No, of course they won't.

No, of course they won't.

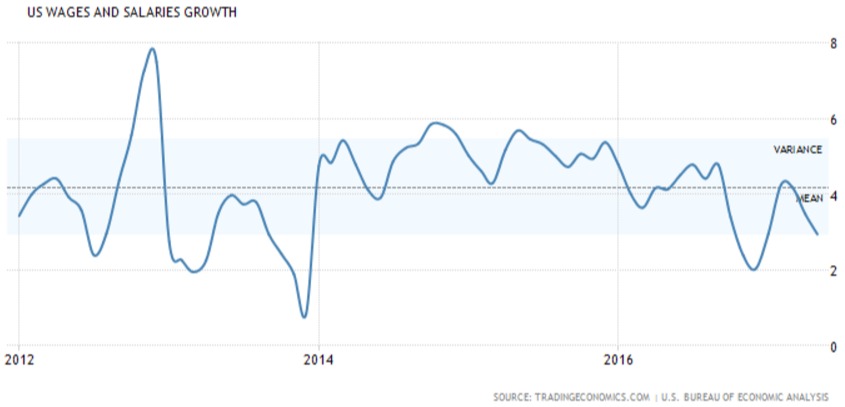

What can the World leaders possibly do to sustain these ridiculously over-priced markets? Things have simply gotten too expensive to buy – as in, there's simply not enough money in the World to buy the S&P 500 for 100% more than it was priced less than 5 years ago. That's 20% average growth in an economy where wages are rising at 4% and GDP is rising at 1.8% which simply suggests that stocks have gotten 100% more expensive for no particular reason.

We'll get some more payroll information later this morning but, historically, wages have grown 6.26% annually since 1960 and that INCLUDES the crappy growth we've had this past decade (wages were -5% in 2009, in fact) and the market has grown at about 8.5%. THAT we can accept. It makes sense, more money – bigger markets – sure, we get that.

What we have now, however, is a stock market that is outpacting wage growth, productivity growth, GDP growth – pretty much anything you want to measure growth EXCEPT the growth in income of the Top 1%, who are, of course, the primary owners of stocks. Their salaries have jumped about 25% in the same 5-year period but still, even that staggering amount of money isn't enough to justify the 100% rise in market prices.

What we have now, however, is a stock market that is outpacting wage growth, productivity growth, GDP growth – pretty much anything you want to measure growth EXCEPT the growth in income of the Top 1%, who are, of course, the primary owners of stocks. Their salaries have jumped about 25% in the same 5-year period but still, even that staggering amount of money isn't enough to justify the 100% rise in market prices.

When we say market bubbles, it's not really a bubble. People buy stocks every day and people sell stocks every day and prices go up when the buyers are more enthusiastic than the sellers and vice versa but the problem with that is, when the stocks get very expensive AND the sellers get enthusiastic – it becomes much harder to find buyers and you can get violent adjustments in price in order to satisfy the demand for CASH!!! (have I mentioned how much I love CASH!!! lately?).

When you have CASH!!! while other people are panicking, YOU are in charge. When a marlet is in a frenzy, as it is at the moment, then no one wants cash and everyone wants stocks, so the sellers of stocks are in charge and stocks get bid up to higher prices. Just because the small fraction of a company's stock that is being sold is sold at a high price does NOT mean the price set for the company is correct. See Tesla (TSLA) and their idiotic valuation, which corrected by 20% in the last two weeks – erasing a month of gains in just over a week:

As with yesterday, TSLA shares are being pumped back up in pre-market trading but we told you it was BS yesterday and it's the same BS today and we're still watching the same bounce lines that failed yesterday, using our fabulous 5% Rule™. Forbes just published: "Why You Should Sell Tesla On Week's $9 Billion Plunge" and Elon Musk's girlfriend is rumored to be leaving him and perhaps you should consider leaving the stock (we are short – see yesterday's report for details). As noted by Forbes:

The highly-touted $35,000 Model 3 is likely to cost Tesla shareholders $2,800 per copy sold. As I wrote, UBS believes that in order to break even on the Model 3, consumers will need to fork over $51,250 for the shiny electric car.

The losses on the Model 3 are likely to make Tesla's cash flow situation worse.

Goldman Sachs set a price target of $180 — 45% below its current level. "Analyst David Tamberrino, who reiterated a sell rating on July 5th, wrote that the Model 3 will initially lower its profit margins. Tamberrino lowered his price target for the stock to $180 from $190. He believes that demand for Tesla's other higher-end vehicles, the Model S and the Model X, are 'showing plateauing demand.'" according to MarketWatch.

8:30 Update: Non-Farm Payrolls indicate a healthy 222,000 jobs gained in June and May was revised up 14,000 to 152,000 with unemployment up just a bit at 4.4%. Average Hourly Wages went down 33%, from 0.3% to 0.2% and that's great for Corporations but bad for humans. Who needs minimum wage laws, right? Your boss should pay you only what you are worth and treat you like a disposable commodity and you should be thrown out without a safety net the second you are of no more use to the Corporations, right?

Yep, the G20 isn't going to save anyone – other than the Corporate Citizens who keep them in power.

Have a great weekend,

– Phil