So close, and yet so far.

So close, and yet so far.

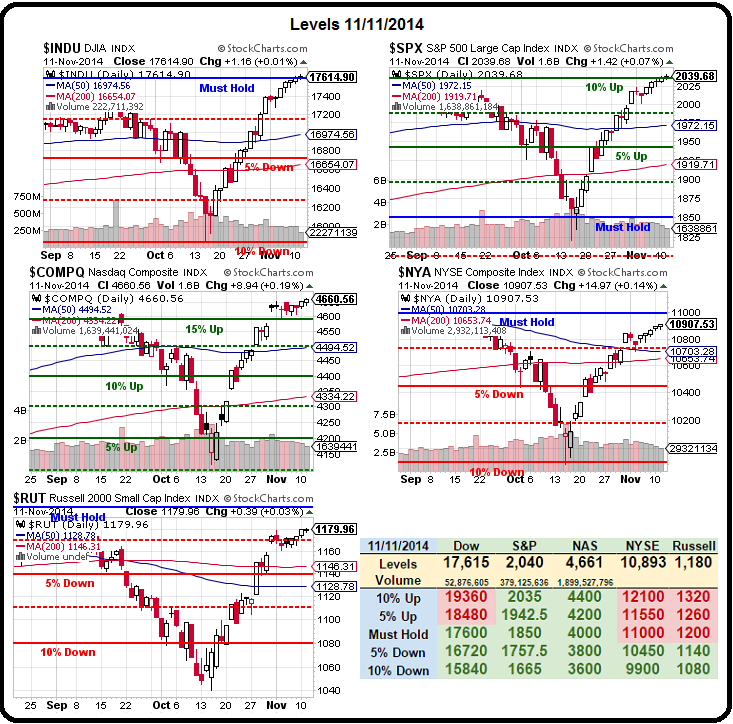

Our 5% Rule™ dictates that we need to have two consecutive DAYS (not just closes) above one of our support levels before we consider it as a real sign and, yesterday, the Dow did FINALLY hold its critical "Must Hold" line at 17,600.

Unfortunately, that lasted all of 2 hours and then the Futures re-opened 20-points lower and, since then, we've lost another 50 points. So REJECTED so far on our first test of the middle for the Dow, which has long been the laggard in getting up to our expected trading range for 2015 (the Big Chart is always a year ahead).

The Nasdaq, on the other hand, has long been our leader (thanks to our Stock of the Year, AAPL, gaining 46% and contributing 9% to the Nasdaq's 23% move). Perhaps we should have realized that, if we were right about AAPL, we should have set more aggressive targets for the Nasdaq in the first place.

The Nasdaq, on the other hand, has long been our leader (thanks to our Stock of the Year, AAPL, gaining 46% and contributing 9% to the Nasdaq's 23% move). Perhaps we should have realized that, if we were right about AAPL, we should have set more aggressive targets for the Nasdaq in the first place.

As Dave Fry notes on his Nasdaq chart, it's hard to write anything meaningful about the movement of the last few weeks other than, as I pointed out yesterday – it's Bullshit. The Nasdaq has popped 400 points (10%) in 4 weeks and is on pace to be up 130% by next December OR, if that doesn't seem likely to you, then maybe you see why it's our key short in our Short-Term Portfolio.

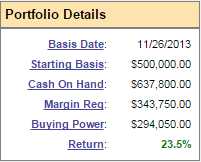

Our Short-Term Portfolio has, in fact, taken a beating this past month – as it's full of hedges that are getting slaughtered. Now we're only up 70% for the year (down from over 100%) but the trade-off is, of course, that our bullish (and 5x larger) Long-Term Portfolio is now up 23.5% for the year. That's pretty good as they aren't both supposed to be up at the same time anyway.

Our Short-Term Portfolio has, in fact, taken a beating this past month – as it's full of hedges that are getting slaughtered. Now we're only up 70% for the year (down from over 100%) but the trade-off is, of course, that our bullish (and 5x larger) Long-Term Portfolio is now up 23.5% for the year. That's pretty good as they aren't both supposed to be up at the same time anyway.

We haven't changed our aggressively bearish short-term position, despite losing 30% of our gains on this rally, because the volume simply isn't confirming the breakout and that means that all these gains can be just a quickly reversed – and we sure don't want to be giving up our bullish LTP gains into the end of the year.

We've already gone to very cashy positions ahead of the holidays. In fact, the LTP has more cash ($637,800) than the portfolio is worth ($617,505) because it follows our "BE THE HOUSE – Not the Gambler" strategy of SELLING premium, which we were just reviewing for our Members at our live Las Vegas Seminar this past weekend.

We've already gone to very cashy positions ahead of the holidays. In fact, the LTP has more cash ($637,800) than the portfolio is worth ($617,505) because it follows our "BE THE HOUSE – Not the Gambler" strategy of SELLING premium, which we were just reviewing for our Members at our live Las Vegas Seminar this past weekend.

Even our Short-Term Portfolio is mostly in cash, but the positions we do have are highly leveraged to the downside, in anticipation of a market correction that may not come between now and April. Meanwhile, we can pick up short-term gains by shorting the Futures – like our call to short /TF (Russell Futures) at 1,180 that was noted right in yesterday's morning post (which you can have delivered to you pre-market, daily, by SUBSCRIBING HERE), which are already up $1,000 per contract this morning – not bad for 24 hours' "work".

I also mentioned shorting EWJ in the morning post but, for our Live Chat Members, I sent out a Top Trade Alert specifically on the Jan $12 puts at 0.52 to go along with our call to short /NKD (Nikkei Futures) at 17,500 at 8:22 am (also in the morning post) and by 11pm last night we were close enough, at 17,490 and, already this morning, we're back at 17,100 – for a $1,950 per contract gain – all overnight and all "according to plan".

I also mentioned shorting EWJ in the morning post but, for our Live Chat Members, I sent out a Top Trade Alert specifically on the Jan $12 puts at 0.52 to go along with our call to short /NKD (Nikkei Futures) at 17,500 at 8:22 am (also in the morning post) and by 11pm last night we were close enough, at 17,490 and, already this morning, we're back at 17,100 – for a $1,950 per contract gain – all overnight and all "according to plan".

Also in yesterday's Top Trade Alerts, for non-Futures players, we identified a TZA (ultra-short Russell) hedge we liked, the Jan $12/16 bull call spread at $1.20 – that one pays $4 (up 233%) if the Russell drops enough to send TZA from $13.30 to $16 (20%) which would be a 6.6% move down on the Russell (because it's a 3x negative ETF) from our 1,180 top call back to 1,100. Being able to make 233% on a 6.6% correction is why we can use a Short-Term Portfolio that's 1/5th the size of our Long-Term Portfolio as a hedge and still remain very well-covered.

So please, don't complain if, a month from now, we're talking about how the 200% gains on our hedges saved us from suffering during the nasty November market correction and you wonder why you never heard of that hedge.

So please, don't complain if, a month from now, we're talking about how the 200% gains on our hedges saved us from suffering during the nasty November market correction and you wonder why you never heard of that hedge.

30 days ago, in fact, we picked up 100% gain off a DXD trade (ultra-short Dow) in just 3 days using a very similar premise (and we're short DXD again in our STP). That collapse quickly reversed itself but the profits remained in our STP.

That's all we're trying to teach you here: Markets will go up and markets will go down – by diversifying your positions, managing your cash and hedging your portfolio, you can learn to enjoy AND PROFIT FROM the ride.