’s energy crunch could ‘throw a wrench’ into the global chip industry

- Here Are The 5 Supreme Court Issues Set To Reshape America’s Political Landscape