First the good news.

First the good news.

I just got my new Mayan calendar delivered and it's good through 7,024. Turns out when you buy 5,000 years, you get 12 years free and that explains the confusion with the old calendar. And now the bad news – despite my emphatic call for a revolution yesterday – the Republicans are still in charge of Congress and, once again, they have blown it completely in our hour of crisis and thrown the economy into turmoil.

Amazingly, stunningly, unbelievably, a supposed veteran politician like John Boehner can't even do something as simple as count the votes in his own base before he attempts to pull a power play and now that his own party has rejected his idiotic grandstanding "Plan B" – the markets have been thrown into turmoil, dropping as much as 2% last night and still down 1.25% in the Futures (7am). The only good news is Boehner may have just cost himself the speakership for 2013 but the bad news there is there are much stupider people vying to replace him.

Is Paul Ryan stupid enough to be the next Speaker of the House? He's certainly psychotic enough – he proved that during his campaign last year. He has demonstrated a willingness to lie, to make up data, to ignore facts, to stick to ridiculous positions no matter how untennable. He has proven that he cares nothing for the poor, the young, the elderly or the sick and that he is willing to throw them all under the bus to kowtow to his rich constituents – everything the Republicans look for in a leader. He's also been soundly rejected by the American people as a potential leader – who better to lead the GOP in their last 2 years in power?

With the chance of making a Fiscal Cliff deal in time to avoid the event slipping away (Congress celebrated their complete failure yesterday by taking a week off), we now have to contemplate how much damage will actually be done when it all hits the fan on January 1st.

As you can see from the chart below, the net of all the tax increases and spending cuts from the Fiscal Cliff can knock 3.5% off the GDP – pushing the US back into Recession but it's difficult to say how much it will impact overall consumer spending as the increases have very little effect on the bottom 90% (people earnings less than $108,000 a year) – much as they got very little benefit from the cuts in the first place:

Is this really going to be a catastrophe or just an inconvenience for the upper middle and upper class? That's why the Democrats are willing to let the Republicans hang themselves on this one – in the end, the "Fiscal Cliff" is nothing more than going back to pre-Bush levels of taxing and spending – levels at which we had a strong, robust economy with a much more equitable distribution of wealth. Of course the transition will be rough but it's the GOP that is choosing to rip the band-aid off by failing to reach a compromise but, much like this morning, if the cliff happens and the World doesn't end – then maybe we can just move on with our lives and let things get back to normal on their own.

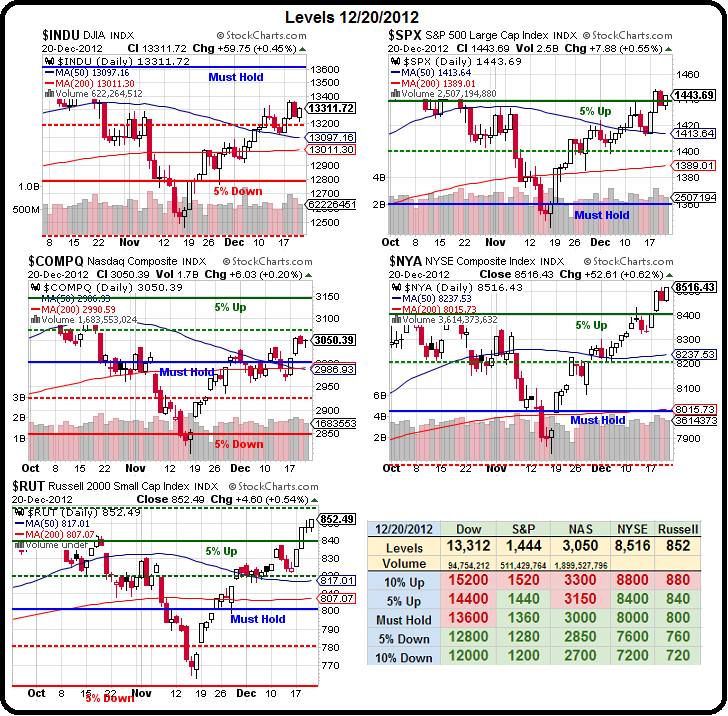

This isn't much different from the austerity plan that went through in Europe and their markets have rocketed ahead of ours this year (see Wednesday's post for Europe's outperformance discussion). Apparently the markets like a bit of fiscal discipline and, if this is the only way we're going to get it – so be it. Already the Dollar is strengthening in reaction to the potential deficit reduction caused by the cliff but we can still expect a stock market temper-tantrum and now we'll be watching those 50 dmas again to see if we can hold them through this disappointment at Dow 13,097, S&P 1,413, Nas 2,986, NYSE 8,237 and Russell 817. If we can hold these levels – there's still hope.

This isn't much different from the austerity plan that went through in Europe and their markets have rocketed ahead of ours this year (see Wednesday's post for Europe's outperformance discussion). Apparently the markets like a bit of fiscal discipline and, if this is the only way we're going to get it – so be it. Already the Dollar is strengthening in reaction to the potential deficit reduction caused by the cliff but we can still expect a stock market temper-tantrum and now we'll be watching those 50 dmas again to see if we can hold them through this disappointment at Dow 13,097, S&P 1,413, Nas 2,986, NYSE 8,237 and Russell 817. If we can hold these levels – there's still hope.

Fortunately, we played things right this week as we followed through with our plan to pick up hedges with DIA puts, USO puts and TZA longs (ultra-short Russell) – all of which we discussed on Monday – so don't say I didn't warn you!

We even covered our AAPL longs in Member Chat yesterday as we were very concerned by the weak action into the close and we found no long plays that we liked all day – always a bad sign. Wednesday was also a short day for us in Member Chat, as we initiated the USO puts (at the $90 level in oil along with Futures shorts) and DIA puts in our $25,000 Portfolios. We also sold some QQQ calls in one of our virtual portfolios but we did find F, HOV and AMLP long trade ideas that day but they were well-hedged in anticipation of the potential pullback. GS via Zero Hedge has a nice flow-chart that brings us to where we are now and the likely outcomes:

The S&P went limit down last night on the news, with the Futures hitting 1,390 from the 1,440 close. It's 8:30 now and we're about to get some data and we've recovered to 1,420 and we just got good Personal Income (up 0.6%) and Spending (up 0.4%) numbers along with surprisingly good Durable Goods numbers (up 0.7%, up 1.6% ex-Transport) and, hopefully, that will put an end to the pre-market sell-off and little is expected from 9:55's Michigan Consumer Sentiment Survey so we're clear to drift into the weekend without too much additional damage.

Today our goal is simply to hold those 50 dmas but, unfortunately, no matter what happens today, we're back at the mercy of those fools in Washington next week so we're going to maintain our hedges and maybe pick a few new bear plays – just in case this cliff dive turns into a repeat of 2008's fiasco (also caused by Boehner and his GOP buddies).

Have a great weekend,

– Phil