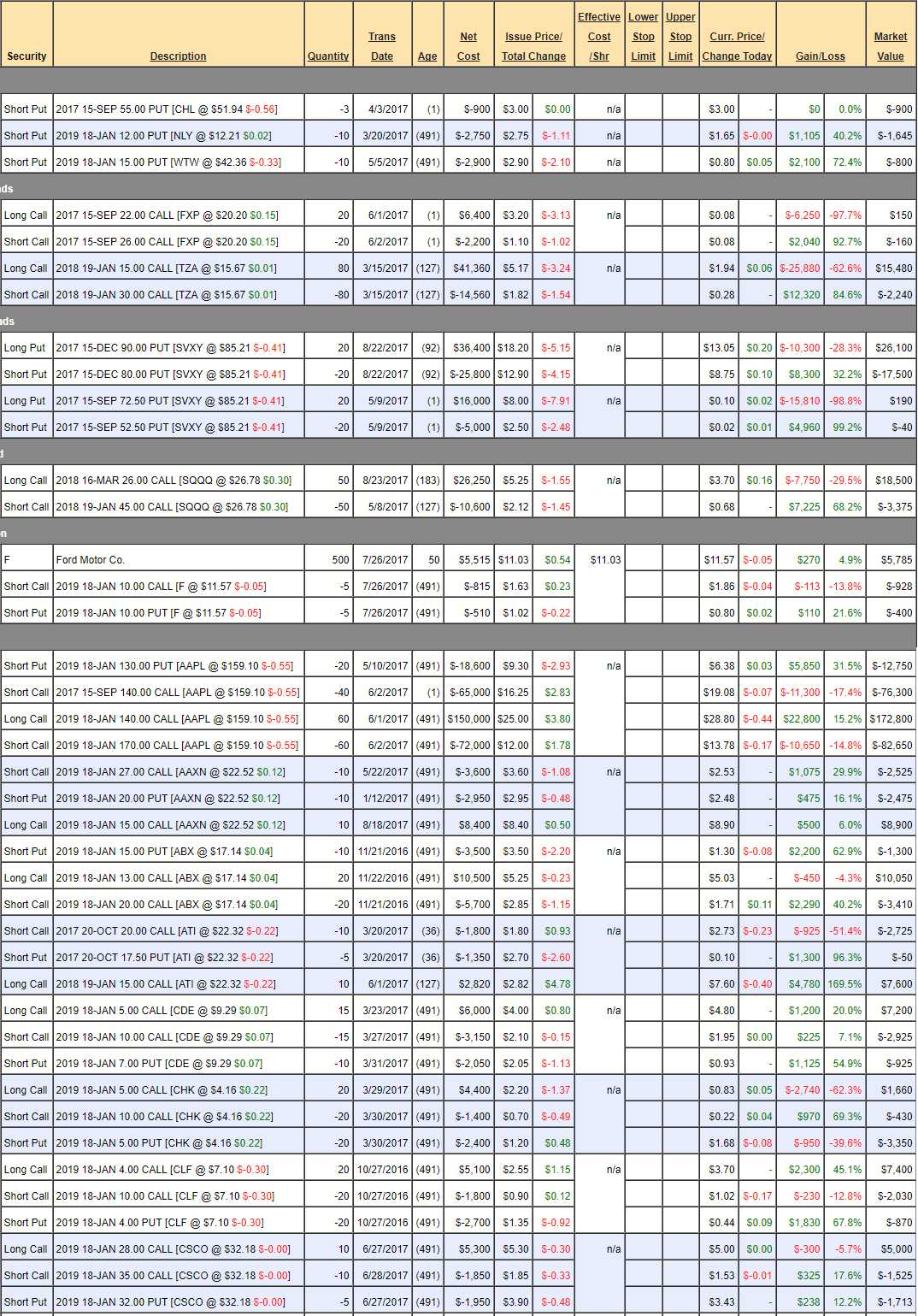

Options Opportunity Portfolio Review (OOP): It's been a quiet month, with just 3 new trades (XRT, MO, SCO) including one we just made today. The last review was Aug 17th and we stood at $311,063 which was a pullback from our July 18th high of $325,753 so we decided to get more bullish and now we're back at $321,930 - up $10,867 for the month and up 221.9% overall in the first month of our 3rd year.

We've been very conservative this summer and we're only using $43,500 of IRA margin - so no impact on our buying power, which is over $600,000 of ordinary margin. That leaves us flexible enough to handle whatever the market throws our way going forward.

With North Korea threatening to nuke Japan and the US this morning, I'm back to being concerned as to whether we are covered well enough - in case of catastrophe. No, I don't think he'll actually do it but we could end up with a Cuban Missile-like tension situation in Asia because Japan cannot let a threat like that go unanswered from their next-door neighbor - especially as Abe likes to present himself as strong on Defense.

For those who are new, we transitioned this portfolio to more of a long-term portfolio as our first few months (back in Aug 2015) made us realize most people were not able to follow active trading due to the platform restrictions at SA. We've moved towards a hybrid portfolio that mirrors the style of PSW's Long-Term/Short-Term paired portfolios, which relies on long-term positions, short-term premium selling and hedging to create a steady income stream.

- CHL - Right at the money and it will expire on Friday.

- NLY - On track but a long way to go. With the Fed next week, I prefer to take the money and run, rather than risk giving back our gains so let's kill this trade.