Fundamentals don't matter, until they do – then they matter a lot…

Fundamentals don't matter, until they do – then they matter a lot…

We had a fantastic week because we stuck to the fundamentals and stayed short – even though it was a very painful path to follow. In last week's wrap-up, facing the never-ending market climb on low volume I had said "I am trying to get bullish, really I am," and I was trying to find bullish plays for members – but we still ended up bearish for the week with a lot of bearish plays being added and thank goodness as it gave us a fantastic week this week!

Just following the plays I mentioned in last week's wrap-up would have been great as we had SKF bullish at $21 (now $26), DIA bearish at $98 (now $96.74), FAZ bullish at $16 (now $22.12), OIH bearish at $120 (now $114.75), SRS bullish at $8.50 (now $9.93) – and those were just from Thursday and Friday, last week was very active and very successful. I had been quoting Samuel Jackson to highlight my difficulty joining the bullish analysts and I closed last week's comments by saying: "It really is hard to be the shepherd in this market as I see wolves everywhere, waiting to pounce on the flock as the mainstream media leads them off to slaughter. Or maybe (hopefully) I’m just being paranoid and everything’s fine…"

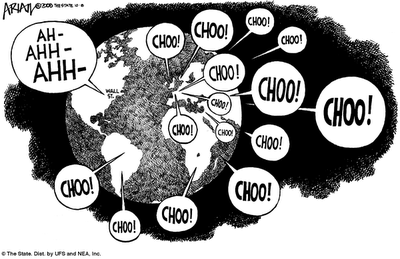

Monday I led off the week with my concerns about the spread of the flu, as the season is upon us. That gave us 4 bullish (but hedged) plays on SVA, BCRX and CAH (2), none of which are performing so far so all of which are still good entries, especially CAH who got whacked by a DB downgrade on Thursday yet paid back $1Bn in debt on Friday and still look very good long-term.

Monday I led off the week with my concerns about the spread of the flu, as the season is upon us. That gave us 4 bullish (but hedged) plays on SVA, BCRX and CAH (2), none of which are performing so far so all of which are still good entries, especially CAH who got whacked by a DB downgrade on Thursday yet paid back $1Bn in debt on Friday and still look very good long-term.

I had an early look at the G20s "Framework for Sustainable and Balanced Growth," and our conclusion was that, although a good plan, it sure wasn't something the markets should be all pumped up about as stability was not going to grow us into the bullish valuations that our stocks had already risen to. I warned members that the media was misinterpreting/misrepresenting this report saying: "You can bet though, that "THEY" are acting on this information and they will be SELLSELLSELLING, as they did on Friday afternoon even as the MSM pump-monkeys continue to tell you to BUYBUYBUY as if, not only has the economy fully recovered – but $70 oil, a global pandemic, massive unemployment, limited credit availability, record mortgage and credit card defaults and unsustainable levels of government stimulus and debt are nothing you should be concerned about either."

That was pretty much the pattern for the week as our day's ended in sell-offs followed by pumping action in the futures, culminating in that silly Fed day on Wednesday and our big drop. On Monday though, we took bearish profits off the table at 10:51 as manipulation was clearly in the air and, for the rest of the day, we were pretty much watching and waiting as the markets rose slightly. We spent the day watching our levels but I did endorse a $37.71/38.85 leap buy/write on CAT as they do pay a nice 3.1% dividend and make a nice place to park cash. We went fot the GLD $100 puts at $3.10 (now $3.80 and even better for those who rolled as planned) and I added a VZ leap spread at net $21.75/23.38 as that pays an amazing 6.3% dividend which is raised to 8.7% thanks to our discounted entry. That's what we call a quiet day watching and waiting!

Tuesday Morning got off to a bang with Gordon Brown lying to us. We didn't know he was lying at the time or maybe he really hoped the G20 would double up on stimulus spending but I did nominate him for the very prestigious "Globey Award for blatant market manipulation" – so you know how I felt about it. I pointed out that he had stiff competition that day from notorious Gang of 12 members UBS, GS and JPM who teamed up to tell us that Russia, yes Russia, was poised to move up an additional 88% this year. I think the award has to go to Brown because at least what Brown said was somewhat believable.

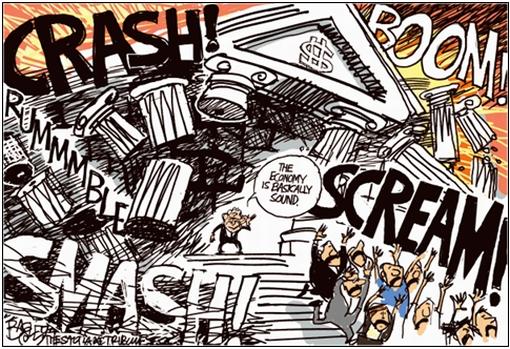

The image on the right says it all. A bunch of market cheerleaders building a pyramid of BS, which makes for a good picture but really isn't sustainable for any long period of time. Bad data was already pouring in from Retail Sales as well as LOW earnings/outlook and the FDIC was out of money but the pump monkeys were clearly in charge on Tuesday and we wisely stayed out of their way, following through with Monday's plan to keep our cash and look for bearish re-entries.

The image on the right says it all. A bunch of market cheerleaders building a pyramid of BS, which makes for a good picture but really isn't sustainable for any long period of time. Bad data was already pouring in from Retail Sales as well as LOW earnings/outlook and the FDIC was out of money but the pump monkeys were clearly in charge on Tuesday and we wisely stayed out of their way, following through with Monday's plan to keep our cash and look for bearish re-entries.

AIG went crazy and my 9:47 Alert to Members was: "Let’s take the 2011 $30 calls off the table for $27" and that 100% profit was the best exit we were offered since we bought the contract. In that same alert I called EDZ a buy at $6.97 (now $7.49) with a $5.32/5.66 buy write as our way of playing against the G12 call on Russia. ALSO, in that SAME alert, we set up our usual Fed spread, picking up DIA 9/30 $97 puts at .60 and $99 calls at .67, so it was a pretty busy first 17 minutes in the market.

Tuesday seemed like an excellent place to start shorting oil and we began with a short position on CVX which is working out perfectly so far. FSLR, also a favorite target of ours was ripe for the taking, selling the $170 calls for $4.80, now $2.40 (up 50%) but stopped out Thursday. We had an opportunity to sell SRS Nov $8 puts naked for .80, now .45 and we also took a Jan $6/8 bull call spread for $1.10, which is looking good with the ETF at $9.93.

MPEL was ready to fly and we took a couple of bullish leap spreads and by 12:34 I fired off an Alert to Members indicating RSX had run up enough on those idiotic upgrades for us to go short and we grabbed a Jan $29/27 bear put spread for $1 and a backspread where we sold the Oct $28 calls for $1, now .65 (up 35%) while our Jan $31s have dropped a dime to $1.15. In that Alert we also took the opportunity to roll our DIA puts up to the $98 puts for net .90 and balanced with $99 calls at .60. Later in the afternoon we decided BXP had had enough and went short on them with a Jan $90/75 put spread that's looking very good after a 7% drop to $65 and that was enough for that day as we were worried about the Fed statement the next day.

Wednesday morning I pointed out how our situation was very similar to the last couple of tops and how we were long overdue for a correction. We reviewed our very successful buys from the last sell-off, which gives us a nice group to keep our eyes on for entries as our favorite stocks hopefully go on sale again and also, hopefully, served to remind members that patience does indeed have it's rewards. As I said in the morning post in reviewing our previously accurate market calls:

Wednesday morning I pointed out how our situation was very similar to the last couple of tops and how we were long overdue for a correction. We reviewed our very successful buys from the last sell-off, which gives us a nice group to keep our eyes on for entries as our favorite stocks hopefully go on sale again and also, hopefully, served to remind members that patience does indeed have it's rewards. As I said in the morning post in reviewing our previously accurate market calls:

I am telling you this in the hopes that you take me seriously when I tell you that the same logic and reasoning and observations that led me to believe that the market was oversold at 8,100 (which was the bottom of a 5% rule range we had been tracking since last fall) is just as overbought at 9,800 – which does happen to be 20% off the bottom and is SCREAMING for a 5% correction.

I listed my lingering concerns about the economy and we talked about Paul Vinga's excellent article on the "Pinocchio Recovery," which made me the annoying little cricket who doesn't want to let you have too much fun but turns out to be right most of the time. I said we'd have to get a some real "Blue Fairy" magic from the Fed to keep the plates spinning. We bravely took the USO $37 puts for $1.75 ahead of the oil inventory in my 9:48 Member Alert and those finished the week with a clean 100% gain at $3.50 so a pretty good week for first calls!

Second calls were rockin' too with my 9:57 trade idea for members the OIH $115 puts for $2.55, now $4.45 (up 75%) even after the bounce back. EDZ hadn't moved yet so we went at them again with a $5.80/6.40 October buy/write that's looking pretty good with the ETF at $7.49 already. We also kept on VZ with a short sale of the 2011 $30 puts, which are still $5.20 for a $24.80 net entry – there aren't too many stocks we think are cheap right now so we are not shy about going back to the ones that are as we look for some bullish balance. Just ahead of the Fed we went for a slightly bearish RIMM spread at $2.30 but RIMM was so pathetic we're actually down to $1.45 (down 36%) on our March $100s but we do like RIMM to recover eventually. We also missed (so far) with the MHP 2011 $25 puts at $5.20, now $6.60 (down 34%).

Second calls were rockin' too with my 9:57 trade idea for members the OIH $115 puts for $2.55, now $4.45 (up 75%) even after the bounce back. EDZ hadn't moved yet so we went at them again with a $5.80/6.40 October buy/write that's looking pretty good with the ETF at $7.49 already. We also kept on VZ with a short sale of the 2011 $30 puts, which are still $5.20 for a $24.80 net entry – there aren't too many stocks we think are cheap right now so we are not shy about going back to the ones that are as we look for some bullish balance. Just ahead of the Fed we went for a slightly bearish RIMM spread at $2.30 but RIMM was so pathetic we're actually down to $1.45 (down 36%) on our March $100s but we do like RIMM to recover eventually. We also missed (so far) with the MHP 2011 $25 puts at $5.20, now $6.60 (down 34%).

We got the Fed statement and I reviewed it in my 2:29 Alert to Members and found it to be both bullish and BS at the same time. Our play was to cash out our $99 calls for .85 and double down on the $98 puts at .55, which worked out fantastically as it was a nice 25% profit on the calls followed by a 100% profit on the puts as they slid down and, the good news was we had twice as many puts as calls! Kudos and thanks to Cramer for his 2:35 appearance on CNBC where Cramer called the action "very positive" and a "breakout" almost right at the exact top, which gave us fantastic prices to short into. This is very possibly the wrongest call he's made all year. As the market kept going up and Cramer rambled on and Erin predicted 10,000, some members were getting nervous so I pointed out how minor the changes to the Fed statement were saying: "Here’s how many words it took for the market to gain 50 points – stop capitulating just because it’s fooling the sheeple!" 200 down points later, at the close, I was looking pretty smart.

The G20 meeting on Thursday kept us from being uber-bullish but the signs were certainly there that all was not going to be as stimulating as Gordon Brown had predicted on Tuesday morning.

I had to reflect on the fact that the G20's "Conehead" plan for encouraging mass consumption in the emerging markets in order to make up for the G7 having maxed out their credit cards was a plan with certain flaws, not the least of which is it made a 30-year old Saturday Night Live sketch look like our new economic blueprint.

Shipping indexes were my other big concern of the day and my play of the day in the morning post was the IYT Dec $75 puts at $6.20, which already shot up to $7.70 (up 24%) and we covered during the day with the $71 puts at $5.30 for a net .90 entry on the $4 spread that is already 100% in the money at $2.10 (up 133%). As I said in the morning: "THAT’s a nice hedge, just in case the G20 doesn’t solve everything."

We had enough bearish positions that there was no need for morning picks as we went back to watching our levels. By 11 we were in the mood for a little bargain hunting and we started with shorting the naked AAPL Jan $165 puts at $7.40, which are still there if you like AAPL at net $157.60, a 15% discount. We went back to a 1/2 cover on our long DIA puts (55% bearish) as the sell-off ran out of gas and that's the cover we kept into the weekend (short Sept 30th $97 puts at $1.05). In the afternoon we attempted to set up positions on MCO (hedged at $14.10/15.80) as well as MHP with a spread that calls for them to hold about $25 through January. We took a quick upside momentum play on DIA but the stick save was weak that afternoon, leaving us fairly certain there would be follow-through on Friday.

Friday Morning I predicted a poor durable goods report and it actually came in worse than I expected – which was catastrophically worse than what the usual gang of idiots they survey expected. One day I hope to understand how people who are paid to do nothing else but anlayze data all day long can be so completely clueless as to what that data means and, even more important, how the IBanks and the Media manage to charge people for compiling these "consensus" figures and getting people to act on them as if it's some sort of inside information. We wonder how our economy can get so far off track but I have yet to see anyone point to these ridiculous economic forecasts that are routinely off by 50-500% as a possible, even probable, cause of our problems.

With Q3 earnings fast approaching, there are fresh concerns about loan losses in the financial sector and without solid action from the G20 it didn't look like it was going to be a good day but GS decided to raise their forecast for oil (as they often do when it's falling in order to shore up the price of the contracts they are holding in clear violation of a dozen securities laws). That little move managed to pull oil off the floor at $65 that morning and ran it back to $67 before settling in at $66 for the close. In my morning Alert to members we thought we had a good deal selling the RIMM March $60 puts for $4.30 but they are $7 now (down 62%) even though RIMM is holding $68.91 but they can still be rolled to the 2011 $50 puts, now $6.25 and we really don't mind owning RIMM at around net $45, which is about half of what they were trading for on Thursday morning.

Friday was a resting day for us, one of quiet reflection on the markets, which held up pretty well overall. We added an INFY Nov $50/45 put spread for $2.70 and a bullish play on ARNA since the Apr $4/5 calls spread was just .25 with a 400% return. BAC got low enough to be interesting and we finally sold 5 Oct $17 puts for .97 in the $100K Virtual Portfolio as well as a 2011 $10/15 call spread for $3. The C 2011 $5/7.50 call spread for .52 and the Jan $4/5 call spread for .42 were also added as our main fear for our bearish positions over the weekend is some sort of seeping stimulus aimed at boosting the banking sector which, in the long run, we think is a good bet anyway.

So are fundamentals making a comeback or are we just resting before the next big push to 10,000? We'll be keeping a very close eye on our 5% rule levels next week, especially the retrace levels from the 20% run-ups since early July:

| Dow | S&P | Nasdaq | NYSE | Russell | Trans | HSI | Nikkei | FTSE | DAX | |

| Current | 9,665 | 1,044 | 2,091 | 6,824 | 599 | 1,932 | 21,024 | 10,266 | 5,082 | 5,581 |

| 2.5% Up | 9,950 | 1,077 | 2,160 | 7,034 | 617 | 2,001 | 21,577 | 10,808 | 5,206 | 5,745 |

| Prev Close | 9,707 | 1,051 | 2,108 | 6,862 | 602 | 1,952 | 21,051 | 10,544 | 5,079 | 5,605 |

| 2.5% Down | 9,465 | 1,025 | 2,055 | 6,691 | 587 | 1,903 | 20,524 | 10,281 | 4,952 | 5,465 |

| July Base | 8,200 | 880 | 1,750 | 5,600 | 480 | 1,650 | 17,500 | 9,200 | 4,200 | 4,600 |

| 20% Up | 9,840 | 1,056 | 2,100 | 6,720 | 576 | 1,980 | 21,000 | 11,040 | 5,040 | 5,520 |

| Retrace | 9,512 | 1,020 | 2,030 | 6,496 | 556 | 1,914 | 20,300 | 10,672 | 4,872 | 5,336 |

We can see from the chart that only the Nikkei has blown it's retrace level but they have also never hit their 20% level. All the other indexes have hit 20% up and the Hang Seng is in the most immediate danger of giving it back but the NYSE and Russell are playing it close to the bone while hitting the 2.5% line off Thursday's close would put most of the indexes under the 20% mark so we are a small slip away from a very red chart.

The DAX should hold it together as Merkel won her election (stability is good) and Iran has been test-firing short-range missiles this weekend in order to keep oil above $60 a barrel next week, coordinating their efforts with the Taliban, who attacked the Afghan Energy minister and staged multiple suicide bombings in Pakistan as well as Palestinians, who held riots at the Temple on the Mount as Jews attempted to visit for the Holy Days. Osama Bin Laden also worked overtime this weekend to help Goldman Sachs hit their oil target, demanding the EU nations pull their troops out of Afganistan or face "retaliations." We'll wait patiently to see who's turn it is to have their Nigerian outpost attacked by Rent-A-Rebel – all in all, the usual nonsense that pops up every time oil needs defending at a critical inflection point.

It's going to be a race between those retrace levels turning red or the 20% up levels turning green but if they can't get the Nikkei to join the party (and that's a tough trick with the dollar down at 89 Yen) then it's not likely the other indexes will be able to gain much momentum. If oil fails $65, that sector has a long way to fall and metals and miners are also teetering on the verge of a correction so many, many things that can go wrong next week with lots of data on deck including Tuesday's Case-Shiller Index and Consumer Confidence Survey ahead of the bell, our final Q2 GDP (-1%) on Wednesday with ADP Employment and the Chicago PMI. Thursday is the very dangerous Personal Income and Spending along with Jobless Claims, ISM, Construction Spending, Pending Home Sales and Auto Sales. Friday is our Non-Farm Payroll Report along with August Factory Orders – busy, busy…

We also have earnings from PBG, WAG, DRI, JBL, NKE, ZZ, WOR, STZ, BLUD, MU and Cramer's TSCM, which will be interesting to me anyway…. So we'd better rest up, things are sure going to be interesting.