Well, this is what we've been waiting for.

Well, this is what we've been waiting for.

8:30 brings us the Durable Goods report and we keep shorting the Russell (/TF) Futures, unsuccessfully so far, in anticipation of a sell-off. Now we're favoring the S&P (/ES) shorts, as they are right on the 2,500 line – so it's easy to just set a stop above and short below to limit your losses. We're still using the $52 line to shore Oil (/CL) but taking quick profits when the dips reverse and, of course, tight stops above with a re-short at $52.50. That's what you have to do to play bearish in this market – quick in and out plays.

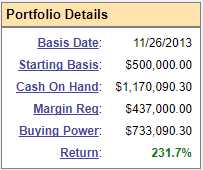

Why play bearish at all? Well, we're playing short-term bearish because the bulk of our portfolio allocations are in long-term bullish positions. That's the case in both our Options Opportunity Portfolio and our Long-Term Portfolio, which has gained another $51,816 (3.2%) since our 9/15 Review. That portfolio is 100% bullish and is now at $1,658,699 from our $500,000 start on 11/26/13 (up 231.7%) and we strive to lock in those gains by spending roughly 1/3 of the gains on short positions – like our Russell and Nasdaq hedges.

Why play bearish at all? Well, we're playing short-term bearish because the bulk of our portfolio allocations are in long-term bullish positions. That's the case in both our Options Opportunity Portfolio and our Long-Term Portfolio, which has gained another $51,816 (3.2%) since our 9/15 Review. That portfolio is 100% bullish and is now at $1,658,699 from our $500,000 start on 11/26/13 (up 231.7%) and we strive to lock in those gains by spending roughly 1/3 of the gains on short positions – like our Russell and Nasdaq hedges.

Of course, then we hedge the Short-Term Portfolio with additional longs and we tend not to lose the whole 1/3 we allocate to our shorts – it's just that we're willing to because we'd rather lock in 66% of our gains than go for broke – and end up that way when the market corrects (if it ever does). You might think we are not maximizing our gains but, of course, with a 58% average return, we're able to be far more aggressively bullish in our LTP than we would ever consider being if we didn't have our buffer hedges in the STP.

Unfortunately, we end up talking about our short-term shorts a lot more often than our long-term longs – that's just the nature of having daily reports. Our Long-Term positions rarely change but we're constantly tinkering with the shorts. It tends to give outsiders the impression we're market bears when, in fact, the Short-Term Portfolio only has 8 total positions while the Long-Term Portfolio has 62! Yesterday, we shared our Nasdaq Portfolio in the Morning Report and those are picks we made live on the air in April and May at the Nasdaq and those are up another 1% since yesterday, at 23.5% – and they even include a QQQ hedge – so we're betting against ourselves and still making 23.5% in less than 6 months!

Hedging makes investing fun. We don't sweat over all of our positions, we can take days off – even weeks – and not worry about what's happening in the markets. After training our Members to hedge long-term portfolios for the past 4 years, as of March we're not even going to work Mondays anymore. After all, we didn't become traders so we could be stuck at a desk for the rest of our lives, did we?

Hedging makes investing fun. We don't sweat over all of our positions, we can take days off – even weeks – and not worry about what's happening in the markets. After training our Members to hedge long-term portfolios for the past 4 years, as of March we're not even going to work Mondays anymore. After all, we didn't become traders so we could be stuck at a desk for the rest of our lives, did we?

If you are not having fun, you are doing it wrong and we're going to discuss that in today's Live Trading Webinar – which will be open to the public (1pm, EST) on what may be the last day of the great market rally. Well, maybe not the last day as the Fed has scheduled uber-dove Neel Kashkari to speak at 9:15, mitigating the damage of a poor GDP report.

Tomorrw we have the GDP at 8:30 and that too is likely to be revised down. The Atlanta Fed, in their GDPNow forecast, have taken their GDP forecast all the way down to 2.2%, just over half of where it was on August 1st, when they began making forecasts for Q3. That's why we call them "Economorons" – these people do not have a clue and all you are going to do is frustrate yourself if you insist on taking this whole game seriously – much like trying to win at a casino.

That's why we teach our Members not to play that game at all. We teach our Members to "Be the House – NOT the Gambler" – a very simple concept where we make most of our money selling risk premium to other traders – who all like to think they know what a stock is going to do. While we like to anchor our trades with value stocks (again, see yesterday's Report), we never assume they are going to go up and up. Our simple strategy is to find stocks that are not likely to go down and then set up trades that pay us when they only go down a little, or if they are flat, or if they go up.

Only when they go down a lot do we lose money but, since we mainly stick to stocks that we'd love to buy more of if they get cheaper – that's rarely a problem and that's where our allocations strategies kick in (see our Strategy Section for more details). In fact, in the video, which is from late 2011, Transocean (RIG) was an example at $44. We got called away but, even if we had stayed in it and let the stock go to the current $10.24, we were collecting $1.60 a month selling premium – and that was 72 months ago! That's how you can win with stocks the vast majority of the time – let other people PAY YOU to take risks!

For example, AT&T (T) is a perennial favorite of ours, ranging between $25 and $40(ish) for the past decade and now $38.72, so the high end of the range. They pay a lovely $1.96 (5.13%) while you wait but they are at the top of their range and we're not too interested in getting in now. HOWEVER, we would certainly like to own them for $30 so we can initiate a position by promising to buy T for $33 by selling the 2020 $33 puts for $2.75. That nets us in for $30.25 if it's assigned to us and, if not, we just keep the $2.75 ($275 per contract) for stock we never have to buy.

The ordinary margin on the sale is $2.46 so it's a margin-efficient play that returns over 100% on margin in just over two years. About 1/3 of our Long-Term Portfolio plays involve short-put sales like that: Stocks that we're happy to promise to buy in exchange for CASH!!! – IF they get cheaper.

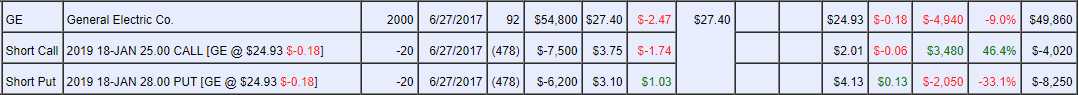

GE is cheap, down at $24.93, which is a market cap of $215Bn for a company that earned $9.5Bn last year and should do about $10Bn this year. While not a massive bargain at 20 times earnings, they are not likely to go much lower and the stock pays an 0.96 dividend (4%) while you wait. We jumped the gun early on GE and bought in at $27.40 back in June but, because we were BEING THE HOUSE – we're actually right on track in the LTP:

As you can see, though we bought the stock for $27.40, we felt it was still likely to head lower and we sold the 2019 $25 calls for $3.75 and the 2019 $28 puts for $3.10 (net $24.90 entry) so our target was firmly at $25+. The sales took $6.85 off our net cost so our basis was ($27.40-$6.85) $20.55 and, if we are called away over $25 in Jan, 2019, we will have a $4.45 (21.6%) profit AND we'll collect 6 dividend payments of $1.44 for another 7% profit. That's 28.6% profit in 18 months on a stock that goes DOWN from where we bought it.

If GE is below $28, we get assigned the stock again at $28 and re-initialize the process with another set of short puts and calls. Our main goal in this one is simply to collect a nice, safe dividend with cash that would otherwise be sitting on the sidelines collecting less than 1%. If you have $1M in cash collecting 1% ($10,000) and you put $250,000 of it into something that pays you 18%, like the above trade, you collect $7,500 from your 75% CASH!!! (have I mentioned how much I love CASH!!! lately?) position and another $45,000 from your stock and that's $52,500 – 5.25 TIMES more money in your pocket and all you do is risk owning a blue chip stock that pays a 4% dividend trading at 20x earnings. THAT is how you can BE THE HOUSE!

We sold calls to a guy who thought GE would go up and we sold puts to a guy who thought GE would go down and we don't give a crap what it does – as long as it pays our dividend – something GE has not failed to do in the past 100 years.

8:30 Update: Durable Goods came in in-line at 0.2%, down from last month's 0.8% (revised up from 0.5%) but in-line with expectations, so no real damage to the markets from that report and the indexes are up about 0.25%. The headline is 1.7% due to strong aircraft orders but last month at was down 6.8% due to weak orders – and the market ignored it. Today it will be an excuse for the bulls to push for a rally.

8:30 Update: Durable Goods came in in-line at 0.2%, down from last month's 0.8% (revised up from 0.5%) but in-line with expectations, so no real damage to the markets from that report and the indexes are up about 0.25%. The headline is 1.7% due to strong aircraft orders but last month at was down 6.8% due to weak orders – and the market ignored it. Today it will be an excuse for the bulls to push for a rally.

I can't even understand how GDP consensus is still at 3% – the hurricane alone should have knocked out half a point. Maybe I'm wrong and maybe the economy is much stronger than we think it is but I was down at the Nasdaq yesterday for my interview and, on the short walk back to my hotel, I saw dozens of empty store-fronts, some with cracked and broken windows – indicating they'd been empty for a very long time. That's in the middle of Manhattan – the retail center of the universe! And no, it doesn't mean Amazon (AMZN) is taking all the business.

Amazon, for all it's over-hyped glory, sold just $135Bn worth of stuff last year – WORLD-WIDE, out of $5.3 TRILLION in total US Retail Sales alone. That's just 2.5% of sales vs 10% for WalMart (WMT) and about the same as Costco (COST). Amazon is one of the shorts in our STP – we decided $1,050 was ridiculous and put our foot down back in July.

Amazon, for all it's over-hyped glory, sold just $135Bn worth of stuff last year – WORLD-WIDE, out of $5.3 TRILLION in total US Retail Sales alone. That's just 2.5% of sales vs 10% for WalMart (WMT) and about the same as Costco (COST). Amazon is one of the shorts in our STP – we decided $1,050 was ridiculous and put our foot down back in July.

Anyway, this is not about Amazon, this is about empty retail space all over the county and that's not due to Amazon gaining $29Bn (0.5%) in sales last year (out of $175Bn gained by all Retail) – that's just a case of reporters and analysts who can't do math, or use logic or check facts… There's something deeper going on and it's the erosion of the Middle Class, which is something that's hard to see in the numbers because MORE yachts are being sold, MORE jewelry is being bought, MORE $100/bottle wines are being drunk and that adds to Retail Sales, even as the day-to day purchases of ordinary Americans trails off.

The measurements of this economy do not account for the massive income disparity that is eroding the broader market and this is how you can become completely unprepared for a collapse. The rich get richer and the rest get poorer but MOST of the economy functions on taking care of the broader population and those empty storefronts are trying to tell us the population is in trouble while your "trusted" news outlets try to convince you it's only because Amazon is a super-stock and is taking over the planet.

Nothing to worry about here…