The Collapse Of 3.4 Trillion Dollar Black Gold

Via BEC Finance

(from a talk originally produced about a year ago)

Timeline

0:09 – Beyond major producers

1:22 – Brazil pre-salt: deepwater, high cost, long-timeline risk

2:35 – Venezuela collapse: intervention or Maracaibo secession scenarios

3:57 – West Africa (Nigeria/Equatorial Guinea/Angola): offshore, security, UK/France role

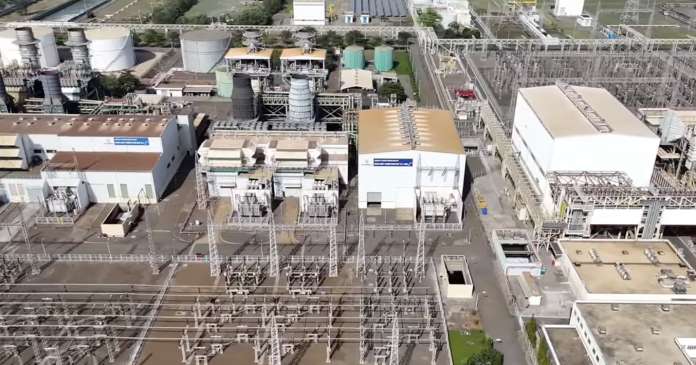

5:12 – Southeast Asia & Australia/Brunei/Indonesia/Malaysia/Thailand/Vietnam: demand absorbs supply

5:59 – North Sea

6:45 – Algeria: French leverage; Spain/Italy as alternatives

7:41 – Libya: Italian dependence drives intervention

8:40 – Tally of reliable exportable oil

9:15 – Refining basics: crude grades and configuration constraints, natural gas vs oil

14:04 – Gas emissions shift, pipeline dependencies, LNG disruptions

16:12 – Gas shortages

16:48 – Price gaps: expensive in Europe/NE Asia, surplus-cheap in U.S.

17:56 – Closing

Summary

Warning on Refinery, AI, Iran tanker hijack, Russia & China

Timeline

0:00 – U.S. refineries: capacity expansion vs. new builds; Jones Act constraints

1:48 – Global supply: China decline, Iran “gray market,” Saudi cut claims

2:30 – Saudis shopping for a new security guarantor

2:54 – Nuclear, solar/wind, and AI impacts

3:33 – Solar/wind economics and the Inflation Reduction Act’s boost

5:16 – AI disruption: editing/legal research/tax prep; political micro-targeting

8:00 – Tucker Carlson question; alignment with Russian propaganda themes

9:00 – Saudi image/strategy via sports; social reforms and yuan oil sales

10:00 – China collapse vs. Russia’s durability; “useful idiot” dynamic

12:05 – Sanctions on China scenario; Xi’s information purge; spy-balloon intel coup

15:31 – U.S. cyber dominance and potential to disable China’s networks

16:40 – Top U.S. threats: cartel evolution and proposed military strikes in Mexico

19:46 – Risks of striking Mexico: NAFTA supply-chain damage and economic costs

21:50 – Sea-lane security, Iranian tanker seizures, and U.S. energy

Summary

Zeihan says the U.S. isn’t building many new refineries but is expanding existing ones—adding ~4–5 mb/d of capacity over seven years—while the Jones Act keeps crude/products from moving cheaply between U.S. coasts, raising coastal energy costs. Globally, he sees Chinese oil output sliding, Middle East output roughly steady, Iranian barrels shifting from “black” to “gray” markets (not actually increasing), and Saudi Arabia talking cuts but not always delivering; Riyadh is shopping for a new security guarantor as U.S. protection recedes.

He notes the U.S. has exceptional renewable potential—solar in the Southwest and wind in the Great Plains—and that Inflation Reduction Act incentives make many more areas economically viable. He expects combined solar and wind to supply roughly 25–33% of U.S. electricity within a decade. On AI, he warns of early disruption in text- and research-based jobs such as editing, paralegal work, and tax preparation, and of growing risks from hyper-targeted political propaganda.

Zeihan notes that Tucker Carlson’s Ukraine/Biden content often mirrors Russian propaganda in timing and phrasing, though motive is unclear. On Saudi “sports diplomacy,” he frames it as part of a broad hedge—social changes, Indian labor ties, yuan oil payments—amid uncertainty about U.S. backing.

Geopolitically, he contends Russia is more durable than China; sweeping Russia-style sanctions on China would trigger rapid famine and de-industrialization because China is a top importer of energy and food. He portrays Xi as isolated from information—citing the spy-balloon episode as an intelligence windfall for the U.S. He also claims U.S. offensive cyber capacity eclipses everyone else’s and could quickly cripple Chinese networks in a conflict.

Domestically, he sees two rising risks: (1) Mexico’s cartel dynamics—especially if a more violent group gains U.S. footholds; and (2) U.S. politics, where he argues the Trump-aligned GOP wing undermines fact-based policy and is floating ideas like bombing cartels in Mexico—something he says would devastate NAFTA supply chains and cost Americans thousands per capita.