Good morning!

We need to buy more DIS! Now they own Spielberg's company?

I don't think people understand how incredible their movie year is going already and check out what's coming on the Marvel side alone:

Most of the money in movies is made over time and DIS is off to a record start and Shanghai is on schedule for opening next month and they raised the prices at the parks for admission and hotels and it's certainly not keeping people away because they have 150M visitors a year (pre-Shanghai) and there are 7,000M people on the planet but it's an average 3-day visit per person so 50M people(ish) out of 7Bn is only - Ta Da! - the top 0.7% and if you figure they go once every 10 years - you can JUST have the top 10% go to your parks and charge whatever you want to price-insensitive people.

Sure a few lower-class people slip in - but they have to blow so much money it's often "one in a lifetime" trips for the poor but there is no limit to how high they can raise those ticket prices over time (now $125/day). Disney even has low-cost hotels on property though "on property" is pretty far away from their expensive hotels (it's a big property).

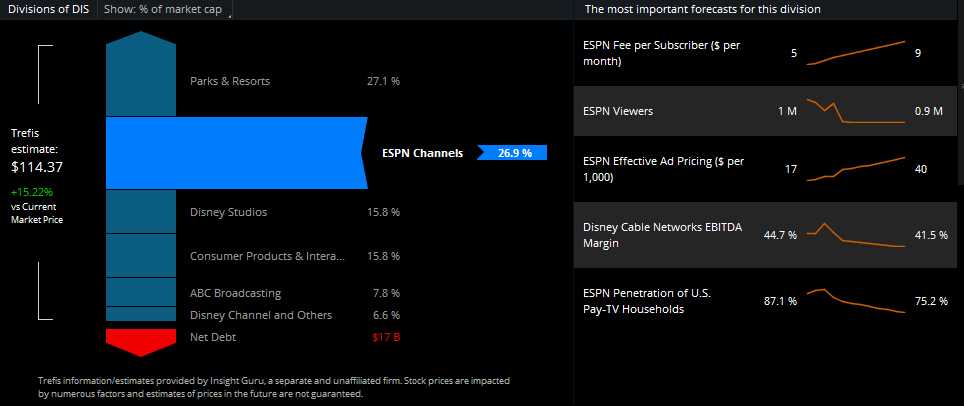

Though there is a lot of concern about ESPN's declining margins as people opt out - like the theme park, it's offset by drastically rising prices paid per viewer. In other words, they used to shove it down the throats of 87% of households for $5/month and now it just goes to the 75% who actually want it for $9/month - once again, analysts simply don't know how to do math and think this is a bad thing!

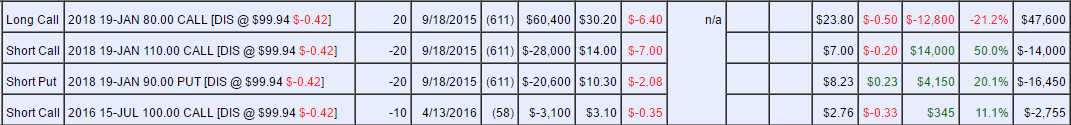

In our Butterfly Portfolio, our position is this:

It's a large position and aggressively bullish with a 1/2 sale of July calls and still playable at net $26,995 as it returns $60,000 at $110 in Jan 2018.

It's a large position and aggressively bullish with a 1/2 sale of July calls and still playable at net $26,995 as it returns $60,000 at $110 in Jan 2018.