10,500 – that's 75% of 14,000 in the Dow!

10,500 – that's 75% of 14,000 in the Dow!

On the S&P we topped out all the way up at 1,550 in October, 2007 so 1,162 would be the target there. For the Nasdaq it's 2,100 (already over), 7,750 on the NYSE is still far away and 637 on the Russell is tantalizingly close (5%ish). The SOX still need to gain 30% to get back to 400 and the the Transports are going to need a lot of gas to get back to 2,250. (see Fallond's breakout charts here)

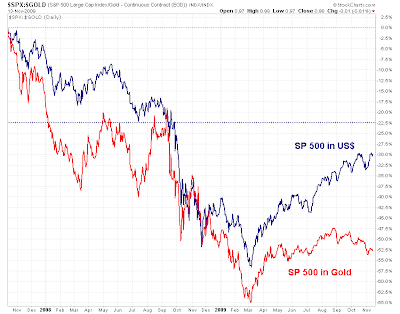

Oil was $100 a barrel in October 2007 so $75 is right on track and gold is clearly our over-achiever, UP 42% from 2 years ago and that is "obviously" according to the pundits, because the dollar is trading 1.5% lower than it was back then. We are being led higher by great companies like XOM who, at $75 are well above their 75% level at $67. This is VERY impressive since they earned $9.4Bn in Q3 '07 and just $4.7Bn last Q on 20% less sales but that doesn't stop investors (or at least tradebots) from snapping them up at these prices.

TRV was added to the Dow and that stock is now OVER the 2007 highs of $52.50, which is really impressive as they are doing it with less revenues ($200M) and less earnings ($263M, 21%). Perhaps we are seeing a pattern? Earn 50% less, like XOM and get valued 16% lower, earn 21% less, like TRV and get valued 5% HIGHER. CAT was at $70 in Q3, 2007 with $11.4Bn in sales and a $927M profit so OF COURSE they are at $60 now (down just 14%) on $7.3Bn in sales and $404M in profits. Just like XOM, 56% less earnings equals a 14% haircut on the stock price. After all, you can't fool these savvy investors, can you?

TRV was added to the Dow and that stock is now OVER the 2007 highs of $52.50, which is really impressive as they are doing it with less revenues ($200M) and less earnings ($263M, 21%). Perhaps we are seeing a pattern? Earn 50% less, like XOM and get valued 16% lower, earn 21% less, like TRV and get valued 5% HIGHER. CAT was at $70 in Q3, 2007 with $11.4Bn in sales and a $927M profit so OF COURSE they are at $60 now (down just 14%) on $7.3Bn in sales and $404M in profits. Just like XOM, 56% less earnings equals a 14% haircut on the stock price. After all, you can't fool these savvy investors, can you?

I'll be going through the Dow in detail this weekend as we set up our new Buy List for Members as (if we are going to accept the premise that these investors are not crazy) there are certainly some bargains in the Dow like VZ (got 'em already), who earned $1.3Bn on $23.8Bn in sales 2 years ago and earned $1.2Bn on $27.3Bn in sales last Q, yet they are still trading 25% below where they were. INTC made more money on less sales but they are trading 20% off while DIS made more money on more sales yet trades at a discount. When the market is insane, you need an investing premise and comparative valuations are helpful to determine what to buy and what to stay away from.

To say we are reluctant bulls is an understatement of epic proportions. The global economy is propped up by stimulus, stimulus and then some more stimulus. Our friend Jeff Immelt (Dow component GE) held a webcast with Dow component BAC (who took over MER to place them squarely in the Gang of 12) to say they expect Congress to approve a second economic-stimulus package to help what would otherwise be a slow economic recovery. The speakers, on a BofA Merrill Lynch webcast, said global economic recovery would be led by governments and emerging markets.

“If you look at where we were a year ago, without a stimulus plan we wouldn’t be where we are today, talking about a recovery,” said Michael Hartnett, chief global equity strategist at BofA Merrill Lynch Global Research. Harold Ford Jr., a former congressman and vice chairman of BofA Merrill Lynch, predicted a second stimulus will take place sometime next year. Isn't that clever, they get a former Congressman to tell you what he thinks Congress will do – it sounds nice and inside doesn't it?

Note that both GE and BAC are on the low end of the Dow earnings pool with GE off more than 50% in earnings last quarter and BAC LOSING $1Bn, down from the $3.7Bn they claimed to earn in Q3 '07. I say claimed because they put a number down, took bonuses on the money they made but then all the loans went bad and they nearly bankrupted themselves and the nation. Ah, good times….

Note that both GE and BAC are on the low end of the Dow earnings pool with GE off more than 50% in earnings last quarter and BAC LOSING $1Bn, down from the $3.7Bn they claimed to earn in Q3 '07. I say claimed because they put a number down, took bonuses on the money they made but then all the loans went bad and they nearly bankrupted themselves and the nation. Ah, good times….

So the hat-in-handers make a speech and use the words jobs and unemployment over and over again as reasons they need more stimulus but both of these firms have gotten tens of Billions in stimulus already and have nevertheless laid off tens of thousands of workers. BAC got $45Bn in TARP funds and GE pulled in $48Bn of government debt guarantees. $93Bn is enough money to give all the remaining 600,000 GE and BAC employees $155,000 each, but that even distribution would prevent GE's top 5 executives from drawing $34M in salaries off the top (on drastically lower earnings) – just something to think about…

Still, you have got to love stimulus. We must be doing something wrong over here because stimulus in China is working so well that PC sales are up 60% in Q3 but that's nothing compared to auto sales, which were up 72.5% from last year. And it's not 72.5% of a small number, China is now buying more cars per year than the US. What a fabulous year they must be having. Surely the Chinese are superior people as they have fixed their economy SO WELL that there are 72% more car sales AND 60% more PC sales. How does that compare with your neighborhood and, more importantly, how does that reconcile with China's unemployment hitting a 30-year high?

Having someone show up at the unemployment office and giving them a laptop and a new car to drive back to the farm is NOT a sustainable plan for economic growth! That did not stop us from going with the flow yesterday as we did what we had to do above our levels with 4 bullish trades in my 9:50 Alert to Members and we had 6 more by lunch but then we decided things were toppy again and went for a few short plays. One from our Watch List, SPWRA, fell off a cliff this morning on an accounting investigation and that's going to be a great opportunity for us to get back in at our "wish" price (hedged, of course).

FXP was one of the bearish plays we jumped on in the afternoon as the Dow got near that 25% line. The Hang Seng had a wild ride this morning but finished the day flat at 22,914 after attempting 23,000 on a morning spike. The Nikkei made a brave attempt at opening high but dropped over 100 points from it's gapped-up open to finish the day down 61 at 9,729. We hardly pay attention the the Shanghai Composite as it just goes up every day no matter what happens but they are getting close to testing 400 again, which is where they dove 25% from in August. We have a nice improvement in the 200 dma so we're not expecting a repeat but maybe a 10-15% dip to keep things real looking.

Europe is flatlining ahead of the US open (9am) with a lot of profit-taking in the energy and metal sectors. The Euro Zone posted a surprising trade surplus of $5.5Bn. This number was driven by the fact that EU imports were relatively flat (up 1.1%) while exports rose 5.5%. So far this year European Union trade flows with all of its major partners have fallen. The largest decreases were recorded for exports to Russia, 40 per cent down between January and August compared to the same period last year. Trade with the US over the same period was down 20 per cent and with Japan down by 31 per cent, giving an idea of the scale of the downturn.

Despite the lack of actual money in the US, the Fed's policy of ultra-low interest rates is allowing us to import boatloads of capital goods on credit. Fed Vice Chair Kohn sees no problem with this and, in fact, said yesterday that: "The Federal Reserve's low interest rate policy is meant to encourage investors to move into riskier assets in order to promote economic recovery, and there are no signs currently the policy is resulting in the build-up of a U.S. asset bubble." Wow, than goodness, because I was worried!

One of the purposes of these policies is to induce investors to shift into riskier and longer-term assets in order to lower the cost and increase the availability of capital to households and businesses. The resulting easier credit is designed to encourage spending during a period when output is expected to remain well below the economy's capacity for a prolonged period.

Well, they say you can't fight the Fed and the Fed is doing everything in their power to force your money into "riskier" investments and encourage you to BUYBUYBUY during tough times. Meanwhile, Mortgage delinquency rates are on course to hit a record in 2009, TransUnion.com says in its Q3 analysis this morning. Delinquencies (60+ days overdue) increased for the 11th straight quarter, hitting an all-time high of 6.25%, up from Q2's 5.81%. Still, it marks the third straight quarter that the rate of increase has slowed, which is progress at least.

As I said, we're reluctancly bullish but we'll still take those quick bearish bets along the way, just in case Kohn is wrong and something finally pops.