My eyes adored you

Though I never laid a hand on you

My eyes adored you

Like a million miles away

From me you couldn't see

How I adored you

So close, so close

And yet so far away

Yes, I'm old.

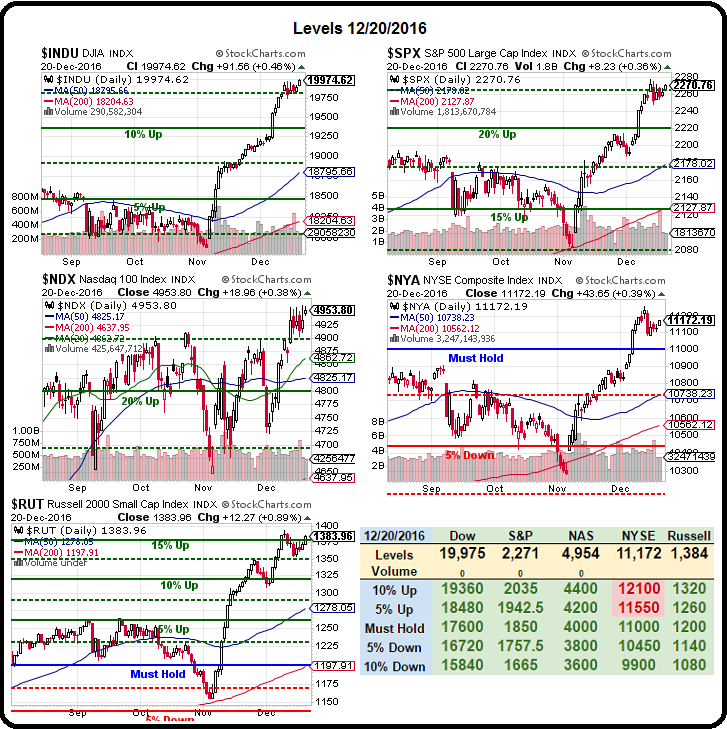

But so is this Dow 20,000 nonsense and I know they already made the hats and all that yet somehow I am the only person left in America who sees this as a SELL signal. That's OK, I'm used to being a contrarian (I called 13 long plays live, while the market was collapsing in March, 2008) because most other analysts are IDIOTS and traders, for the most part, are sheep and valuation models get tossed right out the window at EXACTLY the times when they are most useful.

If you feel like a lamb being led to the slaughter by market pundits, it's not your fault – they are paid to mislead you. Americans especially, as well as people throughout the World, have been the subject of intense psychological manipulation their whole lives. You have been trained since birth to believe whatever BS the media shoves down your throats and, no, it's not a conspiracy theory, not when the people running the conspiracy can be quoted on it, right?

"We must shift America from a needs to a desires culture. People must be trained to desire, to want new things, even before the old have been entirely consumed. Man's desires must overshadow his needs." – Paul Mazur, Lehman Brothers

According to the very excellent documentary on the subject, "The Century of the Self":

The growing wave of consumerism helped in turn to create a stock market boom. And yet again Edward Bernays became involved. Promoting the idea that ordinary people should buy shares borrowing money from banks that he also represented. And yet again, millions followed his advice.

Throughout the 1920s speculators had borrowed billions of dollars. The banks had promoted the idea that this was a new era where market crashes were a thing of the past. But they were wrong. What was bout to happen was the biggest stock market crash in history. Investors had panicked and begun to sell in a blind relentless fury that no reassurance by bankers or politicians could halt. And on the 29th of October 1929 the market collapsed.

Over the 90 years that Corporations have been using these WWI brain-washing techniques on the US population, most people are no longer aware they are being manipulated. In fact, when you point out they are being manipulated, most people become angry because it threatens their self-identity as freedom-loving, independent Americans – yet another image that's been sold to them to make them hate groups (because groups share and consume less than individuals).

Over the 90 years that Corporations have been using these WWI brain-washing techniques on the US population, most people are no longer aware they are being manipulated. In fact, when you point out they are being manipulated, most people become angry because it threatens their self-identity as freedom-loving, independent Americans – yet another image that's been sold to them to make them hate groups (because groups share and consume less than individuals).

We now have officially moved into a Russian-style (some say controlled) Oiligarchy in the US, where the Industrialists take control of Government and I'm not witing about that disaster today (historians will surely spend centuries examing this moment in history). What I am writing about is how the underlying techniques that were used to fool people into buying stocks in 1929 are fooling people into buying stocks in 2016 – sadly, with likely the same result.

As noted by Paul Farrell at MarketWatch:

"I’ve been observing the Wall Street machine in action since my days at Morgan Stanley years ago. The truth is, Wall Street really doesn’t need a sophisticated high-tech “Infinity Machine.” They’re already in a Snowden-style low-tech “Singularity,” “accelerating returns” skimming money from 95 million Main Street investors."

Remember, Wall Street has only one goal, make insiders superrich, and shareholders rich. The public interest and the rest of the world are never part of their competitive algorithms. Never. They achieve their goal with the basic ideas of behavioral-finance geniuses like Richard Thaler, by keeping investors in the dark, dependent, irrational and uninformed. Very simple. Here are 10 of Wall Street’s high-tech/low-tech weapons used by their psychological/neuroscientific/behavioral finance cyberwarriors to control their casinos:

1. Hire psychologists, neuroscientists to manipulate the media

Use consulting contracts, grants and retainers and lock up the best talent to work to keep America’s 95 million individual investors “irrational and uninformed” as Thaler says.

2. Free experts constantly deliver Wall Street’s message to media

Network, cable, bloggers must fill their channels every day. Talking heads are free advertising for Wall Street to manipulate investors using so-called news content.

3. Invest megabucks on lobbyists to control politicians, government

Lobbying is one of Wall Street’s best investments. Lobbyists control Washington: control politicians, fight reforms, push favorable laws, regs, spin the truth to mislead investors.

4. Fuel anxiety by pushing the investor’s buy/sell/ trade button

Wall Street’s a casino, makes money on “the action,” skimming a percentage off the top. They fuel investor anxieties, fears, optimism, volatility, maximize action on exchanges.

5. Kill our savings button, undercut self-confidence, long-term planning

Wall Street uses neuroscience technology to sow doubts about retirement security, do-it-yourself investing, how indexing beats trading, then overloads us with misleading ads.

6. High-frequency trading, misleading Wall Street and Main Street

Short-term online trading makes Wall Street billions annually. Hyperactive traders have a competitive edge using high-tech neuroscientific strategies, plus keep markets churning.

7. Brokers trained on aggressive selling and closing techniques

Securities are sold not bought: Broker’s advice is self-serving, often misleading, anything to get a commission. They’re trained to use high-powered psychological techniques.

8. ‘Investor education’ programs are self-serving sales gimmicks

Most Wall Street-sponsored “investor education” programs are loaded with new business, sales and promotional gimmicks. But they help Wall Street present a “we care” persona.

9. New ‘designer’ funds based on latest fads to replace losers

Fund companies constantly design new funds based on the latest fads, for anxious investors chasing higher returns, driven like teenagers who need the latest video games.

10. Retirement gatekeepers: kept in the dark and manipulated

Two-thirds of all funds are controlled by corporate pension and retirement managers. So Wall Street focuses sales pitches on easy to manipulate naïve plan managers.

At Philstockworld, we don't fight the game – that's hopeless. Instead we teach our Members how to play the game from the manipulators' side of the table, using a strategy we call "Be the House – NOT the Gambler" and here's my year-old interview in Forbes on the subject where, as an example of how we like to play the market, I gave Forbes readers the following trade idea (pg 4):

- Buy 10 UCO July $5 calls for $3.70 ($3,750)

- Sell 10 UCO July $10 calls for $1.55 ($1,550)

- Sell 10 USO July $8.50 puts for $1.10 ($1,100)

That's net $1,050 on a spread that will pay back $5,000 if Ultra-Long Oil (UCO) is over 10 at July options expiration day (15th). The potential downside to the trade is the Oil ETF (USO) finishing below $8.50 (currently $8.79), where 1,000 shares would be assigned to you for $8,500 plus the $1,050 you already spent would effectively be $9.55 per share or, roughly $30 oil. So our worst case is being long on oil in July at $30 and our best case is making a 376% return ($3,950) on our $1,050 cash outlay. That's not bad for 6 months' "work"!

UCO contracts expired in July (15th) at $10.91 for a full $5,000 pay-off and the USO expired at $10.99, making the short puts we sold expire worthless so we netted $5,000 back on the trade for a $3,950 profit (376%) in less than 6 months. When we initiated the trade, oil was at the year's lows, under $30, but we KNEW it would be manipulated higher into the summer driving season.

Just like yesterday, when we KNEW Silver was oversold (and the Dollar was overbought) and we knew people were panicking for not Fundamental reason so, right in the pre-market post (which you'll never miss if you subscribe) we called a long on Silver Futures (/SI) at $15.75 and we rocketed up to $16.10 for a $1,250 per contract gain on the day. You are very welcome!

Just like yesterday, when we KNEW Silver was oversold (and the Dollar was overbought) and we knew people were panicking for not Fundamental reason so, right in the pre-market post (which you'll never miss if you subscribe) we called a long on Silver Futures (/SI) at $15.75 and we rocketed up to $16.10 for a $1,250 per contract gain on the day. You are very welcome!

We are not knee-jerk contrarians but the real money is made when the beautiful sheeple stampede in at the top (where we short) or out at the bottom (where we go long), ignoring the Fundamentals. That gives us fantastic entries. Dow 20,000 is a fantastic entry – on the short side! We're ridiculously overpriced, as noted in Monday's Morning Report, where we noted a very important study by RealInvestmentAdvice and Global Technical Analysis, who pointed out:

Over the last five years, the R2K’s aggregate annual net income has shrunk from $33.6 billion to $9.7 billion, a 73% decline. That compares with nominal GDP growth of +18% and a 1% decline in S&P 500 earnings growth over the same period. Of the nine industries and the catch-all category that comprise the R2K, only four have experienced income growth over the last five years. Even more interesting is that 83% of the R2K’s earnings growth over the last five years is from one sector, financials. Exclude financial companies from the index, aggregate earnings have been negative in each of the last two years.

Market Capitalization, also known as market cap, is the aggregate value of the equity shares underlying the index at a specific point in time. Currently, the R2K’s market cap stands at $2.311 trillion. Financial companies comprise the largest share at 25.4%, followed by technology (17.5%) and services (16.8%). Over the last five years, as shown in the graph below, the market cap of the R2K has nearly doubled, rising 91% despite declining earnings over the same period.

I think I need to summarize that into something tweetable: The Russell 2000 (IWM) now has a market cap of $2.3Tn which is supported by less than $10Bn in actual earnings. That works out to a price/earnings ratio of 230/1! How can this be? Because, when you buy the Russell, you are buying 2,000 small-cap companies and a lot of them are dogs that lose more money than the good ones make. Since they are small caps, the profits are generally limited (or they'd be mid-caps and out of the index) while the losses are not (Uber is losing about $3Bn this year).

I think I need to summarize that into something tweetable: The Russell 2000 (IWM) now has a market cap of $2.3Tn which is supported by less than $10Bn in actual earnings. That works out to a price/earnings ratio of 230/1! How can this be? Because, when you buy the Russell, you are buying 2,000 small-cap companies and a lot of them are dogs that lose more money than the good ones make. Since they are small caps, the profits are generally limited (or they'd be mid-caps and out of the index) while the losses are not (Uber is losing about $3Bn this year).

Yet when people allocate their portfolios to ETFs, they tend to put more than 10% into the $2.3Tn Russell when the S&P is 10x bigger at $23Tn. The S&P is no picnic either, as last August, at 1,850, it was $18.5Tn and now $23Tn in $4.5Tn larger in market cap yet earnings are flat to last year, at best. That means you are simply paying 24% more for each Dollar of earnings this year vs last year – even in the S&P.

And, if you think that is worrying, check out ETFGI's report that only $324Bn of net inflows are "supporting" this rally – that's 1/10th of the change in market cap! What that means is that, if you think you are going to be able to find buyers for more than 10% of those inflated stock values in you portfolio – you are sadly mistaken.

Sure, today you can still find some sheeple to sell to – as they are all being herded into the markets by Wall Street and their paid media lackeys, who are wearing their Dow 20,000 hats because they want to make sure you go home for Christmas and tell Uncle Joe to dump his bonds and put all his money into the market. That's part of the manipulation game, to make you feel good enough to become evangelical about stocks because they need A LOT more money to come into the market in order to support this nonsense.

I'll be doing a Live Trading Webinar at 1pm (EST) this afternoon – we'll see if they can make those last 26 points by then!