MORE FREE MONEY!!!

MORE FREE MONEY!!!

How many ways can they goose these markets? Too many to count as Japan's QUADRILLION Yen debt soars to new highs as the Government backs away from using a sales tax to attempt to balance (as in slow the deficit slightly) the budget. After all, once you pass the Quadrillion mark in debt, what's a few Trillion more in debt between friends?

The BOJ's friendship is a wonderful thing for the Nikkei and the Japanese exporters that are part of the index. It's not so wonderful for the Japanese people, who have seen 30% of their purchasing power disappear in the past two years and that allows Abe's Government to point to low inflation (because people can't afford to buy things) as an excuse to devalue the currency further – enriching the investor class at the expense of everyone else on the island:

It's a SCAM people, this is nothing more than an illusion of market prosperity – they are simply repricing the currency the stocks (and earnings) are measured in to give you the impression that things are getting better – BUT THEY ARE NOT – they are getting worse. Infinite debt is no free lunch and it's really starting to concern me that US and European markets are following Japan higher when Japan's move is total BULLSHIT!

We're going to be shorting the Nikkei, of coures (17,370 on /NKD and $12 on EWJ), as it tests it's all-time high – hopefully at 17,500 but we're not going to let 17,350 fail without jumping on that bandwagon as this is complete and utter BS. Did I mention this was BS? I want to make sure that's clear. BS. Totally….

We're going to be shorting the Nikkei, of coures (17,370 on /NKD and $12 on EWJ), as it tests it's all-time high – hopefully at 17,500 but we're not going to let 17,350 fail without jumping on that bandwagon as this is complete and utter BS. Did I mention this was BS? I want to make sure that's clear. BS. Totally….

We already took a short position with conviction on /TF (Russell Futures) as it tested 1,180 this morning in our Live Member Chat room as well as during yesterday's Live Trading Seminar in Las Vegas (my last day here ![]() ). I've been urging our Members to take the money and run into the holidays, taking advantage of this rally to get back to mainly cash and, as we pointed out in our Buy List Review live in Vegas yesterday, there are still plenty of good deals to be found – but you need the CASH!!! in your pocket to pick them up.

). I've been urging our Members to take the money and run into the holidays, taking advantage of this rally to get back to mainly cash and, as we pointed out in our Buy List Review live in Vegas yesterday, there are still plenty of good deals to be found – but you need the CASH!!! in your pocket to pick them up.

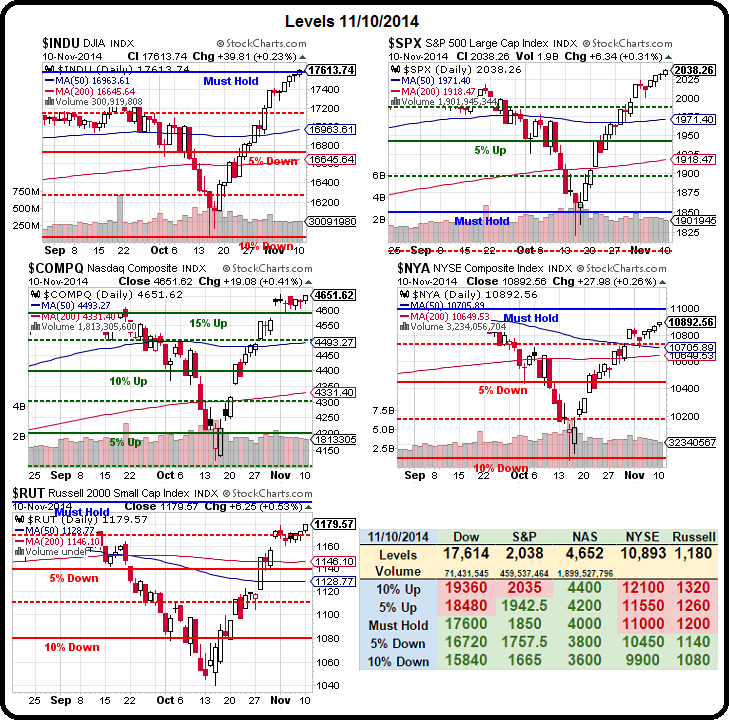

Japan isn't the only thing we're worried about (we discussed the Global Macro environment in Sunday's session) – it's just the stupidest thing going on in the Global markets this morning. TECHNICALLY, the markets look pretty good, with the Dow finally settling over our Must Hold line (the line at which we will go bullish again) for the first time yesterday:

We're not going to be terribly impressed until the NYSE and the Russell join the others over the line – as both of them have been over before so why should they struggle now? Of course, we're shorting the Russell below 1,180, so you know how we think things will turn out. We also have large hedges on the Nasdaq and the Dow, looking for pullbacks of 100 (4,550) and 250 (17,350) points respectively.

We also held a seminar on the 5% Rule™ in Vegas yesterday, so those numbers should be obvious to all of our Members!

Be careful out there,

– Phil