Higher, higher!

Higher, higher!

Up and up the markets go but we see shorting opportunities this morning IF we cross back below Dow (/YM) 26,100, S&P (/ES) 2,800, Nasdaq (/NQ) 6,810 and Russell (/TF) 1,585. The rule of thumb for shorting the futures is wait for 2 to cross below and then pick the next one that crosses and keep very tight stops back above the line and if ANY of the indexes go back above their line – kill the trade and wait for the next set-up.

We demonstrated the stopping out part in yesterday's Live Trading Webinar but I missed my chance to flip long as we got caught up in another discussion and missed the Beige Book Rally. Still it was a nice day trading as we picked up $4,312 on our Coffee (/KC) trade and now we're waiting for a nice pullback to reloaid and do it again. Speaking of releading, we're still short on Gasoline (/RB) at $1.86 and it's a $1.865 this morning so we're down $210 per contract at the moment – ahead of the EIA Inventory Report at 10:30.

The Futures are not only a fun way to pick up some extra cash while we wait for our positions to pay off but they also provide a quick hedge – even when the equity markets are closed. As you can see from the chart, our call on the Dollar long at 90 in yesterday morning's PSW Report was also a nice winner, topping out at $750 per contract and now back at 90.40 but we think consolidating for a better move up – hopefully to 92.50, which would be $2,500 per contract gains.

Remember, I can only tell you what is likely to happen and how to make money playing it – that is the extent of my powers – the rest is up to you!

As we're moving into earnings season, this last leg of the market bubble is being driven by earnings revisions due, mostly, to Trump Tax Breaks but, as we warned about in December, the reality simply isn't enough to justify the gains. This is a great BoA/Merrill chart showing how guidance for the S&P has moved up from 148 to almost 151 since the Tax Plan passed.

As we're moving into earnings season, this last leg of the market bubble is being driven by earnings revisions due, mostly, to Trump Tax Breaks but, as we warned about in December, the reality simply isn't enough to justify the gains. This is a great BoA/Merrill chart showing how guidance for the S&P has moved up from 148 to almost 151 since the Tax Plan passed.

That's pretty good, you may thing but really, it's only 2% higher and still puts the 2,800 S&P at an 18.5 forward multiple and, in reality, we expected 149 earnings a year ago and these stocks are up 550 points from 2,250 last January, so that's 24.4% – which seems like a bit of an overshoot for a 2% rise in earnings, doesn't it?

Let's say your stock was going to earn $100 last year and you paid $1,000 for it. Now it's projected (not guaranteed) to earn $102 this year – not because sales are up and not because they got more efficient but because they are paying less taxes and now they are asking you to pay $1,244 for it. You are paying $244 more for $2 more in earnings, a p/e of 122 on the increased earnings. Meanwhile, taxes are ridiculously low and debt is skyrocketing, which will lead to rising rates which will hurt earnings down the road – so all we've done is borrowed from the Future to make the present look 2% better in order to take 24.4% more of your money for the same stock. Sucker!

We'll see how the rest of earnings season panhs out. So far, only 17% of the S&P 500 have actually reported, so all this stuff is extrapolation. Next week, 100 S&P companies report and 175 on the last week of the month. THEN we will have a good idea of how the companies see the tax changes but 2% improvements is certainly not what traders had in mind when they rallied the markets 10% since November, is it?

We'll see how the rest of earnings season panhs out. So far, only 17% of the S&P 500 have actually reported, so all this stuff is extrapolation. Next week, 100 S&P companies report and 175 on the last week of the month. THEN we will have a good idea of how the companies see the tax changes but 2% improvements is certainly not what traders had in mind when they rallied the markets 10% since November, is it?

As I pointed out on Thanksgiving, traders will be disappointed with Q1 results because Corporations were only effectively paying 13% of their income in taxes so "cutting" the official tax rate to 20% really doesn't make much of a difference. The S&P 500 has added over $2Tn in market cap since than and certainly $2Tn hasn't actually flowed into the index. In fact, S&P net money flows on any given day are usually from $5 to $10Bn so, even if ALL 40 market days since Thankgiving were $10Bn inflows, that would only account for 20% of the indexes gain and, in reality, it's about half that so the rest is speculation that will need another 400 days of inflows to actually support the current prices.

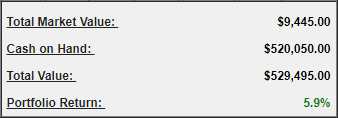

We don't think that's likely so we're still mainly in cash and yesterday, we discussed some more hedges in the Morning Report and, of course, we have our Futures hedges as well. Meanwhile, that doesn't prevent us from enjoying the rally. On Friday, our Long-Term Portfolio was up $21,755 for the year at $521,755 and yesterday we hit $529,495, up $7,740 for the week – those are the gains we are hedging to protect!

We don't think that's likely so we're still mainly in cash and yesterday, we discussed some more hedges in the Morning Report and, of course, we have our Futures hedges as well. Meanwhile, that doesn't prevent us from enjoying the rally. On Friday, our Long-Term Portfolio was up $21,755 for the year at $521,755 and yesterday we hit $529,495, up $7,740 for the week – those are the gains we are hedging to protect!

Our $100,000 Options Opportunity Portfolio, which you can also follow over in the Seeking Alpha Marketplace, has jumped from $103,300 on Friday to $105,317 so up about $2,000 (2%) for the week is certainly keeping up with the market – even though we're still 90% in CASH!!!, waiting for better deals before we make larger commitments. I did a full review of both portfolios in yesterday's Live Trading Webinar.

We also told you about GreenCoin (GRE) yesterday at 0.00137 and this morning, while people are all excited about BitCoin $11,700 (up 11.7%), GRE is back to 0.001891, which is up 38% for the day (we've been consistently outperforming BitCoin for ages). So congrats to peple who got some bargin shopping in but don't forget to take profits or you will end up like Chris Larsen, the founder of Ripple, who was "worth" $59.9Bn on Jan 4th and now "just" $15.8Bn. Had he used our crypto-currency profit-taking strategy which we outlined for you in yesterday's report – he would have had $20Bn off the table and $8Bn in coins left – don't be like Chris!

We still have the overhang of a possible Government Shut-Down which will be followed by a relief rally when they don't actually shut down and THEN, next week, we can finally begin to focus on earnings.