Or is the stock market broken? Can the stock market be broken? Something is clearly wrong at this point as market prices have nothing to do with earnings, which have dropped dramatically this year, running 15% lower than they were at the start of 2017 yet the market is acting as if those projections were being exceeded by 15%.

As a fundamental value investor, it's very hard for me to get behind a rally that has taken the Russell (IWM) up 18% in 9 months and all of that has come since the Russell went back to 0% in mid-August – so we're talking 18% in 45 days. Yes, there is a little sour grapes here as the Russell is one of our hedges but that's BECAUSE the run is so ridiculous – that's what makes it a good hedge (in theory).

What makes it a bad hedge is it's been up 23 of the past 28 days – an incredible run that is very close to mirroring the previous record, which was set in 1998, right before the small caps collapsed 38%, leading the rest of the market lower in a correction that was sparked by concerns over Russia's economic collapse as well as data that showed the US economy slowing.

What makes it a bad hedge is it's been up 23 of the past 28 days – an incredible run that is very close to mirroring the previous record, which was set in 1998, right before the small caps collapsed 38%, leading the rest of the market lower in a correction that was sparked by concerns over Russia's economic collapse as well as data that showed the US economy slowing.

Our biggest fear duing this rally has not been Russia but China and Japan, as both countries are 250% in debt and can't afford a misstep but, so far, they haven't had one and their economies have both shown signs of improvement this summer. Despite the turmoil in Spain and Brexit, the EU seems intact and the broad story of a Global recovery seems to be holding water – so many good reasons for the broad-market rally to continue – but that doesn't mean the Russell can't be getting ahead of itself.

Of course the big catalyst is Trump's proposed tax cut – that's what sparked an 18% gain in 90 days but is the tax cut REALLY going to happen or is yet another Republican fantasy being sold to us by an Administration that is 0/1,000 in passing legislation so far?

As I have been repeating a lot lately (see almost every September Report) it's not that we're bearish. In fact, 43 of our 47 Trade Ideas for our Members in September were bullish Trade Ideas. However, I do preach taking 25-33% of our profits an putting them into bearish hedges and, because those are short-term positions that are frequently adjusted – we end up talking about them a lot more than our "boring" long-term longs, which make the other 67-75%.

As I have been repeating a lot lately (see almost every September Report) it's not that we're bearish. In fact, 43 of our 47 Trade Ideas for our Members in September were bullish Trade Ideas. However, I do preach taking 25-33% of our profits an putting them into bearish hedges and, because those are short-term positions that are frequently adjusted – we end up talking about them a lot more than our "boring" long-term longs, which make the other 67-75%.

It was just 30 days ago that North Korea's Kim Jong Un detonated a hydrogen bomb over Labor Day Weekend. The Russell was at 1,415 that day, now up 100 points (7%). 2 Major hurricanes hit us and a third hit Puerto Rico on the 20th – yet up we continued. Is our lesson then to buy whenever something bad happens or, because the market is broken, just BUYBUYBUY all the time?

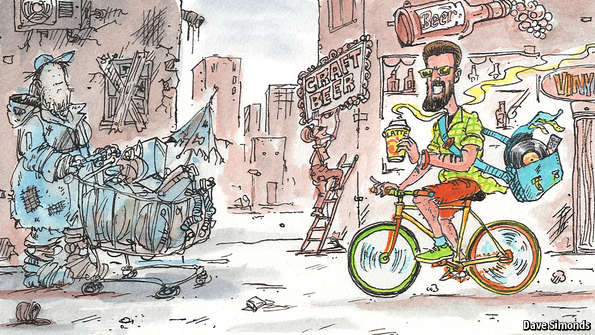

Who does a broken stock market benefit? Well certainly the Top 10%, who own 80% of all US assets. That's why "no one" is complaining about the market rally – how many people do you even know in the bottom 90% and how many of them understand that the 10% gain in their IRA might be $20,000 while it's more like $200,000 for people in the Top 10% (on avg – some get much, much more and some less) – which only serves to widen the wealth gap even further.

How does my wealth hurt the average citizen? Well, for example, I have a nice house ($800,000) and I want to build a pool but I can't build a big enough one on my yard so I buy my neighbor's house ($500,000) and knock it down and build a pool and a tennis court for another $300,000. Is my new house with double the property and a pool and a tennis court now worth $1.6M? Maybe not but it's probably worth $1.2M and, if the house appreciates 5% a year, that's another $60,000 a year and my "loss" is erased in 7 years so, if I'm planning to stay around that long – why not? After all, I just made $200,000 in the market so covering the additional mortgage is no big deal.

How does my wealth hurt the average citizen? Well, for example, I have a nice house ($800,000) and I want to build a pool but I can't build a big enough one on my yard so I buy my neighbor's house ($500,000) and knock it down and build a pool and a tennis court for another $300,000. Is my new house with double the property and a pool and a tennis court now worth $1.6M? Maybe not but it's probably worth $1.2M and, if the house appreciates 5% a year, that's another $60,000 a year and my "loss" is erased in 7 years so, if I'm planning to stay around that long – why not? After all, I just made $200,000 in the market so covering the additional mortgage is no big deal.

Did my wealth hurt anyone? Of course it did! If everyone in the Top 10% doubled their property, there would be 10% less property available in the town but I already own twice as much property as most of my neighbors and way more property than the bottom 50% of my town so really the Top 10% already have 25% of the property and doubling our lands would use up 50% of the towns land, leaving just 50% for the bottom 90%. Effecitively, our actions have taken 1/3 of the bottom 90%'s land away.

That makes land much more expensive for the rest of you (as I've made it scarce) and, even worse, I've effectively decreased the population of the town (no more neighbor) which increases the net per-capita tax burden you must pay to keep things running. It also decreases the customer base of local merchants, which forces them to charge more to meet their increasing rents and taxes and the marginal players begin to close down and good riddance to those discount stores with low margins – because I never shop there anyway.

Those vacant stores get replaced by higher-priced stores that can afford the rents and I'm thrilled because I don't mind paying 30% more for organic groceries and gourmet coffee because my grocery bill is roughly the same as yours + 30% but my income is nothing like yours at all – so you may spend $10,000 a year on food and $3,000 more is 15% of your stock gains while I spend the same $13,000 for my family and $3,000 a year is only 1.5% of my stock bonus. What else can we buy?

Those vacant stores get replaced by higher-priced stores that can afford the rents and I'm thrilled because I don't mind paying 30% more for organic groceries and gourmet coffee because my grocery bill is roughly the same as yours + 30% but my income is nothing like yours at all – so you may spend $10,000 a year on food and $3,000 more is 15% of your stock gains while I spend the same $13,000 for my family and $3,000 a year is only 1.5% of my stock bonus. What else can we buy?

The same thing happens to restaurants and clothing stores and everything else you might want to buy. Slowly but surely our upper-class gentrification drives up the prices and now there's suddenly a "nice" mall in town that used to be a regular mall and you can't afford it anymore so you have to go to the "other" mall but prices there have gone up too as there's less available retail space due to all the designer shops moving in. You know the designer shops – things in there cost thousands and there's often just one saleperson who sits there all day and makes one sale that has more profit than the store in your mall with 5 people who sell low-priced tchotchkes all day.

Oops, and there's more damage I cause – unemployment. When rents go up jobs get cut and those luxury stores tend to employ less people because most of you wouldn't even dare walk in to one of those places, right? You know that feeling – you walk in and they size you up in a second and the salesperson doesn't even look up from their magazine – other than to make sure you aren't stealing anything. You may think the salespeople are "snooty" but when WE come in, they couldn't be more charming. Did you even know they have a cappuccino machine for the customers? Those "snooty" salespeople turn downright friendly when they smell money walking through their door!

Oops, and there's more damage I cause – unemployment. When rents go up jobs get cut and those luxury stores tend to employ less people because most of you wouldn't even dare walk in to one of those places, right? You know that feeling – you walk in and they size you up in a second and the salesperson doesn't even look up from their magazine – other than to make sure you aren't stealing anything. You may think the salespeople are "snooty" but when WE come in, they couldn't be more charming. Did you even know they have a cappuccino machine for the customers? Those "snooty" salespeople turn downright friendly when they smell money walking through their door!

That's another way the rich mess with your life. When I go to the local restaurant, the waiter knows I'm a big tipper, so I get more attention – who do you think ends up geting less? I don't need to make reservations either. I'm going to get the best plumber, the best lawn guy, the best electician, the best handyman, doctor, dentist… and you will have to wait for them to be free or find someone else and my kids will go to the best schools and then I'll vote no to funding your school – because my kids don't go to that crummy place anyway.

And don't even think about what my wealth does to the cost of your kid's college (if they can get there with that crummy education). Who on Earth can afford $50,000 a year for tuition and another $20,000 for living expenses? We can – that's only 1/3 of my stock gains this year but it's 350% of yours! There's a good example, in fact, of how my wealth makes you poor. My kid's college causes me to save "just" $130,000 of my $200,000 gain this year while your kid's college costs you 3.5 years worth of GREAT market gains every year for 4 years – that's 14 years of your stock market gains wiped out sending one kid to school.

How's that $20,000 looking now?

How do you level the playing field so the Bottom 90% have even a chance of not being broke when they retire? Well taxes are a good way to redistribute the wealth but, OOPS, the GOP tax plan will only add 1.2% to your $60,000 salary ($720) while it adds 8.5% to my $200,000 salary ($17,500). See – it works just like the stock market – good for you but so much better for me that I will destroy you and your family with my wealth.

How do you level the playing field so the Bottom 90% have even a chance of not being broke when they retire? Well taxes are a good way to redistribute the wealth but, OOPS, the GOP tax plan will only add 1.2% to your $60,000 salary ($720) while it adds 8.5% to my $200,000 salary ($17,500). See – it works just like the stock market – good for you but so much better for me that I will destroy you and your family with my wealth.

Well, at least when I pass away the money will – OOPS AGAIN – no more death tax means my kids and my grandkids will start their lives with HUNDREDS of times more money than yours will.

Love and kisses from the land of opportunity (sucker)!

– Phil

Is

Is