What a crazy morning already!

What a crazy morning already!

As you can see, the S&P rocketed 20 points higher as Hillary put those Trump fears to rest during the debate last night and the markets had a huge relief rally but then, at the European open (3am), Deutsche Bank (DB) continued the 10% slide that was saved by the bell at yesterday's close and the EU markets followed down about 1% (so far). No, in addition to DB having issues, Germany's 2nd largest bank, Commerzbank, announced it would lay off 18% of it's workforce (9,000 employees) in a massive restructuring. Sure folks – everything is just fine – don't panic….

Already the market is lower than we were ahead of the Fed on Wednesday and it turns out I was a few day's early with my market prediction but, honestly, it wasn't hard to call as they've tried FREE MONEY for 8 years now and it hasn't worked yet and it won't work now because they are giving the money to the wrong people.

Already the market is lower than we were ahead of the Fed on Wednesday and it turns out I was a few day's early with my market prediction but, honestly, it wasn't hard to call as they've tried FREE MONEY for 8 years now and it hasn't worked yet and it won't work now because they are giving the money to the wrong people.

As Hillary said last night, "trickle down economics has not worked in the past and it will not work in the future" THOSE are the failed policies of the past we can't afford to repeat. If we want to turn the global economy around, we need to engage in some massive infrastructure projects that consumer materials and put people to work building things that last and have long-term beneficial effects on society like roads, bridges, aqueducts, electrical grids, forest reclamation, carbon reduction… These are not whimsical things – these are all things we NEED and have been putting off.

Rather than give another $6Tn to the Banksters to buy another 8 years of stagnation – why not give $6Tn to the people and see what they can do with it? Instead, we are dooming the Bottom 90% to years of ZERO return on their meager savings, giving them no chance whatsoever of retiring in sound financial shape. Even that isn't far enough and, as you can see on this chart, $7 TRILLION Dollars worth of debt (and that was Q1) is "paying" a NEGATIVE yield – we are punishing people for saving money – the Fed has actually become a comic book super-villain!

Rather than give another $6Tn to the Banksters to buy another 8 years of stagnation – why not give $6Tn to the people and see what they can do with it? Instead, we are dooming the Bottom 90% to years of ZERO return on their meager savings, giving them no chance whatsoever of retiring in sound financial shape. Even that isn't far enough and, as you can see on this chart, $7 TRILLION Dollars worth of debt (and that was Q1) is "paying" a NEGATIVE yield – we are punishing people for saving money – the Fed has actually become a comic book super-villain!

Speaking of comical villains, OPEC is meeting in Algeria and it's starting to seem more like an episode of the 3 Stooges with minister after minister contradicting each other. Actually, it's starting to seem like the Fed, isn't it? Well, like the Fed, OPEC is disastrously failing to restore confidence in the energy markets and Goldman Sachs (GS) has already cut it's Q4 oil (USO) target to match ours – from $50 to $43 – that's a 15% write-down for GS. Even as I write this, oil is failing the $45 line (we expect a dip below $40 by October before we become serious buyers).

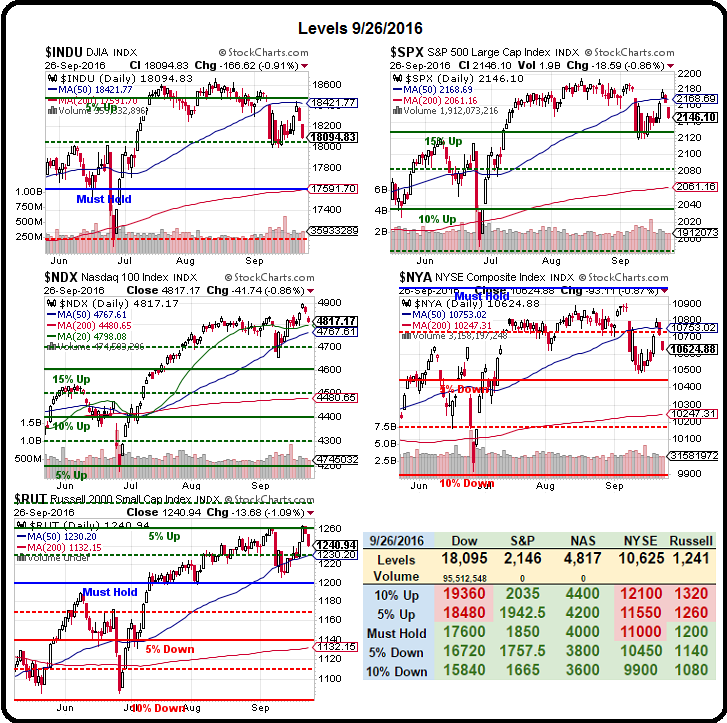

Today we'll have to watch the 18,000 line on the Dow (DIA) very carefully as that's the 2.5% line on our Big Chart and, if that fails, 17,600 is the Must Hold Line below which is nothing but doom and despair! On the S&P (SPY), 2,127.50 is the 15% line – also critical, Nasdaq (QQQ) 4,700 is the 17.5% line but the losing the 50 dma at 4,800 would be a very bad sign.

NYSE, as usual, is well below the Must Hold Line, which has kept us bearish throughout and I don't think we'll see 10,450 today but it will be bad any time we fail the -5% line. Russell is the most exciting index to trade and the 50 dma at 1,230 also happens to be the 2.5% line and then it's 1,200 and then – doom and despair!

I know you are all well-hedged so we will enjoy the ride but, if not – we've posted plenty of useful hedges in previous posts and in our Member Portfolios.

Please, be careful out there.