Hey all.

I am doing this afternoon gamble of the day. This harks back to something I tried before, but it couldn’t be consistent enough. I found a gamble for overnight tonight that I am really fond of that I think you should definitely try out.

Gamble of the Day: Big Lots Inc. (BIG)

Discount stores have been doing exceptional this earnings season. Across the board, all the companies are beating expectations and doing well on hitting some solid growth. One company that is last to get into this earnings season is Big Lots. The company is a small-scale Wal-Mart that is bigger in volume and size than a Family Dollar or Dollar Tree. The company will be reporting earnings tomorrow morning, and I think we can expect a beat on the way. That will mean a solid gap up and gain moving into tomorrow. Why? Big Lots is extremely undervalued moving into the earnings reporting, and it has a ton of upside.

Why am I excited about this company’s earnings? Discount stores have all beaten. In October and November, out of the eight major discount retail/variety stores, such as Wal-Mart, Target, and Family Dollar, they have all beaten expectations. Not a single company hasn’t done better than what analysts were thinking. People are still buying, and these discount stores are taking flight still. Big Lots has seen exceptional earnings from one year ago. The company has beaten expectations consistently, and the company is looking at EPS estimate of 0.18. One year ago the company hit 0.15. The past quarter, however, the company hit an EPS of 0.35. Further, Big Lots has a lower P/E ratio than all its competitors. This means people are expecting less in earnings, and if the company beats, we can expect a more severe run up in price.

The company at the beginning of November, commented that they saw their Q3 same-store sales down 0.2%. From that moment, the stock has dropped as much as 10%. The stock has had a slight rebound with the market trading up, but it is down again today. The same-store sales would worry me, except for the fact that the company said sales as a whole were up almost 1% from one year ago. More sales, more $$$.

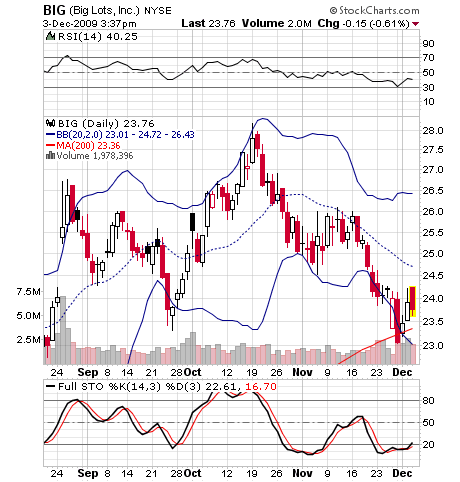

The technicals are the final key to this puzzle. The stock is very undervalued, has been oversold, and it is near its lower bollinger band. Everything is set up for a solid run if earnings are beat. Tomorrow’s market may be a weak day with unemployment being released, but I think Big Lots provides a discounted opportunity right now for a value investment. Get in, sell at the open tomorrow and make some money.

Good Luck and Good Investing,

David Ristau