By Surly Trader

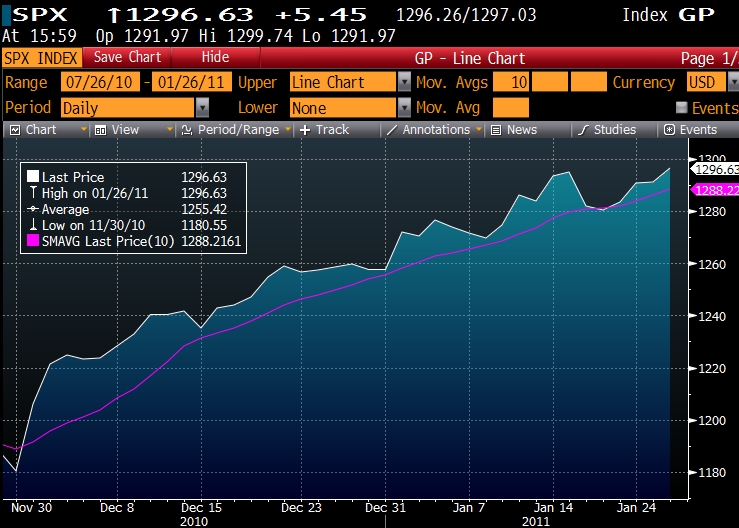

Since the beginning of December, the S&P 500 has yet to meaningfully break down below its 10 day moving average. We just like to blissfully crank upwards in valuations. The Dow has hit its momentous 12,000 level and the S&P was inches away from 1,300. Now that we have touched our psychological targets, maybe it is time we reassess how enthusiastic we have gotten. Instead of looking at P/E ratios on 2011 earnings forecasts, I have seen more and more analysts consider 2012 and 2013 forecasts…

I guess our 10 day moving average is a fixed positive slope

When it comes to the lesser of investment evils, it certainly still looks like equities are more attractive than bonds. The issue that I have is that most investors have set aside the significant tail risks that are out there. Not to belabor the point, but there is still significant risk in the Eurozone. Equity markets have ignored it, as well as concerns with local municipalities and states. These risks are real and will take quite a long time to resolve. While the VIX sits around 16 and realized volatility hovers near six year lows, we need to understand that risk flares come quickly and unexpectedly and there are plenty of issues that could precipitate are run.

The default spreads on the PIGS do not appear resolved to me so why is the Euro rallying?

I do not like to be negative, but it does get tiring when the arguments switch so fiercely from bearish to bullish stances. It seems to be the psychology of not wanting to be miss out when the market is rallying or not wanting to be the last one in when the market is tanking. Feast or Famine, no in-between.