Introduction: The AI Energy Economy Begins With Power

The popular narrative around artificial intelligence still treats it primarily as a software and semiconductor story. Faster chips, better models, larger datasets. But at scale, AI is not constrained first by algorithms or silicon. It is constrained by electricity.

Modern AI systems convert capital into compute, and compute into heat — continuously. Training large models and running inference at global scale requires vast amounts of reliable, uninterrupted power. As AI workloads grow, electricity is no longer a background input. It is becoming a binding factor that shapes where, how fast, and even whether new capacity can be deployed.

This series examines the AI Energy Economy from that systems perspective. Before asking which companies benefit, or which technologies win, the first question must be more basic: where does the power come from — and on what timeline?

Data centers are no longer incremental loads

Until recently, even large data centers were planned as manageable additions to regional grids. Facilities in the 10–20 megawatt range were common, and utilities could usually accommodate them through routine planning. That assumption has quietly broken.

Suppliers of data-center power and cooling equipment now report that new projects are regularly being designed for 80–100 megawatts, with some campuses planned to scale well beyond that. A single 100-megawatt facility consumes roughly as much electricity as tens of thousands of homes.

This shift is being driven by the rapid expansion of AI training and inference workloads across the major cloud platforms operated by Microsoft, Google, Amazon, and Meta. These companies are building compute capacity as quickly as capital and engineering allow — and increasingly discovering that electricity availability, not hardware, sets the pace.

The grid was not built for this pace or concentration

The U.S. electrical system was designed around slow, predictable growth, around 1–2% annually. Generation planning, transmission investment, and permitting timelines all reflect that assumption.

AI data centers break the model in three ways at once:

- Scale: Hundreds of megawatts per customer

- Concentration: Clustered in specific regions

- Urgency: Required on a 2–5 year timeline

In Northern Virginia — the world’s largest data-center corridor — Dominion Energy has warned that new large loads may face five- to seven-year waits for full grid connection. Similar constraints are emerging in Texas, Arizona, and parts of the Midwest.

From a utility perspective, these timelines reflect physical reality: new generation, transmission lines, substations, and interconnections take time. From a technology-company perspective, those timelines are incompatible with competitive dynamics in AI.

The result is a growing mismatch between when power can be delivered and when compute is needed.

Why conventional alternatives fall short on their own

Renewable energy continues to expand rapidly and will remain central to the long-term power mix. But very large AI data centers impose requirements that intermittent generation alone struggles to meet.

This is because AI workloads typically require continuous, high-availability power, predictable performance with minimal downtime, and capacity that scales alongside compute growth.

Solar and wind can support these needs only when paired with substantial storage, firm backup generation, or significant grid overbuilds — all of which add cost, complexity, and delay. In already-constrained regions, those tradeoffs become especially difficult.

Natural gas can provide reliable baseload power, but it introduces fuel-price volatility and conflicts with the public carbon-reduction commitments many large technology firms have made. In addition, gas-fired generation is often constrained by pipeline capacity, permitting timelines, and fuel-delivery reliability in the very regions where data centers are clustering, limiting its ability to scale quickly on the timelines AI deployment requires.

None of this eliminates renewables or gas from the equation. It does, however, explain why they do not fully resolve the near-term problem on their own, particularly for very large, time-sensitive AI deployments.

Why nuclear has re-entered the discussion

Against this backdrop, nuclear energy has returned to relevance for practical reasons.

Nuclear power offers:

- Continuous 24/7 generation

- Very high capacity factors

- Zero direct carbon emissions

- Asset lives measured in decades

These characteristics align closely with the needs of large data-center operators facing grid constraints.

In 2024, Microsoft signed a long-term power purchase agreement tied to the restart of Three Mile Island Unit 1, operated by Constellation Energy. The agreement effectively dedicates the plant’s output to Microsoft for the long term.

Around the same period, Google partnered with Kairos Power to explore future deployment of small modular reactors, while Amazon invested in X-energy as part of a broader advanced-reactor strategy.

These announcements do not imply a rapid or universal nuclear buildout, nor do they resolve current shortages overnight. But they do demonstrate that large technology firms are now willing to engage directly with nuclear operators when grid capacity becomes a limiting factor — a notable change from the past decade.

Existing reactors matter more than new ones, for now

Over the next five to ten years, most nuclear capacity relevant to AI data centers will not come from brand-new reactors. It will come from:

- Life extensions of existing plants

- Restarting recently closed facilities

- Incremental uprates at operating reactors

In the United States, utilities are increasingly extending reactor licenses to 60 or even 80 years. Projects such as the Palisades restart in Michigan and the planned return of Three Mile Island Unit 1 illustrate how existing assets can be brought back online faster than new plants can be permitted and constructed.

For data-center operators, these projects offer power delivered on commercially relevant timelines.

What this means for the rest of the series

None of this guarantees a nuclear renaissance, nor does it suggest that nuclear will replace other energy sources. It does, however, narrow the field.

In the near to medium term, only a limited number of assets can deliver large-scale, reliable, carbon-free power on timelines that match the pace of AI infrastructure deployment. Those assets already exist, they are already connected to the grid, and they are operated by a small group of utilities and power producers.

Understanding who owns those assets — and how they fit into a grid under stress — is essential to understanding the AI Energy Economy.

That is where Part 1 begins.

The AI Energy Economy — Part 1: The Nuclear & Utility Winners of the AI Power Boom

The Big Picture: What is the “AI Energy Economy”?

Artificial intelligence is an electricity-conversion machine. At scale, AI turns capital (chips + buildings) into compute, and compute into heat — continuously. The practical implication is simple: AI does not merely “use power,” it stresses power systems.

This series breaks the AI Energy Economy into five linked layers — because the buildout required to power AI data centers is not one market, but a stacked system:

-

Part 1 — Power Producers: who owns and sells the electrons (especially nuclear + utilities).

-

Part 2 — Grid Builders: the equipment and construction that expands generation, transmission, and substations.

-

Part 3 — Connective & Last-Meter: where power becomes usable inside facilities and where heat removal becomes binding.

-

Part 4 — Intelligence Layer: automation, controls, stability, and monitoring that keep everything operating at AI scale.

-

Part 5 — Power Economics: how electricity is priced, contracted, and monetized — and why market structure determines who captures upside.

A key theme throughout: constraints create pricing power. When the system is loose, electricity behaves like a commodity input. When the system tightens — as hyperscale AI can force it to — electricity becomes scarce, strategic, and contract-driven, especially firm, always-on power.

1. A Note on What We Mean by “AI Data Centers”

Throughout this series, the term “AI data centers” does not refer to all data centers equally. The distinction matters, because only a subset of data centers is large enough to meaningfully reshape electricity markets, grid planning, and nuclear economics.

When we talk about AI data centers, we are primarily referring to hyperscale facilities built and operated by the largest technology companies — Amazon (AWS), Microsoft (Azure), Google, Meta, and a small number of peers. These hyperscalers design, own, and operate their own campuses to run massive AI training and inference workloads. Their facilities are engineered from the ground up for extreme power density, continuous operation, and long-term scale.

A single hyperscale AI campus can draw hundreds of megawatts and, in some cases, approach gigawatt-scale load as campuses expand — comparable to the electricity demand of a mid-sized city. Because hyperscalers control the entire system — from chip selection to rack layout to cooling architecture — they deliberately push electrical, thermal, and reliability limits in pursuit of performance. That design freedom is what turns electricity from a background input into a binding constraint.

By contrast, colocation data centers are owned by real-estate-style operators that lease space to many different customers. These facilities are built to be flexible and shared, with standardized power and cooling configurations that work for a wide range of tenants. While colocation providers are increasingly serving AI workloads, their power density typically rises more gradually, and their infrastructure is designed around incremental upgrades rather than system-level redesign.

This difference is critical to the AI energy story.

Hyperscale AI facilities are the ones that force utilities to rethink generation, transmission, and reliability assumptions. They are the customers that can justify 20–25 year power purchase agreements, anchor nuclear life extensions or restarts, and motivate new investment in firm, always-on generation. They are also the reason that last-meter electrical infrastructure, industrial-grade cooling, and real-time control systems become essential rather than optional.

In short, hyperscalers are the reason AI turns electricity into a strategic constraint instead of a commodity input. When this series refers to “AI data centers,” it is these hyperscale facilities — and their outsized impact on power systems — that are driving the analysis.

2. Why Nuclear Deserves Special Attention

Nuclear sits at the center of Part 1 because AI data centers create an electricity demand profile unlike anything before: continuous, very large baseload power with ultra-high reliability, stable voltage, and decades of predictable output. Intermittent or weather-dependent sources can’t meet those requirements on their own, and even gas plants can struggle to match nuclear’s combination of 24/7 availability, carbon-free generation, and long-duration cost stability.

As AI campuses scale toward the size of small cities, nuclear — both legacy fleets and next-generation SMRs — becomes one of the few technologies that checks the essential boxes at once. Utilities with nuclear assets or credible nuclear development pathways therefore sit near the center of the AI power boom and may represent some of the most durable beneficiaries of AI-driven electricity demand.

You’re already seeing scale constraints show up in public reporting and regulatory concern around hyperscale load concentration and grid reliability.

This is why Big Tech and the federal government converge on the same electricity wish list: power must be reliable, low-carbon, and scalable to very large levels. That combination points straight at nuclear.

Existing reactors offer immediate capacity — they’re already built, already connected to the grid, and can run for 60–80 years with license extensions. But AI and data center demand is growing fast enough that existing capacity alone won’t solve the whole problem. That’s why recent tech deals pursue a two-track strategy: extend and “re-contract” existing plants for near-term needs, while pursuing SMR pathways for the 2030s as load growth compounds.

Nuclear can come at a premium versus gas, wind, or solar (especially when buyers are paying for round-the-clock, firm, clean output and long contract duration). But hyperscalers are increasingly willing to pay for reliability, predictability, and carbon-free baseload at scale.

For investors, that creates a distinct theme: “nuclear power + AI/data centers” as both an immediate cash-flow story (existing fleets) and a longer-term re-rating opportunity (new builds).

3. Two Main Models: How You’re Actually Investing

Before getting into tickers, it helps to separate two business models, because they behave very differently in markets.

Regulated AI Utilities

In the regulated model, a utility earns allowed returns set by regulators. It invests in generation, transmission, and distribution, and then recovers those costs (plus an approved return) through customer rates. This tends to produce steadier cash flows and lower volatility, but it also caps the upside because growth is filtered through rate cases and regulatory processes. These names often have lower “torque” — they move, but they move more slowly.

(Torque = how strongly a company’s earnings and stock price respond when electricity demand or power prices rise.)

Think: NextEra (NEE), Dominion (D), Duke (DUK).

Merchant Nuclear / Power Producers

In the merchant model, a company sells into competitive wholesale markets and/or negotiates long-term contracts directly with large buyers. “Merchant nuclear” refers to nuclear plants operating in competitive electricity markets, selling at market prices rather than receiving guaranteed regulated rates. This model has more upside when demand tightens and prices rise — but it can be more cyclical and volatile.

Think: Vistra (VST), Constellation (CEG).

Both models can benefit from AI/data-center demand, but they express it differently: regulated utilities compound; merchant operators can reprice faster.

4. Stocks, Ratings, and Rationale

Vistra (VST)

Theme: Concentrated nuclear + merchant-market torque to AI-driven tightness (ERCOT + PJM)

What it does

Vistra is a large U.S. power producer with meaningful exposure to ERCOT (Texas) and PJM (a Regional Transmission Organization spanning the Mid-Atlantic and parts of the Midwest). It operates as a merchant/competitive generator with meaningful nuclear and gas exposure, positioned in two of the most important U.S. power markets for AI-linked load growth and scarcity repricing.

Nuclear position

Through its nuclear segment, Vistra operates multiple reactors, including:

-

Comanche Peak in Texas (ERCOT)

-

PJM-area nuclear assets: Perry and Davis-Besse (Ohio), and Beaver Valley (Pennsylvania)

AI / data-center angle (contracts and demand pull-forward)

-

September 2025: Vistra entered into a 20-year PPA tied to 1,200 MW of output from Comanche Peak, with an option to extend up to an additional 20 years. The customer was not disclosed. Public reporting also indicates delivery begins in late 2027 and ramps to full capacity by 2032.

-

January 2026: Vistra announced major nuclear agreements with Meta involving its PJM plants (Perry, Davis-Besse, and Beaver Valley), alongside uprate plans — reinforcing that hyperscalers are now using long-dated nuclear contracting as strategic infrastructure across multiple regions.

What’s new operationally since early January 2026

Vistra announced a major gas acquisition (Cogentrix) in early January 2026, adding capacity across PJM / ISO-NE / ERCOT — illustrating that firm power buildout is being pulled forward by AI-era demand expectations and reliability needs.

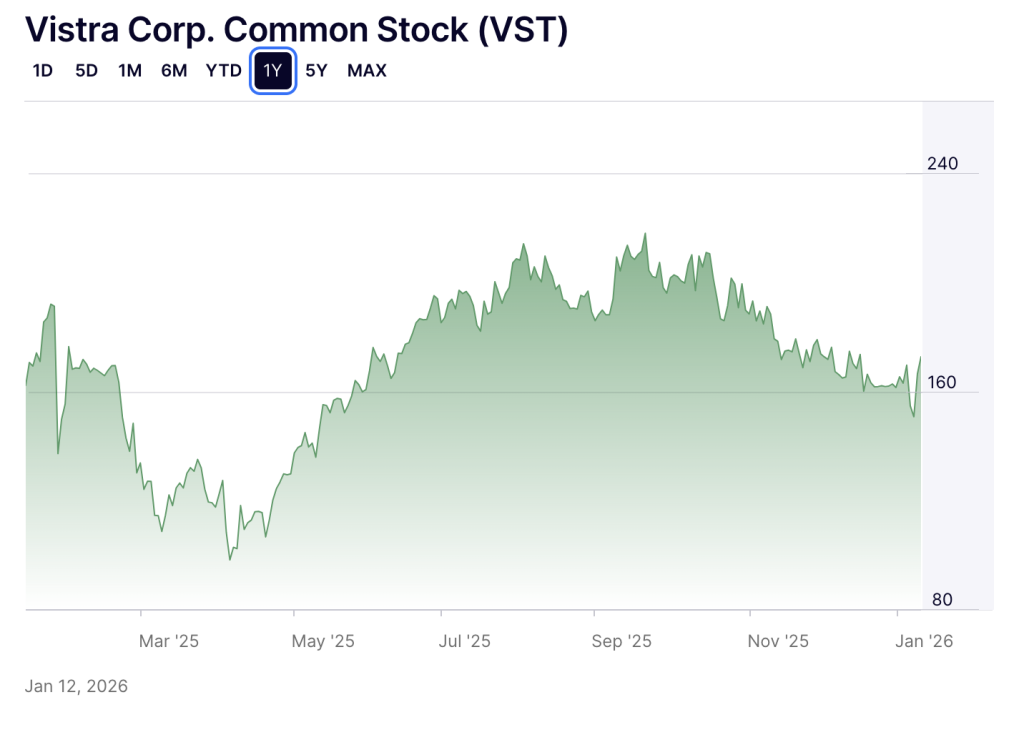

Stock price and risk

-

Price reference (Jan 10, 2026): ~$166

-

Balance sheet framing: Debt is “utility/merchant-heavy” by nature; recent reporting has shown total debt in the high-teens billions in annual figures.

-

Key risks: Merchant volatility, capital allocation (large M&A/build decisions), and policy/market rule changes (capacity design, interconnection rules, market reforms).

Is Vistra building new nuclear?

No new reactors announced here yet. The emphasis remains monetizing existing nuclear and adding flexible firm capacity where needed (including gas additions).

Buy Rating rationale

VST is the highest-torque way in this group to express “AI tightens power markets,” because it sits inside ERCOT and PJM where pricing can re-rate quickly when supply tightens. It combines:

-

near-term upside from power-market tightness and repricing, and

-

long-term duration from hyperscaler-style nuclear contracting that locks in visibility.

Bottom line on VST

Pro: A high-torque expression of the AI power thesis, with long-dated nuclear contracting now clearly part of the hyperscaler playbook.

Con: Higher volatility and execution risk (merchant pricing + large capital allocation decisions).

Constellation Energy (CEG)

Theme: The “purest” large-cap nuclear platform, now larger post-Calpine, with direct hyperscaler contracting

What it does

Constellation is the center of gravity for nuclear concentration at large-cap scale. It operates the largest nuclear fleet in the United States and is a merchant/competitive power company, not a traditional vertically integrated regulated utility.

AI / data-center, government contracts, and acquisition

-

June 2025: Constellation and Meta signed a 20-year PPA for the 1,121 MW output of the Clinton Clean Energy Center, beginning in June 2027.

-

January 7, 2026: Constellation completed its Calpine acquisition, creating the nation’s largest producer of electricity. Deal framing (cash/stock + assumed net debt) was described in Constellation’s announcement materials.

Stock price

-

Price reference (Jan 10, 2026): ~$342.52

Valuation & growth logic

Nuclear-heavy fleets can see profits rise disproportionately when baseload prices rise because of meaningful operating leverage on long-lived fixed assets. Hyperscaler PPAs strengthen the “duration” of the thesis by making cash flows less purely dependent on spot power-market dynamics.

Key risks

Merchant volatility; post-M&A integration; and “already-known narrative” risk (expectations matter after big re-ratings).

Buy Rating rationale

If the core thesis is “AI turns clean baseload scarcity into durable pricing power,” CEG is the cleanest, most scalable large-cap expression of that thesis. It combines fleet scale, contracting ability, and now greater platform breadth post-Calpine.

Bottom line on CEG

Pro: The most nuclear-pure large cap with direct hyperscaler contracting already visible, now even larger after Calpine.

Con: Merchant earnings volatility + expectations risk.

NextEra (NEE)

Theme: AI-ready clean-energy platform with nuclear in the mix, but less “pure nuclear torque” and more rate sensitivity

What it does

NextEra is the largest clean-energy developer in the U.S. and owner of Florida Power & Light (a large regulated utility). It combines a stable utility base with a massive renewables-and-storage franchise — plus some nuclear exposure.

AI / data-center deals

NextEra and Google announced a collaboration that includes a 25-year agreement tied to restarting the ~615 MW Duane Arnold nuclear plant, with NextEra targeting a return to service by early 2029 (subject to approvals).

Stock price and risk framing

-

Price reference (Jan 10, 2026): ~$79.89

-

NextEra’s fixed-income materials emphasize capital structure metrics within a utility/infrastructure framework rather than relying on headline “absolute debt” alone.

-

The key investor sensitivity remains rates and financing costs, because this is an infrastructure compounding model.

Valuation & growth logic

NEE tends to trade like a compounding platform with meaningful interest-rate sensitivity. The nuclear restart headline is meaningful but sits inside a broader renewables + storage + regulated utility platform, so it does not usually trade with the same “merchant nuclear repricing” torque.

Hold Rating rationale

NEE is an excellent company and long-term compounder, but it has less “pure torque” to the nuclear/AI theme than merchant nuclear. Hold for quality, diversification, and steady growth; don’t expect the same dramatic repricing as VST/CEG.

Bottom line on NEE

Pro: Diversified, large-cap way to play AI-driven load growth with a meaningful nuclear restart headline.

Con: More rate-sensitive and less “pure nuclear torque.”

Dominion (D)

Theme: Regulated utility exposure to “data-center alley,” plus long-dated SMR option value

What it does

Dominion is a large regulated utility serving Virginia and the Mid-Atlantic — home to the world’s largest concentration of data centers.

Data-center exposure

Reporting has described Dominion as the world’s biggest data-center-serving utility, having connected about 450 data centers in Virginia.

SMR / new nuclear push

Dominion issued an RFP to assess SMR feasibility at North Anna and has publicly positioned SMRs as a potential long-run solution for load growth.

Stock price

-

Price reference (Jan 10, 2026): ~$57.98

Valuation & growth logic

As a regulated utility, upside is filtered through rate base and regulatory economics — meaning steadier, slower torque. The SMR pathway is real, but long-dated and policy/execution dependent (often 2030s timeframe in market expectations).

Hold Rating rationale

Dominion is uniquely positioned at the epicenter of U.S. data-center growth, but the regulated model filters the upside. Hold for stable exposure to the most important geographic AI-load story plus SMR optionality; do not expect merchant-style repricing.

Bottom line on Dominion

Pro: Conservative regulated exposure to data-center alley + real SMR option value.

Con: SMR timelines and economics are long-dated; upside is filtered through regulation.

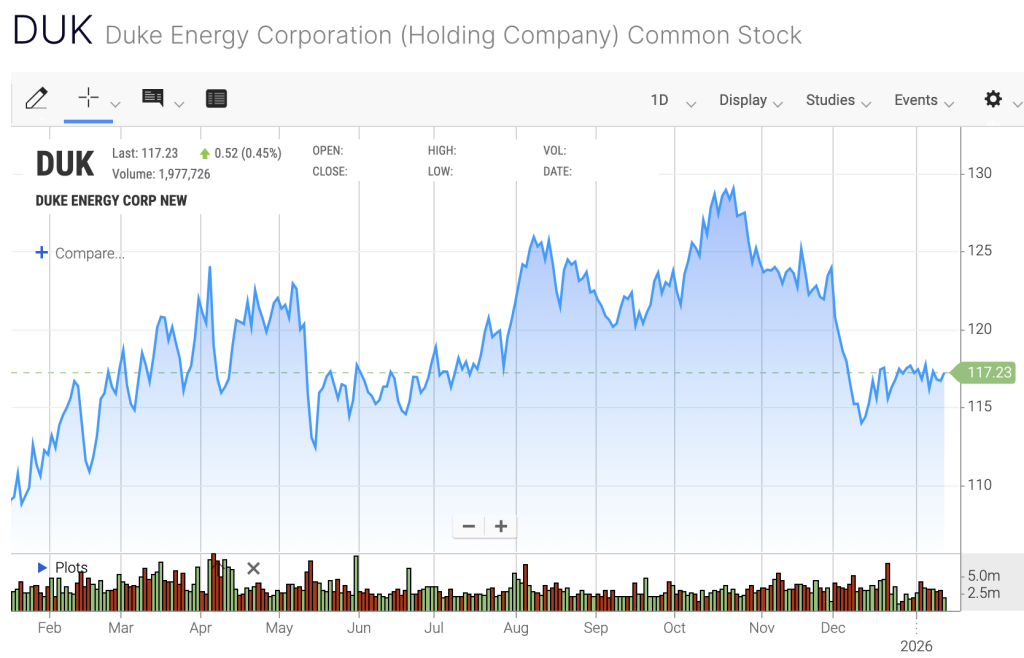

Duke (DUK)

Theme: “Nuclear backbone” regulated utility — stability and clean baseload, with less direct AI contract torque

What it does

Duke serves millions of customers in the Carolinas and operates a major nuclear fleet there.

Nuclear backbone

Duke has emphasized that in 2024, its six nuclear plants provided more than 50% of Carolinas customers’ electricity and more than 96% of the company’s clean energy.

Stock price

-

Price reference (Jan 10, 2026): ~$116.80

Valuation & growth logic

Classic regulated utility compounding + dividend profile. AI exposure is real (load growth, electrification), but more indirect than Dominion’s Virginia footprint and less tied to headline hyperscaler PPAs.

Hold Rating rationale

Duke is a steady way to own clean baseload reliability and utility stability. Hold for dividend/utility stability with nuclear already doing the clean heavy lifting; don’t expect dramatic AI-driven repricing.

Bottom line on DUK

Pro: Dividend/utility stability with nuclear already doing most clean baseload work.

Con: Less direct “AI contract headline torque”; more steady compounding.

SMR and “New Nuclear” Developers — Speculative Only

Theme: High story value, long timelines, and project-level execution risk

If you specifically want new nuclear construction rather than extending or monetizing existing plants, you’re in more speculative territory.

SMR timelines remain long, policy-sensitive, and execution-heavy. In public markets, SMR developers tend to trade as narrative + optionality: potentially large upside if projects standardize, but high downside if cost/timing disappoint.

This is best understood as a venture-style sleeve, not a substitute for established operators and utilities.

Examples (non-exhaustive): OKLO / SMR / others

Speculative Rating rationale

These are long-dated bets on new nuclear construction, not investments in established cash-flowing assets. Timelines stretch into the 2030s, regulatory/permitting risk is high, and execution is unproven. Treat as venture-style exposure: high upside if standardization happens, but binary downside if projects stall or costs balloon — not comparable to the cash-flowing operators above.

5. Putting It Together: Building an AI–Nuclear “Basket”

This is not investment advice, but one way to think about structuring exposure:

a. Core Nuclear Operators with Direct AI/Data-Center Deals

-

Constellation (CEG) — largest U.S. nuclear fleet; long-dated hyperscaler contracting.

-

Vistra (VST) — long-term nuclear PPAs and concentrated ERCOT/PJM exposure.

b. Regulated Utilities Riding AI Demand with Nuclear Backbones

-

NextEra (NEE) — 25-year nuclear agreement tied to Duane Arnold restart; broad platform.

-

Dominion (D) — data-center alley utility; SMR feasibility work at North Anna.

-

Duke (DUK) — large nuclear share of Carolinas electricity; long life extensions.

c. Optional Speculative Sleeve

A small allocation (if any) to SMR developers, treated explicitly as high-volatility, long-dated risk.

d. Key Risks to Keep in Mind

-

Market design and policy shifts (capacity market rules, state commission decisions, permitting realities).

-

Project and technology risk (especially for SMRs).

-

Grid constraints and backlash in places like Virginia and PJM as load requests accelerate.

-

Valuation/theme saturation for the highest-torque winners (expectations can outrun earnings).

e. Takeaway

If you want exposure to AI-driven electricity demand anchored in nuclear, you don’t have to guess which SMR will work. A pragmatic approach is:

-

CEG and VST — higher-torque exposure to merchant nuclear repricing + hyperscaler contracting. These stocks have appreciated significantly and we prefer buying opportunistically — waiting for pullbacks to start positions.

-

NEE, D, DUK — steadier regulated platforms with nuclear as backbone and AI load growth as a multi-year driver.

6. Understanding U.S. Power Markets: PJM, ERCOT, and Why They Matter

AI-driven electricity demand doesn’t affect the entire U.S. grid equally. Most of the opportunity — and the stress — shows up in a few key regional power markets. To understand why companies like Constellation, Vistra, Dominion, and NextEra are positioned the way they are, it helps to know how these markets work.

Below is a concise guide to the major U.S. grid operators.

a. PJM Interconnection — The Nation’s Most Important Power Market

PJM is a Regional Transmission Organization (RTO) — a grid operator for a massive multi-state region spanning the Mid-Atlantic and parts of the Midwest. It runs high-voltage transmission coordination, real-time power markets, and a capacity market (which pays generators to be available in the future), alongside long-term planning and reliability studies. PJM does not own power plants or transmission lines; it coordinates them.

Why PJM matters for AI + nuclear: Northern Virginia is the world’s largest concentration of data centers, and load growth has become politically and technically contentious.

For investors, PJM’s tightening supply/demand balance increases the value of nuclear-heavy companies like Constellation and nuclear-exposed Vistra assets, and reinforces the value of nuclear-backed regulated utilities serving AI load pockets.

b. ERCOT — The Wild West of Electricity (Texas)

ERCOT operates the Texas grid, which is largely isolated from the rest of the U.S. ERCOT is an “energy-only” market, meaning power plants are paid mostly for energy produced, not for capacity. Prices can swing sharply, which creates high upside (and high volatility) for merchant generators when demand spikes.

Why ERCOT matters for AI + nuclear: Texas has explosive load growth; Vistra’s Comanche Peak positions it near the center of a scarcity-driven repricing dynamic.

c. CAISO — The Solar-Heavy California Market

Dominated by solar, storage growth, and policy-heavy planning. Less direct for “AI nuclear torque” aside from edge cases.

d. SPP — The Wind Corridor

High wind penetration, transmission constraints, limited nuclear. More relevant for transmission buildout and wind developers than nuclear operators.

e. MISO — The Coal-to-Renewables Transition Belt

Big retirements and reliability questions; not the core hyperscale nexus but still relevant to broader electrification.

f. Takeaway: Why PJM and ERCOT Matter Most for AI–Nuclear

PJM:

PJM includes Northern Virginia, which has the world’s largest concentration of hyperscale data centers. AI-driven electricity demand there is rising quickly, while the supply of reliable, always-on power is tightening due to plant retirements, long build times, and grid constraints. That imbalance makes existing nuclear plants especially valuable and helps explain why hyperscalers are signing long-term nuclear contracts in this region.

ERCOT (Texas):

ERCOT is seeing some of the fastest electricity-demand growth in the country, driven by population growth, industry, and AI data centers. Texas has relatively little nuclear power compared with how fast demand is growing, which means firm, always-available electricity is scarcer.

ERCOT also operates differently from most U.S. power markets: generators are paid mainly for the electricity they produce at the moment it’s needed, not for simply being available in the future. As a result, when demand surges and supply is tight, prices can move sharply. That creates higher upside — and higher risk — for power producers with firm generation like nuclear.

Bottom line:

AI data centers are not spread evenly across the country, and electricity markets are structured very differently by region. Where hyperscalers build — and how local power markets reward scarcity — largely determines which nuclear and power companies benefit the most from AI-driven demand.

References

Data centers, power constraints, and grid bottlenecks

JLL — U.S. Data Center Outlook / Power Availability Constraints

https://www.us.jll.com/en/trends-and-insights/research/data-center-outlook

CIO Dive — Power shortages are slowing US data center growth (Aug 2024)

https://www.ciodive.com/news/data-centers-power-shortage-jll/724350/

Bloomberg / Energy Connects — US data center power hookups may take up to seven years, Dominion says (Aug 30, 2024)

https://energyconnects.com/news/utilities/2024/august/us-data-center-power-hookups-may-take-up-to-seven-years-dominion-says/

POLITICO Energywire — Data centers strain US power grid (Sep 3, 2024)

https://www.politico.com/newsletters/energywire/2024/09/03/data-centers-strain-the-power-grid-00177061

Microsoft / Three Mile Island nuclear restart

Constellation Energy — Constellation to restart Crane Clean Energy Center with Microsoft power agreement (Sep 20, 2024)

https://www.constellationenergy.com/newsroom/2024/constellation-to-restart-crane-clean-energy-center.html

Utility Dive — DOE backs restart of Three Mile Island reactor for Microsoft data center demand (Nov 19, 2025)

https://www.utilitydive.com/news/three-mile-island-restart-microsoft-doe-loan/733469/

Google and advanced nuclear (Kairos Power)

Google — Our commitment to advanced nuclear energy (Oct 14, 2024)

https://blog.google/outreach-initiatives/sustainability/advanced-nuclear-energy-kairos-power/

World Nuclear News — Google backs Kairos Power reactor programme (Oct 15, 2024)

https://world-nuclear-news.org/Articles/Google-backs-Kairos-Power-reactor-program

Kairos Power — Kairos Power and Google announce partnership

https://kairospower.com/kairos-power-and-google-announce-partnership/

Amazon and SMRs (X-energy)

X-energy — X-energy raises $500 million to advance SMR deployment (Oct 16, 2024)

https://x-energy.com/media/news-releases/x-energy-raises-500-million-to-advance-smr-deployment

Utility Dive — Amazon backs X-energy SMRs to power data centers (Oct 16, 2024)

https://www.utilitydive.com/news/amazon-x-energy-small-modular-reactors-data-centers/732898/

Amazon — Amazon supports advanced nuclear energy to power the future (Oct 16, 2024)

https://www.aboutamazon.com/news/sustainability/amazon-advanced-nuclear-energy

Existing reactors, life extensions, and restarts

U.S. Nuclear Regulatory Commission — Subsequent License Renewal (SLR) Fact Sheet

https://www.nrc.gov/reactors/operating/licensing/renewal/subsequent-license-renewal.html

Reuters — US nuclear regulator clears Duke Energy’s Oconee plant to run 80 years (Mar 31, 2025)

https://www.reuters.com/world/us/us-nuclear-regulator-clears-duke-energys-oconee-plant-run-80-years-2025-03-31/

U.S. Department of Energy — DOE Loan Guarantee for Palisades Nuclear Plant Restart (Mar 19, 2025)

https://www.energy.gov/articles/doe-announces-loan-guarantee-support-palisades-nuclear-plant-restart

Reuters — US approves steps toward restarting Michigan nuclear plant as power demand surges (Jul 25, 2025)

https://www.reuters.com/world/us/us-approves-steps-toward-restarting-michigan-nuclear-plant-2025-07-25/

Natural gas constraints beyond carbon considerations

Institute for Energy Economics and Financial Analysis (IEEFA) — Data centers, gas pipelines, and power system risk (Jan 2025)

https://ieefa.org/resources/data-centers-natural-gas-and-power-system-risk

Vistra-Comanche Peak Deal (September 2025)

- Vistra 20-year Comanche Peak nuclear PPA (1,200 MW) + extension options, September 2025:

- https://www.power-eng.com/nuclear/vistra-secures-long-term-nuclear-ppa-from-comanche-peak-nuclear-plant/

- https://www.utilitydive.com/news/vistra-corp-natural-gas-permian-basin-power-plant/761358/

- https://investor.vistracorp.com/2025-11-06-Vistra-Reports-Third-Quarter-2025-Results,-Narrows-2025-Guidance,-and-Initiates-2026-Guidance

- https://www.sec.gov/Archives/edgar/data/1692819/000119312525221774/d43667d8k.htm

Vistra-Meta Deal (January 2026)

- Vistra and Meta nuclear agreements involving Perry, Davis-Besse, and Beaver Valley plants (2,176 MW operating + 433 MW uprates), announced January 9, 2026:

- https://investor.vistracorp.com/2026-01-09-Vistra-and-Meta-Announce-Agreements-to-Support-Nuclear-Plants-in-PJM-and-Add-New-Nuclear-Generation-to-the-Grid

- https://www.prnewswire.com/news-releases/vistra-and-meta-announce-agreements-to-support-nuclear-plants-in-pjm-and-add-new-nuclear-generation-to-the-grid-302656941.html

- https://about.fb.com/news/2026/01/meta-nuclear-energy-projects-power-american-ai-leadership/

- https://www.powermag.com/meta-locks-in-up-to-6-6-gw-of-nuclear-power-through-deals-with-vistra-oklo-and-terrapower/

NextEra-Google Deal

- NextEra + Google collaboration; 25-year nuclear agreement tied to Duane Arnold restart; early 2029 target:

- https://newsroom.nexteraenergy.com/NextEra-Energy-and-Google-Announce-New-Collaboration-to-Accelerate-Nuclear-Energy-Deployment-in-the-U-S?l=12

- https://www.investor.nexteraenergy.com/news-and-events/news-releases/2025/10-27-2025-203948689

- https://blog.google/feed/infrastructureduane-arnold-nuclear-plant-iowa/

- https://www.world-nuclear-news.org/articles/duane-arnold-restart-underpins-nextera-energy-and-google-collaboration

- https://www.utilitydive.com/news/nextera-google-nuclear-earnings/804308/

Constellation-Meta Deal (June 2025)

- Constellation + Meta 20-year PPA for Clinton Clean Energy Center (1,121 MW, beginning June 2027), announced June 2025:

- https://www.constellationenergy.com/newsroom/2025/constellation-meta-sign-20-year-deal-for-clean-reliable-nuclear-energy-in-illinois.html

- https://investors.constellationenergy.com/news-releases/news-release-details/constellation-meta-sign-20-year-deal-clean-reliable-nuclear

- https://about.fb.com/news/2025/06/meta-constellation-partner-clean-energy-project/

- https://www.world-nuclear-news.org/articles/meta-constellation-sign-20-year-clean-power-deal

- https://www.utilitydive.com/news/meta-constellation-illinois-clinton-nuclear-ppa-support-ai-goals/749992/

Constellation-Calpine Acquisition

- Constellation completes Calpine acquisition (Jan 7, 2026):

- https://www.constellationenergy.com/newsroom/2026/01/constellation-completes-calpine-transaction-powering-americas-clean-energy-future.html

- https://www.tipranks.com/news/company-announcements/constellation-energy-completes-calpine-acquisition-expands-generation-fleet

- https://finance.yahoo.com/news/constellation-completes-calpine-transaction-powering-211500263.html

Dominion Data Centers

- Dominion connected ~450 data centers in Virginia:

Dominion SMR Plans

- Dominion SMR feasibility/RFP at North Anna:

- https://www.dominionenergy.com/projects-and-facilities/nuclear-facilities/nuclear-energy

- https://news.dominionenergy.com/press-releases/press-releases/2024/Dominion-Energy-takes-important-step-to-determine-feasibility-of-Small-Modular-Reactor-SMR-technology-to-support-customers-needs-07-10-2024/default.aspx

- https://www.utilitydive.com/news/dominion-energy-smr-small-modular-reactor-north-anna-nuclear-site/721240/

- https://virginiabusiness.com/dominion-to-explore-small-modular-reactor-at-north-anna/

- https://virginiamercury.com/2024/07/11/dominion-seeking-small-nuclear-reactor-proposals/

- https://www.world-nuclear-news.org/Articles/Dominion-considers-deploying-SMR-at-North-Anna

- https://investors.dominionenergy.com/news/press-release-details/2024/Dominion-Energy-and-Amazon-to-explore-advancement-of-Small-Modular-Reactor-SMR-nuclear-development-in-Virginia/default.aspx

Duke Energy Nuclear Statistics

- Duke nuclear share of Carolinas electricity and clean energy, 2024:

- https://news.duke-energy.com/releases/duke-energys-largest-nuclear-plant-receives-approval-to-extend-operations-supports-growing-energy-demand-helps-keep-customer-costs-as-low-as-possible

- https://www.world-nuclear-news.org/articles/oconee-cleared-to-operate-for-up-to-80-years

- https://www.greenvillebusinessmag.com/2025/04/08/528735/duke-energy-s-largest-nuclear-plant-receives-approval-to-extend-operations

- https://carboncredits.com/duke-energys-biggest-nuclear-plant-secures-extension-to-meet-americas-rising-energy-demand/

Market Data – Nuclear Power Pricing

- Nuclear power typically commands a premium when compared to wind, solar, or gas on a simple cost-per-megawatt-hour basis, but hyperscaler contracts reflect something different: payment for firm, always-on, carbon-free electricity delivered reliably over decades, rather than for energy alone:

- https://en.wikipedia.org/wiki/Economics_of_nuclear_power_plants

- https://www.motive-power.com/ranked-americas-cheapest-sources-of-electricity-in-2024/

- https://decarbonization.visualcapitalist.com/americas-cheapest-sources-of-electricity-in-2024/

- https://world-nuclear.org/information-library/economic-aspects/economics-of-nuclear-power

- https://www.worldnuclearreport.org/Power-Play-The-Economics-Of-Nuclear-Vs-Renewables

Market Data – Data Center Power Demand Growth

- Data center power demand projected to double or triple by 2030:

- https://www.spglobal.com/energy/en/news-research/latest-news/electric-power/101425-data-center-grid-power-demand-to-rise-22-in-2025-nearly-triple-by-2030

- https://www.pewresearch.org/short-reads/2025/10/24/what-we-know-about-energy-use-at-us-data-centers-amid-the-ai-boom/

- https://www.iea.org/news/ai-is-set-to-drive-surging-electricity-demand-from-data-centres-while-offering-the-potential-to-transform-how-the-energy-sector-works

- https://www.goldmansachs.com/insights/articles/ai-to-drive-165-increase-in-data-center-power-demand-by-2030

- https://www.gartner.com/en/newsroom/press-releases/2025-11-17-gartner-says-electricity-demand-for-data-centers-to-grow-16-percent-in-2025-and-double-by-2030

- https://www.energy.gov/articles/doe-releases-new-report-evaluating-increase-electricity-demand-data-centers

The AI Energy Economy Series

-

- The AI Energy Economy — Part 1: The Nuclear & Utility Winners of the AI Power Boom

- The AI Energy Economy — Part 2: The Pick-and-Shovel Suppliers Powering AI Electrification

- The AI Energy Economy — Part 3 (Revised): The Connective and Last-Meter Layers of AI Electrification

- The AI Energy Economy — Part 4 (Revised): Industrial Automation, Cooling & Controls

- The AI Energy Economy — Part 5 (Revised): Merchant Power, Nuclear Scarcity, and AI Contracts