We are partying like it's 1999!

We are partying like it's 1999!

The Nasdaq is up over 20% from it's October low, addine $1.5 TRILLION in "value" in less than 4 months. Of course, AAPL contributed 10% of that $181Bn with it's own 32% run from $95 to $126 but we're not here to be skeptical today – we're going to let Dave Fry do it for us:

$6.9 Trillion In Stock Buybacks Dwarf QE

$6.9 Trillion In Stock Buybacks Dwarf QE

I noted the other day the Atlantic article asserting the above number is the amount corporations spent buying back stocks since 2004.

It makes QE look like a sideshow. This represents the ongoing bid under the market thanks to ZIRP which makes being anything other than long stocks and bonds wrong.

There’s no question this didn’t have much effect on commodity, currency and some single country markets. But for U.S. investors the message is clear: buy, buy, buy.

Thursday markets belonged to “bad news bulls” since key economic data both sucked and blowed. Jobless Claims jumped to 304K vs 288K expected & prior 279K as finally lost jobs in the energy sector are starting to show up. And, Retail Sales dropped for the second month in a row to -0.8% vs -0.4% expected and prior -0.9%.

Greece seems to be coming to grips with a deal that changes some conditions around the edges but primarily is a temporary face-saving remedy. Russia and Ukraine agreed to a cease fire just as they did in September. Once again both situations are just a stalling tactic.

Earnings continued mixed even as many pundits stated earnings were beating estimates 78% of the time. Future guidance is another issue and firms routinely engineer earnings beats complicit with their corporate CFO counterparts.

So really, what do you want us to say? For people like Dave and I, who have been doing this since way before the Dot Com bubble burst – the trick is obvious. What you are watching is masterful magicians (Central Banksters) levitating a market and defying Fundamental Economic Laws for as long as they can.

So really, what do you want us to say? For people like Dave and I, who have been doing this since way before the Dot Com bubble burst – the trick is obvious. What you are watching is masterful magicians (Central Banksters) levitating a market and defying Fundamental Economic Laws for as long as they can.

It's a good trick, and no one likes the guy who tells the audience where the wires are. You might KNOW it's just an illusion but you don't WANT to know – it's more fun believing that things can fly – or that stocks are worth over 20x earnings just because bond prices are artificially depressed.

Providing you have a gullible person sitting next to you (a counter-party), you can make good money betting on what LOOKS like levitation but don't let them go backstage and pull the strings or that winning bet will quickly turn into a loser. This is my concern for the current markets and we're now in a mode of spending about 1/3 of our bullish portfolio profits on downside hedges – that way we can lock in the bulk of our gains – just in case someone pulls back the curtain and we crash back to Earth.

As PT Barnum noted over 160 years ago – "there's a sucker born every minute" and that was back when there were just over 1Bn people on the planet – with over 7Bn people now, that's 7 suckers born every minute or 10,080 every day or 907,200 per quarter and 3.6M per year. Those are your counter-parties! Don't feel bad – take their money – that's what they're there for…

As PT Barnum noted over 160 years ago – "there's a sucker born every minute" and that was back when there were just over 1Bn people on the planet – with over 7Bn people now, that's 7 suckers born every minute or 10,080 every day or 907,200 per quarter and 3.6M per year. Those are your counter-parties! Don't feel bad – take their money – that's what they're there for…

That's why, YESTERDAY, right here in my morning post, BEFORE the markets opened, I was able to tell you how to make a fortune trading options contracts – just by using simple strategies we teach our Members every day at Philstockworld. It's not complicated, we're just going with the flow and assuming there are masses of suckers ready to run back into Greece, again, and our GREK Feb $11/12 bull call spread opened at $1.75/1.15 (net $60 per contract) GREK closed all the way up at $12.99 – on the way to returning $100 per contract (up 66%) by next Friday.

Should you be able to make 66% in a week trading off such obvious news? Of course not – it's ridiculous. But, for those of us lucky enough to be in the investing class, this is what the World's Central Banks have been gift-wrapping for us for the past 4 years.

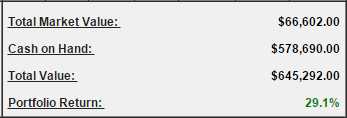

Our Short-Term Portfolio, where we have begun hedging (see Wednesday's post for our Hedging Lessons) has pulled back to $201,630 (up 101% but down $6,400 this week). We expected that to happen, as we flipped more bearish there to protect our Long-Term Portfolio, which closed yesterday at $645,942 – up 29.1% and up $32,000 (5%) since our update last week.

Our Short-Term Portfolio, where we have begun hedging (see Wednesday's post for our Hedging Lessons) has pulled back to $201,630 (up 101% but down $6,400 this week). We expected that to happen, as we flipped more bearish there to protect our Long-Term Portfolio, which closed yesterday at $645,942 – up 29.1% and up $32,000 (5%) since our update last week.

Your whole, CONSERVATIVE Portfolio is NOT supposed to gain 5% in a week – it's unnatural. One thing our ancestors were right about was fearing the unnatural – more often than not, it means something bad is about to happen! We have barely touched our positions (cashed USO, added a few long plays) and these are LONG-TERM positions that we HOPE will make 20% a year – something is wrong when they make 5% in a week.

That's why we're pumping up our hedges – these are silly gains and we need to do our best to lock them in (we tried cashing them out in our review but we liked them too much – and we were right, as they gained 5% in a week!), so we'll keep donating a percentage of our profits to high-percentage hedges that will keep us from giving it all back when and if this bubble bursts. If not, we'll still make 66% of the market's gains and, if that means more weeks like this one – that's fine with us!

Have a great weekend,

– Phil