Go Japan!

As you can see from the chart, the Nikkei is up 600 points (2.8%) since Thursday's close as Prime Minister Shinzo Abe's party retained its 2/3 majority in the Diet (Parliament) – though it doesn't REALLY matter as Japan, like the US, is actually controlled by large Corporations. “Corporate Japan is determined to play a role in rebuilding our economy and is cooperating with the Abe administration’s strategy,” Sadayuki Sakakibara, chairman of Japan’s main business lobby Keidanren, said in a statement..

Either way, the end result is a continuation of Japan's ultra-easy money policies that have led the nation to over 1.2 QUADRILLION Yen of Debt, which is $12.5Tn(ish) and 250% of their annual GDP.

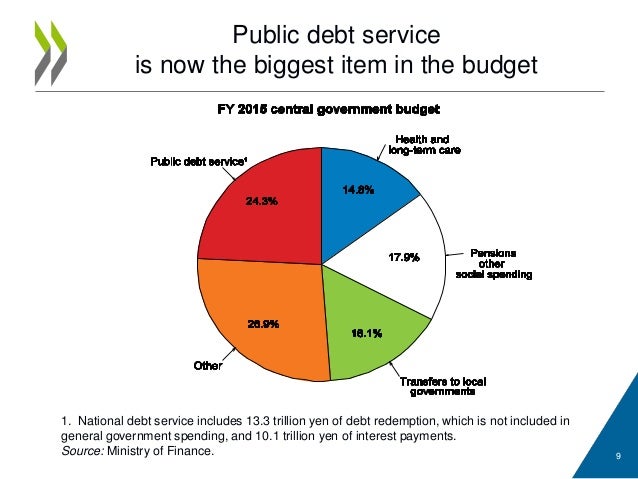

The reason no one is worried about the US being $20Tn in debt is because it's "only" 110% of our GDP and that means we can borrow another $20Tn and STILL look better than Japan but Japan is a ticking time bomb, where 24.3% of Government revenues went to debt service alone last year – and that's at these ultra-low interest rates. Japan, by the way, like the US, gets 41% of their tax revenues from the Social Security contributions of an aging population and only gives back 17.9% but the people don't seem to mind – they just voted for much more of the same.

The reason no one is worried about the US being $20Tn in debt is because it's "only" 110% of our GDP and that means we can borrow another $20Tn and STILL look better than Japan but Japan is a ticking time bomb, where 24.3% of Government revenues went to debt service alone last year – and that's at these ultra-low interest rates. Japan, by the way, like the US, gets 41% of their tax revenues from the Social Security contributions of an aging population and only gives back 17.9% but the people don't seem to mind – they just voted for much more of the same.

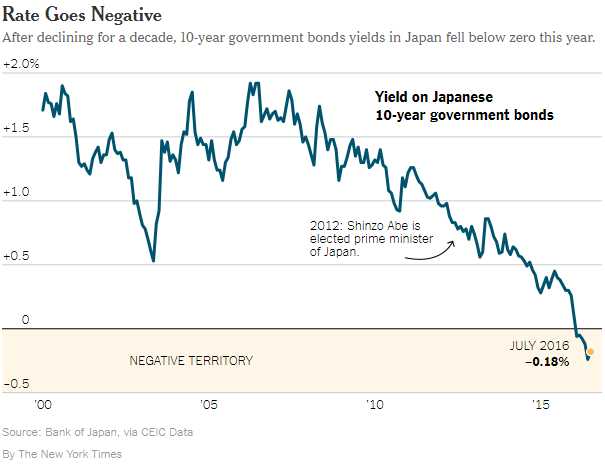

Japan is able, so far, to sustain their massive debts because their current borrowing rate is essentially negative. The Japanese people and even the Corporations consider it their duty to support the Government by buying bonds, and they do so at any price – even when the rates are costing them money to save. Things will be fine for Japan as long as the rates stay below 0.5%, where they have been for the last 5 years but, over that, and the share of debt service goes up 12.5% with each half point of intererst – Japan is one credit downgrade away from a real catastrophe.

In theory, the negative rates are supposed to spur consumer borrowing and spending but, like in the US, low wages for the Bottom 90% have kept spending and prices stagnant and, like in the US, the Top 10% just can't quite seem to figure out what is wrong with those lazy poor people – why won't they go shopping? The buying power of the Yen has dropped 12% in the last 12 months which, coincidentally, is about the same as the decline of the Dollar's buying power since Trump was elected. In both cases, that's a 12% confiscation of your life's savings by the Government but, because it's abstract, no one seems to complain.

Fortunately for us, there are no strong currencies (other than BitCoin) as we're pretty much in a Global race to the bottom as all the Central Banks are running the printing presses 24/7 to cover up what is still a struggling global economy. As I noted last week, a lot of this FREE MONEY finds its way into the hands of our Corporate Masters who, lacking any better ideas to improve their bottom line, use the money to buy back their own stock and thus make is LOOK like earnings are improving when, actually, it's just the number of shares they dividen the earnings by that's making things look much better than they really are.

IBM (IBM), for example, just jumped over 10% on earnings that put them on pace to earn $13Bn this year and the stock is up 20% from it's 2006/7 highs of $130/share but, in reality, revenues are way down, earnings are way down and even earnings divided by the lower share base are down – yet the PRICE just keeps going higher.

Now, we're long on IBM, so I'm not here to dis them (we think they are a long-term grower and, artificial or not, NOW they have less shares to divide the earnings by) but this is what's happening across the board in the markets as investors are overpaying for stocks like they have never overpaid before (with the exception of the Dot Com bubble, of course). This time is different – now they are overpaying for every sector – not just tech!

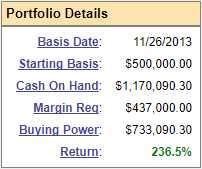

We did our Member Portfolio Reviews last week and we TRIED to find things to cash out of but, the way this market is holding up, we just have to hold our noses, cross our fingers and hope our hedges hold up when we finally do get a correction. Our Long-Term Portfolio is 70% CASH!!! (have I mentioned how much I like CASH!!! lately?) and is well on-track for our 40% annual goal. We're using very little margin and looking for bargains into earnings and most of our adjustments have been bullish ones.

We did our Member Portfolio Reviews last week and we TRIED to find things to cash out of but, the way this market is holding up, we just have to hold our noses, cross our fingers and hope our hedges hold up when we finally do get a correction. Our Long-Term Portfolio is 70% CASH!!! (have I mentioned how much I like CASH!!! lately?) and is well on-track for our 40% annual goal. We're using very little margin and looking for bargains into earnings and most of our adjustments have been bullish ones.

Unfortunately, at this point, people are giving up and looking for RELATIVE bargains, which is something we discourage. There are still plenty of companies out there that generage a good cash-flow in relation to the amount of money you spend on a share and those are the companies we like to keep in our LTP whereas, in our Options Opportunities Portfolio, we tend to be a bit more – opportunistic…

Last weeks Sketchers (SKX) trade was a good example of an opportunistic trade, as we grabbed them ahead of earnings. SKX is a stock we often buy into and $24 was too cheap to ignore on Thursday. As noted in our PSW Report, the trade idea for SKX was:

- Sell 10 SKX 2020 $20 puts for $3.20 ($3,200)

- Buy 10 SKX 2020 $25 calls for $6.25 ($6,250)

- Sell 10 SKX 2020 $35 calls for $3.25 ($3,250)

It's a long-term trade where we planned for SKX to be over $35 (up 50%) in just over 2 years but we got an early gift as the stock gained 41% on Friday as it was even more undervalued than we thought it was. The spread was a net credit of $200 and the short puts obligated us to buy 1,000 shares of SKX for $20, but that's not going to happen and already the short puts have fallen $1.80 ($1,800) but, for that price – I'd sell more rather than buy them back! The $25/35 spread is still just $5 so net $3.20 ($3,200) on the spread is up $3,400 (1,700%) in a day and that's only "on track" to our full $5,200 expected pay-off.

That means that, even if you aren't a Member and didn't get this trade idea hot off the wires on Thrusday, you can STILL get in today for $3,200 and it's hard to imagine not making $1,800 (56%). 28% a year is still better than almost any hedge fund so, if you are too cheap to subscribe to our service, you can still make a pretty good return playing with our scraps – enjoy!

This week, we hear from 150 of the S&P 500 companies and THEN we will have a better idea of whether or not we should be putting more money to work – or taking more off the table. As I mentioned last week, I transferred ALL of my kids' 529 College Plans to CASH!!! as it's hard to hedge them and I didn't see it being worth the risk. Our own portfolios are, of course, well-hedged and we'll want to see those guidance projections turning around before we're motivated to risk our children's futures over the Holidays.

Meanwhile, there's lots of fun ways to make money while we wait. Silver (/SI) is back to $16.90 and that's down 0.40 from Thursday's close but back to where we went long on Wednesday so why wouldn't we play it again (with tight stops below) as it was a $1,500/contract winner last time? $16.75 should be the low-low, so that's where I'd look to try again if $16.90 fails and we'll follow up on this one into Wednesday's Live Trading Webinar.

We also discussed Coffee (/KCH8) last week at $1.28 and it's still only $1.29 so don't say I didn't tell you so over and over and over again on that one! Natural Gas (/NGV8) has already popped to $3.027 so you're welcome for that $370 per contract winner (since Thursday!) but it's a long-term hold for us – or at least until we're up at least $1,000 per contract so again, enjoy our Member's leftorvers!

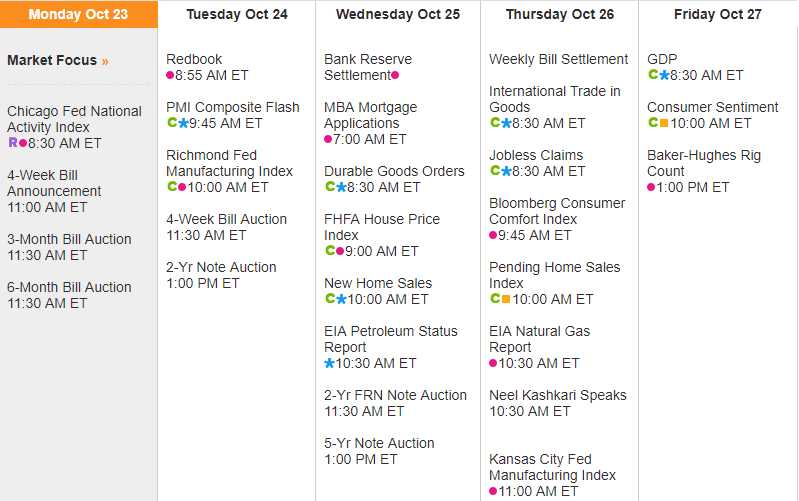

Economically, it's a pretty slow week, with PMI Tuesday, Durable Goods Wednesday, Consumer Comfort Thursday and GDP Friday and not much Fed speak either – Yawn!

Things will heat up again as we roll into November but, unless earnings take a nose-dive, I think Buffett is correct and the markets will hold up into next year – as Team Trump is promising us rich folks MUCH lower taxes on our gains next year – so why should we take profits this year? Unless we think the market is going to correct more than 10% – there's no logic in taking our gains off the table ahead of "the biggest tax cut in history." Oh, and in case you're in the middle class – enjoy the $800 per family they are promising you. Yes, very fair and balanced indeed!

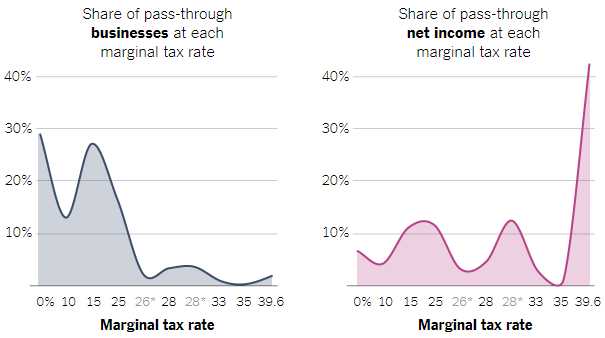

The key to our tax savings is the 25% "pass-through" rate vs the 39.6% individual rate we pay now (on incomes over $418,400). You see, it SOUNDS like it's helping small business people but 1.7% of those businesses pay 40% of all the taxes and that is where the bulk of the Trump Tax cuts will be ailmed – so "ordinary" people like you and me and Donald Trump, who have accountants that put most of our money throught Trusts, Partnerships and S-Corps, will now pay the same tax rate as people who make $37,950 a year – without ANY deductions at all (no more silly charity donations needed) – God Bless America!!!

The key to our tax savings is the 25% "pass-through" rate vs the 39.6% individual rate we pay now (on incomes over $418,400). You see, it SOUNDS like it's helping small business people but 1.7% of those businesses pay 40% of all the taxes and that is where the bulk of the Trump Tax cuts will be ailmed – so "ordinary" people like you and me and Donald Trump, who have accountants that put most of our money throught Trusts, Partnerships and S-Corps, will now pay the same tax rate as people who make $37,950 a year – without ANY deductions at all (no more silly charity donations needed) – God Bless America!!!

Isn't it GREAT… again? And what will happen to the $350Bn we used to contribute to the Government to fund those programs the poor people seem to be so fond of? We don't care! That will be the next administrations' problem (and if they are Democrats – it will be all their fault anyway) but we're warning them now: If they try to raise taxes on us – we're just going to leave, because that's how Government works; the rich threaten the Government and the Government rolls over and does whatever we want – just as the founders intended!