What an incredible rally!

That's INcredible as in, NOT credible. Oil is up almost 50% in 3 months and INcredibly, we now have 23 MILLION MORE BARRELS in inventory than we had then, representing an average build of 1.9M barrels in each of the 12 weeks. That's why yesterday's 6.2Mb draw in inventories came as such a shock and sent oil flying up from $45.25 ahead of the report (10:30) to $46.40 (+2.5%) after the report and again the real surprise is the small reaction – unless you take into account the fact that this completes a 10% run on oil this week. Somebody knew that the EIA data would surprise us.

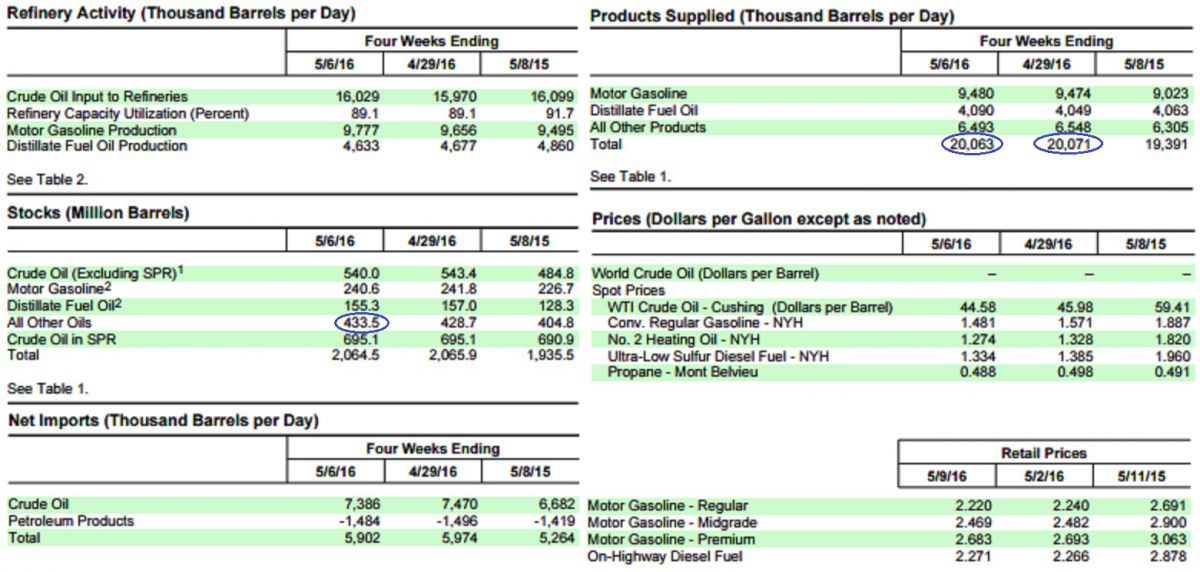

Since our toothless regulators certainly won't be investigating this, we decided to and we found something very interesting. Looking at the EIA's full report for the week, we noticed that, in fact, inventories as a whole were at 2.0645Bn barrels (yes, that's enough to cover 278 days of imports) but that's only down from 2.0659Bn barrels last week (and up 130.4M from 1.9355Bn last year). How is that possible if the report said:

- Crude -3.4M barrels vs. +0.7M consensus, +2.8M last week.

- Gasoline -1.2M barrels vs. -0.7M consensus, +0.5M last week.

- Distillates -1.7M barrels vs. -1M consensus, -1.3M last week.

As it turns out, there was an unreported 4.8Mb BUILD in "Other Oils", which is a bundle that includes Aviation Gas (but not Jet Fuel, which is a Distillate), Kerosene, LNG, Lube Oils, Waxes, Asphalt, Coke, etc. – things we usually don't care about. But we should care when almost the entire draw on inventory was clearly nothing to do with a change in demand but merely a change in the mix the refiners put into the inventory.

As it turns out, there was an unreported 4.8Mb BUILD in "Other Oils", which is a bundle that includes Aviation Gas (but not Jet Fuel, which is a Distillate), Kerosene, LNG, Lube Oils, Waxes, Asphalt, Coke, etc. – things we usually don't care about. But we should care when almost the entire draw on inventory was clearly nothing to do with a change in demand but merely a change in the mix the refiners put into the inventory.

We caught this discrepancy during our Live Trading Webinar yesterday (replay available here) and ended up shorting 2 oil contracts (/CL) at $46.30 with the intent to DD as we tested $47, which we're doing this morning. That will make for an average short at $46.65 on 4 contracts and I have yet to see anything to change my conviction. Note also, on the EIA chart above, that we are EXPORTING 10.388Mb of Petroleum Products PER WEEK – and even with that massive amount of product being shipped out of the country – we're STILL building our reserves to record levels.

We caught this discrepancy during our Live Trading Webinar yesterday (replay available here) and ended up shorting 2 oil contracts (/CL) at $46.30 with the intent to DD as we tested $47, which we're doing this morning. That will make for an average short at $46.65 on 4 contracts and I have yet to see anything to change my conviction. Note also, on the EIA chart above, that we are EXPORTING 10.388Mb of Petroleum Products PER WEEK – and even with that massive amount of product being shipped out of the country – we're STILL building our reserves to record levels.

That's right, at this pace (-3.4Mb), it will "only" take 23 weeks to get back to the top of the 5-year range in oil inventories yet oil is already priced as high as it was last July and by the end of August it was down to $37.75 – 20% below today's open at $47! With a 20% downside and a 2.5% move up yesterday, it brings to mind our fabulous 5% Rule™, which we noted on May 2nd with this chart:

At the time I said:

Don't get sucked into the energy sector just because oil is back over $45 – it may last the summer (we expect $50ish in July and bet accordingly when it was $30) but we'll be shorting again by August, looking for a spectacular fall!

OPEC can talk about production freezes all they want but that 2Mb week reduction in US usage flows over to almost 1Mb/d each year World-wide and that will more than offset any growth in demand from increasing population (1.1%) though a pickup in the economy will give us a temporary boost – that's the one the oil bulls are counting on into the summer – so we'll be keeping a close eye on that as well.

For now, we're not too enthusiastic in the middle of our range but we did use $46.50 for a shorting line on Friday. Speaking of oil, the Baker Huges (BHI)/Haliburton (HAL) deal is OFF and we have a lot of BHI but we are THRILLED to own the company as they collect their $3.5 BILLION break-up fee. Would anyone else like to make an offer? BHI is using $1.5Bn of that money to buy back 10% of their shares at this discounted price ($48.50) and our 2018 spreads are targeting $50 or more for some spectacular payouts (see Top Trade Alerts).

As you can see, without even trying to play the in-betweens, there was plenty of opportunity in the past 10 days to make money playing our oil range and now we're looking for a pullback of at least $1.20 from $47, back to $45.80, which would be a nice $3,400 gain on our 4 contracts – not bad for a day's work! Of course, if you were lucky enough to only read this morning's pre-market Post (this one), then you started at $47 and $45.80 pays $1,200 per contract or $4,800 if we hit our target – even better for a couple of hours' work!

Keep in mind, we're not bearish on oil, per se. We have A LOT of oil longs in our Member Portfolios that we picked up back in February – we simply like to short when oil gets ahead of itself to protect the gains we already have in our main positions. The Futures trades are all about BALANCE – very important to keep that in perspective!

The BOE this morning left their rates on hold in a unanimous decision BUT they also downgraded GDP growth by 10% to 2% (from 2.2%) and the housing market is clearly in decline and Eurozone Industrial Output fell again, this time 0.8% more since February's 1.2% decline from January. TERRIBLE data like this is giving investors hope that the BOE and ECB will turn on the taps over the summer – lest the whole thing starts unraveling faster than they'll be able to fix it in the fall.

Sure, one would think a 2% decline in industrial output in the first quarter would indicate LOWER demand for oil – but that's what happens in the real world – not the fantasy trading camp that is the NYMEX, where all negative FACTS are ignored while all positive rumors are celebrated as the gospel.

So, if the oil rally is BS then you need to be concerned that the stock rally is BS too, so I'd be very cautious going into the weekend (or this morning) as things can unravel very quickly if we get more than a small correction on oil. I warned you about all this yesterday morning – ahead of the drop and now we have a chance to short S&P Futures (/ES) again at the 2,070 line – a short that was good for $500 per contract yesterday (again). This is not rocket science folks – we're simply playing the channel!

Not only that but we have a $15Bn, 30-year note auction at 1pm today so the powers that be have no incentive to hold the market up as, like yesterday, they need people to be scared enough to give them $15Bn at 2.62% interest and you have got to be TERRIFIED to take a deal like that! We have Consumer (Dis)Comfort at 9:45 and then the Fed's Mester spins the markets at 11 followed by Esther George batting clean-up at 2:15 – just in case things are getting out of hand to the downside – don't you just love Fed Speak controlling the markets?

It's going to be another exciting day so get ready for a wild ride.