Now we're seeing some misses!

Now we're seeing some misses!

After the bell we got misses from AXP, EXP, RE, FNB, HPC, HXL, HIFN, LOGI, SNDK and TXN with guidance lowered by AAPL, MHK, SNDK and TXN while AXP said no more guidance – effectively saying they give up "until the economy turns around." Well, that's not very helpful is it?

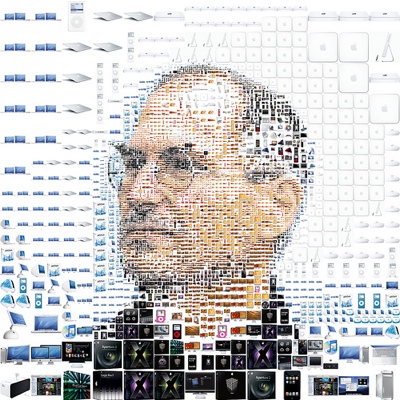

AAPL's earnings were fantastic but, as usual, their guidance was low but the big issue was and still is Steve Jobs' health and CEO Oppenheimer's comments (Jobs was not on the CC as usual) that "We get a lot of questions about Steve's health, but would you mind addressing the situation? Steve loves Apple, he serves as CEO at pleasure of Apple's board and has no plans to leave. Steve's health is a private matter" did not exactly put the situation to rest.

SGP and MRK got bad news on Vytoren during the day and both companies lowered guidance over night so we have AXP and MRK assauting the Dow tomorrow and PFE will likely follow MRK down and T was killed yesterday and will probably go lower and JPM tanked with the financials after Paulson laughingly said he believes in a strong dollar on CNBC as it seems to be about as effective on reality as my daughters belief in faries. TXN had sales down 2% and missed by 5% AND issued downside guidance on lower sales – they were executed in after hours trading but no worse than AAPL, who beat by a mile.

As was American Express, who were shockingly bad with earnings at .56 a share versus .83 expected. Revenues actually increased 8% over last year to $7.5Bn but still below $7.6Bn estimated and the company had to set aside $600M in credit reserves and took a $136M charge against securatized interest against cardmember loans that was suddenly looking less secure than they thought. Even worse, the company tossed guidance out the window due to an unexpected downturn in spending by their "affluent" cardholders, who make up a significant portion of earingns. "They may not be in the same situation as other [customer] segments, but the reality is that we're seeing very affluent people who historically have had strong spending histories…change some of their spending behavior," CEO Chenault said.

As was American Express, who were shockingly bad with earnings at .56 a share versus .83 expected. Revenues actually increased 8% over last year to $7.5Bn but still below $7.6Bn estimated and the company had to set aside $600M in credit reserves and took a $136M charge against securatized interest against cardmember loans that was suddenly looking less secure than they thought. Even worse, the company tossed guidance out the window due to an unexpected downturn in spending by their "affluent" cardholders, who make up a significant portion of earingns. "They may not be in the same situation as other [customer] segments, but the reality is that we're seeing very affluent people who historically have had strong spending histories…change some of their spending behavior," CEO Chenault said.

"While we have been able to generate substantial earnings and returns relative to many in the financial sector, we do not expect to meet or exceed our long-term financial targets until we see improvements in the economy," Mr. Chenault said. Despite the results, "the position of our company today is financially sound and competitively strong," he said.

This will lead us to a fun retest of the lows of last week in many stocks. I'm still seeing a fairly direct inverse correlation between oil and the Dow and it's still not being discussed in the oil-boosting media but they jammed the NYMEX up $1.50 in the last 15 minutes of their session, bringing oil back to $131.50 and it seemed strange that the Dow stayed up. Now it is no longer strange and we have a 100-point drop post market and you can point to a lot of things but when oil was at $131.50 on Thursday, the Dow was at 11,250 and when oil was at $135+ earlier in the week, we were below 11,000.

Oil used to not affect the markets because it was never such a significant factor in people's spending. Now that we are spending (at $131 a barrel and 21M barrels a day) $2.75Bn a day on oil which, combined with refinery mark-ups and ancillary food and other inflation, comes to about $5Bn a day on essential consumables – it matters a lot! A 20% rise in fuel and food costs (they are up over 100% this year) takes $1Bn a day out of the hands of US consumers. Already since last year $2.5Bn a day is being spent on food and fuel that was able to be used to purchase IPods and Levis last year as well as used for paying for things like the mortgage and the American Express bill.

This is THE problem with our economy. $912Bn being funneled away from companies that produce things that last and used up on consumables and even the companies that produce the consumables are facing rising costs so they aren't even making more money selling them to us anymore. As TBoone points out, the real winners are the guys who have black goo in the ground that used to get $20 a barrel and now get $140 a barrel for the same goo, coming out of the same ground. The failure of this administration to address this situation and take action has destroyed the American economy and is on the way to destroying the American way of life.

People are in big trouble in this country and we need our leaders to……… LEAD! The celebration at the NYMEX came as the crooks who trade over there cancelled all but 63M barrels of the 367M barrels that were available for August delivery just 2 weeks ago and they are going to create another artificial shortage of oil while they pray for a hurricane to further disrupt supply so they can mark up the 313M barrels they have now "ordered" for September before they cancel them. Hopefully Pelosi can get something together that will force Bush to open the SPR so they can choke on those contracts but, until then, the dollar is getting weaker and oil is going higher and our market is heading back down until we get oil under control.