What’s Happening with Oracle (ORCL) and Today’s Tech Sell-Off

Oracle’s stock (NYSE: ORCL) is sharply lower today amid renewed investor concern over the financing of its massive AI data center build-out. Reports that a key financing partner backed away from a marquee project have hit sentiment, contributing to weakness not just in Oracle shares but across AI-linked technology stocks.

What Triggered the Move

Today’s sell-off began after multiple outlets reported that Blue Owl Capital, a private credit and asset manager, will not back a planned $10 billion Oracle data center in Michigan — a facility expected to support Artificial Intelligence workloads, including capacity for OpenAI. StreetInsider.com+1

-

According to reports, negotiations between Oracle and Blue Owl stalled because the deal terms did not align with what Blue Owl had structured on prior Oracle data center financings. StreetInsider.com

-

Oracle responded that the equity financing for the Michigan project is still progressing with other partners, and that Blue Owl simply was not selected from a competitive group. Bloomberg

-

Blackstone has been mentioned as a potential replacement partner, but no definitive commitment has been announced. StreetInsider.com

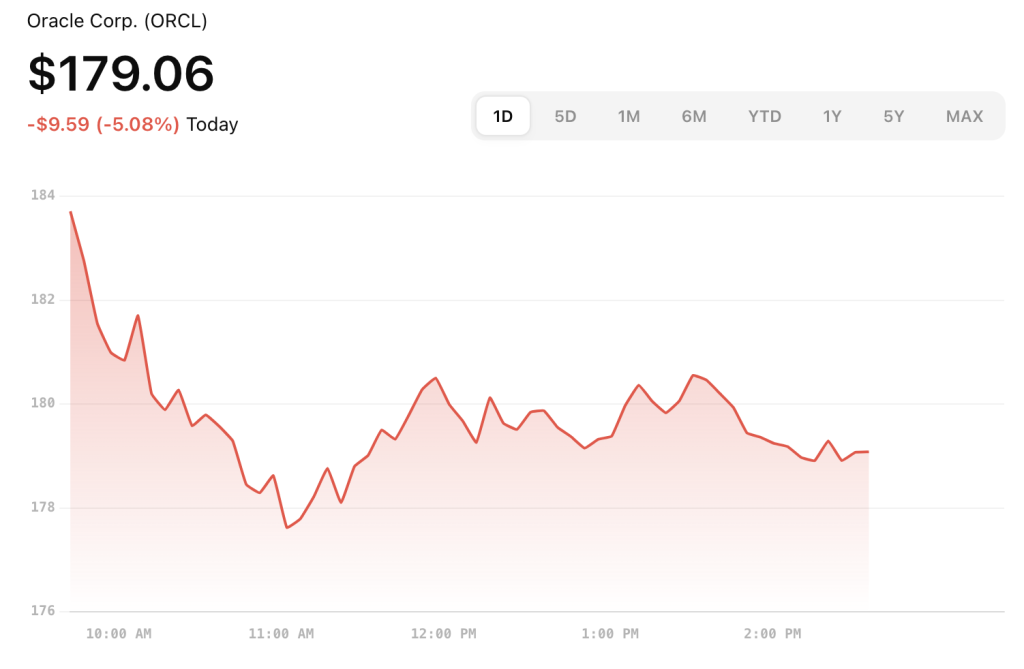

The market reaction was swift: ORCL shares fell roughly 4–6% on the Blue Owl news, according to early trading reports. Seeking Alpha+1

Why This Matters to Investors

Oracle’s data center strategy is central to its AI and cloud growth story. Building facilities capable of supporting advanced AI workloads requires vast amounts of capital, often financed through a mix of partnership equity, debt, and lease commitments.

When a major financier like Blue Owl steps back, investors interpret it through multiple lenses:

-

Execution Risk: Questions arise about Oracle’s ability to secure cost-effective financing for large-scale infrastructure projects.

-

Balance Sheet Stress: Oracle has significantly increased debt and lease obligations to fuel AI data center expansion — a strategy with long payback periods. The Economic Times

-

AI Sentiment: As enthusiasm for AI has cooled from earlier peaks, the market is less willing to price in aggressive growth expectations for expensive build-outs.

How the Market Is Interpreting It

The Blue Owl story isn’t just about one deal — it feeds into broader unease about tech companies that are:

-

Raising large amounts of debt to fund capital-intensive AI infrastructure,

-

Burning cash flow faster than revenue grows, and

-

Facing compressed margins on cloud and infrastructure services. The Economic Times

One market note pointed out that the negative focus on Oracle’s data center financing might be overblown, but the stock already reflects depressed sentiment. MarketWatch

Broader Tech Impact

Oracle’s weakness has been part of a broader move lower in technology stocks today. The Financial Times and other outlets highlighted that loss of confidence in one major AI infrastructure project can ripple through the sector, particularly for companies perceived as highly levered or dependent on external financing. Financial Times

Other AI-linked names have also struggled as investors reassess the pace and profitability of AI capital spending — suggesting today’s action is not entirely isolated to ORCL.

The Takeaway

Today’s decline in Oracle shares boils down to execution and financing concerns around its AI infrastructure push:

-

A key partner, Blue Owl Capital, didn’t join the $10 billion Michigan data center project after all. StreetInsider.com

-

Oracle says talks with alternative partners are on track, but uncertainty remains. Bloomberg

-

The stock is reacting not just to that headline, but to broader concerns about heavy debt, cash flow impacts, and the valuation of AI-related growth. The Economic Times

Keep an eye on financing developments for the Michigan project and broader commentary from Oracle on capital allocation — these could drive sentiment in the coming days.