China's markets fell 2-3% this morning.

Losses for Chinese companies came after the yield on the nation's 10-year Treasury note ended unchanged at 3.98%, trading within a striking distance from its three-year high. "Whether the selloff is a slight correction after a strong surge in 2017, or steeper declines on the way, remains to be seen," Hussein Sayed, chief market strategist at FXTM, wrote in a note. "However, rising bond yields, particularly junk bonds, should keep investors worried." “The Chinese stock market drop is reminiscent of the selloff that we saw in the summer of 2015, and that is causing some investors to become cautious going into the thin year-end markets,” said ING currency strategist Viraj Patel, in London.

South Korea's market also took a tumble, finishing the day down 2.4% and led down by Samsung's 5.1% drop but that was nothing compared to Qudian's (QD) 20% pullback (see chart above), now down more than 60% since their IPO last month and a great example of what I was talking about last week, when I said we need to be concerned with how much of our own US Markets are now indexed against Chinese companies of EXTREMELY QUESTIONABLE valuations.

Now that we've established that I do know how to connect a few dots, I will once again point out that China is only the second-most indebted nation on a debt to GDP basis (maybe higher by some counts) and the massive debt taken on by their Corporations is the Global Catastrophe in the on-deck circle. Japan is still the king at about 265% while the Trump Tax Plan will do a great job of catching us up, by putting us on a path to 200% debt to GDP in just 10 years.

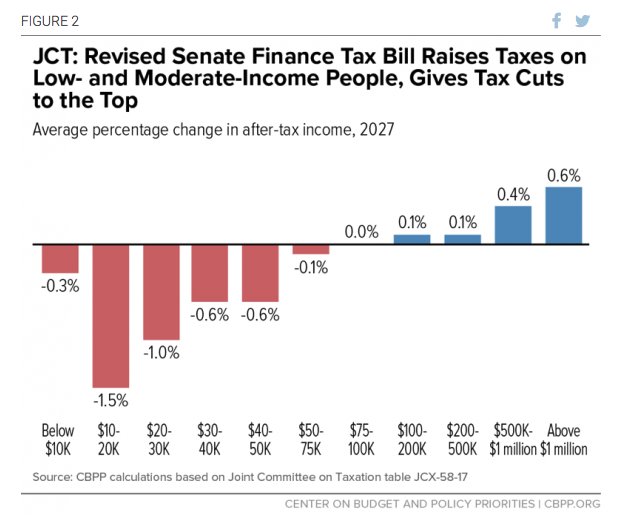

At a 4% interest rate, servicing $20Tn in debt that we now have would take $800Bn. At $40Tn, we'd need $1.6Tn a year just to make our interest payments – that would be 1/2 of all the taxes our Government currently collects and far more than half after Team Trump performs their massive tax givaway to the Top 1%, leaving the Bottom 99% holding the bag for all the new Debt and subsequent interest – keeping your children and grandchildren in wage slavery forevermore.

You KNOW inflation is real – no matter how much the Fed may deny it. Investors know this too and are no longer willing to loan Governments money at less than 2% interest rates as that's effectively negative to even the lowest of forward inflation forecasts. We're not surprised this is happening – only that it took so long to finally happen…

Combine irresponsible spending (on Tax Cuts) with irresponsible collections (more Tax Cuts) and your credit rating goes down as you are on the path to becoming Greece. Randy Levine, President of the NY Yankees and major Trump supporter just asked the President to stop the madness and rework this monstrous Tax Reform Bill before it destroys the country:

Combine irresponsible spending (on Tax Cuts) with irresponsible collections (more Tax Cuts) and your credit rating goes down as you are on the path to becoming Greece. Randy Levine, President of the NY Yankees and major Trump supporter just asked the President to stop the madness and rework this monstrous Tax Reform Bill before it destroys the country:

"This is a plan that helps Wall Street, hedge funds, private equity managers, real estate and oil and gas partnerships and individuals who disguise income as profits or distributions. In fact, some of those entities keep money offshore and don't pay any tax at all. Not surprisingly, some of the largest supporters of these bills are donors who come from those industries. No one wants to penalize them, but they should not be given benefits which are far greater than those given to others. This plan does not help many individuals who earn their income and report it as such.

"It is wrong to eliminate or limit property tax, mortgage and interest deductions. Hardworking people have relied on them for years, this is how they afford to buy homes and build nest eggs in the equity of their homes. These proposals erode that equity, equity countless numbers of Americans rely on for retirement. These current bills will be extremely harmful to those who live in the suburbs and small towns. Similarly, the removal of the state and local tax deduction is a de facto tax increase for tens of millions of Americans. The argument that other states should not subsidize big government states is a complete red herring."

It may all be too little, too late as the Senate is planning to rush a vote on the bill this week unless you call (202) 225-3121 and tell them to stop it. There are the 10 swing Senators that matter most in the upcoming vote – hopefully we can sway a few of them to put a stop to this madness. There's a great campaign called 5 Calls, which is gaining traction on this and other issues.

Only 1 out of 42 Economists surveyed by the University of Chicago said the Trump Tax Bill would increase economic growth substantially – that's actually an even worse percentage of Tax Believers than there are Climate Deniers! Without that growth, our National Debt will quickly balloon to unsustainable levels, rates will rise and the country will tumble into a recession we may not be able to cut our way out of – because we already gave all the money to the Top 1%. This is simply idiocy, folks – we HAVE to stop it! As noted by Bill Cohan – "It's a Ponzi Scheme."

As you can see from the Dollar chart, we're already tumbling against other currencies as Trump promises passage of his Tax bill is imminent. The Dollar has fallen another 1.5% since Wednesday and that, more than anything, is what's holding up our markets this morning. Fortunately, we knew this was coming and, in our Live Member Chat Room last Tuesday, I noted:

- Oil back to $56.50 but too scary to short. /RB just under $1.75, probably a better long than short into the weekend.

- Still likin' coffee in the morning (/KCH8) at $125

- /YG looks good at $1,278. I'd play long over $1,280. /SI is always a buy at $16.90.

Oil topped out at $59 with an OPEC meeting this week aiming to get them to $60 (where we'd love to short) and Gasoline (/RB) hist $1.79 for a $1,680 per contract gain while Coffee (/KCH8) hit $130 for gains of $1,875 per contract and Silver (/SI) is now $17.15 for $1,250 per contract gains and Gold (/YG) is at $1,297 and that's good for gains of $547 per contract (so far).

As we noted on Wednesday, we're down to our Final 5 contenders for our 2018 Trade of the Year and I'll be announcing it to our Members by Tomorrow and to the public soon after. Our Trade of the Year is the options spread that is most likely to return 300-500% in two years or less and WE'VE NEVER MISSED A CALL! So we're expecting to keep the streak alive in 2018 though I'm not very excited about setting up new trades in what is very likely to be a January correction.

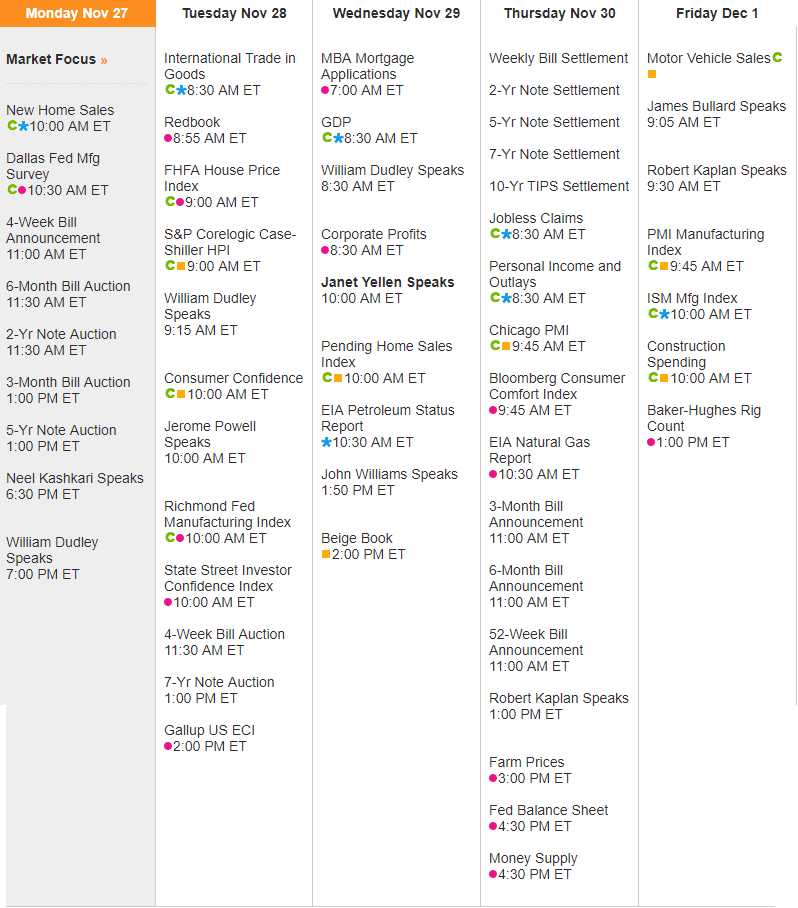

It's a busy data week and yes, we still have earnings trickling in and still plenty of playable names:

There's going to be 11 Fed speeches and the Beige Book along with GDP on Wednesday so plenty of market-moving info that won't move the market as long as people think the Tax Cuts are going through, making it silly to take profits in 2017 when they'll be taxed at higher rates. As long as the Top 1% are willing to hold onto their equities – the market will continue to drift along at the highs into the year's end but look out in January – as it will be every man for himself to start the year off with a bang.