Well, that about sums it up, right?

Well, that about sums it up, right?

As I said in yesterday morning's Report: "On the whole, I'd rather if we consolidate here before even popping above 2,700 again as 2,850 was too high. Hopefuly we can hang around 2,650 for a week or two and form a proper base before trying to move higher again – but traders are so impatient.…"

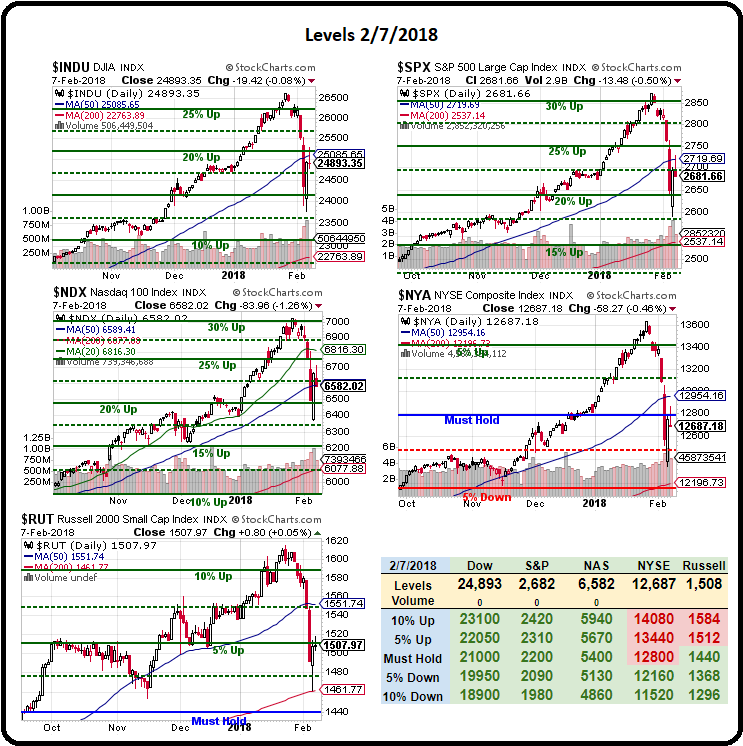

Well, it's been a day and people are already freaking out because we haven't flown back to 2,850 and it's going to be a while before they realize 2,850 shouldn't have happened in the first place and it's more likely that this (2,700) is the top of the range, not the bottom – at least through Q2. On our Big Chart, 2,640 is the 20% line on the S&P and, even being generous, THAT should be the middle of a range we move 5% up (2,772) and 5% down (2,508) in, so call it 2,500 to 2,800 with 2,650 the middle line. That's where I think we'll settle once all the dust clears.

This morning, however, in our Live Member Chat Room, we are playing for a bounce using the following levels:

I also like /TF over 1,500 and /NQ over 6,600 and /NQ is lagging and likely to pop big if we get moving. /YM 24,800 and /ES 2,675 will confirm and tight stops if 2 of the 3 fail to hold those lines!

Remember, 25 points (back to 2,700) on the S&P (/ES) is good for $1,250 per contract – nothing to sneeze at. The Russell (/TF) hit 1,520 yesterday and that's up $1,000 per contract and the Nasdaq hit 6,700 and getting back there pays $2,000 per contract, so it's well worth playing for the bounce and the BOE gave a more hawkish statement this morning and that should keep the Dollar in check and allow our indexes a bit of breathing room today.

In the Futures, we tested 2,550 on Tuesday and our 30% line is 2,860 and 2,640 is 20% so, ignoring the spike below, we have a 220-point drop and our 5% Rule™ tells us to expect a 20% weak bounce off that fall (44 points) back to 2,684 and then the strong bounce line is 44 more points at 2,728 and that is EXACTLY where we topped out yesterday. It also tells us that we can expect a 44-point overshoot of 2,640 on the way down and we saw that (and a bit more, but not during market hours) as well so, so far, things are going exactly as we expect they would – indicating the Bots are in charge of the moves.

As you can see, we're following the 5% Rule™ pretty much to the penny so it's not a good time to "think" when we can just watch and see what happens. If the market is recovering, we should get back over that strong bounce line and hold it into the weekend and, if the weak bounce line fails to hold this morning – it's more likely we head back down than up.

Our base level on the S&P (what we call the "Must Hold" line) is way down at 2,200 and that is where we think the bottom line value for the index is and the 20% line (2,640) is the highest we think the S&P should go in 2018. This is why I was so upset when we were over the line. The indexes simply haven't yet grown into that valuation yet. Since we ran the numbers (last fall) we've had the Tax Cuts and the Repatriation of Overseas Cash so I'm willing to bump up to the 10% line (2,420) as a base but that still makes 2,860 way overbought and 2,650 is the level we're expecting to consolidate around into Q2 earnings.

.jpg) We use our 5% Rule™ for futures trading as well – as we did yesterday when Gasoline (/RB) made a 2.5% correction back to $1.755. Live, during our Weekly Trading Webinar, we picked up 2 long contracts and used a 3rd to lower our basis a bit and ended up picking up a quick $1,121 profit – LIVE, so that was worth attending the Webinar for, right?

We use our 5% Rule™ for futures trading as well – as we did yesterday when Gasoline (/RB) made a 2.5% correction back to $1.755. Live, during our Weekly Trading Webinar, we picked up 2 long contracts and used a 3rd to lower our basis a bit and ended up picking up a quick $1,121 profit – LIVE, so that was worth attending the Webinar for, right?

This morning, I put out a note to our Members and even issued a Top Trade Alert to go long again at $1.76 and we'll see how that plays out into the weekend. We expect at least $500 per contract gains and we're happy to take those quickly off the table, along with similar gains on our Nasdaq (/NQ) longs.

Bear (oops, don't say "bear"!) in mind 2,684 is likely to be rejected on /ES, so that's the point at which we want to take profits on /NQ (6,605) and /TF (1,510) and then, if we brake over, /ES becomes a good play over 2,685 with tight stops below along with the others (and /YM should be 2,850). That's all it takes to play the Futures and we call that our Pony Express Strategy, where we ride a horse up to resistance and then get a fresh horse for the next leg up. All the futures contracts pay similar amounts for similar moves, so it doesn't matter which one we play so we go for the one with the best lines at any given moment.

Not much else to do but watch and wait today. Unless we're over our strong bounce lines tomorrow, we'll be re-hedging into the weekend (we're a bit bullish at the moment) but I'll be surprised if we clear 2,700 – let alone 2,728 and that means we're back to the same hedges we were using before the crash.

Meanwhile, enjoy the bounce but "Don't get excited!"