Am I too bullish?

Am I too bullish?

I know I've been making a bearish case last week and I know we put out our first bearish list since April this month but, in reviewing October's Overbought Eight for Members this weekend we reviewed the week's picks and I realized that, despite all my griping, we had ended up with 21 bullish trade ideas vs. just 10 bearish ones AND, not only that, but half the bearish bets were quickie trades where we played the drops, like Friday's DIA and QQQQ puts from the morning Alert that didn't even last an hour (but made 300% and 200% respectively, so worthwhile, nonetheless).

That's not very bearish. I had said to Members in last Monday's Morning Alert: "The critical test levels above 7.5% are Dow 10,950, S&P 1,160, Nasdaq 2,400, NYSE 7,450 and Russell 690- all green for day 2 and that does put us technically bullish if we hold it, even though it’s a BS, low-volume day." and we did hold those lines on Tuesday's dips to we cashed our first set of shorts and ended up flipping more bullish for the ride up to the 10% lines (Dow 11,220, S&P 1,177, Nas 2,420, NYSE 7,500 and Russell 700), despite out misgivings. When the technicals are very strong, you have to switch off the fundamental side of your brain and go with the flow.

It has been ALL about the dollar and, as we mentioned in this week's Stock World Weekly, Trichet gave us the word we expected on Tuesday that knocked the dollar down to new lows against the Euro, Pound and Yen, with the dollar index bottoming out at 76 which should, in theory be strong technical support.

So, we have strong technical AND fundamental reasons to expect a dollar bounce and we KNOW that a dollar bounce will knock down commodities and we KNOW that a pullback in commodities will knock down the indexes as the energy and metals sector lead us lower. If we KNOW all this, then we MUST be too bullish, right?

Of course we reached that conclusion on Thursday and this is just a recap as 6 of those 10 bearish trade ideas from last week were from Thursday and Friday with EDZ, QID, QQQQ, SQQQ, QID (again), and DIA all picked short as we tested those 10% lines. We like to go with the ultras as hedges because we get more bang for the buck, the QQQQ's and DIA's were quickie plays but we do still like our Naked Mattress play on the DIA as well. As this point, we can (and did) take a defensive long on AAPL as the only thing that will keep the Nasdaq up in the face of a rising dollar is some stunning performance from the stock that is now over 20% of the index.

So I do think that's bearish enough for now. Assuming the market brakes work (so far untested) we shouldn't fall too far without a chance to reload and layer our short plays and our longs are so deep in the money at this point that we're already regretting our hedges so it would actually be nice to see a little pullback so we don't feel so silly having picked months worth of long ideas that capped our gains at 20-30% if the Dow held 10,200.

So I do think that's bearish enough for now. Assuming the market brakes work (so far untested) we shouldn't fall too far without a chance to reload and layer our short plays and our longs are so deep in the money at this point that we're already regretting our hedges so it would actually be nice to see a little pullback so we don't feel so silly having picked months worth of long ideas that capped our gains at 20-30% if the Dow held 10,200.

That is, unfortunately, the nature of the Buy/Write Strategy, we give ourselves a big discount on entry but limit the upside because, MOST YEARS, the market doesn't go up 20%, does it? That's the downside to hedging, in seeking to guard against big losses, we also end up guarding against big gains in a runaway market. That's why I was worried last week that we had gotten too bearish but, upon reflection this weekend (see Weekend Reading – Oil's Not Well), I am comfortable with our current mix.

Over in our Chart School this weekend, Chris Kimble points out that the Nasdaq (remember all our Nasdaq shorts?) is on a Highway to the Danger Zone with the VXN (Nasdaq Volatility Index) completing a bearish wedge (like the Dollar) and the Nasdaq at the way tippy top of its resistance, which may prove futile if AAPL can get over $330 but, even then, it will be up to the rest of the index to provide long-term support.

Chris also points out that the dollar only has 3% to go before it is 100% bearish and he continues our weekend theme of setting stops on the upside because things can turn from good, to bad to ugly very quickly!

Is there a limit to how far Benny and Timmy are willing to go to debase our currency? Just because 100% of the people are bearish on the Dollar, doesn't mean they are wrong. If my 8-year old daughter's soccer team was selected to play the Los Angeles Galaxy and 100% of the people in the stadium were betting on the Galaxy, would they be wrong just because they are all on the same side of an obvious bet? That's one of the great market fallacies that people cling to – that everybody can't be right.

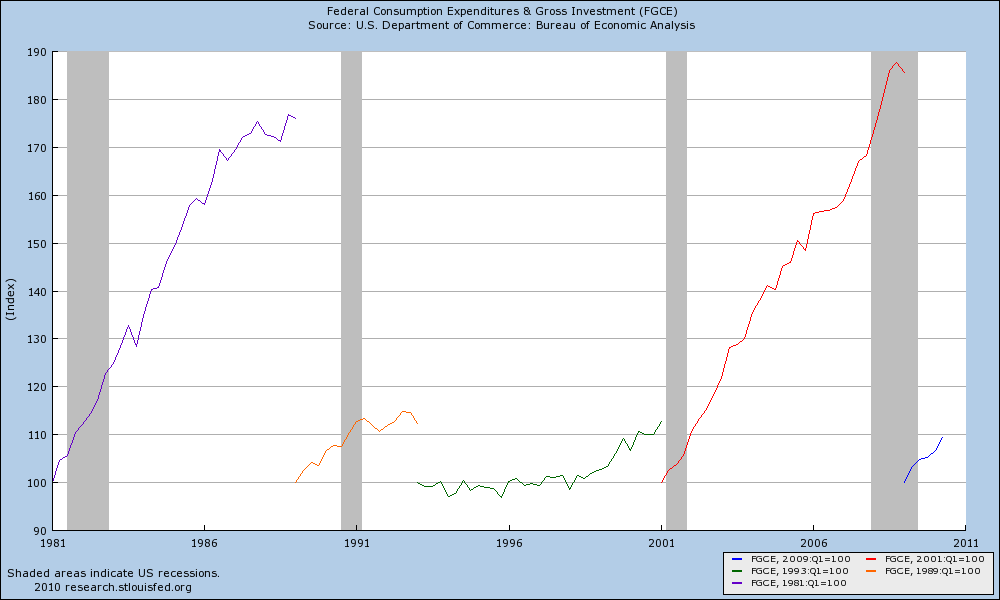

Yes they can – there are certain facts in the World that are obvious like: Republicans expand Government at a rate of 5 to 7 times more than Democrats do. Fortunately, there's a chart for that too (thanks to Barry Ritholtz for pointing this one out):

Of course, like profligate Republican spending habits, some people just don't want to accept the facts of painfully obvious market trends either – no matter how much evidence you put in front of them. This weekend, we discussed the obvious glut of oil but we took the money and ran on Friday's dip because the declining dollar lifts all ships. Until we ACTUALLY see that trend start to reverse, the fundamentals will be damned.

While we certainly THINK the dollar will bounce off support here, the question is whether we will have a strong bounce or a weak one. Much the same as we question whether we will have our expected 2.5% pullback to the 7.5% lines or something a little more harsh. That will depend on earnings and the dollar and that will depend on what China, Japan and the EU do and much of that will depend on the upcoming G20 meeting next month and then, of course, there's this US Election thing in 2 weeks.

This week, we have Industrial Production at 9:15 and the NAHB Housing Index at 10 to start us of. Tomorrow we'll see Housing Starts and Building Permits and I'm sure all six remaining construction workers in this country are just going to be very excited about that one. Wedensday is the MBA Mortgage Applications and they should be well up as record low rates have brought on a wave of refinancing activity. We also get the Beige Book at 2pm. Thursday ends a fairly dull data week with the usual 450,000 pink slips but we do get Leading Economic Indicators and the Philly Fed at 10 am and those could both be market movers. As you can see from the chart, those leading indicators are going to be getting ugly if they are down again.

This week, we have Industrial Production at 9:15 and the NAHB Housing Index at 10 to start us of. Tomorrow we'll see Housing Starts and Building Permits and I'm sure all six remaining construction workers in this country are just going to be very excited about that one. Wedensday is the MBA Mortgage Applications and they should be well up as record low rates have brought on a wave of refinancing activity. We also get the Beige Book at 2pm. Thursday ends a fairly dull data week with the usual 450,000 pink slips but we do get Leading Economic Indicators and the Philly Fed at 10 am and those could both be market movers. As you can see from the chart, those leading indicators are going to be getting ugly if they are down again.

Asia was generally off this morning with the Hang Seng dropping 1.2% (288 points) and the Shanghai dropping 0.5% (16 points) and breaking a 7-day winning streak, rejected off the 3,000 mark and finishing the day at 2,955. The Shanghai was at 3,361 last November so we're not too impressed with 3,000 other than it's a nice recovery off July's 2,350. Volume has been HUGE on the last 400 points of this run so it is looking hard to sustain. The Bombay and the Nikkei held fairly flat and it was commodities that led the pullback in Asia as the dollar did hold that 76 line.

Europe is generally upbeat this morning with the Dax up 0.5% and the FTSE up 0.3% while the CAC is flat but that may be just because France is still on strike and there's no one there to post changes. The UK is cutting their defense budget, leaving the Falklands vulnerable, but I'm sure Argentina learned their lesson last time they tussled with Great Britain… Angela Merkel joined the Tea Party this weekend, declaring that multiculturalism in Germany had been a "total failure." This will be a situation that bears watching as the heart of it is a clash between Germans and Muslim immigrants.

Europe is generally upbeat this morning with the Dax up 0.5% and the FTSE up 0.3% while the CAC is flat but that may be just because France is still on strike and there's no one there to post changes. The UK is cutting their defense budget, leaving the Falklands vulnerable, but I'm sure Argentina learned their lesson last time they tussled with Great Britain… Angela Merkel joined the Tea Party this weekend, declaring that multiculturalism in Germany had been a "total failure." This will be a situation that bears watching as the heart of it is a clash between Germans and Muslim immigrants.

Don't kid yourself – it's all about AAPL this evening. They either justify having a $300Bn market cap (XOM is the World's largest at $331Bn, GE is $174Bn) or the Nasdaq drops 5% in 3 days – that's pretty much what is likely to happen. The dollar us like the current our market ships are riding on, giving them a constant push up but that may also reverse if those 97% bears begin to cash out their massive winnings on the support line.

As I discussed in the Weekend Reading, NYMEX contracts roll over on Wednesday and we do expect selling into the close, possibly we'll get an opportunity to short oil off that $82.50 line in the futures today. Stay alert – it's going to be another wild week!