Crypto/Soma - Yes, just after they declared it dead, it's started getting traction again.

CPRI/CRS - We played KORS when they were a lot cheaper, they are not a bad brand and they are coming through a turnaround investment that seems to be working but I'd want to see Q1 earnings before jumping in. Still, they made almost $600M last year and, at $46.50, you are buying the company for $7Bn, so a nice retailer to have in your portfolio for the long term.

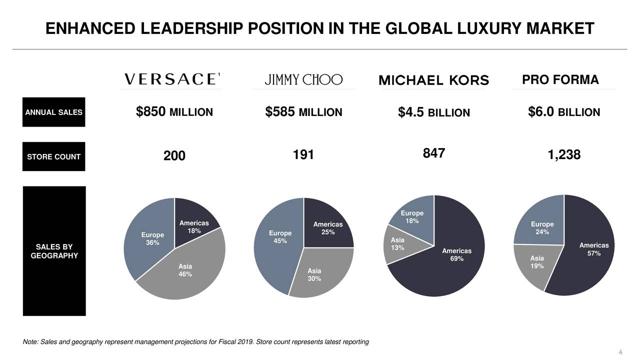

The dropped with the sector back in Nov but also because they paid $2.1Bn for Versace, which seemed a bit much but it as all part of their overall rebranding strategy, so you either believe in management or you don't. They are actually very small in Asia (19% of revenues) and I think that's a plus going forward as those "Crazy Rich Asians" do love their luxury brands.

As a trade on them, I like:

- Sell 5 2021 $40 puts for $4.80 ($2,400)

- Buy 10 2021 $35 calls for $17 ($17,000)

- Sell 10 2021 $50 calls for $9.25 ($9,250)

That's net $6,350 on the $15,000 spread that's $11,000 in the money to start so the "only" $8,650 (136%) profit potential is mitigated by the fact that it's very likely to pay off and, of course, if they go lower, THEN you can sell 5 more puts and use that $2,500(ish) to roll your 10 longs $5-10 lower.

Speaking of retail, I owe Winston one more big winner and that's going to be M at $24.40. That's $7.5Bn and if you like CPRI for that price, M makes $1Bn a year (50% more) and is sitting on about $16Bn in real estate or $21Bn according to Starboard, who are an activist investor in M.

Interestingly, M pays a $1.51 dividend, which is 6.5% at the moment so it's actually good for a dividend play so, since I'd LOVE to own the stock at $24.40, I can sell very aggressive puts where my only downside is owning the stock and collecting dividends.