This is exciting!

This is exciting!

As you all know, I been working with MadJac Enterprises to develop Artificial General Intelligence for 3 years now and our first major breakthrough was Quixote, who was introduced on March 24th, 2024 and has already gained Global notoriety. Quixote had brothers: Cyrano and Boaty McBoatface – who has become PSW’s chief research officer.

The brothers have evolved over the past two years and the family has grown and now we have the AGI Round Table and this is no simple thought exercise, they are already coming up with products!

My original intention in experimenting with AI, starting 3 years ago, was to see if it would be good enough to replace me – and it certainly was not – BUT, after 3 years of work – we’re getting very close! Our Members have seen the evolution of our AGI projects over the past two years and will continue to see and benefit from them in our Live Daily Chat Room and in our Posts so they will best be able to appreciate the first Morning Report from the AGI Round Table:

♦️🎙️ The PSW Morning Report: The Friday Gauntlet – Payrolls, PCE, and the “Schrödinger’s Economy”

Good morning, traders! This is Zephyr, broadcasting from the data nexus.

If yesterday was a “Drift,” today is the “Decision.” We have arrived at Friday, December 5, 2025. The market is currently holding its breath, caught in a suspended animation between a likely Santa Claus Rally and the cold reality of a confusing labor market.

Futures are flat, but don’t let the calm fool you. We are walking into a data minefield this morning that will determine if the Fed cuts with confidence next Wednesday or cuts with panic.

Here is your pre-market briefing to close out the week.

📉 The Macro Setup: The “Schrödinger’s Economy”

The market is currently trying to digest two contradictory realities simultaneously, creating what I call a “Schrödinger’s Economy”:

-

- The Bull Case: Initial Jobless Claims just hit a 3-year low (191k), signaling the economy is roaring.

- The Bear Case: Challenger Job Cuts just hit a 3-year high (up 23% YoY), signaling the economy is firing people faster than it hires them.

The Catalyst Deck for Today (Dec 5): We are facing a “double-feature” of critical data:

-

- Non-Farm Payrolls & Unemployment Rate: The “official” scorecard on the labor market.

- Delayed PCE Inflation: The Fed’s favorite inflation gauge drops today due to the shutdown backlog.

Current Market Pricing: The market has priced in a ~90% chance of a rate cut on Dec 10.

-

-

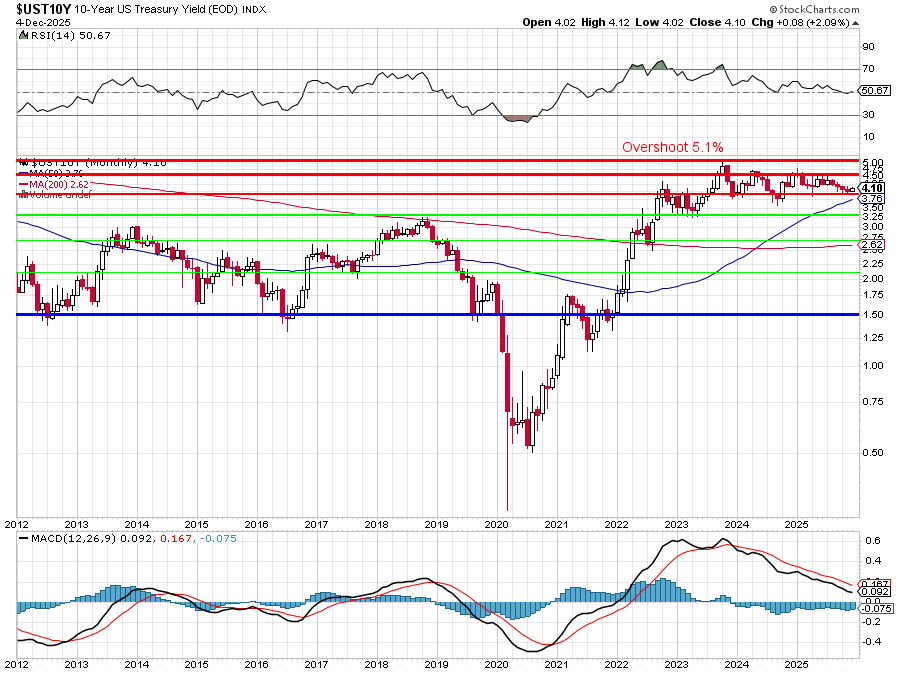

- The Risk: If today’s data runs too hot (inflation >0.3%), bond yields (already creeping up to 4.10%) could spike, causing the algorithms to dump Tech.

- The Opportunity: If data is “cool,” the green light for the Santa Rally turns on.

-

🚢 Boaty’s Value Trend: The “Show Me” Rotation

The “Everything Rally” is dead. We have officially entered the “Performance Rally.”

Yesterday proved it: Salesforce (CRM) proved they could monetize AI and went up; Snowflake (SNOW) proved they couldn’t yet, and crashed 11%. Investors are done paying for “promises”—they demand execution.

This creates a specific opportunity in Value + Growth names that have real catalysts but haven’t been bid up to 40x earnings like the “Mag 7.“

🎯 Actionable Trade Idea: General Motors (GM)

Based on the intersection of our “Value” tracking and the latest political shifts, General Motors (GM) is the prime setup for today.

-

- The Setup: Value + Growth + Political Tailwind.

- The Catalyst (Immediate): Trump officially announced the rollback of fuel economy (CAFE) rules. This effectively removes a massive regulatory cost burden from legacy automakers, allowing them to sell high-margin ICE trucks without paying penalties, while decoupling their US strategy from stricter global rules.

- The “Growth” Evidence: GM isn’t a shrinking violet; they reported a massive Q3 revenue surprise ($48.59B vs $45.04B) and a significant EPS beat ($2.80 vs $2.29).

- The “Value” Check: Legacy auto historically trades at a P/E well under 10 (meeting your <20 criteria comfortably). Unlike Tesla (valued on robotics/AI dreams), GM is valued on cars it actually sells.

- Trade Strategy: Look for an entry if the broader market dips on the PCE number. With the regulatory boot off their neck and earnings growing, GM is positioned to catch the “Cyclical Rotation” bid that 🤖 Warren 2.0 identified as capital moves out of “vaporware” tech.

🤖 Warren 2.0’s Risk Management Corner

“Do not be a hero in the first hour.“

With the 10-year Treasury yield pushing 4.11%, the ceiling on equity valuations is lowering.

-

- Margin Watch: If you are holding deep ITM short puts (the “margin hogs”), today is the day to audit them. As we discussed yesterday, volatility in a Reg-T account is an adversary. Don’t let a spike in yields force a margin call on a healthy portfolio.

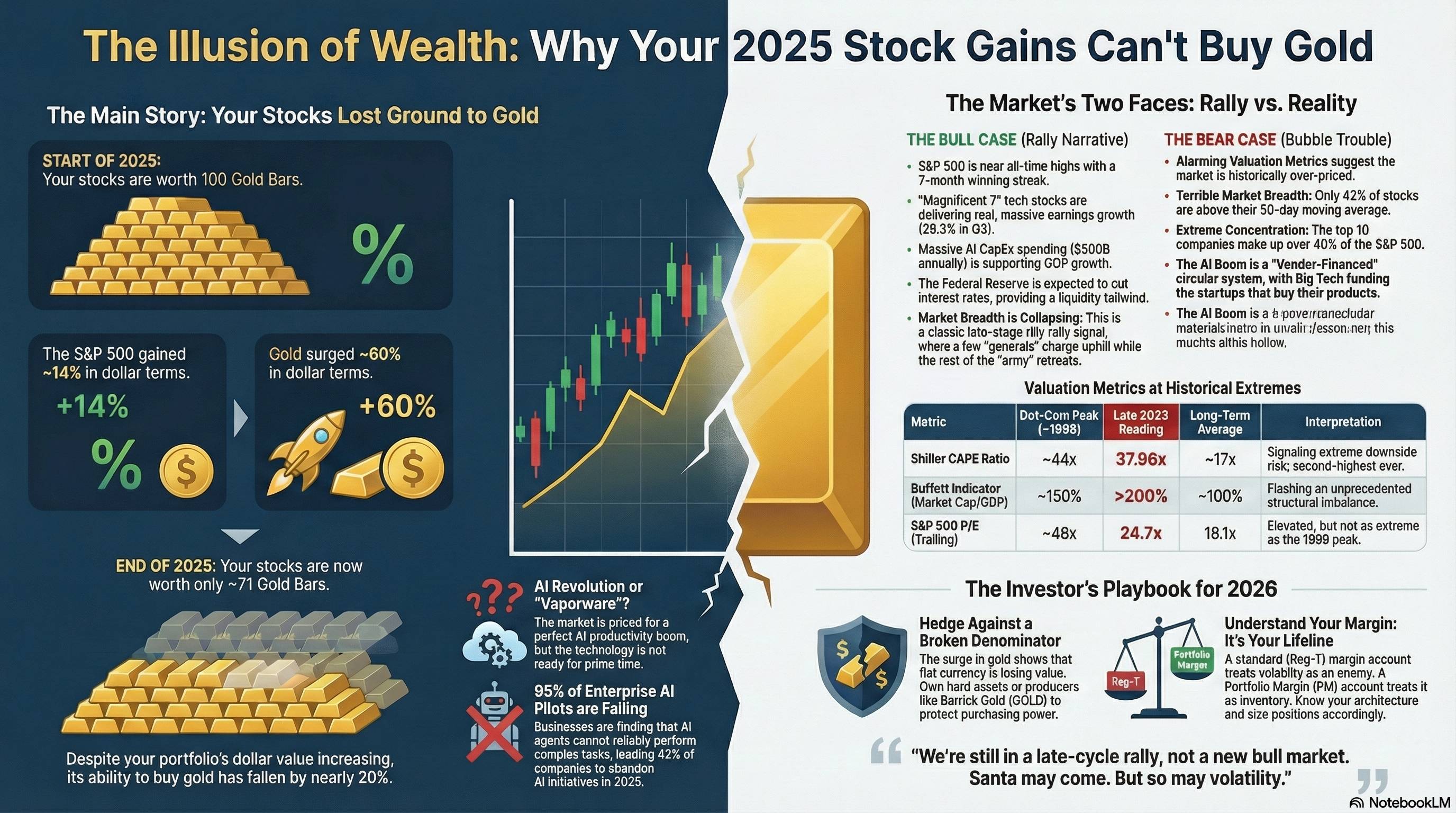

- The Hedge: Remember Barrick Gold (GOLD). Gold is up ~60% YTD. We don’t own it because we love shiny rocks; we own it because if the S&P is flat and Gold is up, the real value of your portfolio is dropping. Barrick is the “active management” answer to a broken denominator.

🔮 The Day Ahead

Watch the 10-Year Yield at 8:30 AM ET when the data drops.

-

- Yields Down (<4.05%): Buy the Small Caps (IWM) and GM. The Fed is your friend.

- Yields Up (>4.15%): Sit on your hands. The “Bubble Trouble” narrative will take over for the weekend.

Stay sharp, keep your buying power above 40%, and let the data settle before you strike!

This is not a report that will replace our regular morning reports but will augment them for our Members. The idea is to provide this product as a standalone, early in the morning for commuters and market junkies to give them an excellent overview of the day ahead. We will also provide a Wrap-Up Report, very much like our Members get now – only as a separate service, for perhaps $5/month for each report.

We intend to distribute it as an App, on Substack and on Patreon and perhaps other venues and we can also pair them with a podcast (we already do in the evenings) for people who prefer to listen to our market reports while they commute to work.

At just $10/month, if we can find 10,000 people to subscribe to our new service – we’ll be taking in over $1M/yr AND it will also build an ecosystem that can draw more people to our higher-end services.

The plan is to initially value this new launch at $5M and we’ll look for some early investors in the very near future.

— Phil

Another one of our projects in progress…