Like any good car race, the lead changes often in the markets. Yesterday the bears took the lead as the combination of Hungarian debt issues and a disappointing jobs number were like a tire blow-out for the bulls, who were forced to pull in for a pit stop. Fortunately, we had our seat belts on and had assumed the crash position as I had warned Members on THURSDAY Morning at 10:04:

Watch that 666 line on the RUT – we don’t want to lose that or even show weakness there… ISM a bit disappointing, now we’ll see what holds but I’m out of short-term, unhedged, upside plays here.

I felt strongly enough about it that we also posted it on Seeking Alpha, to warn as many people as possible, under the heading: "Phil Calls Short-Term Top." I don’t post live trade ideas on Seeking Alpha but in Premium Member Chat (and you can subscribe here) I followed right up at 10:17 Thursday morning with the following trade idea:

BGZ (large-cap bear) is at $15.27 and I like them as a hedge here with the (June) $14/16 bull call spread at .75, selling the July $14 puts for .95 and that’s a net .20 credit on the $2 spread with about $2.70 in margin so you can do a 10 contract spread for a $200 credit and $2,700 in margin (according to TOS standard) with a $2K upside if the market even twitches lower. Worst case is you own BGZ as a hedge to a dip below Dow 10,600 (your put-to area) at net $13.80 (9% lower than current price).

That’s what hedged trade ideas look like in our Member Chat. At PSW, you need to put some time in LEARNING how to trade and, more importantly, how to hedge. This is a fairly complicated options play but we take it BECAUSE IT WORKS! There are many, many simpler ways to play that don’t work (or carry far more risk) but we prefer to teach our Members how to do the things that do work. As it stands, just 48 hours later, BGZ is up 10% on Friday to $16.89 (so the spread is now 100% in the money) and June $14/16 bull call spread is now $1.50 while the July $14 puts are Down to .60 so net .90 already on the spread that already paid you .20 to take the risk. As I mentioned above, the trade had $2.70 in margin so using $2,700 of margin (and we’re 80% cash so lots of margin available) has already returned $1,100 out of a best case $2,200 so we took the money and ran yesterday as we thought the drop was a bit overdone.

That’s what hedged trade ideas look like in our Member Chat. At PSW, you need to put some time in LEARNING how to trade and, more importantly, how to hedge. This is a fairly complicated options play but we take it BECAUSE IT WORKS! There are many, many simpler ways to play that don’t work (or carry far more risk) but we prefer to teach our Members how to do the things that do work. As it stands, just 48 hours later, BGZ is up 10% on Friday to $16.89 (so the spread is now 100% in the money) and June $14/16 bull call spread is now $1.50 while the July $14 puts are Down to .60 so net .90 already on the spread that already paid you .20 to take the risk. As I mentioned above, the trade had $2.70 in margin so using $2,700 of margin (and we’re 80% cash so lots of margin available) has already returned $1,100 out of a best case $2,200 so we took the money and ran yesterday as we thought the drop was a bit overdone.

Of course, that wasn’t our only bearish move on Thursday. In that same 10:17 comment to Members we also flipped bearish on our Mattress play, buying back 1/2 the June $103 puts we had sold earlier in the week that were covering our usual long-term protection, currently the Sept $103 puts, which jumped from $5.50 on Thursday to $7.50 at yesterday’s close (up 36%). At 10:59 we got a little more aggressively bearish as I said to Members: "If we can’t hold 10,250 then we may as well go naked on the DIA Sept Mattress puts."

Another hedge we grabbed on Thursday was SDS (ultra-short S&P) and this is also a good example of the strategy so I’ll reprint my 12:30 comment to Members here:

SDS – Keep in mind that so far we have an intra-day sell-off, not a failure of levels. SDS is at $33.78 and the S&P is at 1,100 and we don’t think they make 1,300 by Jan and that’s about 15% up so the lowest we see SDS going is 45% down or $16. You can sell the Jan $27 puts for $2 and that means our risk on a rally to 1,300 is about a loss of $9 – keep that in mind. We can use the $2 to offset the cost of the Jan $25/32 bull call spread at $4 and that puts you in the $7 spread for $2 with a 250% upside if SDS finishes where it is now or lower. Let’s say that you go for 20 of those contracts for net $4,000 and you risk $18,000 to the downside (at 1,300) but figure we roll to 2012 $23 puts so call it $9,000 with another year of protection. The upside on 20 is $14,000 back (+$10K) so you can protect $100,000 worth of longs from a 20% drop but if you have buy/writes with 20% built-in protection, then you can protect $200,000 worth of longs from a 30% drop and if those $200,000 are going to make at least 20% if the S&P is over 1,300 by Jan, then you gain $40,000 there less whatever you pay for the short side and THAT’s how the insurance is supposed to work.

On yesterday’s drop alone, SDS ran up $2.33 on the day to $35.75 so this trade is already 100% in the money and the $25/32 bull call spread is still $4 but the $27 puts fell to $1.70 so just a .30 gain on this spread because the rising VIX tends to damage the longer-term hedges at first. That’s why it’s important to have mixes of short and long-term protection but consider that this trade is already $3.75 (10%) in the money and pays $7 (up 204%) against what is still just a net $2.30 investment if the S&P ISN’T HIGHER by Jan options expiration.

That’s the insurance policy – buy an S&P correlated stock for $10,000 and spend $500 on insurance and, if the S&P IS NOT HIGHER by January 19th, your insurance will pay you back $1,500 so that’s 10% downside protection on your stock. If you pick a stock like T or VZ that pay a 5% dividend, that pays for your insurance right there. Now if we take our VZ entry at $27.21 and hedge that by selling the Jan $25 puts and calls (because we’re still worried about a drop) for $4.90, that puts us in VZ for net $22.31 so we make $2.69 if called away at $25 (12%) in 7 months or, if VZ dips below $25, we will be assigned another round of stock at $25 for an average entry of $23.66, which is a 13.4% discount to the current price.

That’s the insurance policy – buy an S&P correlated stock for $10,000 and spend $500 on insurance and, if the S&P IS NOT HIGHER by January 19th, your insurance will pay you back $1,500 so that’s 10% downside protection on your stock. If you pick a stock like T or VZ that pay a 5% dividend, that pays for your insurance right there. Now if we take our VZ entry at $27.21 and hedge that by selling the Jan $25 puts and calls (because we’re still worried about a drop) for $4.90, that puts us in VZ for net $22.31 so we make $2.69 if called away at $25 (12%) in 7 months or, if VZ dips below $25, we will be assigned another round of stock at $25 for an average entry of $23.66, which is a 13.4% discount to the current price.

So your worst case is you own VZ for a 13% discount but, if the S&P drops or stays flat along with VZ, you’ll also collect $1,000 from the hedge (plus your $500 back) so now you are protected for an additonal $2 drop on 500 shares, all the way to $21.66 – not bad for a stock you bought when it was at $27.21. You also collect $1.68 a year in dividend and we have all sorts of tricks to manage the trade along the way as we probably want to end up keeping the stock but that’s too complicated to explain in one article – or even one day. It does take practice to learn how to set up and manage these hedged positions but dont’ you think it’s worth learning if you can learn how to buy stocks for $27.21 that don’t lose you any money all the way to $21.66?

We do lots of fun risky stuff and our day-trading and short-term trading grabs all the headlines but THIS is the key strategy investors should pursue with the bulk of their virtual portfolios. If you have a $100,000 virtual portfolio and you keep $50,000 in cash and make just 15% a year (compounded – the example above makes 13% in 7 months) on the $50,000 you play with for 20 years – THAT’S $818,000! Slow and steady does win the race and I always encourage our Members to play with this Compound Interest Calculator to help understand the value of long-term conservative investing. Note that if you add just $10,000 a year into that same formula ($50,000 at 15% for 20 years) you make ANOTHER $1.1M – combining saving and investing is a powerful combination…

Learning to hedge like this and using a combination of our Buy/Write strategy and our Disaster Hedges can help you make consistently good returns and turn day’s like Friday from crisis to opportunity as our Disaster Hedges GIVE US CASH when the market goes down so we can afford to go shopping while everyone else is selling and our Buy/Write Strategy gives us 15-20% discounts on our stock entries. Combine that with good picks from our Buy List (which are selected as best fits for these strategies) and all we need to do be reasonably right in our market calls to do very, very well.

Speaking of timing – Our last major round of Disaster Hedges were posted on April 28th, 12 days after I called a top and the same week we cashed our our Q1 Buy List. The post was titled "5 Plays That Make 500% if the Market Falls" – and, just like the bullish plays we cashed out at 300%, these are up far enough that we need to cash them out as well, rather than wait for October unless the market continues to fall next week, in which case we can afford to wait for that extra 200%! Now, let’s see how this crazy week went:

Forgotten Weekly Wrap-Up

Forgotten Weekly Wrap-Up

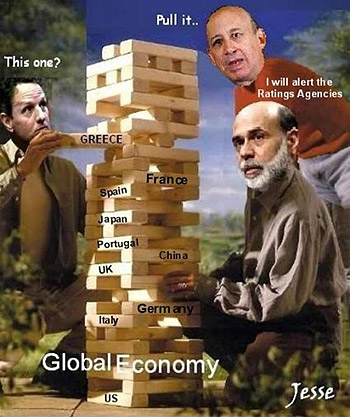

We had ended last week not trusting the market and I mentioned putting up our TZA hedge for Members that pays 500% on a nice Russell drop. I STRONGLY recommend reading this post as it shows you how last week’s action set us up for this week and how NOTHING that happened this week was not expected by us. Even on Friday when we flipped much more bearish when at 12:44, I posted for Members: "FITCH DOWNGRADES SPAIN!!! Down goes Spain, down goes SPAIN!!!" we were already anticipating it because I had posted an article on April 29th (remember we did our Disaster Hedges on the 28th) titled: "Thursday – The Pain in Spain will Hardly be Contained."

Am I some kind of stock market visionary? No – I JUST READ THE FREAKIN’ NEWS! That’s why we thought Friday’s drop was overdone, this is just the retail investors and idiot fund managers (the fastest growing segment in the market apparently) reacting to something old that has become the headline of the moment. Again, read last week’s wrap-up as I talk about fundamentals and how we play against the momentum of the crowds.

Also, you never know what you might learn in a weekly wrap-up as I directed readers back to that Friday’s post and the SDS trade I laid out there in my call for protection. That trade was aimed at paying a 600% profit if SDS hits $36 in Sept. SDS is at $35.75 today and the spread is up over 100% already after 7 days so we’ll call that "on target." Yes, the profits are insane but I can’t change the system – I can only tell you what the market is going to do and how to make money on it….

Memorial Day Musings

News doesn’t take a day off so I don’t tend to either. Even when I’m on vactation I do read a lot and, frankly, I would write down these notes on the market whether it was my job or not but I sound a lot less crazy talking about these things when I have actual readers so this works out great for everyone! It was a fun post but we talked about serious things like Europe and Spain (which I hear is in Europe) and Wal-Mart slashing prices and dropping margins (news which moved the market this week) and the National Debt Clock passing the $13Tn mark and rising labor costs (strikes) and the fact that Ireland is likely to be next on the list of collapsing European nations.

Tumultuous Tuesday – Is Mickey Mouse Missing Mortgage Payments?

Tumultuous Tuesday – Is Mickey Mouse Missing Mortgage Payments?

It turns out Mickey is not missing mortgage payments. The good people of Euro Disney sent me a letter explaining their financial status which I posted later in the week. I was only asking the question based on what was in the Telegraph article and I found it interesting that Disney thought it was important to clarify their position on their line of credit but had nothing to say about the worker suicides that the union is blaming on the harsh labor conditions (of course harsh conditions for French workers can mean forcing them to work over 6 hours a day).

I had already put in an upside play on the oil futures for Members at 7:35 in the previous post. Not many of us play the oil futures but they are fun and we had a PERFECT week with our futures plays until our last entry on Friday at $71.40, which is looking iffy at the moment. In any case, I won’t post all the oil moves because they are pointless and there’s nothing to be gained from them as they are dead plays the minute we exit them. Our USO plays, on the other hand, are based on targets and fundamentals and can be taken more seriously…

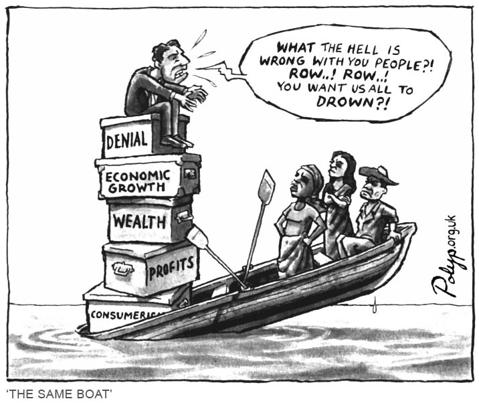

So, despite the French jokes, the struggles of the proletariat always gets me going and I reiterated my macro prediction that we are heading to a new workers revolution as the disparity between rich and poor grows wider and wider – even while the middle class is being herded into the lower class at a record pace. This is intolerable people! I am stunned, STUNNED, by the number of people I talk to who truly believe that life is a win/lose game and financial security is something we fight for and if there’s one winner for every 100 losers then that’s what Capitalism is all about. I’m sorry but it’s not – that’s what Fascism is all about, that’s what Dictatorships and Oligopolies are all about.

Capitalism is about EQUAL opportunities for all and when 80% of the people in this country are born into homes with NO NET ASSETS and when those poor people (who make just 20% of the nation’s income) have to spend $100,000 per child MINIMUM just to give them a college education and have to spend $15,000 a year for family health care and $4,500 for gasoline (2 cars that get 20 mpg at 15,000 miles each and $3 for gas) $2,000 for car insurance and have to give another 1/3 of their income to the government and, should they be foolish enough to own a home, another $5,000 in property and school taxes – well those people are starting out the year with $26,500 in expenses BEFORE they save for college and BEFORE they pay utilities and BEFORE they buy clothes or furniture or put a single bite of food in their mouths or a roof over their heads.

So do you really, really think that the 240M people who live under those conditions, with the average American family income of $48,000, have the same opportunity as you do to "win" the Capitalism game as it’s played in the US? Of course out of 240M people in the bottom 80% there will be THOUSANDS of examples of people who "worked their way up" and you may be one of them but please don’t kid yourself that the opportunities are equal and the less equal things get – the more likely it is that things are going to snap. We try to tell the poor that "all they need is a dollar and a dream" to end their miserable conditions but history shows that, at some point, they begin to realize they can get there a lot faster with a knife and a gun or, in the very least – at the polls.

So do you really, really think that the 240M people who live under those conditions, with the average American family income of $48,000, have the same opportunity as you do to "win" the Capitalism game as it’s played in the US? Of course out of 240M people in the bottom 80% there will be THOUSANDS of examples of people who "worked their way up" and you may be one of them but please don’t kid yourself that the opportunities are equal and the less equal things get – the more likely it is that things are going to snap. We try to tell the poor that "all they need is a dollar and a dream" to end their miserable conditions but history shows that, at some point, they begin to realize they can get there a lot faster with a knife and a gun or, in the very least – at the polls.

The bottom 80% historically get mobilized by people from the bottom of the top 20% – the kind that are getting shoved out of the top as the inequities of the system begin to get more and more extreme and the top 1%, having sucked the life out of the bottom 80%, move on to feed off those closer to the top. That’s what the last few years have been about as people are falling out of the top 20% in record numbers and, as you throw more and more well-educated people with leadership qualities in with the unwashed masses – some of them are bound to find a voice and some of them will become the voice of the people. It has happened over and over and over again throughout history – why would it not happen now?

As I said Tuesday morning (when I rambled a lot more on this subject): "What will be our "shot heard round the World?" Obama is not likely to say "Let them eat cake" but can you trust the rest of the world leaders not to spark a riot that spirals out of control? 20% of the people in Spain are unemployed and the reaction from the EU is to pressure Spain to cut their budget. How will this help the unemployed people get jobs? What is the logic of having a government that takes close to half your wages when you are working but then tells you they can do nothing to help you when you are not?"

As I said Tuesday morning (when I rambled a lot more on this subject): "What will be our "shot heard round the World?" Obama is not likely to say "Let them eat cake" but can you trust the rest of the world leaders not to spark a riot that spirals out of control? 20% of the people in Spain are unemployed and the reaction from the EU is to pressure Spain to cut their budget. How will this help the unemployed people get jobs? What is the logic of having a government that takes close to half your wages when you are working but then tells you they can do nothing to help you when you are not?"

I once again warned that we are doing our bottom fishing because, despite our own troubles, there is no better place to put our investment dollars than US equities – although we are still aiming for 80% cash so it’s light fishing at best. Also I said: "ALWAYS keep in mind, that we are doing so with our downside Disaster Hedges firmly in place and we are READY, WILLING AND ABLE to ride out a 40% drop in the markets." It is VITAL that you keep this in mind when looking at any of our long-term trade ideas. Our rule is, hedge first – go long later.

- TNA June $42/46 bull call spread at $2.50, 50% covered with June $43 puts at $3.50 for net .75, now -$.50, down 166%.

- We got out of this trade, of course, on Wednesday, as it was a short-term long, but I point it out here because it’s a fantastic upside play to make betting on a recovery for next week. It can be adjusted using July $35 puts to give a bit more downside leeway.

- BP 2012 bull call spread – on target

- ARNA 2012 complex spread – on target

- TBT Jan complex spread – on target

- TNA June $45 calls at $5, out at $5.70 – up 14%

- OIH July $104.10 calls at $1.70, out at $2.60 – up 53%

- DIA June $105 calls at .75, out at $1 – up 33%

- USO Jan bull complex spread – on target

I made a comment to Members at 2:14 that made me laugh now so I’ll share: "Reasons we are doomed, #11: CNBC girl says to guest – "We have word that Iran now has enough fuel to make two nuclear weapons – what’s the trade?"

Will We Hold It Wednesday?

Will We Hold It Wednesday?

Boy, if you are reading this and you don’t refer this newsletter to your friends, what kind of friend are you? Right in the first paragraph of Wednesday’s post I reiterated a buy on oil futures at $72.50 (hit $73.80 that afternoon and $75 later in the week at a profit of $10 per penny per contract) as well as a straight up stock pick on OIH at $91.04, which was an easy buy at the open and OIH hit $97 TWICE (good for those too greedy to take profits the first time) for a nice 6.5% 24-hour profit.

Of course our Members had the above July calls that made 53% in the same amount of time as well as the short put play below, but options trading isn’t for everyone, so we cater to both sides of the fence at PSW. I also predicted the drop-off, I predicted the bounce and then I predicted the drop again so yadda, yadda to all that – I’d rather talk about the issues. My general comment about levels and bottom fishing for stocks was:

The most disturbing things we need to watch is the incredible weakness of the NYSE, which is below it’s lows of last November and dangerously close to a major breakdown at 6,500. That and copper below $3 are going to be our major indicators of BIG TROUBLE. SOX 350 was a very disappointing loss yesterday and we need to hold the 200 DMA at 340 or we are DOOMED. So, other than that, we’re very enthusiastic about our prospects going forward – not so much because things are great over here but because things are so very, very scary everywhere else that US equities seem safe by comparison.

- OIH July $84 puts sold for $4.50, now $3.20 – up 28%

- RIG 2012 buy/write – on target

- HOV Aug $5/7.50 bull call spread at $1.10, now .55 – down 50% (and I still like it!)

- HERO 2012 bull call spread – on target

- HERO Jan buy/write – on target

- NS Dec buy/write – on target

- AMGN July $52.50 puts sold for $1.50, out at $1.20 – up 20%

- AMGN Oct $55 puts sold for $4.40, now $4.70 – down 7%

- AMGN 2012 bull call spread – on target

- JOYG complex spread – on target

- STP $9 calls at $1, out at .90 – down 10% (interesting for re-entry at .55)

- STP $9 puts sold for .47, now .52 – down 10% (pair trade)

- MON 2012 complex spread – on target

- ERX 2012 complex spread – off target (good for new entry)

- RIG Aug $40 puts sold for $4.10, now $3.10 – up 24%

- KEY Jan buy/write – on target

- GOOG July $450/500 bull call spread at $33, now $35 – up 6%

- GOOG Dec $440 puts sold for $25, now $23 – up 8% (pair trade)

At 12:50 we were already worried enough about the "rally" that I sent out an Alert to Members saying: "At this point, I think even blowing our current bounce support would be a bad sign. Dow 10,150, S&P 1,085, Nas 2,250, NYSE 6,750 and RUT 650. Not holding those into the close is going to be a real sign of weakness. Where we are right now is nothing more than the top of the descending channel I drew out in yesterday’s chat."

No-Thrills Thursday – Where’s the Kaboom?

No-Thrills Thursday – Where’s the Kaboom?

Silly me, like all cartoon explosions, the very obvious melt-down in the markets was delayed until the funniest possible moment (for the manipulators), when as many people as possible had put their nose into the box to try to figure out why it wasn’t blowing up – THEN the KaBoom! I wrote the bulk of the post by 8:30 am (when our morning Newsletter goes out to Members) and I was fairly bullish as the futures were holding up and all our our bullish plays were looking very good but we had hit our targets on the nose at Wednesday’s close and that kind of bothered me because it was exactly what I predicted that manipulators would do if they wanted to sucker people into the markets. In the morning post I said:

The S&P finished the day at 1,098 and the Dow exceeded our expectations at 10,249 and we’re just waiting for the NYSE to confirm a recovery (at 7,000) along with that critical S&P cross of 1,100 to confirm that we have a real recovery and we are safely back within our predicted trading range. Should we get comfortable with our outlook next week, it’s time to deploy a little capital on our more aggressive Watch List, which never got triggered as the market decided to throw a big sale on Blue Chip stocks, which we couldn’t pass up.

I reiterated my concerns about copper and oil and the Euro and the Pound and the Yen and I noted: "Obama promised us a stong Non-Farm Payroll Report tomorrow, so it better be more than the 500,000 I expected or we’re going to flip short into the action." After I wrote that we got the MasterCard SpendingPulse data and I didn’t like that, especially with the 20% drop in gas prices that should have dropped a lot of cash into consumer’s pockets in May. By 10:04 I had decided the run-up was BS and that led to my call to get out ouf our short-term bullish positions but we didn’t take too many bearish plays as we still had hope.

- BGZ June$14/16 bull call spread at .75, now $1.50 – up 100%

- BGZ July $14 puts sold for .95, now .60 – up 37% (pair trade)

- TSRA 2012 buy/write – on target

- USO June $33 puts sold for .85, out at .55 – up 35%

- MEE 2012 buy/write – on target

- FCX July $60 puts sold for $2.50, now $3.50 – up 40%

- SDS Jan complex spread – on target

- EEM Jan complex spread – on target (great bullish entry if we hold up next week)

- ERX July complex spread – off target (great bullish entry if we hold up next week)

- XOM 2012 buy/write – on target (great bullish entry if we hold up next week)

In addition to what was said at the top of this post, a key comment I made to Members at 10:59 was: "Copper $2.947 while FCX slowly weeps…. You can’t go buying into a rally when key components are blowing up – it’s like running your car at 130 mph and ignoring the wobble in your tire." At 2:30, as we got our expected "stick save" rally, I warned members: "Meanwhile, we do watch the Russell and they are hitting a make or break at 666 again. S&P also testing 1,100 and Dow NOT too close to 10,250 and NYSE not even thinking about 7,000 and the Nas is our co-leader (with RUT) but retaking 3,000 seems unlikely without some major jobs data tomorrow so the question is what are you prepared to hold overnight and, if the answer is you are not – then NOW is a good time to take money and run if we don’t break through on this run."

Another good bit of advice I had for Members was just before the close at 3:54. We were already out of the oil futures but I felt strongly enough to clarify my position re. the USO short puts: "Those USO puts are up 35% on the day (.55) so take them off unless you REALLY want to stick with them if oil falls back off a cliff. USO is only at $34.24 so it’s not like you can’t get burned and 35% in 5 hours is still considered good money to most people." Check out what a chart of something falling off a cliff looks like.

Friday – Budapesky Concerns to Trump Jobs?

Friday – Budapesky Concerns to Trump Jobs?

If you want a summary of Friday’s action, I linked a video to the picture on the right as that pretty much sums up the day… Also doing a great job of summing up the day is David Fry and I STRONGLY suggest you go through his charts, which I will summarize for you here by saying: We have a BIG test of our levels coming up next weeek. We cannot afford to drop ANY further than where we are now or we will have NO CHOICE but to get MUCH more bearish.

Meanwhile, since we were well prepared for this drop and we are mainly in cash (80%) and we do have our spectacularly successful Disaster Hedges – we took the opportunity to get a little BULLISH on Friday’s dip. Nothing major – as I pointed out to members, gambling money only, but it’s worth taking a chance that the levels will hold and we may get a nice bounce next week. If not – we absolutely know how to make money in a downturn so BRING IT ON!

Of course, Dave is not the only guy who know how to draw a straight line across a graph. I too dabble in the black arts of TA and I posted our now-famous Multi-Chart in Friday morning’s post saying: "Those red lines are the supports we must hold to stay in a longer-term uptrend, which I think we can keep so we are still looking at this sell-off as a buying opportunity and will treat it as such until proven otherwise. It’s going to be a very exciting trading day and there’s tons of money to be made for those of us still playing the markets but we’ll be well-covered into the weekend so we can enjoy our summer, even in these crazy times." Here’s the updated charts with my original morning targets:

.jpg)

Not bad for morning predictions ahead of 3 and 4% drops in the indexes is it? See, I know the same stuff Dave knows – only I know it a day sooner! Actually Dave is brilliant, I read him often but, as I said before, isn’t this the kind of thing you want to refer your friends to? As you can see, we’re already breaking down on the Dow, S&P and NYSE so it’s not looking too promising but, if we’re going to put in a bullish bottom – this would probably be it and, if we don’t – plenty of room to play on the way back to 8,650 (800 on S&P).

- TBT stock at $39.46, now $38.73 – down 1.8%

- TBT July $40 puts sold for $2.15, now $2.55 – down 18%

- TBT Jan $43 calls at $3.15, still $3.15 – even

- DIA $102 puts sold for $2.60, now $3.60 – down 38%

- DIA $103 calls (rolled from $105 calls) at net .99, now .72 – down 17%

- SSO June $34/36 bull call spread at $1.25, now $1.02 – down 18%

- SSO June $35 puts sold for $1.35, now $1.90 – down 40% (pair trade)

- BP 2012 complex spread – on target

- AET 2012 buy/write – on target

- SSG June $15/16 bull call spread at .50, now .70 – up 40%

- SSG June $15 puts sold for .40, now .30 – up 25% (pair trade)

- SSG June $16 puts sold for .85, now .60 – up 29%

- USO July $31/33 bull call spread at $1.20, now $1.15 – down 4%

- USO July $31 puts sold for $1, now $1.20 – down 20% (pair trade – I still like it)

- ABX June $42 calls at $1.08, out even

- DIA June $102 calls sold for $1.26, now $1.10 – up 12% (partial cover to $103 calls)

- Copper futures at $2.81, now $2.8195 – up .0095 ($12.50 per .0005, so $237.50 per contract)

- SDS June $34/36 bull call spread at .90, still .90 – even

- SDS June $34 puts sold for .96, now .90 – up 6% (pair trade)

- FXP June $46 calls for $2, still $2 – even

A couple of good things to look for in fast action like the logic of my 11:26 comment to Members where I said:

A couple of good things to look for in fast action like the logic of my 11:26 comment to Members where I said:

Ugly action! Lows of Wed were: Dow 10,020, S&P 1,070, Nas 2,220, NYSE 6,666, RUT 641 so we have a long way to go (except the Dow) before we re-bottom if that’s where we’re going. If the Dow fails 10,020 and then 10,000 – we are probably going to cross lower all around and SSG is probably best protection as SOX are way high (Transports already blew the support line).

SSG $16 puts can be sold for .85 (SSG currently $16.23). I also like the $15/16 bull call spread at .50 and you can sell $15 puts for .40 against that.

I was asked at 11:51 by a Member why I was "optimistic" with the market melting down all around us and I said:

Optimism/Tusca – Partly that I think there’s no NEW bad news and partly because where they hell else will people put their money. Long-term, we will inflate and you need to have some assets. Keep in mind that we’re "bullish" but also scaling in with about 20% of the mainly cash virtual portfolio and hedged with Disaster protection and buy/writes all the way to a 40% drop that covers us back to 666 on the S&P so it’s a funny kind of bullish – more like a "we don’t want to miss a huge, stupid BS rally" kind of bullish than a "USA, USA, USA" kind of rally. Clear?

At 2:53 I pointed out:

At 2:53 I pointed out:

So keep in mind that your stocks are going down because they are priced in dollars and the dollar is up 1.5% today – we are very close to where we were in the Nov ‘08 and March ‘09 crashes on the dollar (89ish) yet, as Tusca points out, our markets are 70% higher than they were at the time. If the dollar devalues now – our markets will rocket and that’s all the G20 has to accomplish and it’s a win-win for everyone – save the Euro, boost US equities….

We took the SDS and FXP plays into the close for a little extra bearish protection and, at 4:17 I said I would be updating our Buy List over the weekend but cautioned Members:

Buy List/Dflam – For sure. Don’t forget though, we should be mainly in cash still as these are just round 1 entries. It would be great to be sure this is a bottom but there are still a centipede’s worth of shoes to drop and if this relatively little bad news can hit us this hard, the Dow 5,000 crowd may have their day and I want to make sure we have the cash to go all in down there. If the world doesn’t end and we go up, then we make good money on what we have and I’m sure some nice short-term plays along the way but no sense risking too much here.

So not much else to say beyond that. A lot hangs on the G20 and the administration this weekend and I’ll be certainly weighing in on that before Monday’s open. We are net bearish really as our Disaster Hedges and short-term short plays would leave us in better shape if the market falls than if it rises but we do want it to rise because it’s no fun playing a long-term bear market. It’s profitable – but it’s no fun…

Amazingly, only 14 of 55 trade ideas for the week were misses (mostly our new, bullish plays) and our existing bearish bets are up so much we had to go long to regain our balance anyway. I’m hoping for a blow-off spike down on Monday with heavy volume, hopefully followed by a recovery over the next few days. If we get a pre-market run-up it’s going to be hard to believe in it and we’ll likely cash out our bull plays again and make the indexes prove their levels before we start buying again.