881!

881!

Right on our target from yesterday's post and last week's predictions and, of course, 880 has been right on our Big Chart, plain as day for years – so don't act all surprised when we hit it (see also, Dave Fry's chart). Now our attention turn to the NYSE, which needs to confirm the move in larger caps by hitting 8,800 (now 8,713) and the Nasdaq needs to hit 3,150 (now 3,131) and the Dow needs to cross 13,600 (now 13,471) or this little move up in the Russell may be short-lived indeed.

Ah, but for the Nasdaq to cross over 3,150, it's going to need AAPL to move up – or at least stop dragging it down. AAPL is down 20% from $660 since October (3.5 months) and that's cost the Nasdaq 4% but the Nasdaq is flat at 3,100 and now over that line a bit. Add 4% to 3,100 and we're at 3,224 and almost at our 10% line at 3,300 so all it's going to take is an AAPL recovery and the Nasdaq is off to the races.

Unfortunately, I had to warn our Members against betting on an APPL recovery coming soon (we expect it eventually), saying:

I don't think AAPL will gap up on China as it's kind of expected, unless there is a special deal, like I outlined yesterday. I think it's dangerous to fantasize about a sudden turn up in AAPL – even when they were $85 and I was screaming for people to buy them, it took 7 months (October '08 – April '09) for them to get back over $100 – and that was down from $200 – more than 50%, so it's not like nobody had seen better value in AAPL earlier – they had been over $150 for about a year and then spent 7 months at a 50%+ discount. Now they fell from $600 (I wouldn't count the brief spike to $700) to $500 for about 3 months – maybe they still go to $400 and maybe it lasts another 6 months – you shouldn't care, you should be thrilled to OWN AAPL at that price. But if you keep betting for a short-term pop, you can go broke while you wait.

That was in the context of discussing our "One Trade" on AAPL and how to insure it so make sure you check that out if you are interested. One encouraging note in tech was seeing the SOX finally get back to 400 – a level they haven't hit since September, when the Nasdaq tested 3,200 and AAPL was trading at $700 – encouraging indeed!

That was in the context of discussing our "One Trade" on AAPL and how to insure it so make sure you check that out if you are interested. One encouraging note in tech was seeing the SOX finally get back to 400 – a level they haven't hit since September, when the Nasdaq tested 3,200 and AAPL was trading at $700 – encouraging indeed!

Sorry to talk about AAPL so much but, as I said in the Fall – if they were selling brand new Range Rovers for $40,000 – I'd talk about what a good deal those were all the time as well. This week, in Member Chat, we found great discounts to make bullish plays on MT, GDX, SHLD, XLF, KO and PBR and, right in Tuesday's post, I had additional bullish trade ideas for AA, MON, YUM and BA.

Of course, we spent some time managing our existing trades in the various virtual Member portfolios (and I will finish updating our main Income Portfolio this weekend – now up 23% in 7 months) and the only short positions we felt compelled to take were our usual TZA hedges as the Russell tested 880 and, of course, the Oil shorts I mentioned in yesterday's post.

Oil tested $93 this morning, down 2% from yesterday's entry but hopefully we can get it back below $90 as we roll into contract expirations at the NYMEX. The Euro has been very strong and helping to support oil a bit while the Yen is stunningly weak as Japan unveils a 10.3 Trillion Yen stimulus plan that's more like 20.2Tn Yen if you include investment from local governments and private firms the new PM (same as the old PM) has lines up. It looks like Japan is on the way to forcing us to learn a new word – can you say "Quadrillion"? You'll have to soon….

Oil tested $93 this morning, down 2% from yesterday's entry but hopefully we can get it back below $90 as we roll into contract expirations at the NYMEX. The Euro has been very strong and helping to support oil a bit while the Yen is stunningly weak as Japan unveils a 10.3 Trillion Yen stimulus plan that's more like 20.2Tn Yen if you include investment from local governments and private firms the new PM (same as the old PM) has lines up. It looks like Japan is on the way to forcing us to learn a new word – can you say "Quadrillion"? You'll have to soon….

As you can see from the chart on the left, the Yen isn't surprisingly weak – it's surprisingly strong with Japan's total debt heading towards that Quadrillion mark at 250% of their GDP at the same time as the Yen falls to 89 for $1.

We were discussing in yesterday's chat the way inflation sort of sneaks up on you and I noted that gold was $250 an ounce in 2006 and jumped to $600 in 2008 and then $1,200 in 2010 and hit $1,923 last year and that's not very different than what happened in Germany between 1919 and 1921 and I'm sure they had some pullbacks as well but look what happens once the real inflation kicks in:

We were discussing in yesterday's chat the way inflation sort of sneaks up on you and I noted that gold was $250 an ounce in 2006 and jumped to $600 in 2008 and then $1,200 in 2010 and hit $1,923 last year and that's not very different than what happened in Germany between 1919 and 1921 and I'm sure they had some pullbacks as well but look what happens once the real inflation kicks in:

This isn't during the war, this was AFTER WWI, which ended in 1918 – this is the result of Germany taking on unsustainable debts and printing money to pay them back over the course of just four years. We're doing a very similar thing here in America and Japan – we're just doing it a little more slowly.

Hopefully, we can avoid kicking into hyper-inflation but I'm sure Zimbabwe's Government had the same hope 5 years ago. Obviously, things are different now but we ignore the current, very obvious signs of inflation at our own peril. Note the end result of Germany's little trip down money-printing lane – 87 Quadrillion Marks for an ounce of gold. Practice saying that word – it may come in handy sooner than you think!

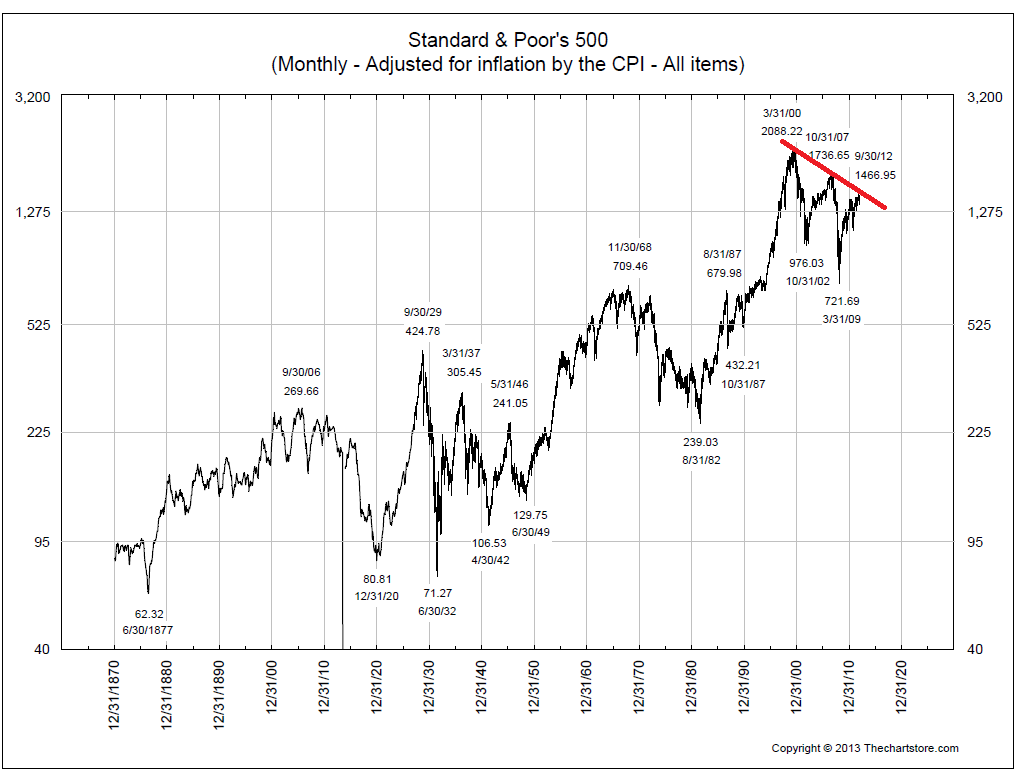

In fact, to put this "rally" in perspective, you have to look at the inflation-adjusted chart of the S&P from TheChartStore, which shows us that we still have another 40% to go before we're back to the overly-enthusiastic, turn-of-the-century highs. When you include non-core items like oil (was $20 back then) and food (Big Macs were $2.50), we've had about 30% inflation in the past decade, which is very sad as wages have actually gone down over that same period of time AND less people are employed now than were employed then.

So, with prospects not as great as they were at the time – it's realistic that we're still off from the top of what Allan Greenspan called at the time "irrational exuberance," but we're also well-off our October 2007 inflation-adjusted high on the S&P of 1,736 by about 20% and THAT has to be our inflation-adjusted goal. That means it's not about being too bullish to expect the markets to go up from here – it's about being very disappointed if we don't, because we still have a long way to go before we can say we're recovered and, in the longer run, stocks make an excellent hedge against inflation still to come.

Have a great weekend,

– Phil