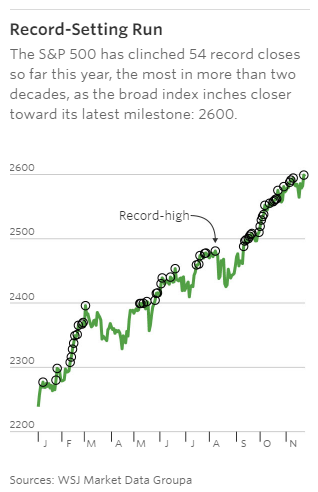

We''ve had 54 record closes in 220 market days so barely a week has gone by this year without a fresh record high but don't call it a bubble – because this is how the market will just go from now on and we'll all be Billionaires when we retire and the Fed is worried that inflation will be TOO LOW.

The key to what went wrong for the forecasters this year was the lack of inflation, something Federal Reserve Chairwoman Janet Yellen has described as a “mystery.” As the year went on, investors became increasingly convinced that inflation would stay dormant, bringing down long-term bond yields and the dollar even as decent economic growth boosted profits and stock prices.

Sure, something in this narrative doesn't add up but that's why Greenspan called it "irrational exuberance" last time something like this happened but he called it way too early and the market went on to add another 100% after that. Perhaps that's why forecasters are now very gun-shy about calling a market top here – they could be 100% wrong by the end of next year, when we're at S&P 5,000.

As noted earlier in the week, we got a bit more bullish in November as there doesn't seem to be any way this market is going down at the moment. We still have our hedges and we still have plenty of CASH!!! (have I mentioned how much I like CASH!!! lately?) but we are quick to pick up bargains when they present themselves – just in case this party never stops and we need some fresh horses to run with.

This morning, in our Live Member Chat Room, we took a long poke on the Dolar (/DX) at 93 and we'll see how that goes. We're hearing chatter about strong Black Friday Retail Sales numbers and, if true, that would indicate more demand for Dollars than is being priced in. The Dollar is often artificially pushed down in order to boost things that are priced in Dollars like oil and stocks and it's much easier to manipulate the currency on slow holidays – when most of the honest traders are off-duty. We're hoping for a nice little bonus next week if things reverse back to "normal."

Normal will have to include China's CSI 300 Index plunging 3% yesterday (0.5% weak bounce today) on news of tightening standards for the Financial Sector, who are heavily leveraged. In fact, the 10-year yield on China Development Bank debt this week exceeded 5% for the first time since 2014, while that on similar maturity government notes topped 4%. 4% or 5% yields on the US's $20Tn in debt would be as high as $1Tn per year and would add $700Bn to our annual deficit but don't worry – it's China, right?

Perhaps it is time to start worrying about Chinese bonds. Tightening regulation has provoked a sharp selloff in the $9 trillion fixed-income market, with collateral damage to share. If stress is sustained, it could infect China’s giant pile of foreign-currency debt.

Perhaps it is time to start worrying about Chinese bonds. Tightening regulation has provoked a sharp selloff in the $9 trillion fixed-income market, with collateral damage to share. If stress is sustained, it could infect China’s giant pile of foreign-currency debt.

Anxiety has been increasing all year, as President Xi Jinping takes a tougher line on financial risk. Regulators have suppressed techniques abused by speculators, such as short-term borrowings using bond-repurchase agreements and so-called negotiable certificates of deposit. This crackdown, combined with expectations of higher rates, had pushed up benchmark yields without much panic until this week, when Central Bank Guidelines targeted excesses in the $15Tn asset management industry.

Nonetheless, Chinese companies, who are already swimming in debt, sold 24% more bonds this year than last year and outstanding debt is now about $2Tn. This is the same kind of crisis situation we had in 2015 – except with more than twice as much debt as there was then and much more of it priced in Euros, Yen and Dollars, which means the impact will be felt more internationally and, if the Yaun loses value on this issue – even worse for Chinese at home as well.

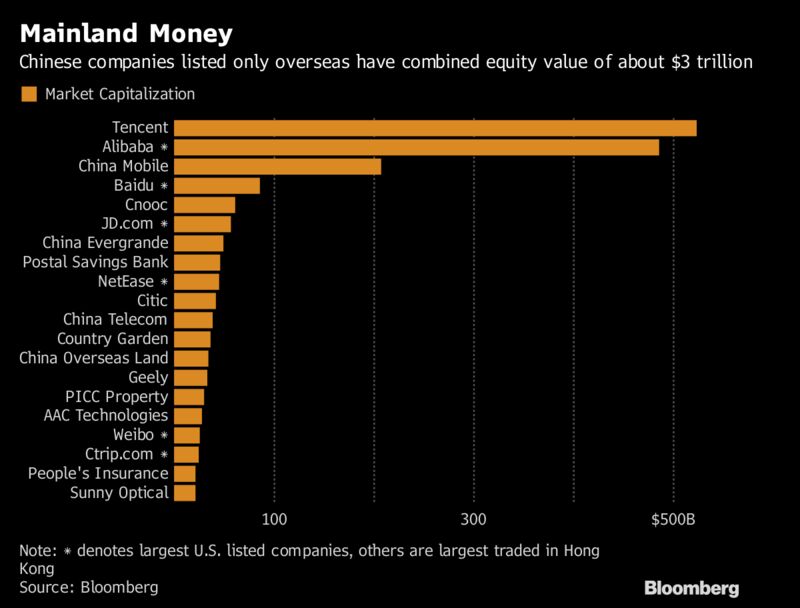

Interestingly, in fact, 5% of the US stock market's gains since Trump was elected have been from the $250Bn gain in China's Ali Baba, whose symbol is (BABA) on the Nasdaq. That's 1/3 of an Apple (AAPL) they have gained in a year while, as a group, Chinese companies listed in the US are now over $2Tn, 4x bigger than they were when we supposedly learned our lesson in 2015.

Interestingly, in fact, 5% of the US stock market's gains since Trump was elected have been from the $250Bn gain in China's Ali Baba, whose symbol is (BABA) on the Nasdaq. That's 1/3 of an Apple (AAPL) they have gained in a year while, as a group, Chinese companies listed in the US are now over $2Tn, 4x bigger than they were when we supposedly learned our lesson in 2015.

I've already cried BS that BABA claimed $25Bn in sales on the "Singles Day" last week while the US HOPES to do $3.5Bn on Black Friday – something there doesn't add up and, if BABA is faking their numbers to that extent – how can we trust any of these Chinese valuations? The nominal market capitalization of China-listed companies is about $7.7Tn, or 8.3% of the global total, Bloomberg data shows.

That's enough of a red flag to keep us in our hedges and we also like the S&P Futures (/ES) short at 2,600 and the Nasdaq Futures (/NQ) short at 6,400 and we already have Russell (/TF) shorts at 1,520 so plenty of fun things to play with on what's likely to be a very slow trading day (US markets close at 1pm).

Have a great weekend,

– Phil