Today we get the "anecdotal" information on the current economic conditions from each of the twelve Federal Districts, we find these reports useful as they give us some insight into what the Fed is seeing on the ground level and we'll go over it live, during our Live Trading Webinar at 1pm, EST today.

As noted yesterday, our trade ideas from the last Live Trading Webinar were good for thousands of Dollars worth of quick gains into the weekend and this morning oil (/CL) was kind enough to dip back to our $48.50 buy lone and gasoline (/RB) is back below the $1.60 line at $1.59 and we love it long over the $1.60 line with tight stops below. See last week's Reports for options trade ideas we had for the Oil (USO) and Gasoline (UGA) ETFs at these levels as well as UVXY, which is still playable. And the Dollar (/DX) is back at the 97 line, where we like that long as well.

I was over at the Nasdaq yesterday and we discussed 3 different ways to hedge your bubblicious Nasdaq positions like Amazon (AMZN) $1,000 or Tesla (TSLA) $335 or Netflix (NFLX) $165 – all of which are a good 33% over even the most generous interpretations of a fair value and, in a downturn, could drop 20% as fast as Bitcoins – which also seemed like they would never go down.

I was over at the Nasdaq yesterday and we discussed 3 different ways to hedge your bubblicious Nasdaq positions like Amazon (AMZN) $1,000 or Tesla (TSLA) $335 or Netflix (NFLX) $165 – all of which are a good 33% over even the most generous interpretations of a fair value and, in a downturn, could drop 20% as fast as Bitcoins – which also seemed like they would never go down.

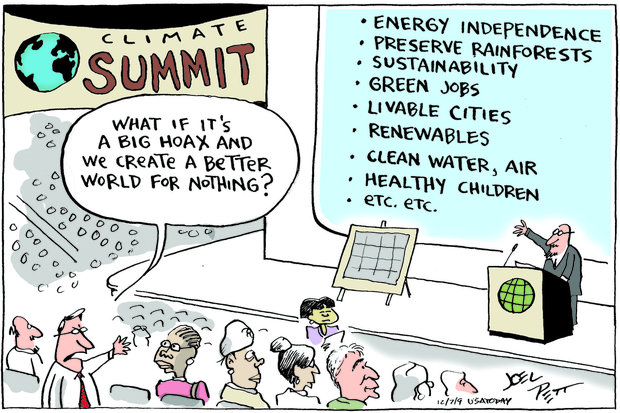

I was just the 8:30 guest on Benzinga's Pre-Market Prep (35 mins in) and we discussed our oil and gasoline longs as well as the overall economic situation so no need to go over it again here. At risk of having yet another post censored for political content, I will mention that Trump just pulled the US out of the Paris Climate Accord and that's terrible for humans, animals and our planet as well as alternative energy companies but good for coal (still dead) and other planet-killing fuels. Now you get to say you voted to end life on Earth – isn't that great?!?

That makes the US one of the World's renegade nations along with Russia and a few African countries and places us against the 198 countries that have signed the accord and, despite the US being responsible for 17% of the World's pollution, they will go on without us and simply sanction us for our pollution with trade sanctions based on our carbon output – only now we have no say in it, but at least we're on Putin's side!

Even Saudi Arabia has ratified the climate accords and now Putin can completely embarrass the US yet again by ratifying the treaty, once again showing how he stands with Europe against the madness of the United States. Well played Vlad!

Even Saudi Arabia has ratified the climate accords and now Putin can completely embarrass the US yet again by ratifying the treaty, once again showing how he stands with Europe against the madness of the United States. Well played Vlad!

Michael Oppenheimer, professor of geosciences and international affairs at Princeton, and a member of the Intergovernmental Panel on Climate Change, added, “it is now far more likely that we will breach the danger limit of 3.6 degrees,” the average atmospheric temperature increase above which a future of extreme conditions is irrevocable. “We will see more extreme heat, damaging storms, coastal flooding and risks to food security.”

That's right folks, you were there the day Donald Trump made a decision that ended humanity! What an honor! It's the kind of thing you could tell your great grandchildren about but, well – it's much less likely they'll be alive now…

Even better, as the rest of the World prioritizes investments in clean energy infrastructure and technology, the US will continue to power itself with coal and other fossil fuels – just like we did 100 years ago and that will make our country less and less competitive Globally. As you can see from this chart, coal is already not as cheap as wind or solar and those technologies are just getting started. This is the kind of bad decision that will impact us for generations but, fortunately, we don't have many of those left now.

We'll see if this has an immediate effect on the Solar Sector (TAN) or Coal (KOL) but the rest of the world (all but two major countries) is going the other way so it's really no help to the struggling coal sector and solar (and wind) is still a massive growth industry that the rest of the World is turning to in order to be competitive for the rest of our time on this planet – however short that may be now.

"America will never be destroyed from the outside. If we falter and lose our freedoms, it will be because we destroyed ourselves." — Abraham Lincoln

"Russia is the only country that can destroy America in a half hour or less" — Vladimir Putin