Article on Solar’s future, courtesy of Trader Mark, at Fund My Mutual Fund.

Photovoltaic Solar Looks to be Arriving in Scale in the U.S.

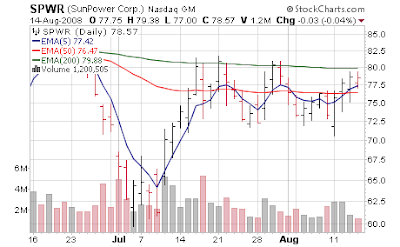

We have quite the huge announcement from Sunpower (SWPR), Optisolar and PG&E (PCG) after hours – this is a long term game changer if the utilities themselves decide to go solar as opposed to individual and corporations. Sadly our Congress still sits on their hands on the renewable tax credits for alternative energies while the rest of the world moves onward. California is trying to move on, with or without, the rest of the U.S.

We have quite the huge announcement from Sunpower (SWPR), Optisolar and PG&E (PCG) after hours – this is a long term game changer if the utilities themselves decide to go solar as opposed to individual and corporations. Sadly our Congress still sits on their hands on the renewable tax credits for alternative energies while the rest of the world moves onward. California is trying to move on, with or without, the rest of the U.S.

Solar is real and not a fad unlike what you are currently seeing on the popular financial TV shows. The questions will be who will be the ultimate winners and how many will there be? [Jan 3: The Long Term in Solar] Intel (INTC) is getting in [Jun 17: Intel Creates a Solar Company Spin Off] Applied Material (AMAT) is getting in – these are not small start ups guessing on a "maybe" industry. And Goldman Sachs (GS) is quietly snapping up the land throughout the southwest US desert. Meanwhile the "Fast Traders" and pundits point their nose upward and remind you of the solar fantasy in the 1970s and how this is just a repeat. Nice.

- Pacific Gas and Electric Company today announced it has entered into two utility-scale, photovoltaic (PV) solar power contracts for a total of 800 megawatts (MW) of renewable energy. This significant commitment to photovoltaic technology will deliver cumulatively 1.65 billion kilowatt-hours of renewable energy annually. This would be equivalent to the amount of energy needed to serve approximately 239,000 residential homes each year.

- PG&E entered into an agreement with Topaz Solar Farms LLC, a subsidiary of OptiSolar Inc., for 550 MW of thin-film PV solar power. The utility also signed a contract with High Plains Ranch II, LLC, a subsidiary of SunPower Corporation (Nasdaq: SPWR – News), for 250 MW of high-efficiency PV solar power.

- "These landmark agreements signal the arrival of utility-scale PV solar power that may be cost-competitive with solar thermal and wind energy," said Jack Keenan, chief operating officer and senior vice president for PG&E.

- The 550 MW Topaz Solar Farm project would utilize relatively low-cost, thin-film PV panels designed and manufactured by OptiSolar in Hayward and Sacramento. Located in San Luis Obispo County, California, the project would deliver approximately 1,100,000 megawatt-hours annually of renewable electricity. The project is expected to begin power delivery in 2011 and be fully operational by 2013.

- SunPower’s planned 250 MW solar ranch, would be located in San Luis Obispo County’s California Valley and will deliver an average of 550,000 megawatt-hours of clean electricity annually. The project is expected to begin power delivery in 2010 and be fully operational in 2012. The ranch would employ SunPower’s proprietary crystalline PV solar cells, which generate up to 50 percent more power than conventional crystalline cells. The company would install its patented SunPower® Tracker solar tracking systems at the site, which tilt toward the sun as it moves across the sky, increasing energy capture by up to 30 percent over fixed systems, while reducing land-use requirements

GreenWombat article – California’s Game Changing Solar Deal

- In a move that could alter the economics of the global solar industry, California utility PG&E on Thursday announced that it will buy 800 megawatts of elecricity produced from two massive photovoltaic power plants to be built in San Luis Obsipo County on the state’s central coast. The 550-megawatt thin-film plant from Bay Area startup OptiSolar and a 250-megawatt PV plant from Silicon Valley’s SunPower dwarf by orders of magnitude the five-to-15 megawatt photovoltaic power stations currently in operation around the world.

- Most of the industrial-scale solar plants designed to replace fossil-fuel power use solar thermal technology, meaning they deploy mirrors to heat liquids to produce steam that drives electricity-generating turbines. Photovoltaic power plants essentially take the solar panels found on suburban rooftops and put them on the ground in gigantic arrays.

- How gigantic? OptiSolar’s Topaz Solar Farm will cover 9 1/2 square miles of ranch land with thin-film panels like the ones in the photo above.

- “Obviously this is huge and a bold move,” says Reese Tisdale, a senior analyst who studies the economics of solar power for Emerging Energy Research in Cambridge, Mass. “It’s a pretty big jump in manufacturing capacity and a big opportunity for the PV industry, particularly for thin-film.”

- If the power plants are ultimately built – and that’s a big if, given the challenges to get such facilities online – and other utilities follow PG&E’s lead, demand for solar modules could skyrocket.

- “If we were trying to do it this year, it would be all of our production,” says Julie Blunden, SunPower’s vice president for public policy. “SunPower is ramping very quickly. By 2010 our production will be at least 650 megawatts.”

- The PG&E deal puts OptiSolar in the spotlight. Founded by veterans of the Canadian oil sands industry, the stealth Hayward, Calif., startup has kept its operations under cover, avoiding the media as it quietly set up a manufacturing plant in the East Bay and prepared to break ground on a million-square-foot factory in Sacramento. (can’t wait for the IPO) 😉

- It has long been an open secret that building massive photovoltaic power plants was not economically viable. So what has changed too make constructing gargantuan PV power plants profitable?

- “Lots of things have changed,” says SunPower’s Blunden. “Power prices are going up and public policy is requiring utilities to have a portfolio of renewables.” And after building some 40 megawatts of power plants in Spain, SunPower has been able to improve its manufacturing processes and cut costs, according to Blunden. “We could see where the cost reductions were coming down and the benefits of scale,” she says. “We saw there was a way for us to be competitive with other renewables.”

- Goldstein says OptiSolar’s business model of owning the supply chain – from building its own machines to making solar cells to constructing, owning and operating power plants – will allow it to reduce costs. “By taking control of the value chain from start to finish, by being vertically integrated and cutting out the middleman,” he says, “we can be competitive not only with other renewable energy but with conventional energy.”

- Photovoltaic power plants do have certain advantages over their solar thermal cousins. They don’t need to be built in the desert, thus avoiding the land rush now underway in the Mojave. PV is a solid-state technology and with no moving parts – other than the sun tracking devices used in some plants – they make little noise and are relatively unobtrusive. Most importantly in drought-stricken California, they consume minimal water. And the modular nature of solar panels means that a power plant can start producing electricity in stages rather after the entire facility has been constructed.

- But contracts are no guarantee the even a watt will be generated. The Topaz and California Valley projects must overcome a number of obstacles, not the least of which is the U.S. Congress’ failure so far to extend a crucial 30 percent investment tax credit for solar projects that expires at the end of the year. SunPower’s Blunden acknowledges the PG&E project is contingent on the tax credit being renewed. (plenty of money for corporate farmers, ethanol, and big oil – lots of strife over any credits for wind and solar – welcome to your US leadership – bought and paid for)

- Two California companies said Thursday that they would each build solar power plants that were 10 times bigger than the largest now in service, creating the first true utility-scale use of a technology now mostly confined to rooftop supplements to conventional power supplies.

- At peak hours, together the plants will produce as much power as a large coal plant or a small nuclear reactor. But they will run far fewer hours of the year so output will be at least a third less than that of a coal plant of the same size.

- The largest current installation in the United States is at Nellis Air Force Base, in Nevada, with 14 megawatts, also built by SunPower. Spain has one completed plant at 23 megawatts. A German company, Juwi, has a 40-megawatt installation east of Leipzig. Florida Power and Light recently ordered a 25-megawatt plant.

- California requires that 20 percent of the kilowatt-hours sold by investor-owned utilities come from renewable sources by 2010, a goal that some companies are struggling to meet.

- SunPower’s panels are mounted at a 20-degree angle, facing south, and pivot over the course of the day, so they face the sun. OptiSolar’s panels are installed at a fixed angle. They are larger and less efficient, but much less costly, so that the cost per watt of energy is similar, company executives said.

- Neither approaches the economy of fossil-fuel burning plants, said Jennifer Zerwer, a spokeswoman for Pacific Gas and Electric. But they are competitive with wind power and with power from solar thermal plants. And prices will eventually fall, she said.

Or if you want the Cliff Notes Video – CBSMarketwatch has one here 😉

Huge. If Congress actually budges and allows us to get to a spot Japan and Germany were 7 years ago and Spain 3 years ago.

[Jul 29: Beggers Can’t be Choosers – Some Minor Solar Deals]

[Jul 10: Well It’s a Start – Sunpower to Build 2 Solar Power Plants]

[Jun 7: As Energy Costs Soar, US Looks to Solar]

Long Goldman Sachs in fund; no personal position