No way to slow down.

No way to slow down.

That line from Tull’s "Locamotive Breath" keeps playing in my head as I look at these rumor-driven markets and contemplate that we MUST keep going higher – or we will fall. On the whole, that’s not generally a winning long-term investing premise BUT – it does so happen to be the entire principal on which space travel is based so let’s not discount it entirely.

As you can see from David Fry’s SPY chart, yesterday was not impressive at all from a volume perspective and we are not big fans of gap-up days in the first place, where pre-market shenanigans set the tone for the day. As David said:

A much overlooked but important factor driving stocks higher is short interest is as high as March 2009 lows and near the highs of June 2010. This can alone stimulate HFT algos to launch short squeeze trades much in evidence Monday. Those HFT haters in the financial media will be silent about them when markets rise.With risk plays back on gold was sold again while the dollar was flat. Bonds lost some ground as investors switched back to stocks while crude oil was higher but most other commodities were mixed. Volume was much lighter occasioned by Irene which made HFT trading easier. Breadth per the WSJ was quite positive and we might even be short-term overbought now.

We are short-term overbought. Any time we have a 2.5% move in a single day with no pullback, that’s overbought but it’s the kind of overbought we expect using our 5% Rule and the real trick is "How do we handle the pullback," not "do we pull back."

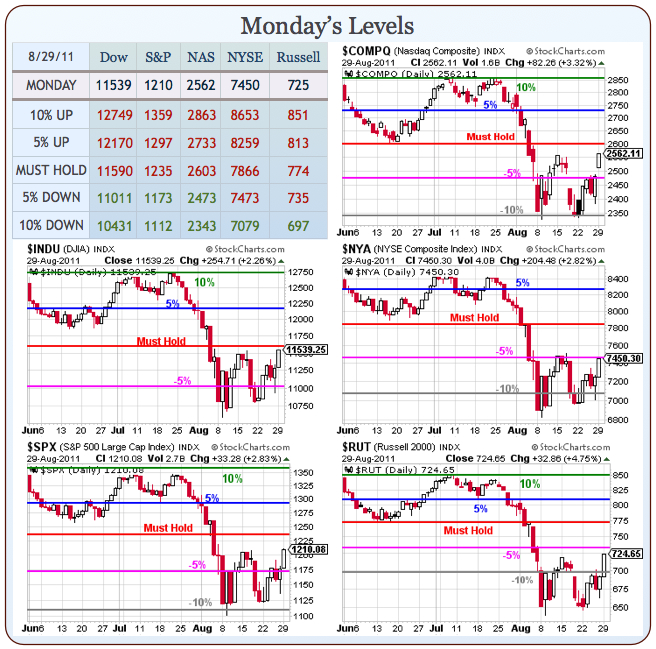

We are short-term overbought. Any time we have a 2.5% move in a single day with no pullback, that’s overbought but it’s the kind of overbought we expect using our 5% Rule and the real trick is "How do we handle the pullback," not "do we pull back." Until the markets move MUCH higher, higher than our 10% lines, they will continue to be subject to gravity. In the absence of news, that gravity tends to center or our Must Hold lines and, as I said yesterday, we have been playing since last week’s lows for a move in our indexes over the center of that W pattern that is now clearly forming on our Big Chart.

We are, so far, simply following the exact pattern we predicted as well as the timing we predicted – way back on August 9th ("Turnaround Tuesday – Waiting for the Fed"), when it looked nothing like a W at all. That has allowed us to make many, many excellent calls this month but now we are getting into a zone of greater uncertainty as we move into the middle of our range again.

We EXPECT a pullback this morning – but less than 1% and, if we don’t hold that, it’s back to Cashy and Cautious after our very brief flirtation with bullishness because anything less than constant progress back to AT LEAST our 5% lines (the blue ones!) is going to leave our indexes inside the the gravity well where it won’t take much bad news to send them crashing back to Earth. Hence the title of yesterday’s post "1,300 or Bust" (on the S&P).

We EXPECT a pullback this morning – but less than 1% and, if we don’t hold that, it’s back to Cashy and Cautious after our very brief flirtation with bullishness because anything less than constant progress back to AT LEAST our 5% lines (the blue ones!) is going to leave our indexes inside the the gravity well where it won’t take much bad news to send them crashing back to Earth. Hence the title of yesterday’s post "1,300 or Bust" (on the S&P).

As I pointed out on the 19th, we need to see Europe turn it back around if we are going to head back up. The trade idea that morning was the short sale of the EWG Sept $19 puts at $1 (now .30, up 70%) and the Jan $17 puts at $1.25 (now .90, up 28%). Germany is not behaving well this morning (down 1%) nor is France (down 0.4%) or England (up 1.8% but they were closed yesterday so catching up) and that is NOT what we need to see from our European cousins.

Not helping over in Europe today were our friends at the S&P, this time taking a knife to the EU and slashing their 2011 growth forecast by 10% to 1.7% and cutting 2012 almost 20%, to 1.5%. Trichet, at the same time, said inflation seems under control (with 1.5% growth, you would think it would be!) and that sent the Euro lower, testing $1.44 and sent the Dollar back to 74.25, which damaged our futures.

It also sent EU traders running back into gold, silver and TBills overnight as the "low inflation" seen by Trichet coupled by a weak economy seen by the ECB can only lead one to conclude that the ECB will engage in its own brand of Quantitative Easing this fall. Also damaging Europe this morning was a note from the International Accounting Standards Board criticizing the inconsistent way in which EU banks and insurers have been writing down the value of their Greek sovereign debt. “This is a matter of great concern to us,” Hans Hoogervorst, IASB chairman, said in the letter, which was seen by the Financial Times.

It also sent EU traders running back into gold, silver and TBills overnight as the "low inflation" seen by Trichet coupled by a weak economy seen by the ECB can only lead one to conclude that the ECB will engage in its own brand of Quantitative Easing this fall. Also damaging Europe this morning was a note from the International Accounting Standards Board criticizing the inconsistent way in which EU banks and insurers have been writing down the value of their Greek sovereign debt. “This is a matter of great concern to us,” Hans Hoogervorst, IASB chairman, said in the letter, which was seen by the Financial Times.

On the one hand, this is exactly the "wall of worry" we were hoping to climb today but the drag of the EU is going to make it very difficult for us to make any real progress and any sort of slip at this stage, could be fatal!

Chicago Fed’s Charles Evans says "strong accommodation" is needed for a "substantial period of time" due to a U.S. economy that seems to be moving "sideways." Evans tells CNBC that more aggressive policy is needed; he is "somewhat nervous" about the recovery, and believes the labor market is in a state "consistent with recession." So the good news is – MORE FREE MONEY as a cure but the bad news is Dr. Evans thinks the disease is a lot worse than his fellow Fed physicians…

Let’s be careful out there!