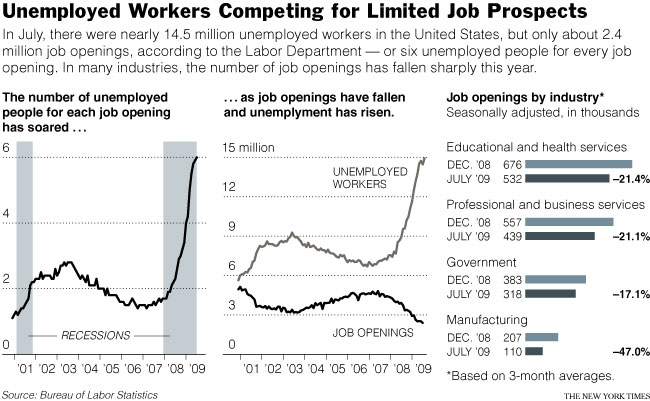

The number of unemployed people per job opening has climbed to 6:

Six is a lot, as you can see from the above chart. 6 means that if you get a job, 5 people absolutely will NOT be able to get a job because you just took the last one. Notice Job Openings are still falling and people without jobs are still rising – this is not a good combination, despite how great you hear things are getting on TV. In the first 6 months of this year, there are half as many manufacturing jobs available, 17% less Government Jobs, 21% less Professional Jobs and 21% less Educational Jobs.

Call me old-fashioned but I still think you need people to work in order to have a strong economy. If we have 10% unemployment (the "official" number) and only 1 in 6 people COULD get jobs if they filled every single available opening tomorrow. That still leaves us with 8.5% unemployment. We are miles and miles away from creating jobs and that is very scary.

As I predicted in the Weekend Wrap-Up, Merkel won her election in Germany and the new "Pro-Business" coalition is making investors happy but Germany has some silly rule about balancing their budget so it will be a long time before you see the massive tax cuts that investors are salivating over. Also, one would think people would sober up and short the Euro if their plan is to start running the German printing presses in a US-styled Spendocracy but no action in the currency markets so far. I wrote some extensive commentary on the German situation in Member Chat so I won't get into it again here.

This weekend, I also posed the questions "Are Fundamentals Making a Comeback," or are we just resting before the next big push to 10,000? We’ll be keeping a very close eye on our 5% rule levels next week, especially the retrace levels from the 20% run-ups since early July:

| Dow | S&P | Nasdaq | NYSE | Russell | Trans | HSI | Nikkei | FTSE | DAX | |

| Fri Close | 9,665 | 1,044 | 2,091 | 6,824 | 599 | 1,932 | 21,024 | 10,266 | 5,082 | 5,581 |

| 2.5% Up | 9,950 | 1,077 | 2,160 | 7,034 | 617 | 2,001 | 21,577 | 10,808 | 5,206 | 5,745 |

| Prev Close | 9,707 | 1,051 | 2,108 | 6,862 | 602 | 1,952 | 21,051 | 10,544 | 5,079 | 5,605 |

| 2.5% Down | 9,465 | 1,025 | 2,055 | 6,691 | 587 | 1,903 | 20,524 | 10,281 | 4,952 | 5,465 |

| July Base | 8,200 | 880 | 1,750 | 5,600 | 480 | 1,650 | 17,500 | 9,200 | 4,200 | 4,600 |

| 20% Up | 9,840 | 1,056 | 2,100 | 6,720 | 576 | 1,980 | 21,000 | 11,040 | 5,040 | 5,520 |

| Retrace | 9,512 | 1,020 | 2,030 | 6,496 | 556 | 1,914 | 20,300 | 10,672 | 4,872 | 5,336 |

We can see from the chart that only the Nikkei has blown it’s retrace level but they have also never hit their 20% level. All the other indexes have hit 20% up and the Hang Seng is in the most immediate danger of giving it back but the NYSE and Russell are playing it close to the bone while hitting the 2.5% line off Thursday’s close would put most of the indexes under the 20% mark so we are a small slip away from a very red chart.

The DAX should do well today as Merkel won her election (stability is good) and that is sending the DAX right back to Wednesday's close at 5,680 (up 1.5%). The FTSE is up about half a point an hour before the US open, also testing Wednesdays low of 5,120 and why should the CAC be any different as there's nothing the French like better than a German show of force and that market is up 1.1%, back at Wednesday's low of 3,780. Other than the election, there is no major news in Europe but the Dow has jumped 100 points in the futures since Europe opened at 3:30 am.

Things did not go so well in Asia as the Nikkei stopped right down at the 2.5% rule and 10,000 but blew that critical 10,200 line on a gap down. Hang Seng Gapped down 300 and the day got worse from there, finishing down 435, which is down 2% but they bounced right off the 5% line at 20,520 for their drop from 21,600 last week so they need to retake 4% (20,736) to be more than a weak bounce tomorrow. The Shanghai composite also dropped 2.7% on the day. As we expected last week, exporters got slammed as the Yen pushed new highs against the dollar. The market was pricing in the risk of weaker-than-expected earnings due to the stronger yen, said Phoenix Securities manager Mamoru Nakajo. "Earnings at Japanese companies will be bad, with exports hurt by the yen's strength and domestic businesses also struggling amid deflation."

If oil fails $65, that sector has a long way to fall but a concerted effort has been made this weekend to make sure that doesn't happen: Iran has been test-firing short-range missiles this weekend in order to keep oil above $60 a barrel next week, coordinating their efforts with the Taliban, who attacked the Afghan Energy minister and staged multiple suicide bombings in Pakistan as well as Palestinians, who held riots at the Temple on the Mount as Jews attempted to visit for the Holy Days. Osama Bin Laden also worked overtime this weekend to help Goldman Sachs hit their oil target, demanding the EU nations pull their troops out of Afganistan or face "retaliations." We’ll wait patiently to see who’s turn it is to have their Nigerian outpost attacked by Rent-A-Rebel – all in all, the usual nonsense that pops up every time oil needs defending at a critical inflection point.

If oil fails $65, that sector has a long way to fall but a concerted effort has been made this weekend to make sure that doesn't happen: Iran has been test-firing short-range missiles this weekend in order to keep oil above $60 a barrel next week, coordinating their efforts with the Taliban, who attacked the Afghan Energy minister and staged multiple suicide bombings in Pakistan as well as Palestinians, who held riots at the Temple on the Mount as Jews attempted to visit for the Holy Days. Osama Bin Laden also worked overtime this weekend to help Goldman Sachs hit their oil target, demanding the EU nations pull their troops out of Afganistan or face "retaliations." We’ll wait patiently to see who’s turn it is to have their Nigerian outpost attacked by Rent-A-Rebel – all in all, the usual nonsense that pops up every time oil needs defending at a critical inflection point.

Metals and miners are also teetering on the verge of a correction so many, many things that can go wrong next week with lots of data on deck including Tuesday’s Case-Shiller Index and Consumer Confidence Survey ahead of the bell, our final Q2 GDP (-1%) on Wednesday with ADP Employment and the Chicago PMI. Thursday is the very dangerous Personal Income and Spending along with Jobless Claims, ISM, Construction Spending, Pending Home Sales and Auto Sales. Friday is our Non-Farm Payroll Report along with August Factory Orders – busy, busy…

We also have earnings from PBG, WAG, DRI, JBL, NKE, ZZ, WOR, STZ, BLUD, MU and Cramer’s TSCM, which will be interesting to me anyway…. So we’d better look sharp, things are sure going to be interesting…