Phil Davis on Money Talk

Phil Davis, founder of philstockworld.com, joins Kim Parlee on BNN’s MoneyTalk to discuss investing strategies and trades.

See also: Money Talk Tuesday – Up 131.5% in 7 Months – Here Are Our New Picks & Adjustments.

Videos:

Billion-dollar loop: Is big tech paying itself to power the AI boom?

Investors have been grappling with a multitude of potential headwinds, including trade tensions, economic uncertainty and a lack of U.S. data as the government shutdown continues. Phil Davis, founder of philstockworld.com, explains why investors should also be paying attention to a capex loop emerging between the big Magnificent seven companies that he believes isn’t sustainable.

How to ‘Be the House’ as an investor

Phil updates the MoneyTalk portfolio and discusses what it means to ‘Be the House’ as an investor and how you can incorporate being the house into your investing strategies.

Two trading ideas from Phil Davis

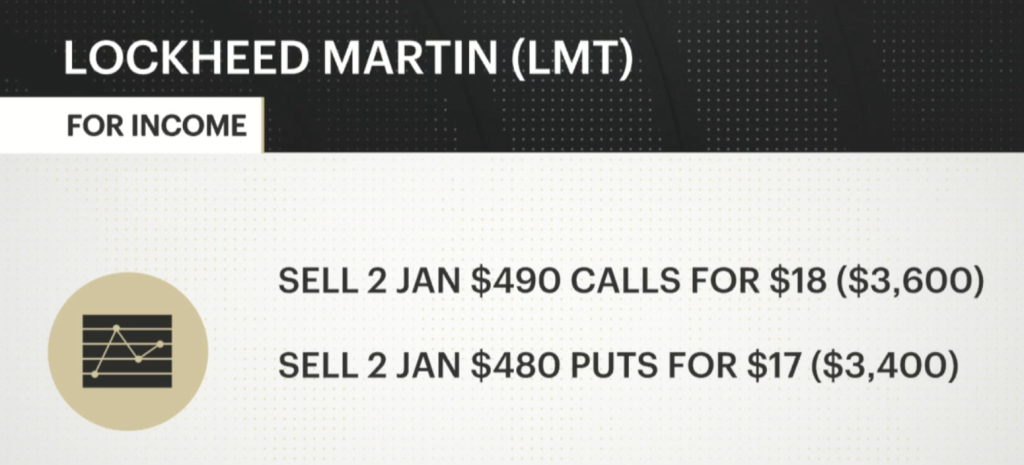

Phil discusses two specific trades ideas: 1) Stock of the century, LMT:

- LMT – The best offense is a good defense and the US’s Department of Offense should be keeping LMT busy for years to come. LMT is our Stock of the Century as we expect them to be a player in Drone Warfare as well as Nuclear Fusion. We will take advantage of the pullback to roll the 3 2027 $470 calls at $18,600 to 5 2028 $450 calls at $91 ($45,500) and we’ll sell 4 2028 $500 calls at $71 ($28,400) and 2 2028 $400 puts at $33 ($6,600) and, for income, we will sell 2 Jan $490 calls at $18 ($3,600) and 2 Jan $480 puts at $17 ($3,400) and that is net $15,100 in our pockets and we’re left with a potential $25,000 spread for net $9,435 (our original investment less $15,100) so there’s $15,565 (164%) upside on the spread and 8 more quarters of $7,000 is another $56,000 so $71,565 (758%) of upside potential make this also great for a new trade!

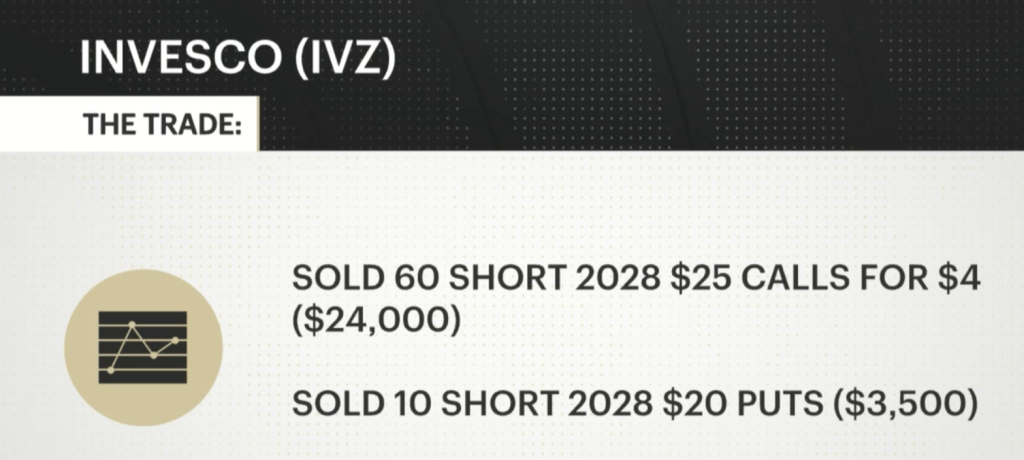

And 2) Underrated asset manager, IVZ:

Step 1: Bull Call Spread: buying 60 call spreads:

- Buy 60 2028 $20 strike calls for $6, and…

- Using options instead of buying stocks gives us the ability to diversify our holding and create income streams not available to most Equity Investors – this is what we teach you to do at PhilStockWorld.com.