Wow, what a rally!

Wow, what a rally!

An entire week of losses erased in a single day. Things must be going fantastically – I don't even need to check the news – if the charts look good, then I'm going to buy stuff for lots more money than it was on Wednesday in the hopes that it goes back to where it was last month, for two weeks, before it fell…

Hmmm, on second thought, maybe that's not such a good buying premise? Oil blasted all the way back from $101.16 to $103.50 and that's why we were using TIGHT STOPS (see yesterday's post for details) and this morning we're right back to $101.61 again and we're doing the same play as we did yesterday. This isn't complicated folks – we do it every month!

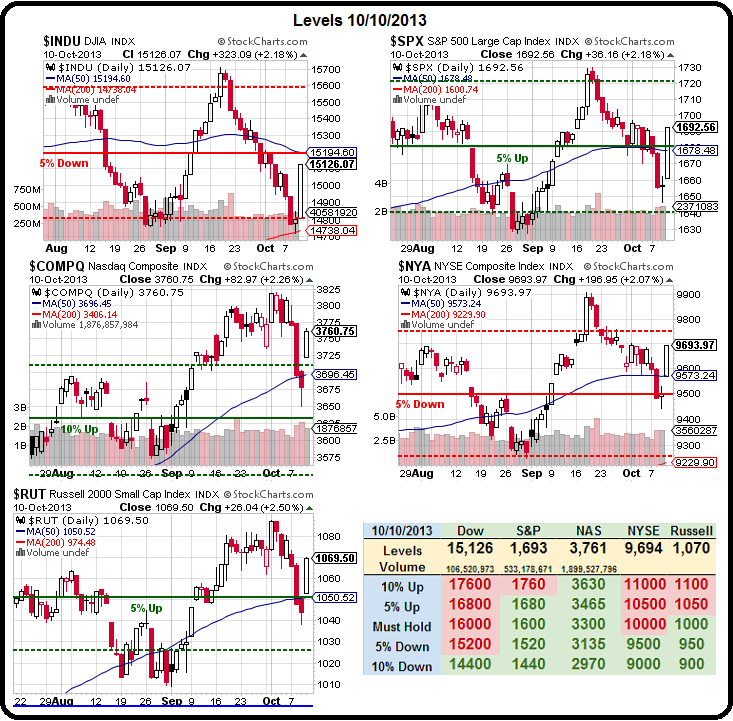

USO and SCO gave people who missed them great re-entries and we stuck with those, of course, in our STP because the oil "rally" was clearly BS, with no underlying fundamentals driving the gain. Of course, the same can be said about the broader market rally and we did, in fact, take a very aggressive short using TZA (ultra-short Russell) into the weekend (20 Oct $23 calls at .65 for $1,300) after our first stab at the weekly $23s didn't work out. We're still looking for a rejection at 1,070, we'll just have to wait a bit for the rest of the market to wise up.

There was lots of news and quoting Jefferson back and forth and discussing Quantum Theory and how it affects the stock market in our Member Chat this morning – make sure you check that out if you you want to get caught up on the Universe.

There was lots of news and quoting Jefferson back and forth and discussing Quantum Theory and how it affects the stock market in our Member Chat this morning – make sure you check that out if you you want to get caught up on the Universe.

At the moment, I'm more concerned by Dave Fry's McClellan Oscillator Chart on the left, which shows you that we worked off our oversold condition (that led us to make bullish adjustments on Wednesday) in just one day. That leads us to thing we can get overbought very quickly as well so we re-covered our naked TSLA longs but we remained bullish on our NFLX long because we hedged those anyway.

We also got jammed up like this in mid June, as the market recovered from 1,608 on the S&P back to 1,654 but then, after a 4-day "rally" we fell fast and hard back to 1,560 over the next 4 sessions. Why? Because the bounce was bullshit and I said as much on the 18th, when I warned that a parabolic move up often has a parabolic move down on the other side. So read that article (or the original Pynchon, which I borrowed liberally from) and we can accept my premise again and move on.

A lot of our trading may seem contrarian but all we are doing is ignoring the noise and focusing on the Fundamentals so, often, we end up buying when others are selling and selling when others are buying. On Wednesday, for example, we sold YUM 2015 $62.50 puts for $6.55 as the first entry in our new Long-Term Portfolio. Those puts are already down to 6.20 for a quick 5% gain in 2 days but we're in them for the long-haul, of course. All we did was follow-through with our original plan for YUM earnings, executing our strategy for the sell-off.

A lot of our trading may seem contrarian but all we are doing is ignoring the noise and focusing on the Fundamentals so, often, we end up buying when others are selling and selling when others are buying. On Wednesday, for example, we sold YUM 2015 $62.50 puts for $6.55 as the first entry in our new Long-Term Portfolio. Those puts are already down to 6.20 for a quick 5% gain in 2 days but we're in them for the long-haul, of course. All we did was follow-through with our original plan for YUM earnings, executing our strategy for the sell-off.

We also added INTC longs for our Income Portfolio and got aggressive on NFLX and TSLA, as mentioned, in our Short-Term Portfolio, got more bullish on AAPL in the STP, bought AMZN weekly $305 calls for $1.40 that hit $3 yesterday but we, unfortunately, let ourselves get stopped out at $1 on the flush into the close (can't win them all). We also set up a bullish trade idea for F and took the money and ran on our CZR short puts. In short, while the market was dropping and people were panicking (and the VIX was high) – we were going long.

Yesterday, on the other hand, other than taking some of the profits from our TSLA and NFLX moves and positioning for a new short on the Russell (and our usual oil plays), we did nothing. Why? Because the market was not at the top or the bottom of our range. It opened near the middle (at our strong bounce lines) and pretty much stayed there – so why should we force ourselves to have an opinion when we have something so much better – CASH!

Yesterday, on the other hand, other than taking some of the profits from our TSLA and NFLX moves and positioning for a new short on the Russell (and our usual oil plays), we did nothing. Why? Because the market was not at the top or the bottom of our range. It opened near the middle (at our strong bounce lines) and pretty much stayed there – so why should we force ourselves to have an opinion when we have something so much better – CASH!

We're not missing any opportunities – we're WAITING for them! When things are clearly ovesold, we buy and, when things are clearly overbought, we sell. When things are in-between – especially when the facts (earnings, debt ceiling, missing Government statistics) aren't clear, what's the sense of throwing money at things?

Until the S&P gets over 170, that entire spike up to 175 is just an anomoly that will get thrown out over time. If we head down from here, however, we will begin to form the dreaded "head and shoulders" pattern on our indexes and, as I warned on Wednesday – that can lead to the dreaded "knees and toes" phase, which can take us down another 20% if we end up heading off that fiscal cliff after all.

I love charts – they say anything you want them to say! Here's that bear trap chart being used on the VIX instead of the S&P and the Dow (as seen constantly on TV for the past two days):

So, if the VIX is going up the markets are going down but if the markets are going down that means they are going up because it's a bear trap and we should buy the dips and good news is bad news and bad news is good news and the Fed will save American jobs because they are are a banking cartel… illogical… illogical..

We were discussing Thomas Jefferson in Chat this morning (see morning Tweet for details) and one of the things he said was "The man who reads nothing at all is better educated than the man who reads nothing but newspapers." Keep in mind that, in 1776, the difference between newspapers and books was mainly the time-frame they covered. Books were still a big deal and were generally written by respected and learned men while newspapers had become easy to publish and any yahoo with an opinion could get it in print – making them essentially useless in a quest for knowledge.

We were discussing Thomas Jefferson in Chat this morning (see morning Tweet for details) and one of the things he said was "The man who reads nothing at all is better educated than the man who reads nothing but newspapers." Keep in mind that, in 1776, the difference between newspapers and books was mainly the time-frame they covered. Books were still a big deal and were generally written by respected and learned men while newspapers had become easy to publish and any yahoo with an opinion could get it in print – making them essentially useless in a quest for knowledge.

Well, now we have 500 TV channels and Infinity web sites and you have to be more careful than ever about who you listen to. Even better, learn to trust yourself and not the last pundit you came across. Keep in mind that most of these guys are sitting in their living room in their underwear typing on a food-stained laptop, telling you how to live your life and how to invest your money!

Have a great weekend – read a book for me!

– Phil