Wheeeee – that was fun!

Wheeeee – that was fun!

Our trade idea in yesterday morning's PSW Report was, very simply:

Our favorite short at the moment is oil (/CL) below the $48.50 line with very tight stops above. We also like the Russell (/TF) below the 1,415 line – tight stops too.

Oil went the other way and we never got a proper entry but the Russell was perfect and gave us a long chance to go short at the open and then promptly began falling straight down to the 1,400 line for very quick gains of $750 per contract. This morning we flipped long at the 1,400 line, expecting at least a strong bounce which, after a 15-point drop, per our 5% Rule™ would be 6 points – to 1,406. Anything less than a strong bounce that holds into the close will be a bearish sign for tomorrow.

The market sold off for very good reasons but the selling volume was still pretty low (89M on SPY) though declining volume on the Nasdaq (1.36Bn) was 272% of the advancing volume (50M) so it's very unlikely that everyone who wanted to raise more cash got their wish on just yesterday's action.

Still, if we do make our strong bounce lines we'll have to stay long as this market has been indeftigable all summer long and it's not the kind of tide we want to be fighting. I did just send out a Top Trade Alert this morning with long trade ideas on Apple (AAPL), Wheaton Precious Metals (WPM), Limited Brands (LB) and IMAX (IMAX) which I will also be speaking about with Kim Parlee over at Money Talk this evening.

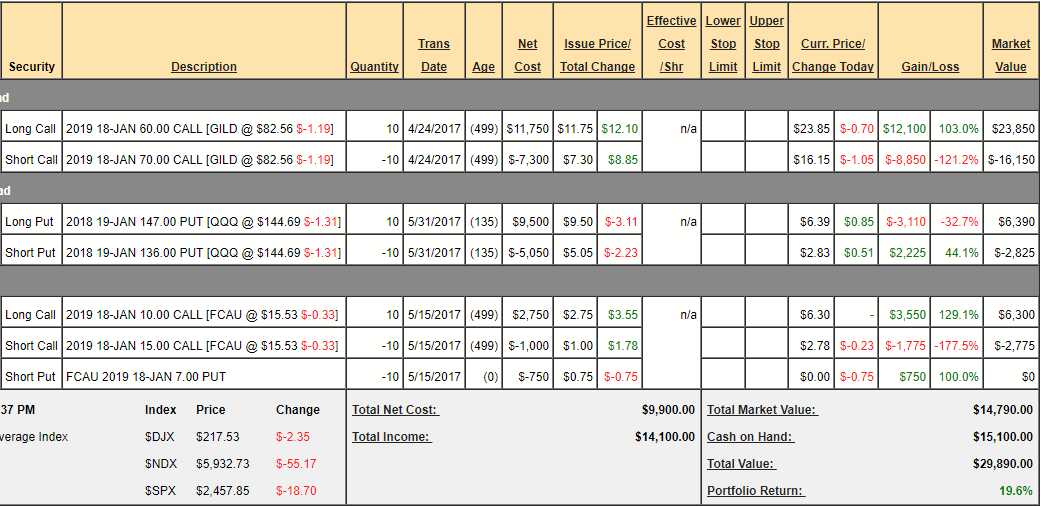

We're going to start a Money Talk Portfolio as we are retiring our Nasdaq Portfolio due to a change of policy over at the Nasdaq Live Show, where they don't want specific trade ideas discussed (they don't want to seem like they are favoring one stock over another) so, officially, we're done with that portfolio as it stands:

Though the portfolio is up 19.6%, we never deployed much of our $25,000, using less than $10,000 in cash to make $4,890 (49%) in less than 5 months. The SQQQ spread is losing, at the moment and is currently net $3,565 on the $11,000 bear spread and still has an upside potential of $7,435 (208%), which means it can still be used as a hedge in the new portfolio, which is starting with $50,000.

Though the portfolio is up 19.6%, we never deployed much of our $25,000, using less than $10,000 in cash to make $4,890 (49%) in less than 5 months. The SQQQ spread is losing, at the moment and is currently net $3,565 on the $11,000 bear spread and still has an upside potential of $7,435 (208%), which means it can still be used as a hedge in the new portfolio, which is starting with $50,000.

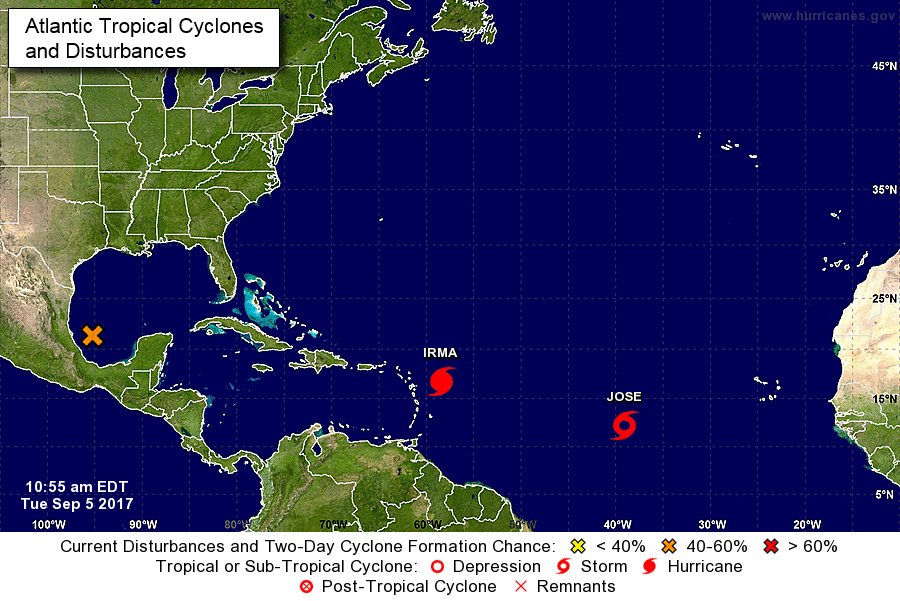

Meanwhile, we're back on hurricane watch already as Irma heads into the Caribbean and looks likely to go right between Florida and Cuba in what would be called a category 6 storm – if there were such a thing. Global warming may force us to add more categories to hurricanes and, sadly, these winds are higher than many homes are able to stand so we pray it passes without too much damage but it's not seeming likely the way it's heading.

This is what they mean when they say ignoring climate change is expensive because we're getting more frequent and more violent storms already (caused by warming waters) and Harvey was the most expensive storm ever at $50Bn and Irma could double that amount if it slams into Miami and Jose is right behind it and it was Rita and Sandy that held the previous records and that's K, L, M, N, O and P storms before we even get to R and S – so we have a lot of hurricane season to look forward to.

Generac (GNRC) should have legs and they've already popped 20% in the past two weeks and they can make $200M in a good year, which makes their $2.6Bn market cap a good deal on the anticipated revenue boost. Still, at PSW, we teach our Members never to pay retail for a stock and we can still sell the Feb $40 puts for $2.60, which gives us a nice net $37.40 entry (18% off) and that's nice for a poke by itself or, you can get more aggressive with the following spread:

- Sell 5 GNRC Feb $40 puts for $2.60 ($1,300)

- Buy 10 GNRC Feb $40 calls for $5 ($5,000)

- Sell 10 GNRC Feb $45 calls for $2.60 ($2,600)

That's net $1,100 on the $5,000 spread that's $2,000 in the money to start. The upside potential is $3,900 (354%) if GNRC is over $45 in 163 days and your worst case is owning 500 shares of a very nice company at $40 ($20,000). The ordinary margin requirement is $3,294 so a great return on margin in such a short time and you could avoid the margin by just buying the bull spread for $2,400 and that makes $2,600 (108%) with no margin at all at $45.

I also still like Lowes (LOW) who barely budged off last week's storm (when we picked them long) but this should widen the affected customer base and really boost their quarter so there's always a pot of gold at the end of those rainbows – if you know where to look. Home Depot (HD) is a good one too, of course but a LOW play does have 2019 options so we could go as follows:

- Sell 5 LOW 2019 $70 puts for $5.75 ($2,875)

- Buy 10 LOW 2019 $70 calls for $10.75 ($10,750)

- Sell 10 LOW 2019 $80 calls for $5.75 ($5,750)

I like LOW because it's hard for Amazon (AMZN) to substitute for their goods, since it's ladders and doors and wood and stuff. This spread pays $10,000 at $80 and it's more than halfway there to start but a long time-frame. The profit would be $7,875 (370%) from the $2,125 cash outlay and you're obligated to own 500 shares of LOW at $70 ($35,000), which I think is quite a good price for them as a long-term position.

Generally, I expect strong bounces today but failing those will put us back in bearish mode and /TF is sill my favorite short, as is oil (/CL), at $49.50 if we hit it or below the $49 line with tight stops if we don't because tomrorrow's inventory report is likely to show a build in crude with all the refineries shut down (though there are a lot of stranded deliveries too) and next week will be worse and, if Irma misses the Gulf – then no way will enough oil production go off-line to even things out.

We also called a long on Natural Gas (/NGZ7) at $3.185 this morning in our Live Member Chat Room and THAT is a great hurricane play if the storm does threaten the Gulf.

Be careful out there!