Wheeeeeeeeee!

Wheeeeeeeeee!

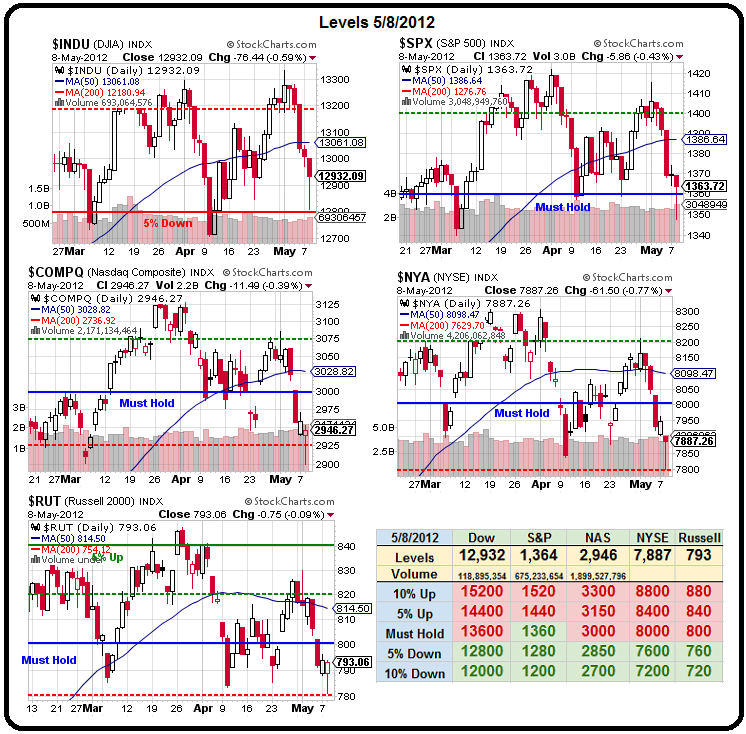

Isn't this fun? We've been having a good old time watching our levels get tested and, as you can see from our fabulous Big Chart – we spiked down to EXACTLY the lines we predicted on the Dow, NYSE and the Russell – all on the same day at the same time, almost to the penny – that's pretty good predicting!

The Nasdaq and the S&P went below but came back above their 5% lines but it's the S&P we were focused on in yesterday's post when I said it would be "1,360 or Bust" and the S&P was not fooling any of us with that BS move back up in the afternoon. As I said to Members in Chat at 3:24:

Holy crap – S&P flying up to 1,360 in Futures – index is back to 1,362 as it gains 10 points since 2:15! For perspective, yesterday the S&P was at 1,360 in the Futures at 10:30 and took until 1:30 to get to 1,370. Oh, and did I mention that it then dropped to 1,345 this morning?

Moral of the story – CASH IS KING – this is a very BS market and these moves are crap. All that matters is whether or not they can establish a breaking up TREND that last more than 2 days – other than that, all this intra-day nonsense is just noise.

Not at all surprisingly, the S&P Futures are down over half a point this morning but we are testing the bottom of our bullish range and we're now at the point where we do expect a little Government/Fed intervention – if not from our own Bernank or do-nothing Congress, then perhaps from the EU, BOJ or PBOC – so many cooks to spoil the broth that we had to take some bearish profits off the table yesterday and move to more cash.

Not at all surprisingly, the S&P Futures are down over half a point this morning but we are testing the bottom of our bullish range and we're now at the point where we do expect a little Government/Fed intervention – if not from our own Bernank or do-nothing Congress, then perhaps from the EU, BOJ or PBOC – so many cooks to spoil the broth that we had to take some bearish profits off the table yesterday and move to more cash.

PCLN was one of the short plays we cashed in as they had such a good sell-off pre-earnings (tonight) that we didn't want to risk the uncertainty. The July $620 puts that we picked up at $13.11 (see 5/2 post's position updates) shot up to $22.50 and you don't have to offer us a 50%+ gain more than once to get us to take it and run.

Our bearish positioning we also closed our short positions in the Financials, which we may regret today but, if XLF can't hold $15, then our previous shorts were not aggressive enough and we'll have to add more for the next leg down anyway.

On the whole, the virtual $25,000 Portfolio we began for Members in January has now doubled up halfway through month 5 and we were THRILLED to get more cashy – especially when that cash is twice as much as we began the year with. We took the bullish money and ran on 5/2 (see same post, where the $25KP was only up $15,098 at the time), which left us very aggressively bearish at what turned out to be an opportune moment as the S&P has dropped 50 points since then. Looking at that post, I am liking my comment to Members during the last days of April (Friday, 27th) from the morning Alert:

I still just want to short everything. My only reaction on Monday if we open down 500 points will be to kick myself for not shorting the crap out of this rally but it's just too crazy to make uni-directional bets. It's the last week in April next week and if the "sell in May" crowd want to exit at good prices – this is exactly what they need to do – spark a BS rally, have Cramer scream BUYBUYBUY until the retailers think they are missing out and then, when the sheeple move in – the funds move out, right on schedule in May.

Now the Dow is down those 500 points and we did, fortunately, short the crap out of the rally as we had a couple of extra days in early May before it all hit the fan – pretty much exactly following the script we expected. Now we'll be looking to switch to fresh downside horses (see Long Put List in Stock World Weekly) like IYR, which Dave Fry notes he is long on but we're seeing it as a nice potential short for the same reasons he is concerned – rising rates.

Now the Dow is down those 500 points and we did, fortunately, short the crap out of the rally as we had a couple of extra days in early May before it all hit the fan – pretty much exactly following the script we expected. Now we'll be looking to switch to fresh downside horses (see Long Put List in Stock World Weekly) like IYR, which Dave Fry notes he is long on but we're seeing it as a nice potential short for the same reasons he is concerned – rising rates.

What makes a good Long Put candidate is mainly to pick a stock or an ETF that you don't think will go up much more or has a clearly defined breakout point where you can exit without too much damage. Then you pick a strike and a time-frame that gives your play a chance to develop. In the case of IYR, we think the entire move up from $60 to $64 in a month was nothing more than QE Madness so we can give it two months to reverse by picking up the June $63 puts for $1.10, which could be worth $3 if IYR pulls back to $60.

Setting a stop on that trade at .60 risks .50 to maybe make $2 – a good risk/reward ratio on a very fresh downside horse – one that hasn't even come out of the barn yet! A less aggressive stop would be using 3 of our 5 Must Hold lines as your stop – no reason to give up 50 cents when we have very clear recovery signals built right into our Big Chart that will let us know when the markets are ready to come back – just don't count on it happening too soon!

Speaking of rates – Spanish bond yields popped over 6% this morning on the 10-year notes but even more scary (for Spain) is the 2-year notes hitting 3.57%, 140 bps higher than February's LTRO price which means the banks that jumped in on the EU "bailout" to buy Spanish Bonds are now facing massive losses on their paper (see our April 13th and April 15th warnings on this). This does not bode well for other PIIGS as they look to move paper to banks who have now been burned twice (Greece and Spain). In fact, the lead PIIG, Portugal, is already paying a whopping 11.47% on 10-year notes – and that is AFTER being backed by the ECB! Can you say – DISASTER?

Disaster is the right word for Spain's market this morning – down a whopping 3.5% but not on the debt news – this is about the Government announcing they will force their banks to recognize and provision for the extent of their real estate losses – just like the US refuses to do! Another reason we are short IYR is the "mark to fantasy" bubble that Commercial Real Estate is still in in this country and THAT is how news happening in Spain can affect our investment decisions in the US – even if our Government continues to allow our Banksters to extend and pretend on their balance sheets – investors will begin to question who else is sitting on Spanish-style time bombs.

And let's not forget Greece! Greece is still the word in Europe (as it was in Feb 2010, when I began warning about it) as Alexis Tsipras of Greece’s Syriza party squared off with political leaders before talks on forming a coalition, handing them an ultimatum to renounce support for the European Union-led rescue if they want to enter government. Tsipras said he expected Antonis Samaras of New Democracy and Evangelos Venizelos, the former finance minister who leads the Pasok party, to send a letter to the EU revoking their written pledges to implement austerity measures by the time he meets them today to discuss a government alliance. Samaras and Venizelos rejected the request. Samaras said he was being asked “to put my signature to the destruction of Greece.” “He interprets, with unbelievable arrogance, the election result as a mandate to drag the country into chaos,” Samaras said.

Wow is this going to be exciting!