Federal Tax Revenues Suffer Biggest Drop Since Great Depression

Courtesy of Mish

Recession? What recession? This is a depression. No it’s not the great depression, but this is no ordinary recession as measured by housing, jobs, the stock market, the CPI, auto sales, and now federal tax revenues.

Inquiring minds note Federal Tax Revenues Plummet Most Since 1932.

The recession is starving the government of tax revenue, just as the president and Congress are piling a major expansion of health care and other programs on the nation’s plate and struggling to find money to pay the tab.

The numbers could hardly be more stark: Tax receipts are on pace to drop 18 percent this year, the biggest single-year decline since the Great Depression, while the federal deficit balloons to a record $1.8 trillion.

Other figures in an Associated Press analysis underscore the recession’s impact: Individual income tax receipts are down 22 percent from a year ago. Corporate income taxes are down 57 percent. Social Security tax receipts could drop for only the second time since 1940, and Medicare taxes are on pace to drop for only the third time ever.

The last time the government’s revenues were this bleak, the year was 1932 in the midst of the Depression.

In May the government’s best estimate was that Social Security would start to pay out more money than it receives in taxes in 2016, and that the fund would be depleted in 2037 unless changes are enacted.

Some experts think the sour economy has made those numbers outdated.

"You could easily move that number up three or four years, then you’re talking about 2013, and that’s not very far off," said Kent Smetters, associate professor of insurance and risk management at the University of Pennsylvania.

The government’s projections included best and worst-case scenarios. Under the worst, Social Security would start to pay out more money than it received in taxes in 2013, and the fund would be depleted in 2029.

The fund’s trustees are still confident the solvency dates are within the range of the worst-case scenario, said Jason Fichtner, the Social Security Administration’s acting deputy commissioner.

"We’re not outside our boundaries yet," Fichtner said. "As the recovery comes, we’ll see how that plays out."

President Barack Obama has said he wants to tackle Social Security next year, after he clears an already crowded agenda that includes overhauling health care, addressing climate change and imposing new regulations on financial companies.

Social Security Fund? What Fund?

There is no fund and there is no trust either. All that exists of Social Security is a bunch of IOUs and unpaid promises that most believe cannot possibly be met.

So now, the biggest socialist since FDR wants to tackle the problem. Rest assured that means more taxes on productive members of society because Obama sure is not going to be calling for reduced benefits.

Reason For Revenue Plunge

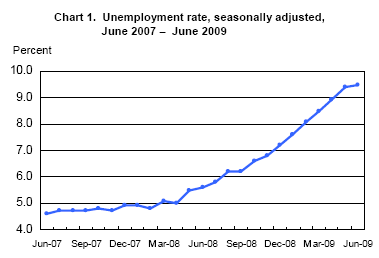

Those looking for a reason for the revenue plunge can find it here: Jobs Contract 18th Straight Month; Unemployment Rate Hits 9.5%.

This has been the worst 10-year track record for jobs since the great depression. Moreover the losses are likely to continue for another year at least. So while some are tooting their horns loudly on news of the end of "The Great Recession", others have some stark Thoughts On The "Recoveryless Recovery".

In short, the bottom may be in, but lock up those party hats because most will not see it in terms of jobs, wages, home prices, and the stock market. From many angles, the most likely scenario is a "Recoveryless Recovery".

Downward Spiral In Jobs Continues

Unlike the Federal government, states cannot just print money to make ends meet. They have to do one of two things, raise taxes or cut services. Please consider Alabama’s Jefferson County makes massive job cuts.

Alabama’s debt-ridden Jefferson County laid off about two-thirds of its 3,600 employees on Monday because of plummeting revenues, a move that will sharply curtail services in areas ranging from roads to courthouses.

Jefferson County has been forced to make drastic cuts because of a lawsuit questioning the legality of a county occupational tax, which raised $78 million annually and was vital to the county’s operation.

Although the revenue is still being collected, it is being held in escrow under orders from an Alabama Supreme Court justice pending a decision on the tax case. Some members of the state Legislature hope to pass a new tax bill this month to raise revenue for Jefferson County.

Jefferson county should simply declare bankruptcy and get it over with. Instead, it appears the state is going to tax the citizens to death to make up for $4 billion in derivative contacts gone awry.

Every time government raises taxes, small businesses respond by cutting employees, or simply not hiring them in the first place.

Obama’s health care plan is going to cost jobs, and no doubt whatever "fix" he comes up with for Social Security is going to cost jobs and raise taxes as well. So if you are looking for more reasons for a "Recoveryless Recovery" you have plenty.

Left alone, it is going to be a long time before federal tax revenues recover. The implications on state spending, services, and taxes on productive members of society are ominous.