Another day, another mass shooting.

Another day, another mass shooting.

At least 50 people are dead and 200 are injured as a gunman (American male, 64) opened fire on the crowd from the 32nd floor of the Mandalay Bay hotel in Las Vegas, which overlooked the concert. According to the NRA, if only the crowd were all armed as well, they could have opened fire at the hotel and then the hotel residents, packing their legally purchased firearms, could have returned fire on the crowd and later we could sort through all the bodies and figure out who started it. Wouldn't that be better than just banning the guns?

As it is, this is simply horrific and yet another concert tragedy to bookend the Summer of 2017. The bombing in Manchester in May was terrorism, this was just a pissed off white guy, opening fire on a country music crowd, of all things. There's no amount of concert security that can protect you from automatic weapons fire from a hotel across the street.

All of Las Vegas went into lockdown following the incident, with flights grounded and guests ordered to remain in their rooms while police ran down leads on possible accomplices or other planned attacks. Thankfully, nothting else has happened – but this one was more than enough!

All of Las Vegas went into lockdown following the incident, with flights grounded and guests ordered to remain in their rooms while police ran down leads on possible accomplices or other planned attacks. Thankfully, nothting else has happened – but this one was more than enough!

Typically, the markets seem unphased by tragedy – and there was plenty of it over the weekend beginning with the massive unfairness of the Trump Tax Plan, which turns out to be exactly what we thought it would be – yet another transfer of wealth from the poor to the rich. As I have pointed out before, the rich have not gotten so rich that any attempt to increase their own wealth comes at a horrific cost to the "losers" in the equations – which is pretty much anyone not already in the Top 1%.

The new tax framework, which the White House rolled out Wednesday, is heavy on cuts for corporations, which tend to reward shareholders, as well as reductions for business owners. As a result, its benefits are skewed toward the wealthy – just over half of the cuts, which total $2.4Tn over a decade, would go to the Top 1% of taxpayers, who would see their after-tax incomes jump about 8.5% on average during the first year of the plan. In contrast, the Middle 20% of taxpayers would enjoy just a 1.2% bump. By 2027, 30% of taxpayers earning between $50,000 and $150,000 and 60% of those making between $150,000 and $300,000 would owe more to the government. Meanwhile, nine in 10 members of the Top 1% would get a tax cut.

There's nothing amazing about what Trump and his Top 1% are doing to this country. What's amazing is that by simply eliminating any negative views of Capitalism from our education system (and most TV and Film) for a few decades and by pushing forth the idea that anything that smacks of Socialsim (an economic system where the needs of SOCIETY are taken into account) is considered anti-American – has led us back to an economic situation this country hasn't sufferred through since we supposedly learned our lessons in the 1930s.

Of course, how can anyone be expected to know what happened in the early 1900s (other than a film version) when no one reads books anymore – or goes to movies where robots aren't crushing each other? Of course, kids better toe the line or they face serious jail time these days. In that same excellent movie (that nobody saw), then humble Harvard Professor Elizabeth Warren lays out the issues that drove her to run for public office but Warren too has been "radicalized" by the elite-owned media and painted as a fringe outsider – rather than an intelligent, concerned citizen.

THAT is a person who SHOULD be in Washington, looking out for the people's interest but, because she's a Democrat, the "deplorables" hate her automatically and hate what she says – even though what she is saying is that they are being treated unfairly and she wants to help them. If you think that must be frustrating for Elizabeth Warren – try being Hillary Clinton!

Of course, mankind has a history of nailing our would-be saviors to crosses rather than allowing them to change the status quo so Hillary and Elizabeth are in good company (don't forget, Jesus' big crime was annoying the bankers). Meanwhile, the people turn to false profits – as promised by Team Trump and all seem ready to completely ignore the facts – and math – and accept a tax structure that will put the nail in the coffin the Middle Class is being buried in. Needless to say, this will not end well.

Of course, mankind has a history of nailing our would-be saviors to crosses rather than allowing them to change the status quo so Hillary and Elizabeth are in good company (don't forget, Jesus' big crime was annoying the bankers). Meanwhile, the people turn to false profits – as promised by Team Trump and all seem ready to completely ignore the facts – and math – and accept a tax structure that will put the nail in the coffin the Middle Class is being buried in. Needless to say, this will not end well.

Meanwhile, our job is to become as rich as possible because it is really going to suck to be anything less in Trumpmerica. The longs in our portfolios are doing very well (see our weekend portfolio reviews) and there's still time to grab the index puts we featured in last week's PSW Reports. Unfortunately, it's a bit late now to follow our oil short (/CL) using the Futures at $52.50 as we just crossed below $50.50 for gains of $2,000 per contract from the top. On Thursday, we featured an options trade, using the Ultra-Short ETF (SCO) as an alternative:

If you don't trade Futures, you can play the home game with the Ultra-Short ETF (SCO), which is down about $32.50 and we can assume things calm down in a month and go with a November spread like:

- Buy 10 SCO Nov $32 calls for $2.50 ($2,500)

- Sell 10 SCO Nov $37 calls for $1.50 ($1,500)

That's just $1,000 on the $5,000 spread and makes $4,000 (400%) if SCO is over $37 in mid-November and it was at $40 at the beginning of the month, when oil was $47.50 so we're looking for a 10% correction in oil between now and Nov 17th (option expiration day). For those of us who lose money on Oil Futures shorts, rather than stay on the roller-coaster, we can shoot to get even by playing with 1/4 of our loss, rather than letting the whole thing ride with all the current uncertainty.

SCO is already blasting over $35 this morning and our spread is looking good with the Nov $32s already at $4.40 while the short $37s are $1.95 so net $2.45 ($2,450) is up $1,450 (145%) in just two market sessions and well on the way to the full $4,000 gain so still not a bad play from here – if you don't mind picking up our scraps. If you don't like to miss the first 145% of a planned 400% gain – you can subscibe to the PSW Report for only $3/day and you will have these morning Reports delieverd to you, in progress, at 8:35 each morning.

Making 145% in two trading days is a great way to move on up towards the Top 1% and, believe me, they did NOT make their money by putting in overtime at the plant (perhaps by ordering it, though). Ridiculous gains like these are a direct result of the kind of market manipulation we track at PSW and it's getting worse and worse as the rich get richer and more powerful and Trump has his regulators looking, not just the other way – but for ways to HELP distort the markets, which the President considers the primary measuring stick of how he's doing.

Keep in mind, our index hedges are hedges, which we expect to LOSE money on if the market keeps climbing. The trick is to have plenty of long plays to back them up and, again, we had plenty of those ideas in the last few weeks of Reports as well. In fact, we also did a Top Trade Alert Review over the weekend and our March/April/May period saw 13 alerts sent out, 10 of which were winners (76%) for a net gain of $24,665 so far.

There should be some buzz in the security space this week – especially as I'm sure the idea will be raised about hotels screening bags like airports do. Companies benefitting from this would be Analogic (ALOG) and OSI Systems (OSIS) and the penny stock, View Systems (VSYM) is also interesting at 0.02 but all these require more research before I would call them a pick, though I'll toss $500 and VSYM just for fun! Consider it a Vegas craps roll…

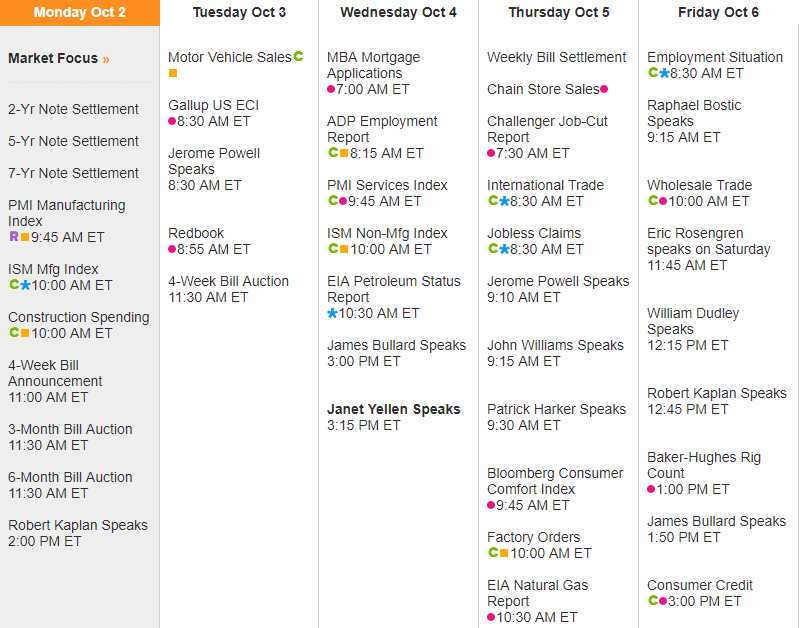

The Fed's Robert Kaplan will speak at 2pm this afternoon and then Yellen will come to bat Wednesday at 3:15 and then 9 Fed speakers on Thursday and Friday, so one has to wonder what they are worried about? Non-Farm payrolls is the Big Kahuna on Friday Morning but it's nothing but record highs today – including Russell 1,500 – so don't say you couldn't get a good entry on the Ultra-Shorts (TZA).

A few earnings are trickling in as well:

Be careful out there,

– Phil