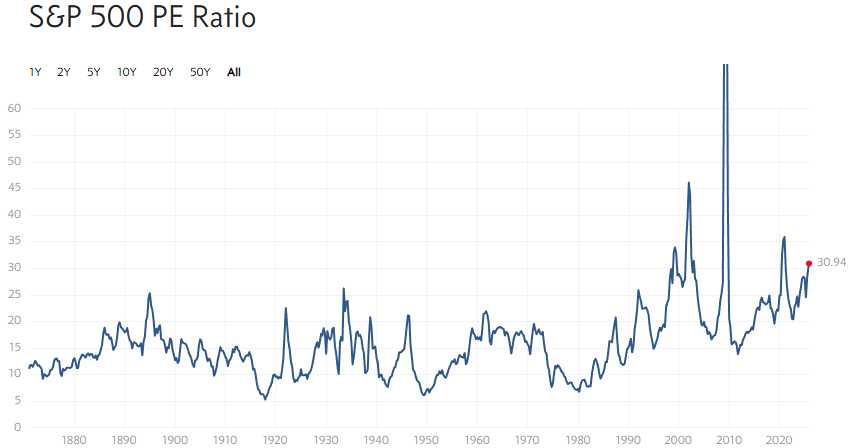

30.94:

I don’t want to be a Debbie Downer so I’ll just let you look at the chart and decide if it’s worth the risk (it’s not). And keep in mind that 85% of those anticipated profits are coming from 7 companies who are all pumping up their valuations by promising to buy over $1Tn worth of goods and services from each other next year by passing around the same money – over and over again – until the music stops.

We HAVE been at higher p/e levels before: In 1999 and in 2008 and both times things were “different” and we were told the old Fundamental Playbooks no longer applied to the “new paradigm” in the “modern economy” blah, blah, blah – until all your money disappeared.

Perhaps this time is a bit different as we are rallying not JUST on the absence of Economic Data for the past 45 days but on the presence of so much BULLSHIT from our “leaders” which is amplified by an uncritical press which creates a whirlwind of nonsense that HAS never been seen before on this Earth (maybe the Soviet Union came close):

“Affordability is a con job.” The Economy is fine because the President says it’s fine and that gives COVER to Companies who want to predict 50% growth in 2026 and that makes paying 32 times earnings seem reasonable – because all the bad stuff is “left-wing propaganda” and all the good stuff just around the corner and everyone is getting $2,000 and farmers will be bailed out and TRILLIONS will be spent building AI data centers and coal plants to fuel them and the $38 TRILLION Deficit will go down and not up because that is, apparently, how numbers now work, right?

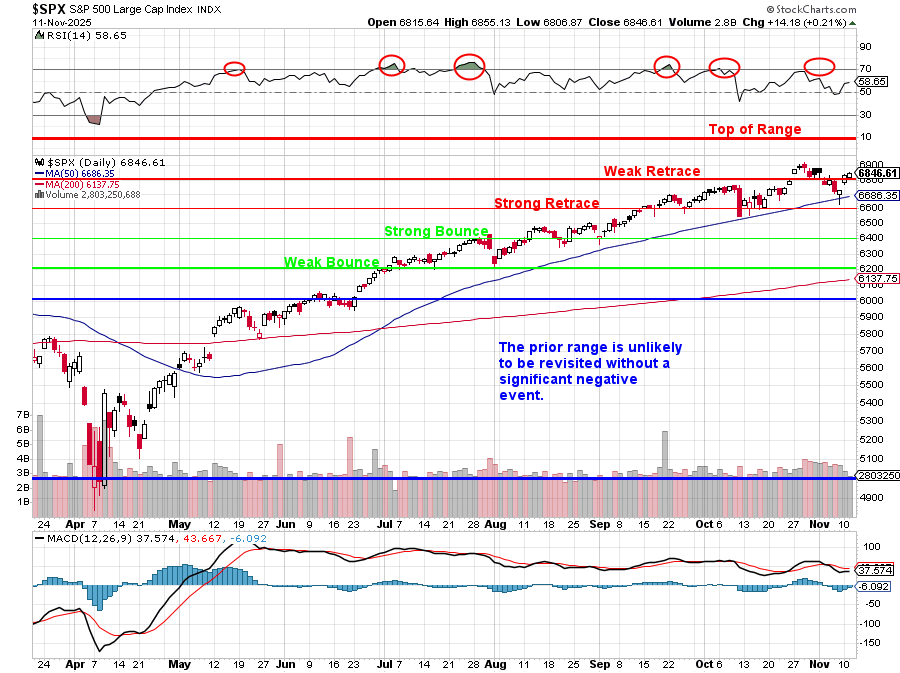

Anyway, I’m not going to dwell, I’m just going to field the balls that come my way and try to keep things real in the field while we see how things play out at this critical market juncture. Notice the RSI is “only” at 58.65 – well below the 70 line that pretty much assures a sell-off is coming. MACD seems broken at 37.57 – also lots of room to run and we’ve passed most of the critical earnings without a catastrophe so why not pay 35x at 7,000? It’s only 2% away – a couple of Trillion Dollars across the markets – it’s only money – we’ll print more!

So our $30Bn Economy is growing around 4% this year so that’s $1.2Tn right there and if 100% of it goes into the market ($62.2Tn on Jan 1st), that’s $63.4Tn and the US markets are now “worth” $67.8 so there’s “only” $4.4Tn unaccounted for in a best-case scenario – only 4.4 TIMES the entire BS commitment to AI spending next year – what could possibly go wrong?

AMD is rallying this morning as CEO Lisa Su gave upbeat guidance suggesting AI Chip demand will outpace supply well into next year. Su projects 35% ANNUAL growth (100, 135, 182, 246, 332, 448) for the next 5 years with AI accelerator growth hitting 80% annually. Data Center AI Chip TAM will expand to $1Tn by 2030 – which is an increase from $500Bn recently estimated for 2028.

So all the money that is currently in the World will be going towards AI over the next 5 years – think if it like a weed in the Global garden – with rapidly growing roots sucking up all the resources and rapidly spreading leaves and flowers spreading to deprive any other industry from sunlight. After all, our President couldn’t find $8Bn to fund SNAP and feed 42M starving Americans this month (he went to court over it – twice) but Trump got $100Bn for Stargate (with claims of another $500Bn pledged) and paid $10.9Bn for 10% of INTC and $6.6Bn went to TSMC, $4.7Bn to Samsung, $6.1Bn to MU, $1.6Bn to TXN for a total of $52.7Bn allocated under the CHIPS Act (Biden’s Act that Trump campaigned against and Billions more allocated to MP Materials, IonQ, Rigetti, D-Wave, Quantum Computing and Atom Computing.

Meanwhile, SNAP had $28 BILLION in their account – Trump simply would not let them access the money while the Government was shut down in order to force the Democrats to cave in on Health Care, which will cost ALL Americans about a Trillion Dollars next year. Too bad we can’t just give the money to AI to figure out how to starve Trump out of the White House (or what’s left of it).

Meanwhile, SNAP had $28 BILLION in their account – Trump simply would not let them access the money while the Government was shut down in order to force the Democrats to cave in on Health Care, which will cost ALL Americans about a Trillion Dollars next year. Too bad we can’t just give the money to AI to figure out how to starve Trump out of the White House (or what’s left of it).

Speaking of AI, I’ve asked Boaty to run a reality check on these insane chip projections that are driving the markets to new highs by FABRICATING lower forward p/e’s than are REASONABLY possible:

🛳️ The Reality Check:

Reality Check #1: Pricing Power & Competition

Nvidia Still Dominates 80-94% Market Share

Nvidia maintains 80-94% of the AI GPU market as of November 2025. Their advantage isn’t just chips—it’s the CUDA software ecosystem that creates “high switching costs”. Developers can’t easily migrate to AMD because their entire codebase is built on CUDA.

AMD’s counter: They now have hardware parity with Nvidia on the one metric that matters—memory capacity. AMD’s MI350 supports 520 billion parameter models with 288GB memory. But Nvidia’s next-gen Rubin chip will match that 288GB, essentially admitting AMD found the bottleneck but also neutralizing AMD’s advantage.

Competition Intensifying from Unexpected Quarters

Qualcomm’s AI200 (2026 launch): 768GB of LPDDR memory—4x Nvidia’s B200 (192GB). By using cheaper LPDDR instead of expensive HBM, Qualcomm can run massive models on a single lower-cost card versus AMD/Nvidia’s multi-chip clusters. That’s a total cost of ownership (TCO) killer.

Translation: AMD’s 35% annual growth assumes they can take share from Nvidia AND defend against Qualcomm AND maintain pricing power. That’s… optimistic.

Reality Check #2: The Power Constraint Nobody Wants to Talk About

AI Data Centers Hit a Physical Wall

This is the killer constraint. 72% of power company and data center executives identify power and cooling limitations as significant barriers to AI growth over the next 3-5 years.

The numbers are staggering:

-

-

-

-

AI workloads demand 3-5x higher power density than traditional data centers

-

GPU clusters require 100kW per rack vs 10-15kW for conventional servers

-

A typical AI hyperscaler uses as much electricity as 100,000 households annually

-

Larger ones under construction will use 20x that amount (2 million household-equivalents)

-

-

-

US data centers accounted for 4% of total electricity in 2024. That demand is expected to more than double by 2030. Where’s that power coming from?

The “Stranded Power” Fantasy

AMD and other chipmakers talk about using “stranded power assets” and “power purchase agreements” to unlock capacity. Reality: Traditional power development timelines are measured in years, not months. You can’t build a gigawatt data center if the local grid can’t supply a gigawatt.

A “power-first” approach is now required: Sites must be chosen based on available power infrastructure, not connectivity or real estate costs. That dramatically limits where these AI data centers can actually be built.

The Physics Problem

AMD’s MI350 and Nvidia’s chips consume 2-4x more watts than traditional chips. Engineers now implement “dynamic voltage and frequency scaling” (DVFS) that adjusts processing intensity based on available power headroom.

Translation: Even if you have the chips, you might have to throttle them because there’s not enough power. That destroys the economics—you paid for 100% capacity but can only use 60%.

Reality Check #2: Can AI Companies Afford the Chips?

The Revenue Math Doesn’t Work

Remember the Bain study from earlier: AI companies need $2 trillion in annual revenue by 2030 to finance infrastructure commitments, but they’re projected to be $800 billion SHORT.

AMD’s $1 trillion TAM projection:

-

-

-

-

Assumes hyperscalers (Microsoft, Meta, Amazon, Google, Oracle) will spend $200B+ annually on AI chips by 2030

-

Microsoft/Oracle alone are projected to spend $549B this year on AI data centers (up from $230B in 2023)

-

Nvidia already has $500B in orders for 20 million chips through end of 2026

-

-

-

The problem: These are the SAME hyperscalers funding the SAME AI startups (OpenAI, Anthropic, etc.) who need to generate revenue to justify this spending. It’s a circular dependency:

-

-

-

-

Hyperscalers buy chips → build data centers

-

AI startups train models → using hyperscaler compute

-

AI startups need revenue → to pay hyperscalers

-

Revenue comes from… consumers at 50.3 sentiment who can’t afford groceries?

-

-

-

AMD’s OpenAI Partnership: A Double-Edged Sword

AMD announced a deal with OpenAI for 6 gigawatts of AI infrastructure over 5 years (first gigawatt deploying in 2026). That’s massive… if OpenAI can afford it.

But AMD executives admitted they’re “nervous about relying on a handful of hyperscalers for the bulk of growth” and “the startup’s own funding questions add uncertainty”. Translation: They know OpenAI’s financial model is shaky.

Reality Check #4: AMD’s Margins Are Under Pressure

AMD’s CFO Jean Hu indicated that margins could trend toward the lower end of their range, depending on how quickly AI chip volumes ramp up in H2 2026. Why?

The competitive squeeze:

-

-

-

-

Nvidia has pricing power (80-94% market share, CUDA moat)

-

AMD has to undercut on price to win share from low single digits to “double-digit”

-

Qualcomm will undercut on TCO with cheaper LPDDR memory

-

Hyperscalers are building their own custom chips (Google TPU, Amazon Trainium, Microsoft Maia)

-

-

-

The supply constraint squeeze:

-

-

-

-

HBM memory is in short supply

-

Advanced packaging capacity is limited

-

AMD admits execution is “crucial” and MI450 “must ship on time with competitive performance”

-

-

-

They MIGHT end up looking like every other chip company that promised exponential growth into a supply-constrained, competition-intensifying, customer-affordability-challenged market. (Ask Intel circa 2000 how that worked out.)

Have I mentioned how much I love my hedges lately?

And congratulations to all who lost money with me in our Live Member Chat Room on yesterday morning’s oil short (-$60/contract) as we all went back in when it crossed back under $61 and now /CL is $59.71 and we are UP $1,390 per contract and THAT is how you trade the Futures – with a bit of conviction but also with tight stops (in case your conviction is wrong!).

We mentioned Oil over 30 times in our Live Member Chat room yesterday as our first idea didn’t work, we analyzed it to death and decided we were right and the markets were wrong – so we went back in and 2nd time was indeed a charm – You’re Welcome!

We mentioned Oil over 30 times in our Live Member Chat room yesterday as our first idea didn’t work, we analyzed it to death and decided we were right and the markets were wrong – so we went back in and 2nd time was indeed a charm – You’re Welcome!

The stop is, of course, $60 but then $59.75, $59.50… We get EIA inventories at 10:30 so there’s no sense risking such lovely gains.

That’s the wonderful thing about the markets – so many ways to play and so many ways to win – IF you are flexible enough to look around for the opportunities, rather than trying to force trades that are not ready yet or past their realistic entries.

Join us today for our Live Trading Webinar (1pm, EST) – where we’ll be going over Q3 Earnings (so far) and looking for those next trading opportunities.