Is America great yet?

It is if you get paid in something other than Dollars, or if your assets are not Dollar-backed. Otherwise, it's 3.4% less great than it was in November – as measured by Global confidence in our currency. Cutting taxes, running up Government spending, threatening war (s) and easy money policies are no way to strengthen a currency.

US Household Wealth is roughly $100Tn so a 3.4% cut in the value of those Dollars means $3.4Tn was essentially taken from us – pretty much confiscated by our Government. That's a lot worse than any tax because it's 3.4% of EVERYTHING we have. Fortunately for those of us in the Top 1%, a lot of that $3.4Tn went right back into the market, where we have the bulk of our wealth anyway and, of course, we have enough money that we diversify our assets into other currencies and, of course, Gold, which has flown up from $1,125 to $1,325 (17%) since the election.

So thank you, Bottom 99%, for your contributions to our portfolios. We couldn't have done it without devaluing everything you own! In yesterday's morning Report, we discussed the massive debt bomb we are facing and looked at the Fed's projections and concluded the market may be wrong and the Fed may tighten at this meeting. If they do, the Dollar will shoot higher and shorts will cover so I like Dollar Futures (/DX) long over the 91.50 line – with tight stops below.

So thank you, Bottom 99%, for your contributions to our portfolios. We couldn't have done it without devaluing everything you own! In yesterday's morning Report, we discussed the massive debt bomb we are facing and looked at the Fed's projections and concluded the market may be wrong and the Fed may tighten at this meeting. If they do, the Dollar will shoot higher and shorts will cover so I like Dollar Futures (/DX) long over the 91.50 line – with tight stops below.

If the Fed surprises us and brings rates up 0.25%, expect the /DX to move up to at least 92.5 for $1,000 gains per contract. Don't forget, Japan, Europe and China do not want a weak Dollar – this is the point they are likely to step in and prop it up anyway – so I feel pretty good about that play. If you are Futures-impaired, you can use the Dollar ETF (UUP) as a proxy. It's at 23.80 and the October $23.50 calls are just 0.45 so 0.15 in premium isn't bad for a month's worth of leverage, right?

.jpg) We'll look at that trade this afternoon at 1pm in our Live Trading Webinar and tune in because it's going to be a wild one with the Fed releasing their statement at 2pm, followed by Yellen's press conference – so big opportunities to profit from the changes but I'm already short the Russell (/TF) and Oil (/CL) again as the new contracts (/CLX7 – November) are at $50.50, which is the old $50, which I told you was a good short on Monday morning and we cashed those in for a quick $10,000 gain on 20 contracts (up $500 per contract) so – you're welcome!

We'll look at that trade this afternoon at 1pm in our Live Trading Webinar and tune in because it's going to be a wild one with the Fed releasing their statement at 2pm, followed by Yellen's press conference – so big opportunities to profit from the changes but I'm already short the Russell (/TF) and Oil (/CL) again as the new contracts (/CLX7 – November) are at $50.50, which is the old $50, which I told you was a good short on Monday morning and we cashed those in for a quick $10,000 gain on 20 contracts (up $500 per contract) so – you're welcome!

So our new shorting line is $50.50 and it's very strange that we haven't gone much lower but all that talk of hurricanes and OPEC cuts have allowed the NYMEX traders to get rid of all but 27,000 open contracts on the last day of October contract trading – effectively cancelling the delivery of (so far) 273 MILLION barrels of oil that were scheduled to be delivered to the US as of last Wednesday, when I told you the open interest was fake, Fake, FAKE!!! and would be essentially all cancelled.

|

Click for

Chart |

Current Session | Prior Day | Opt's | ||||||||

| Open | High | Low | Last | Time | Set | Chg | Vol | Set | Op Int | ||

| Oct'17 | 49.84 | 50.10 | 49.75 | 50.05 |

08:01 Sep 20 |

– |

0.57 | 3791 | 49.48 | 27432 | Call Put |

| Nov'17 | 50.27 | 50.55 | 50.15 | 50.47 |

08:01 Sep 20 |

– |

0.57 | 119987 | 49.90 | 598401 | Call Put |

| Dec'17 | 50.54 | 50.86 | 50.46 | 50.79 |

08:01 Sep 20 |

– |

0.55 | 20637 | 50.24 | 357897 | Call Put |

| Jan'18 | 50.81 | 51.09 | 50.70 | 51.04 |

08:01 Sep 20 |

– |

0.54 | 4186 | 50.50 | 219175 | Call Put |

| Feb'18 | 50.97 | 51.25 | 50.90 | 51.21 |

08:01 Sep 20 |

– |

0.52 | 1757 | 50.69 | 91264 | Call Put |

| Mar'18 | 51.13 | 51.35 | 51.01 | 51.32 |

08:01 Sep 20 |

– |

0.50 | 2265 | 50.82 | 170838 | Call Put |

Although 273M barrels were diverted away from the US (creating an artificial shortage and causing you to pay more at the pump) there are still 1.2 BILLION barrels worth of FAKE!!! orders open in the front 4 months vs 1.25Bn in the front 4 months a week ago. It would seem like they've actually sold 50,000 contracts (50Mb) but then you have to consider that, as of this evening, Feb becomes part of the front 4 months and there's all 2.5Bn FAKE!!! orders accounted for – ready to screw Americans out of $10-$20 per barrel for another month by creating shortages in the middle of a surplus.

You would think this is criminal, possibly even treason – as it threatens the energy security of the Unitied States of American and it's the kind of market manipulation that screws American consumers out of tens of Billions of Dollars each year yet it just goes on and on – even when I TELL you in advance how the crime is going to be committed and SHOW the evidence while it's being committed and EXPLAIN about it after it's been committed – it never changes.

You would think this is criminal, possibly even treason – as it threatens the energy security of the Unitied States of American and it's the kind of market manipulation that screws American consumers out of tens of Billions of Dollars each year yet it just goes on and on – even when I TELL you in advance how the crime is going to be committed and SHOW the evidence while it's being committed and EXPLAIN about it after it's been committed – it never changes.

So what else can we do but profit from it? While the OPEC cuts have put a good dent in their own storage – it has only dropped 92M barrels in 365 days since they said they were cutting production by 1.5Mb. People with math skills may think that doesn't add up and part of that reason is because US production has been rising almost as fast as OPEC has been cutting but that still doesn't explain their own lack of dawdown locally.

That's explained by rapidly declining demand and, as I have said before, things are getting tense in the Middle East because they have less than 20 years before they are sitting on stranded assetts – as the World pulls completely away from fossil fuel consumption (other than material uses). Finally the IEA has caught up with my theory and published their own paper estimating $1.3 TRILLION worth of oil and natural gas could end up being completely abandoned by 2050. Even if you assume 30 years until doomsday for oil, that's still $43Bn/yr worth of assets they should be depreciating or pretty much ALL of their profits.

Of course, they won't do that. They will instead continue to manipulate the trading at the NYMEX and continue to pretend this party is never going to stop – anything to push back the tipping point where people simply move on from Exxon (XOM) and their $339Bn market cap and from Chevron (CVX) and their $220Bn valuation, etc. We're talking about a very major shift away from traditional energy that will drive the next couple of decades of our investing.

Sorry I don't have a newer chart, but you get the idea. This is why we took our money and ran on XOM – there's really no future in it. That's doesn't mean things can't go up and down along the way and not every solar company will be a winner but this IS the way of the Future and we're investing in some of the companies that make battery and solar cell components – as those are the new raw materials for the 21st Century. It's like picking chip stocks at the early stages of the PC boom – we didn't know WHICH brand of computers people would be using – but they were certainly going to have chips in them!

We've been discussing investments in battery tech during our Live Trading Webinars this month and I'm still looking for you to bring us some ideas we can look into. Last week we looked at ALB, LIT, VALE, BHP, OROCF, SYAAF and MGPHF and I can't tell you which ones we picked if you're not a subscriber – just that it's a space we're exploring.

One trade I can talk about is IMAX (IMAX), which has been in both our Long-Term Portfolio as well as our Options Oppotunity Portfolio this year. Back on August 18th, in our LTP Review, I said to our Members:

IMAX – Going to call a bottom here. March is out so we can roll our 25 Dec $29 puts ($10.20) that we sold for $3 (ish) to the March $26 puts at $7.50 so we'll spend the $3 but pick up $4 of position on the roll. The Dec $28 calls can die on the vine and we'll roll our 20 Dec $23 long calls (0.50 = $1,000) to 30 Mar $17 ($3.30)/$22 ($1.20) bull call spreads at $2.10 ($6,300). The spread pays $15,000 if all goes well and we'll be pretty much even at $22.

In the OOP Review the day before, I had said:

- IMAX – Ouch! Way overdone sell-off so we'll take advantage buy buying back the short Dec $28 calls (0.10) and rolling the 10 $23 calls (0.45) to 20 of the March $15 ($4.70)/20 ($1.80) bull call spreads at $2.50 ($5,000). That has $5,000 upside potential which will make up for losses on the call side but the 10 short Dec $29 puts ($10.30 = $10,300) will take some work, starting with rolling them to 20 March $22 puts at $4.30 ($8,600). That's going to cost $1,700 to roll and we collected $3,150 when we sold the originals so still a $1,450 credit but that's not much (0.70/contract). Still, it's an improvement and we don't try to win everything back at once – this would be a huge improvement by itself if $20 or better holds.

As you can see, we hit our bottom call on the nose and IMAX has been up ever since but I'm bringing it up this morning because Goldman Sachs finally caught up with us and has raised IMAX to a Buy Rating and issued favorable comments on growth (duh!). You can see me talking about a new IMAX Trade Idea on Money Talk on Sept 6th, and that trade was included in our Money Talk Portfolio, which we started that evening and is already up 18% – not bad for 2 weeks (WPM was our leftover Trade of the Year, so 14% without it)!

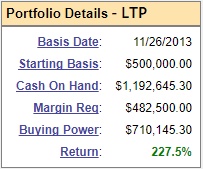

Looking forward to the fun when Yellen speaks later. As you can see, we have almost 80% of our $50,000 portfolio in CASH!!!, so we're really hoping that Dollar catches a bid!

Be careful out there.