The Trouble With Chasing Hot Strategies

Courtesy of Joshua Brown, The Reformed Broker

Courtesy of Joshua Brown, The Reformed Broker

How do most investors (and many advisors) select funds or strategies to allocate to? They look at what’s been working, learn the story and get long. [For the current example, read Zero Hedge's Diversification Is For Dummies – The Nifty Nine Never Mattered More.]

Sometimes they chase a hot manager who’s just made a great call. Larry Robbins nailed the Obamacare trade! Carl Icahn crushed it with Apple and Netflix!

Other times, they chase a hot theme. Currency-hedged European stocks! Gold outperformed the S&P over the last decade! Biotechs have changed the game!

And then there are the strategy chasers. Tony Robbins has a “permanent portfolio”! Dividend Aristocrats are better than bonds! Everyone’s going into passive indexes! My beta is smarter than your beta!

It may continue to work for a period of time, depending on how early or late one shows up to the hoedown – momentum is a well-documented phenomenon, after all.

And then mean reversion shows up – outperforming managers subsequently underperform, hot themes become over-loved, winning strategies become too crowded to offer excess returns. “No problem,” says the advisor, "I’ve got six new ideas to replace the six ideas that are no longer working!”

It’s sad to say, but this is exactly how it works. I’ve been watching this for almost 20 years. The fastest way to know you’re talking to an amateur investor (or an uninformed pro) is to see how much emphasis or meaning they ascribe to things like trailing 12 months of performance. This obsession with “what’s working?” is extremely widespread.

Research Affiliates has an interesting pair of charts demonstrating this phenomenon in a new note from Rob Arnott, Jason Hsu and Co. They illustrate that increasing fund flows are a decent predictor of subsequent underperformance and that performance-chasing is destructive to returns across all types of investment products:

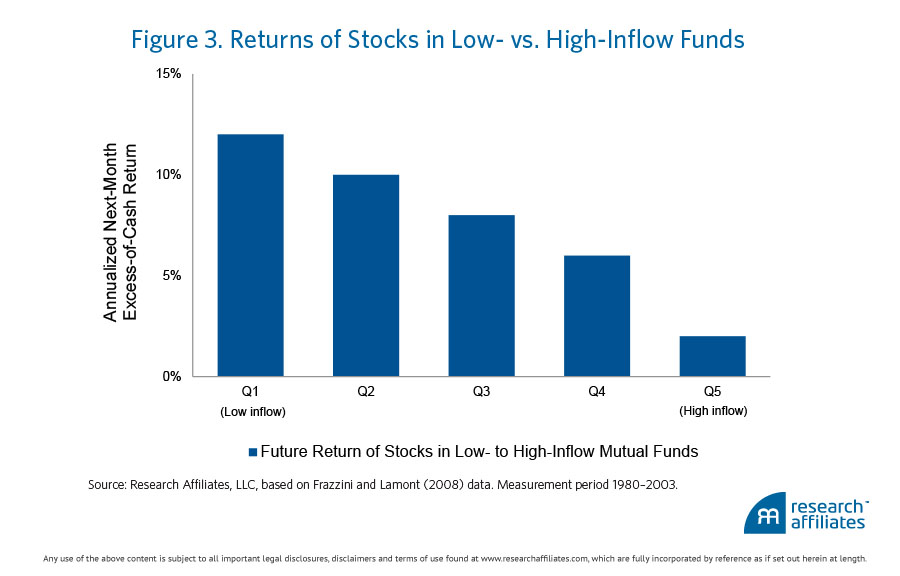

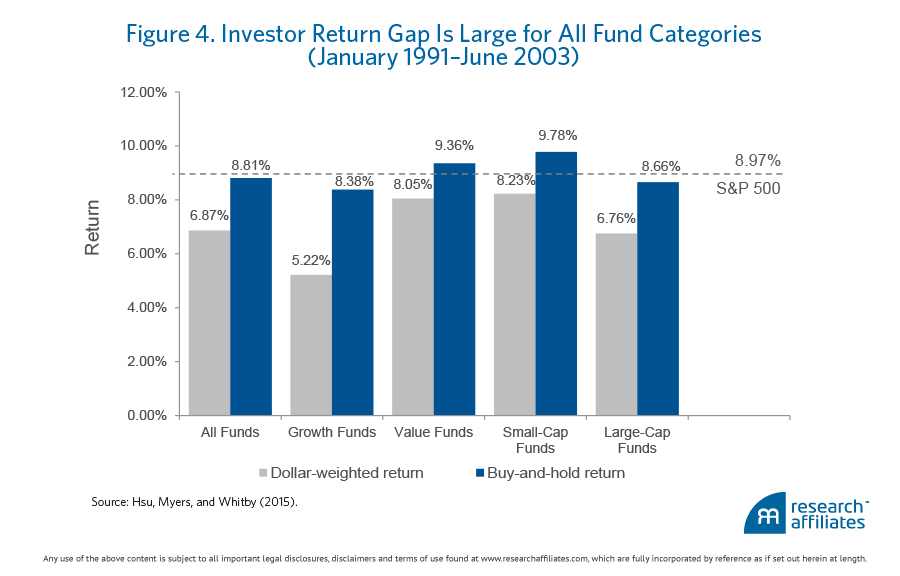

The procyclical or trend-chasing allocation accentuates the underlying economic shocks to various investment styles as flows push valuations. In the short run, this results in self-fulfilling prophecy and momentum. In the long run, it becomes self-defeating and gives rise to mean reversion. This investor pattern contributes to a predictive relationship between the valuation multiple and future return. Frazzini and Lamont (2008) and Hsu, Myers, and Whitby (2015) find evidence that mutual fund flows predict negative future fund performance.

Figure 3 shows that mutual funds with high inflows have low next-period relative performance. Figure 4 shows that the investor return gap, which is driven by the negative correlation between flows and subsequent returns, is large across all fund categories. This pattern is observed for pensions as well, although to a smaller degree.

The charts:

Josh here – these charts could not paint a more starker picture: People underperform their own investments systematically by chasing “what’s working now.” With strategies, as with the asset classes themselves, the investor who trains herself to be excited when something is out-of-favor is the investor who is going to win over time.

Source:

If Factor Returns Are Predictable, Why Is There an Investor Return Gap? (Research Affiliates)

[Picture via Pixabay.]