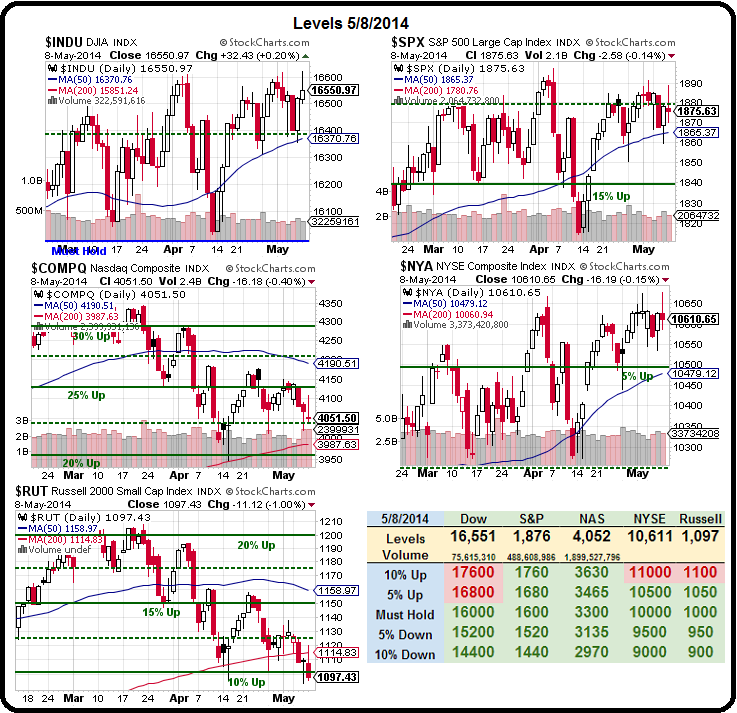

Look at the Russell!

Look at the Russell!

Look at the Nasdaq! Are you seriously still holding onto your Dow, S&P and NYSE stocks? That's exactly what people did in 2008, when they were so used to the markets being saved whenever they dipped, that they ignored all the warning signs – until it was too late.

I know that I've been sounding like a broken record and you can call me Chicken Little but cut me a little slack as we are protecting profits here.

We have 5 virtual porfolios we track for our Members and the $100,000 Butterfly Portfolio is up 19.4% ($19,000), the $500,000 Long-Term Portfolio is up 9.6% ($48,000), the $100,000 Portfolio is down 5.8% ($5,800), the $500,000 Income Portfolio is up 6.4% ($32,000) and our $25,000 Portfolio is up 15.4% ($3,850). Overall, that's a gain of 8.8% on $1.225M deployed in 4 months.

The Short-Term Portfolio is a hedge to the Long-Term Portfolio, so we haven't cashed those in but the Income Portfolio doesn't have an external hedge, so we moved to cash on that one last month (BEFORE the Nas and Rut started crashing off decade highs) and the Butterfly Portfolio is self-hedging while the $25KP has just one position left.

The Short-Term Portfolio is a hedge to the Long-Term Portfolio, so we haven't cashed those in but the Income Portfolio doesn't have an external hedge, so we moved to cash on that one last month (BEFORE the Nas and Rut started crashing off decade highs) and the Butterfly Portfolio is self-hedging while the $25KP has just one position left.

Perhaps I'm wrong and the Nasdaq and the Russell will recover and the other indexes will all move up to new highs. Even if they do, our worst case is we miss a bit of a rally. If we're breaking out to new all-time highs from here – there will be plenty of money to be made. BUT – if I'm right and the market drops 5-10%, then our taking 110% off the table at the top means that when we buy stocks again at 90%, we are buying 120% of what we could have bought had we not wisely cashed out in the rally.

The REWARD for being cautious is owning 20% more shares if we're right, owning maybe 2.5% less shares if we're wrong or owning the same amount if the market stays flat. It doesn't take a degree in statistical analysis to see why I prefer CASH!!! in an uncertain market like this one.

The REWARD for being cautious is owning 20% more shares if we're right, owning maybe 2.5% less shares if we're wrong or owning the same amount if the market stays flat. It doesn't take a degree in statistical analysis to see why I prefer CASH!!! in an uncertain market like this one.

Just because you have decided to trade stocks, it doesn't mean you have to trade them ALL THE TIME. If you are a heart surgeon – you operate when there's a patient – you don't run around opening people's chests on the street. If you are a lawyer, you don't run into court when there's no trail scheduled. With any job – you do the job WHEN THE CONDITIONS ARE APPROPRIATE and, when they are not, you wait.

Traders are very bad at waiting. Investors tend to wait and learn patience. Warren Buffet (and Arnold Rothstein) can go years without making a trade and then, when the time is right (as it was in 2009), he takes his pile of cash and engages in a flurry of activity – taking full advantage of a market correction. That's exactly what we've done with our Income Portfolio – where we are re-deploying our cash to do some bottom-fishing already.

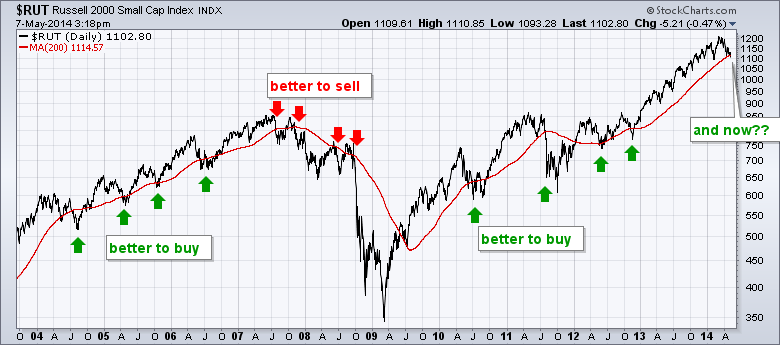

For instance, we bought ABX at $18, got out at $21 and now it's $17.50 – so we'll buy it again! We bought CLF at $16, got out at $24 and now it's $17 – so we'll buy it again! TASR, IRBT, LQMT, TWTR – everything old is new again BECAUSE WE CASHED OUT! We're even long on CMG now, a stock we were shorting earlier in the year. Looking at the Russell chart, you can see what happend the last few times they failed the 200 dma – would you rather ride that down or have cash to go shopping with at the bottom.

It's very difficult not to trade and most people with my job aren't going to tell you not to trade because then you may wonder why you are subscribing to a stock market newsletter (and you can subscribe to this one right here). I don't care because A) We're full and about to close Premium Membership and B) because our guys know we have lots and lots of ways to make money with our sideline cash – we just put on a different trading hat for a while.

Yesterday, for example, right in the morning post – FOR FREE – I told you that we LOVED shorting oil at $100.50 (/CL Futures contracts) and that you could make $2,000 on a drop to $98.50. After the open, oil dropped to $100, for a $500 gain, then back to $100.50, then down to $99.80 for a $700 gain then back to $100.50 and then back to $100 overnight for another $500 gain and, this morning, it's back at $100.50 again. We're still targeting $98.50 but, if they want to pay us $500 ten or twenty times along the way – we're OK with that too!

Yesterday, for example, right in the morning post – FOR FREE – I told you that we LOVED shorting oil at $100.50 (/CL Futures contracts) and that you could make $2,000 on a drop to $98.50. After the open, oil dropped to $100, for a $500 gain, then back to $100.50, then down to $99.80 for a $700 gain then back to $100.50 and then back to $100 overnight for another $500 gain and, this morning, it's back at $100.50 again. We're still targeting $98.50 but, if they want to pay us $500 ten or twenty times along the way – we're OK with that too!

I even talked about taking those $500 profit blocks right in the morning post. We also talked about shorting the Futures at Dow 16,500 (/YM), S&P 1,870 (/ES), Nasdaq 3,550 (/NQ) and Russell 1,100 (/TF) and those made $500, $100, $500 and $1,000 so far.

Again, this is just the stuff we're giving away! ![]()

The TSLA trade I mentioned in the morning post yesterday that gave us a net credit of $8,350 finished the day at -$5,768, up $2,582 (30%) in just one day – this is why we don't fear having cash on the side – there's always something to trade – especially during earnings season.

Not only that but Dollars are cheap right now – it's a good time to buy some!

Have a great weekend.,

– Phil