Wheeeee, what a ride!

Wheeeee, what a ride!

As you know, we called a floor at $44.50 even as we told you the market would falter on Friday morning and those /CL (Oil) Futures made almost $2,000 per contract on Friday's pop but that's nothing compared to the $3,000 per contract move oil busted on the shorts this morning (we're short now at the $49.50 line).

That puts oil up 13.5% in less than 24 trading hours – how's that for a bottom call? As noted in our January Top Trade Review, we pressed our long USO and UCO bets just last week in our Live Member Chat Room and made them our ONLY bets in our $25,000 Portfolio, which will very much reap the rewards this morning. We also have big bets on oil in both our Short-Term and Long-Term Portfolios, some of which we discussed in last week's Live Webinar (replay available here).

We also called a nice bottom in Natural Gas, using the UNG ETF to go long and that one hasn't gotten away – yet. As I often have to remind people: I can only tell you what is going to happen and how to profit from it, the rest is up to you!

Meanwhile, turning our attention back to the indexes, things are NOT GOOD. Last Monday we talked about Greece being an issue again and Tuesday's post was titled "Testy Tuesday – MSFT, CAT and PG Paint a Poor Picture", where we told you we were shorting Russell Futures (/TF) at 1,190 (up $3,000 per contract this morning) and Dow Futures (/YM) at 17,600 (up $2,000 per contract this morning).

Meanwhile, turning our attention back to the indexes, things are NOT GOOD. Last Monday we talked about Greece being an issue again and Tuesday's post was titled "Testy Tuesday – MSFT, CAT and PG Paint a Poor Picture", where we told you we were shorting Russell Futures (/TF) at 1,190 (up $3,000 per contract this morning) and Dow Futures (/YM) at 17,600 (up $2,000 per contract this morning).

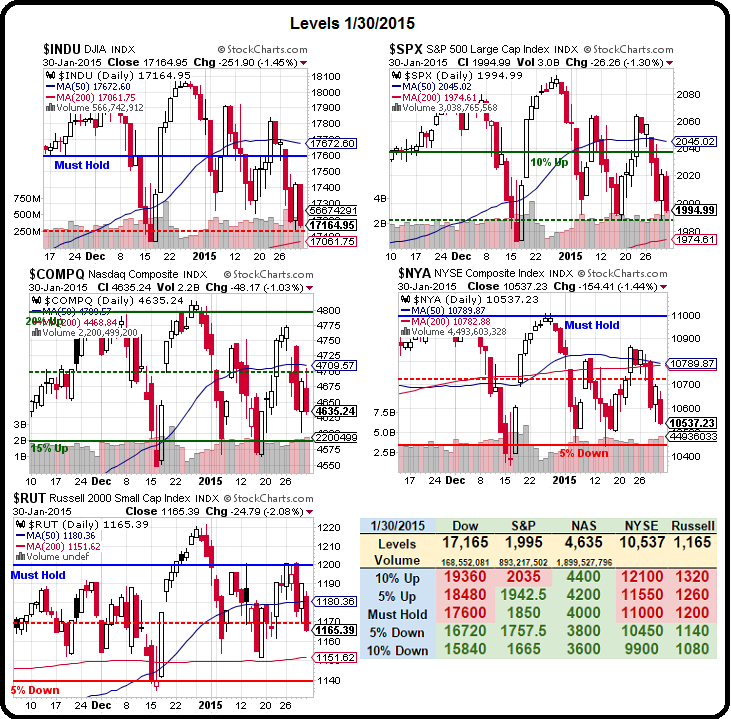

Wednesday we took a break from the Doom and gloom to celebrate AAPL earnings (our Stock of the Year) but Thursday's title said it all: "Faltering Thursday – Weak Bounce Lines Failing After Fed" while we hammered the point home on Friday (in case you missed it) with "Failing Friday – Rejected at our Strong Bounce Lines – Again!." Those lines, of course, are the same ones we've been using all year:

- Dow 17,280 (weak) and 17,460 (strong)

- S&P 2,006 (weak) and 2,027 (strong)

- Nasdaq 4,608 (weak) and 4,656 (strong)

- NYSE 10,560 (weak) and 10,670 (strong)

- Russell 1,172.50 (weak) and 1,185 (strong)

This stuff isn't complicated, folks. Our 5% Rule™ very clearly indicates when it's safe to go bullish and, so far, we haven't gotten that signal again. That's kept us from making some very costly mistakes in 2015, even while our Top Trades (as well as our everyday trades in our Live Chat Room) have been doing very well as we have taken the opportunity to pick up solid stocks that have simply fallen too far out of favor.

This stuff isn't complicated, folks. Our 5% Rule™ very clearly indicates when it's safe to go bullish and, so far, we haven't gotten that signal again. That's kept us from making some very costly mistakes in 2015, even while our Top Trades (as well as our everyday trades in our Live Chat Room) have been doing very well as we have taken the opportunity to pick up solid stocks that have simply fallen too far out of favor.

We're certainly not seeing any improvements in the Global Economy and, as we predicted (we're short FXI), China is beginning to show signs of, not weakness – that ship has sailed – but collapse.

The Shanghai Composite finished down 2.5% this morning, capping off a 5-day, 7.5% drop in that index. China Railway Construction Corp fell limit down 10% as Mexico put off a high-speed rail project the company hadn't even won the bid on yet – just the rumor they were bidding had goosed the stock ridiculously. China Minsheng Banking Corp dropped 3.1% as the President resigned as he falls under investigation for various shenanigans. Meanwhile, the Manufacturing Data fell into contraction territory.

The China data “will be stoking hard landing fears that are ever present in market thinking,” said Evan Lucas, Melbourne-based market strategist at IG Ltd. “The fact new exports are also declining is a big issue on a macro-level. It illustrates that the lower growth in the global economy is impacting consumption of Chinese goods.”

That news has sent commodities back into retreat and we'll see if our markets can pretend to ignore it again – as they have been since 2012, when the Fed officially began their QInfinity program that has distorted the investment climate for the past 3 years.

That news has sent commodities back into retreat and we'll see if our markets can pretend to ignore it again – as they have been since 2012, when the Fed officially began their QInfinity program that has distorted the investment climate for the past 3 years.

Not that we're complaining – as members of the top 1%, we have reaped ALL of the benefits of these endlessly rising markets, but the fastest way for people in the top 1% to fall back into the bottom 99% is when we start believing our own BS and this baseless rally is the basest kind of BS – swallow it at your own risk!

This game will continue only as long as the Fed manages to fool people into thinking that handing out free money to rich folks is the same as economic prosperity. Our Corporate Media is fantastic as keeping all those bottom 99% brains constantly washed but there comes a point at which the proletariat awaken from their stupor and begin to notice how screwed they are getting.

This game will continue only as long as the Fed manages to fool people into thinking that handing out free money to rich folks is the same as economic prosperity. Our Corporate Media is fantastic as keeping all those bottom 99% brains constantly washed but there comes a point at which the proletariat awaken from their stupor and begin to notice how screwed they are getting.

Take this chart, for example. The home ownership rate in the US has fallen 5 points (7.2%) in 10 years and is ACCELERATING to lows we haven't seen since the Great Recession of the 70s. Now the average American may not be that smart but they do know whether or not they have a roof over their heads as well as whether or not they own that roof.

As I pointed out to our Members last week, we're putting the squeeze on the bottom 99% in order to line our own pockets because, even among the top 1%, there is tremendous pressure to keep up and those of us at the bottom of the top 1% (earning over $350,000 but less than $2M per year) feel like paupers compared to the top 0.01%, where you need an ANNUAL $37M just to squeek in to that club.

As I pointed out to our Members last week, we're putting the squeeze on the bottom 99% in order to line our own pockets because, even among the top 1%, there is tremendous pressure to keep up and those of us at the bottom of the top 1% (earning over $350,000 but less than $2M per year) feel like paupers compared to the top 0.01%, where you need an ANNUAL $37M just to squeek in to that club.

The people making $30M (ie landlords), in turn, NEED to make a lot more money to set their sites on the next bracket, where anything less than $100M per year gets you laughed out the door. The Forbes 400, in fact, earned an average of $1,000,000,000.00 EACH last year. For every $1Bn one of the 400 earned, that's 1,000 other Americans who weren't able to make $1M, 400,000 in all.

Is the World better off with 400 people making $1Bn new Dollars or 400,000 people making $1M new Dollars? Who is more likely to "trickle them down" on the bottom 99% by employing them and shopping at their stores and who is more likely to foreclose on their homes and buy out their employers and ship their jobs overseas?

Is the World better off with 400 people making $1Bn new Dollars or 400,000 people making $1M new Dollars? Who is more likely to "trickle them down" on the bottom 99% by employing them and shopping at their stores and who is more likely to foreclose on their homes and buy out their employers and ship their jobs overseas?

We are at a dangerous tipping point in this country and, this weekend, President Obama has proposed raising $300Bn for much-needed Infrastructure Spending by taxing the profits that US Corporations have stashed overseas. $300Bn is only 14% of the over $2Tn in foreign accounts, so they are getting off lightly but expect a fight from Congress anyway (of course). Our Corporate Citizens are the top of top 1%, yet Corporations paid just $300Bn of the $2.7Tn in taxes collected by the Government last year – leaving 88% of the taxes to be paid by the bottom 99.99% – including the people who can afford it leqast.