Can sentiment really get any worse?

Gosh darn it I'm trying to adopt a doom and gloom attitude so I can "fit in" but I just can't do it. I read a lot of foreign papers yesterday and I looked at global markets from an international investing standpoint and I just can't find anywhere I want to put my money. China is downright scary, Japan is a mess, Malaysia's causing strife in the region, India is screwed up, Pakistan has civil unrest, Europe if feeling inflation pressure and both of their export markets look weak and the Euro is so strong by the time I convert my money to Euros I have to be concerned that stabilization later in the year will eat up 10% of my profits at least.

If I'm a European investors I have very strong currency and things look cheap in Asia and very cheap in the US but there is no way I'd put my money in notes as they don't pay enough to cover inflation. In fact, $330Bn worth of auction-rate notes went unsold in February. Auction rate notes are, as the NYTimes points out, supposed to be "As Good as Cash" but investors (mainly wealthy ones as the minimum investment is $25,000) are now stuck with what are essentially worthless pieces of paper that have no redeemable value and pay a paltry average interest rate of 3.25%. We already know about the issues with municipal bonds and don't even pretend that CDO's are something to invest in any more. Real estate is a nighmare (although commercial real estate may not be a dire as predicted) and commodities have risen so quickly that even the buyers are calling it a bubble.

![[hot]](http://s.wsj.net/public/resources/images/OB-BD067_hotnot_20080307191304.gif) So where do we put our money?

So where do we put our money?

As an answer, I'll have to go with our Long-Term Virtual Portfolio. If you want to stay in the market and you don't want to go with cash and you do believe that this economy will, one day, emerge from recession, then our Long-Term Virtual Portfolio strategy is going to be right for you. The VIX is running near record highs, which means we will be collecting big premiums for selling front-month contracts and long-term sentiment is so negative that you can buy AAPL 2010 $100s for $44.12, a $22 premium over today's strike price and sell the April $125 calls for $6.62, a 15% return in 6 weeks. $6.62 is more than enough money for you to roll your 2010 $100s down to the $90s, which are currently $49.77 and Apple doesn't even have strikes below $90 because NO ONE believes it will go that low.

If $90 is a floor and you collect $5 a month in premiums then in less than 10 months you can pay for your entire investment with 12 more months left to sell additional premiums for income. This is not a bad way to ride out a recession! A 15% monthly return should keep us ahead of inflation and even if we end up buying back the occasional caller for a loss – let's say 8 times we have to pay our caller $10 and let's assume that the callers are "at the money" and not a few dollars out of the money when we sell them.

So I sell the $125 caller for $6 and Apple finishes at $135 and I give my caller back his $6 and then I'm out $4 out of pocket, driving my basis up to $48. 7 more times Apple gains $10 and 7 more times I lose $4 drives my basis up to $76 but it also drives Apple up to $205, making my $100s worth $105 PLUS the remaining premium. I can live with that too!

If you are getting killed buying options then become the killer and start selling them!

We will be focusing on Long-Term Virtual Portfolio plays this week as we welcome many new members to the new Basic Membership Site although the Long-Term Virtual Portfolio itself is an exclusive to premium members. In this very, very, awful market the profits belong to the day traders and the sellers of options and we like to go where the money is and adopt our strategies accordingly. As I am still bullish and do still see a recovery in Q2, I really like the LTP plays to bide our time and pick up a nice return for our cash. As I pointed out with the Apple play, even if it goes lower, I am going to stick with options on stocks that I don't mind holding at very low prices for 2 years.

Since the LTP is already full of excellent stocks, I'm going to take Sage's advice and do a review of that virtual portfolio. I do one near expirations each month anyway but I'm going to put one out today as I still think this may be near enough the bottom that the fishin' is good!

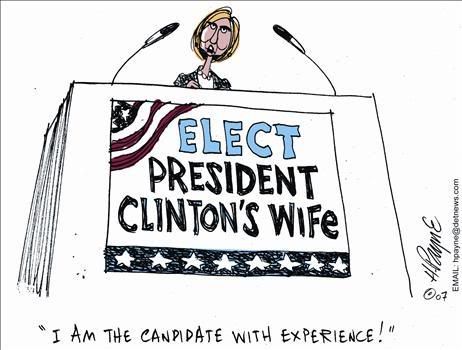

Something is fishy over at the WSJ who's election headlines today are "Obama Favored in Mississippi" with no mention of Clinton's almost certain victory in PA. This article is paired on the front page of the online edition (#2 from the top) with "Political Perceptions: Not Ready for a Woman President." I'm trying to stay party neutral about the primaries but clearly Mr. Murdoch has made his choice and would like Obama to square off against McCain, not Clinton as the conservatives think they can bear Obama but know they have virtually no chance at stopping the Clintons from taking back the White House.

Something is fishy over at the WSJ who's election headlines today are "Obama Favored in Mississippi" with no mention of Clinton's almost certain victory in PA. This article is paired on the front page of the online edition (#2 from the top) with "Political Perceptions: Not Ready for a Woman President." I'm trying to stay party neutral about the primaries but clearly Mr. Murdoch has made his choice and would like Obama to square off against McCain, not Clinton as the conservatives think they can bear Obama but know they have virtually no chance at stopping the Clintons from taking back the White House.

You will hear the press make much of Obama's victory in Wyoming (the state that gave us Dick Cheney) but in reality he won 7 delegates and Clinton won 5 so there was a single delegate swing between them. Obama currently leads by 90 delegates and needs 450 more to clinch the nomination. I mention this to keep things in perspective as you hear all sorts of rubbish from the MSM and it's important to think about the agenda of the source you are reading or viewing. This will go on through Pennsylvania on 4/22 (or maybe all the way to the convention in August) so it's really not even worth worrying about until then.

Also not worth worrying about is the Nikkei giving up another 250 points this morning, that was purely a response to the same declining dollar and declining US market that we already sold off on last Friday. Nothing new happened over the weekend and the Hang Seng showed a little more backbone, taking back 203 points in a strong after-lunch finish that added 500 points but only brought them back to Friday's open after all that work.

China's trade surplus fell off a cliff in February, dropping 63% from January as exports to both the US and Europe slowed while commodity import prices rose substantially. Other than March 2007, when a change in tax policy caused the drop, this is the worst export number in 2 years for China. Exports to the US in particular dropped 5%, to 16.4Bn while imports from the US jumped 33% to $6.1Bn. This gives just a little more incentive for China to put the $1.4Tn in US paper they are sitting on to work, perhaps bailing us out before we drag them down with us!

Of course slowing down their own growth is the biggest favor the Chinese can do for us as the prospect of a global recession can quickly chop $10 a barrel off the price of oil. With global consumption at 86Mbd, that's $860M dropped directly into consumers daily pockets the second we get back to $95. $85 is $1.72Bn a day that can be spent on consumer goods and not oil and $75 is $2.58Bn a day that doesn't go to countries that fund terrorism and instead goes towards new IPhones and paying off the mortgage. $65 oil puts $3.44Bn a day, or $1.25Tn a year back into the pockets of global consumers and would have more impact than any government stimulus package could possibly have so we will be watching the price of oil very closely now as a decline there will lead us out of a recession faster than any inflationary Federal policies ever could. Another Fed cut is expected next week, things are going to be very interesting in March!

How does the MSM not address these stunning numbers in all their talking about a global recession and the "tapped out" consumer? It's like looking at a mugging victim and saying "gee, he doesn't have much money on him does he?" The problem is that oil companies have so many politicians and media organizations so deep in their pockets that there is virtually nowhere for you to hear about this. This is simple, obvious math – Oil cost the world $1.2Tn a year less last year than this year. That is 2% of the Global GDP. Then there are other commodity prices as well – THAT'S where all the money went and OPEC (which includes XOM, BP, Shell, CVX etc,) are laughing at the sheep who simply put up with this BS!

Europe is trading flat ahead of our open which looks so-so so far. They have steadily recovered from a poor open and have turned around for no particular reason other than they've been down for 7 of the last eight sessions so perhaps they are just looking for variety. The dollar fell it $1.58 to the Euro as our pals at the United Arab Emirates set up a task force to consider depegging from the dollar. We'll discuss this in more detail tonight as it's a doozy!

MCD reports an 8.3% increase in US same-store sales and up 15% in Europe, so congrats to all who made that play on Friday. As I said above, it really does seem to be the start of bottom fishing season!